In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons as well as creative projects or just adding an extra personal touch to your space, Fuel Tax Credit Eligible Activities are now a vital resource. The following article is a dive to the depths of "Fuel Tax Credit Eligible Activities," exploring what they are, where to get them, as well as how they can add value to various aspects of your lives.

Get Latest Fuel Tax Credit Eligible Activities Below

Fuel Tax Credit Eligible Activities

Fuel Tax Credit Eligible Activities -

Fuel tax credits provides you with a credit in dollars for the fuel tax excise or customs duty that s included in the price of fuel used in eligible business activities Before claiming fuel tax

You can claim fuel tax credits for eligible fuel you acquired manufactured or imported and use in your business The Fuel tax credit eligibility tool can help you work out

Fuel Tax Credit Eligible Activities offer a wide assortment of printable items that are available online at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Fuel Tax Credit Eligible Activities

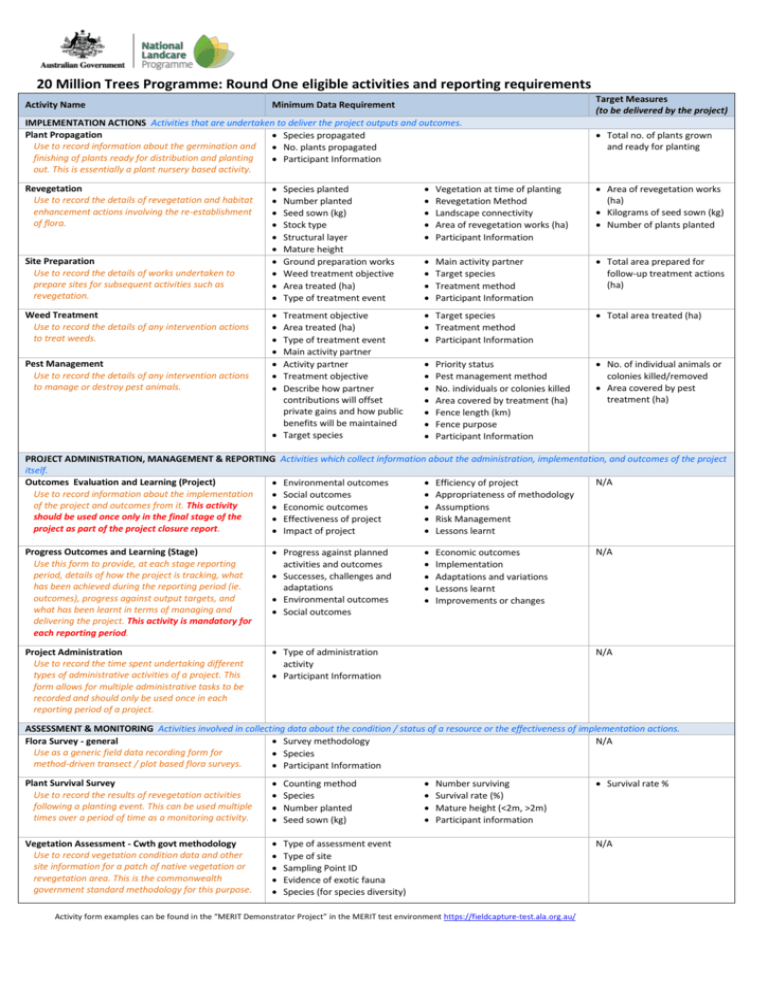

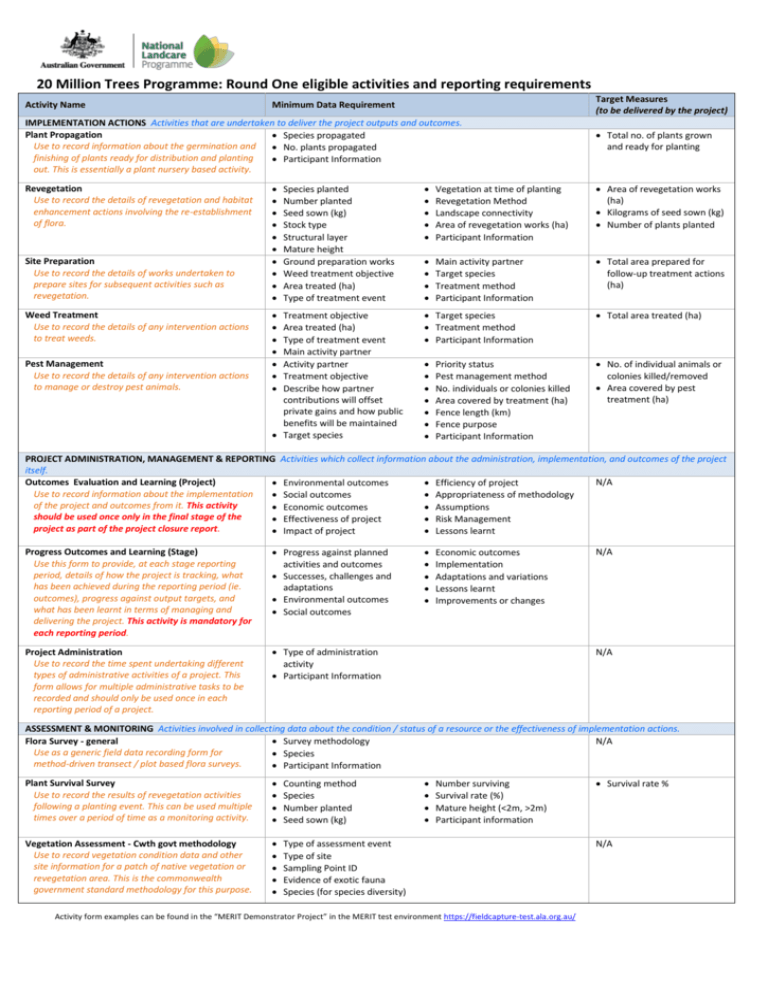

Round One Eligible Activities And Reporting Requirements

Round One Eligible Activities And Reporting Requirements

You may be able to claim credits that is get money back for fuel you use in your small business Find out if the fuel and business activities you undertake are eligible for fuel tax credits Learn

You must be registered for fuel tax credits to claim them Before you register for fuel tax credits make sure you are registered for GST and carrying on an enterprise conducted an eligible

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: You can tailor printables to your specific needs whether it's making invitations making your schedule, or decorating your home.

-

Educational Value Downloads of educational content for free cater to learners of all ages, making them a great resource for educators and parents.

-

Accessibility: You have instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Fuel Tax Credit Eligible Activities

Fuel Tax Credit Eligibility Form 4136 How To Claim

Fuel Tax Credit Eligibility Form 4136 How To Claim

If you use gaseous fuels acquired from 1 December 2011 in eligible business activities you may be entitled to fuel tax credits Gaseous fuels are liquefied petroleum gas

Identify the registrations required and rules to claim fuel tax credits Understand fuels and business activities that are eligible to claim fuel tax credits Recognise how to calculate and

Now that we've ignited your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Fuel Tax Credit Eligible Activities for various goals.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing Fuel Tax Credit Eligible Activities

Here are some fresh ways for you to get the best use of Fuel Tax Credit Eligible Activities:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Fuel Tax Credit Eligible Activities are an abundance of fun and practical tools designed to meet a range of needs and interests. Their accessibility and flexibility make them a wonderful addition to both professional and personal life. Explore the world of Fuel Tax Credit Eligible Activities and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can print and download these files for free.

-

Are there any free printing templates for commercial purposes?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Fuel Tax Credit Eligible Activities?

- Certain printables may be subject to restrictions in their usage. Make sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit a local print shop for better quality prints.

-

What program will I need to access printables for free?

- The majority of printables are in PDF format. These is open with no cost software like Adobe Reader.

Coastal Farm Ranch Current Weekly Ad 10 13 10 19 2021 12

Categories Of Eligible Activities

Check more sample of Fuel Tax Credit Eligible Activities below

Fuel Tax Credit Are You Getting The Your FTC Tax Benefits

2022 Child Tax Credit Who Is Eligible For 2 000 Payments

Am I Eligible For Fuel Tax Credits Fuel Tax Assist

Add A New Fuel Tax Rate Agrimaster

Input Tax Credit Eligible For Canteen Services Provided By An Entity

Restoring The Fuel Tax Credit Survey

https://www.ato.gov.au › businesses-and...

You can claim fuel tax credits for eligible fuel you acquired manufactured or imported and use in your business The Fuel tax credit eligibility tool can help you work out

https://www.ato.gov.au › ... › eligibility › eligible-fuels

To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to

You can claim fuel tax credits for eligible fuel you acquired manufactured or imported and use in your business The Fuel tax credit eligibility tool can help you work out

To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to

Add A New Fuel Tax Rate Agrimaster

2022 Child Tax Credit Who Is Eligible For 2 000 Payments

.JPG)

Input Tax Credit Eligible For Canteen Services Provided By An Entity

Restoring The Fuel Tax Credit Survey

Fuel Tax Credit Calculation

The Treasury s EV Tax Credit Guidance Is Here Includes An 18 Day

The Treasury s EV Tax Credit Guidance Is Here Includes An 18 Day

Our Services R D