In the age of digital, when screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply adding some personal flair to your area, Fuel Tax Credit Eligible Vehicles are now an essential source. Through this post, we'll dive into the sphere of "Fuel Tax Credit Eligible Vehicles," exploring their purpose, where they can be found, and how they can enhance various aspects of your lives.

Get Latest Fuel Tax Credit Eligible Vehicles Below

Fuel Tax Credit Eligible Vehicles

Fuel Tax Credit Eligible Vehicles -

Get a tax credit of up to 7 500 for new vehicles purchased before 2023 The amount varies based on battery capacity and manufacturer phase out

To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax credits

Fuel Tax Credit Eligible Vehicles include a broad assortment of printable, downloadable materials available online at no cost. These resources come in various styles, from worksheets to templates, coloring pages and many more. The beauty of Fuel Tax Credit Eligible Vehicles lies in their versatility as well as accessibility.

More of Fuel Tax Credit Eligible Vehicles

Fuel Tax Credits Banlaw

Fuel Tax Credits Banlaw

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum

The Fuel Tax Credit Eligible Vehicles have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: We can customize printables to your specific needs when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational value: These Fuel Tax Credit Eligible Vehicles provide for students of all ages. This makes them an essential source for educators and parents.

-

Accessibility: Fast access various designs and templates reduces time and effort.

Where to Find more Fuel Tax Credit Eligible Vehicles

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

You can claim fuel tax credits if you package or supply liquid and gaseous fuels when you meet certain requirements You can claim fuel tax credits for any eligible fuel you

Who s Eligible The eligibility criteria for this credit include a large variety of fuel types including the type of fuel that commercial fishermen use to run their boats and the strain of

We hope we've stimulated your interest in Fuel Tax Credit Eligible Vehicles Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Fuel Tax Credit Eligible Vehicles to suit a variety of uses.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Fuel Tax Credit Eligible Vehicles

Here are some fresh ways ensure you get the very most use of Fuel Tax Credit Eligible Vehicles:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Fuel Tax Credit Eligible Vehicles are an abundance with useful and creative ideas designed to meet a range of needs and interests. Their availability and versatility make them a valuable addition to both professional and personal life. Explore the endless world of Fuel Tax Credit Eligible Vehicles today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's based on the terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions in their usage. Be sure to check the terms and conditions provided by the author.

-

How do I print Fuel Tax Credit Eligible Vehicles?

- Print them at home with a printer or visit the local print shop for top quality prints.

-

What software do I need to run printables at no cost?

- Most PDF-based printables are available as PDF files, which is open with no cost software, such as Adobe Reader.

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Fuel Tax Credit Changes HTA

Check more sample of Fuel Tax Credit Eligible Vehicles below

Fuel Tax Credit Calculator Banlaw

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

Fuel Tax Credit Rates Have Changed Small Business Minder

Fuel Tax Credit 2023 2024

Fuel Tax Credit Calculation

Tax Credit For Electric Vehicles Maguire Ford

https://www.ato.gov.au › businesses-and...

To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax credits

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax credits

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

Fuel Tax Credit 2023 2024

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

Fuel Tax Credit Calculation

Tax Credit For Electric Vehicles Maguire Ford

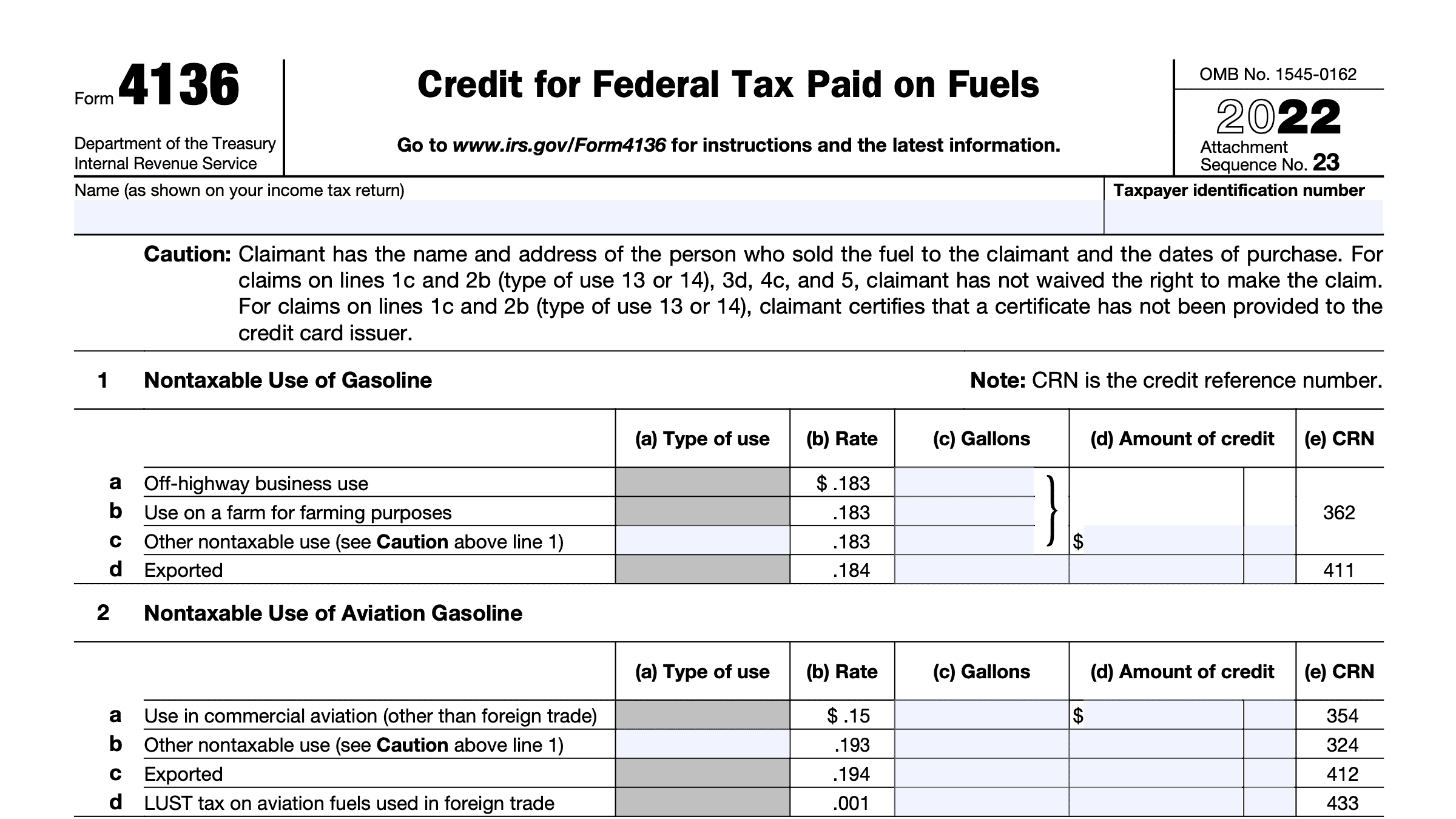

IRS Form 4136 A Guide To Federal Taxes Paid On Fuels

Fuel Tax Credit Rates Have Increased Business Wise

Fuel Tax Credit Rates Have Increased Business Wise

Fuel Tax Credit UPDATED JUNE 2022