In this day and age with screens dominating our lives however, the attraction of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add some personal flair to your area, Fuel Tax Credit Form are now an essential source. The following article is a take a dive through the vast world of "Fuel Tax Credit Form," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Fuel Tax Credit Form Below

Fuel Tax Credit Form

Fuel Tax Credit Form -

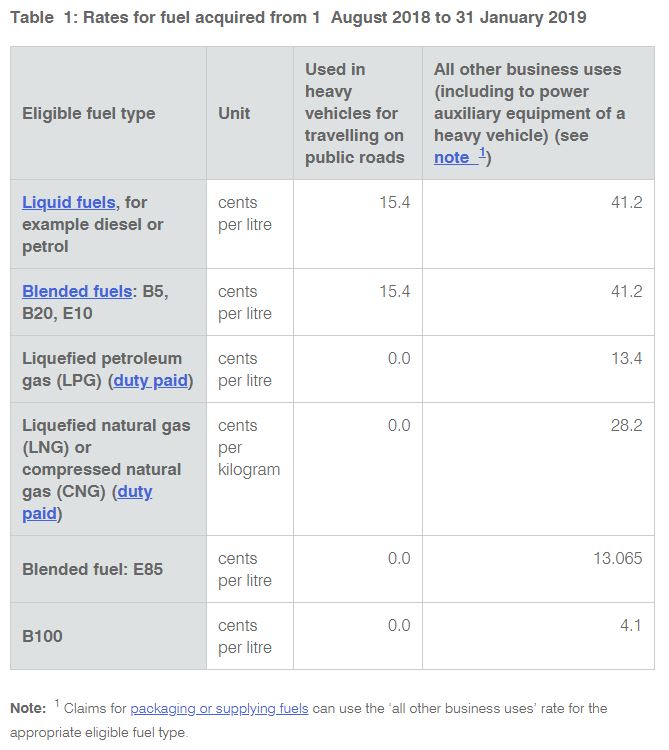

Fuel tax credits business Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles

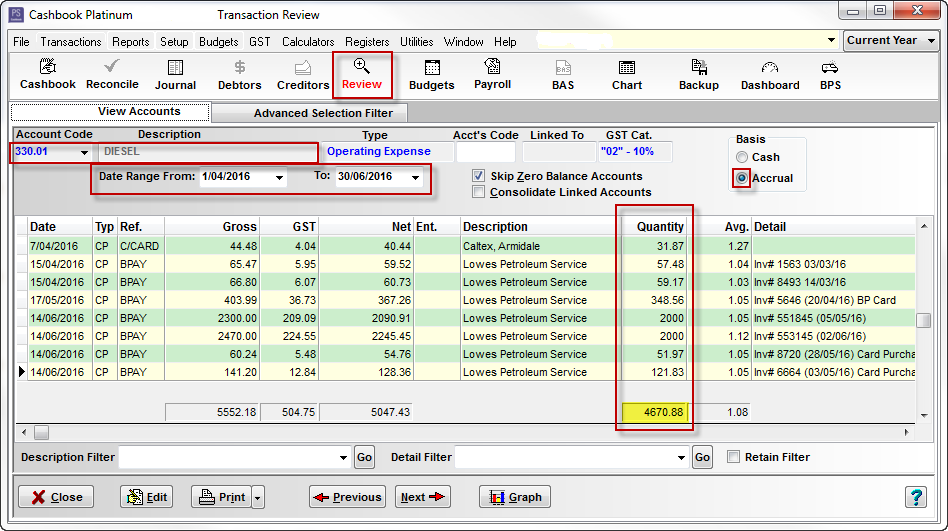

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

Fuel Tax Credit Form encompass a wide selection of printable and downloadable material that is available online at no cost. They come in many types, such as worksheets templates, coloring pages, and much more. One of the advantages of Fuel Tax Credit Form lies in their versatility as well as accessibility.

More of Fuel Tax Credit Form

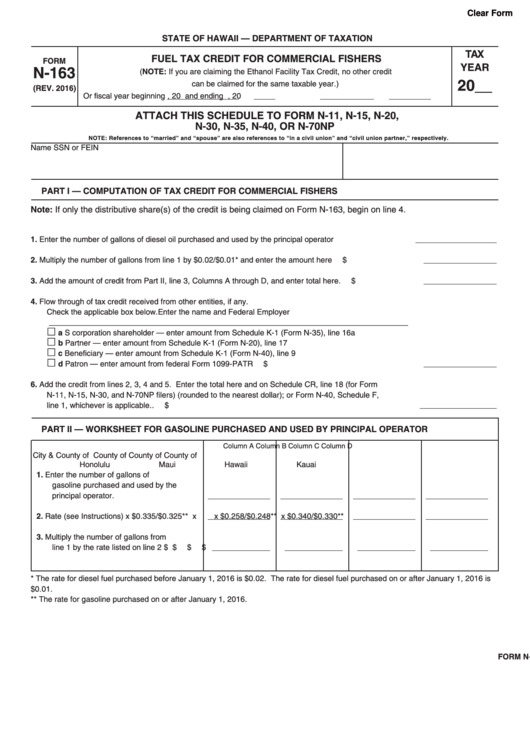

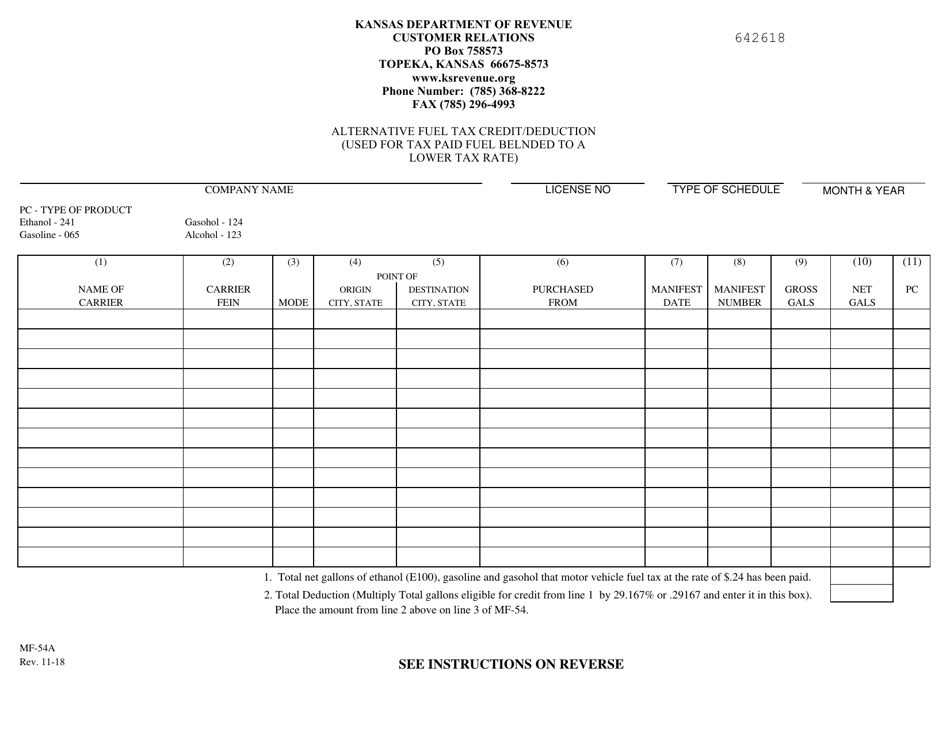

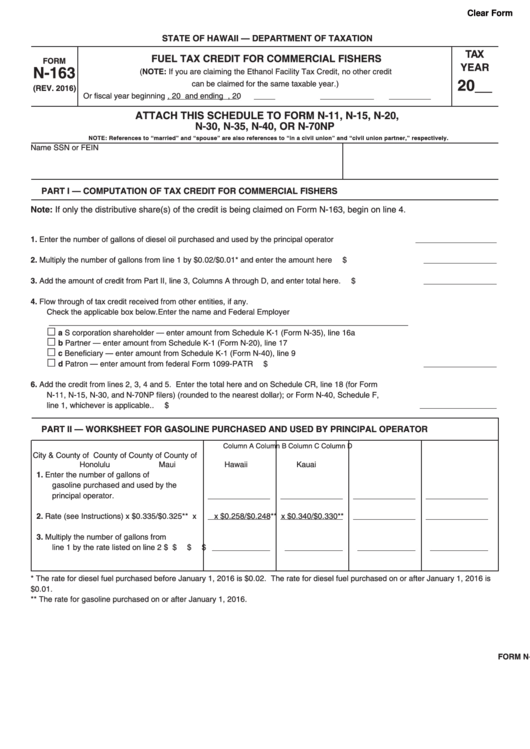

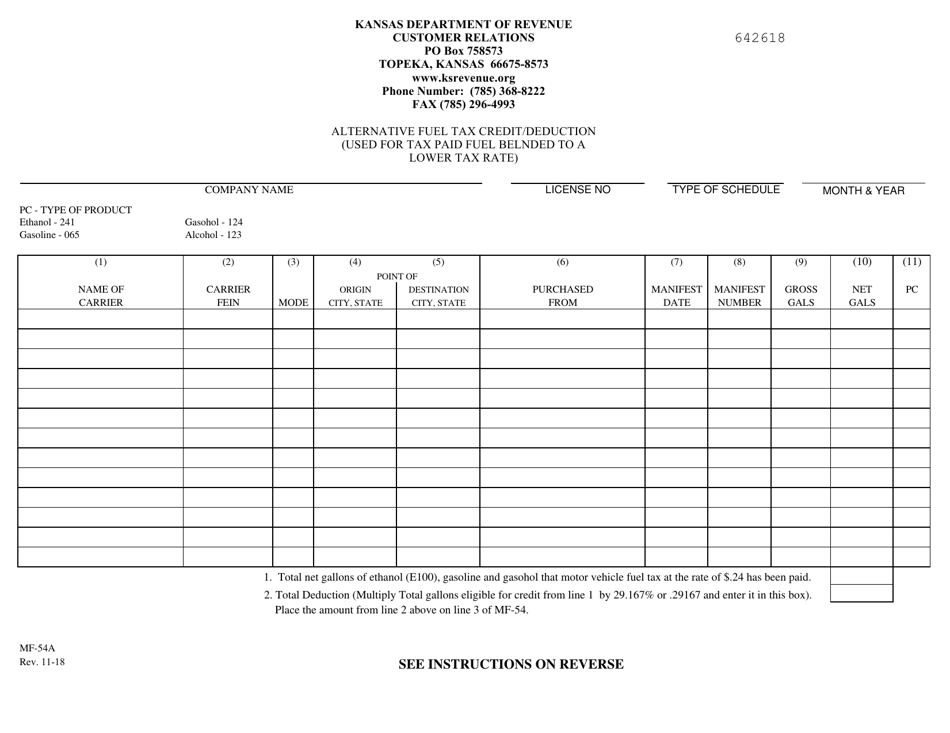

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

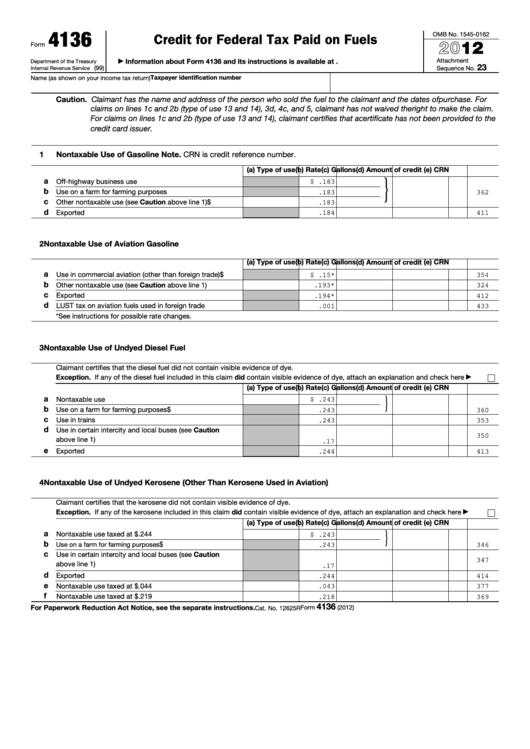

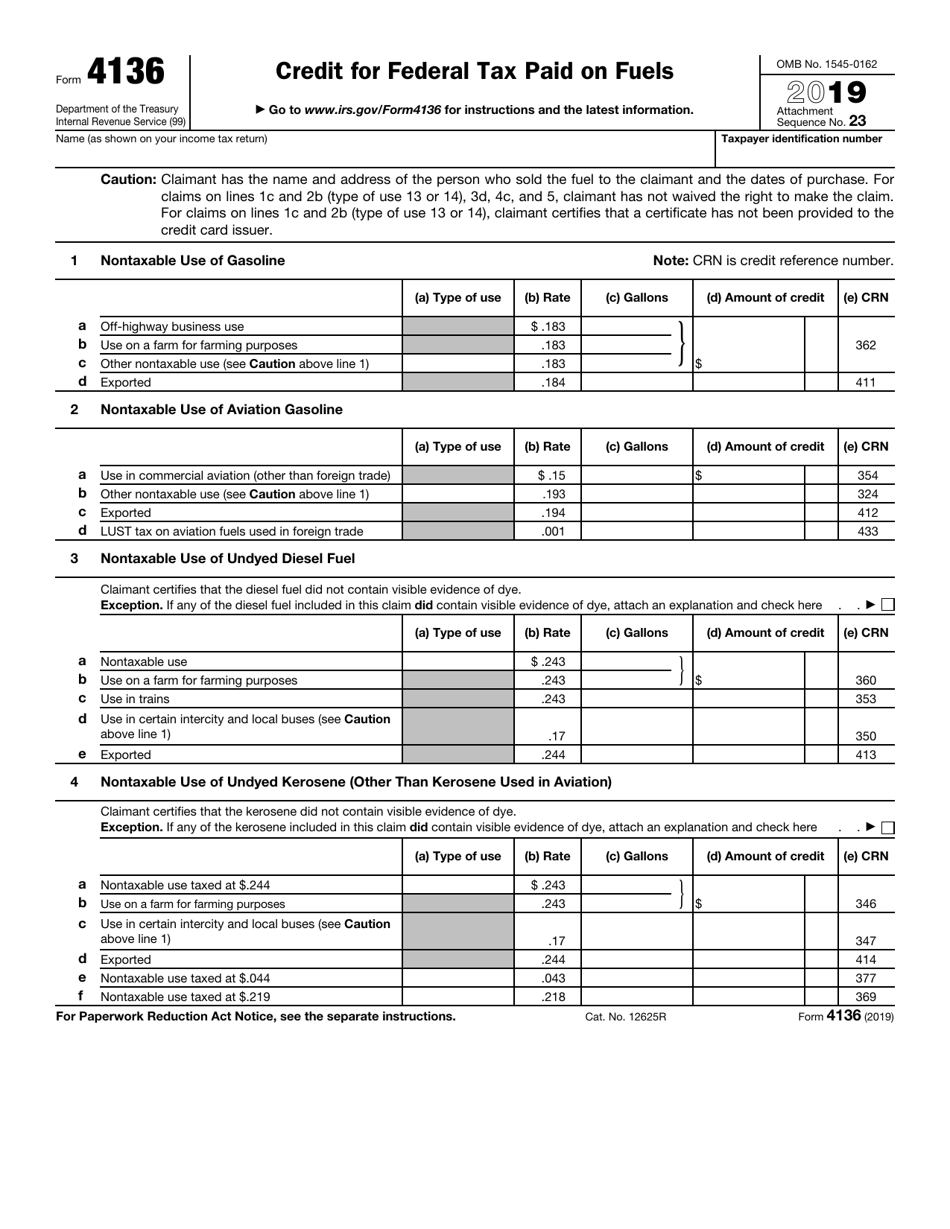

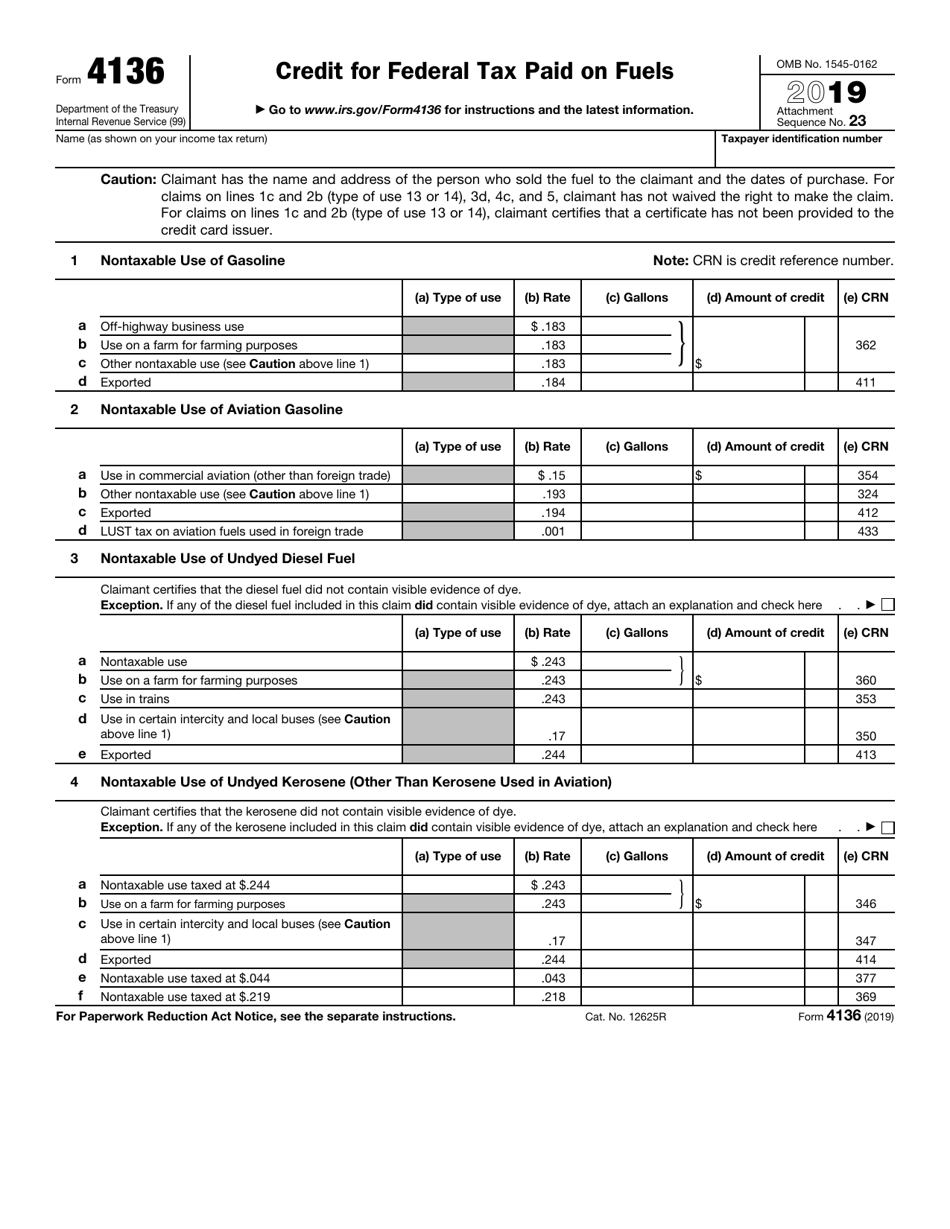

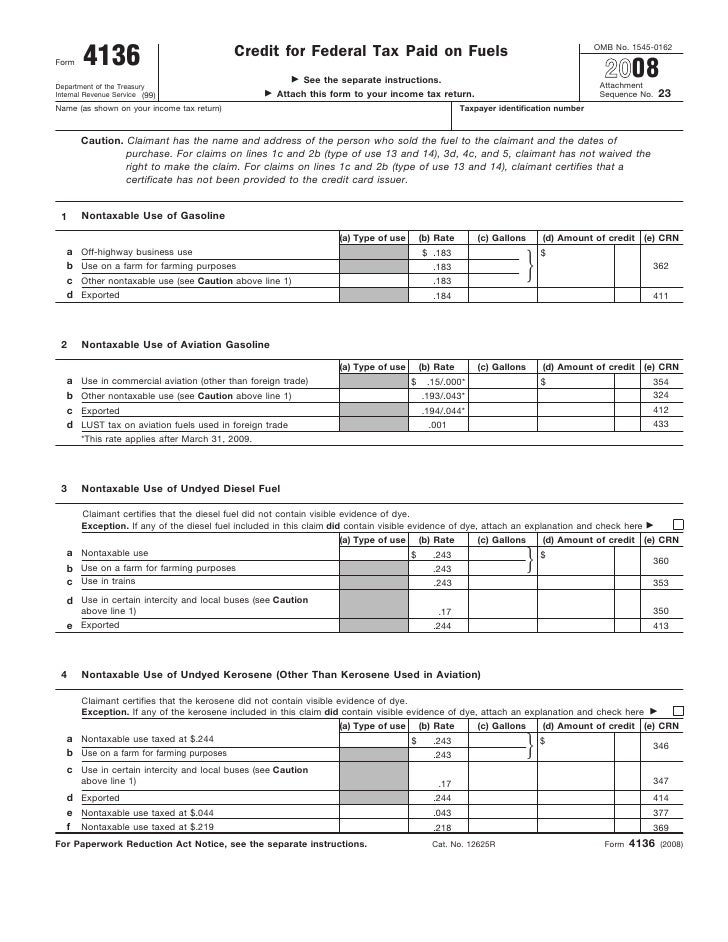

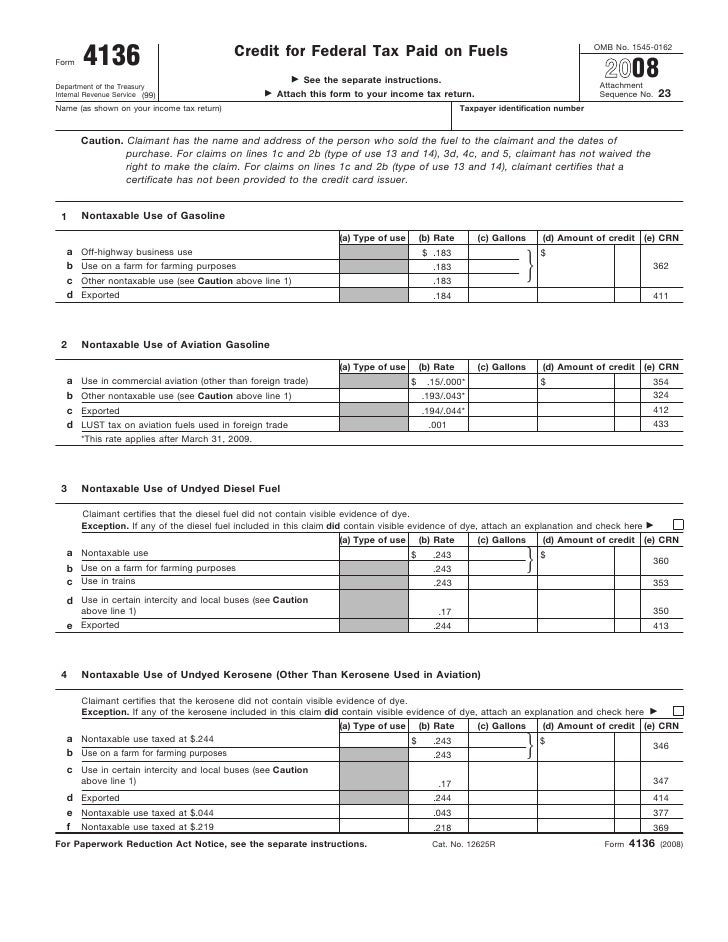

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136

Once they determine that they re entitled to the credit companies and some individuals may apply for the Fuel Tax Credit by using Federal Tax Form 4136 Filers may also use this form to

The Fuel Tax Credit Form have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: You can tailor printables to your specific needs be it designing invitations and schedules, or even decorating your home.

-

Educational Worth: These Fuel Tax Credit Form provide for students of all ages, which makes these printables a powerful device for teachers and parents.

-

Accessibility: Quick access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Fuel Tax Credit Form

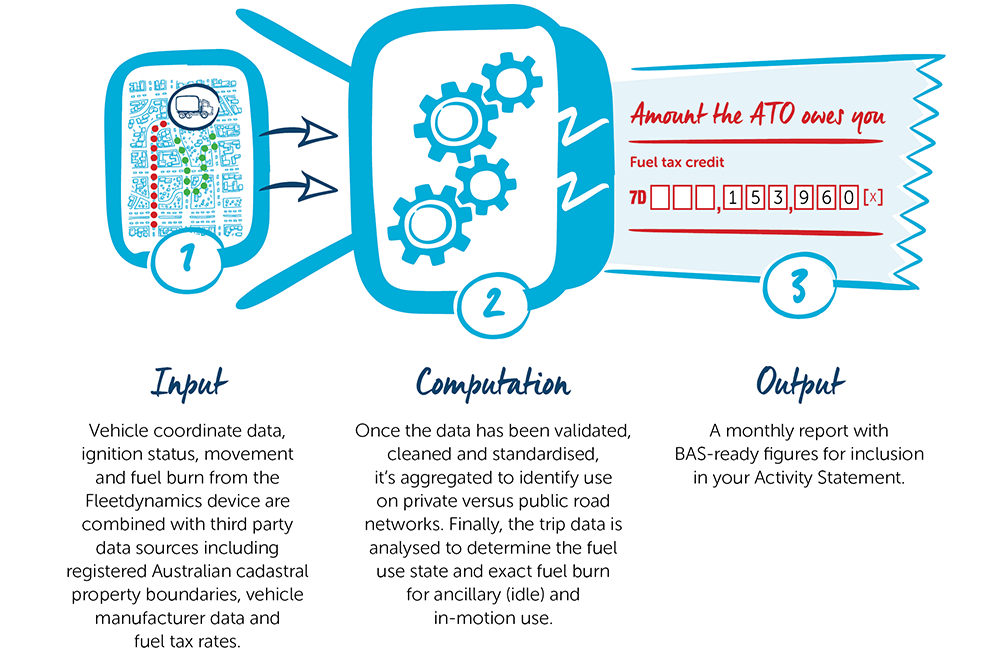

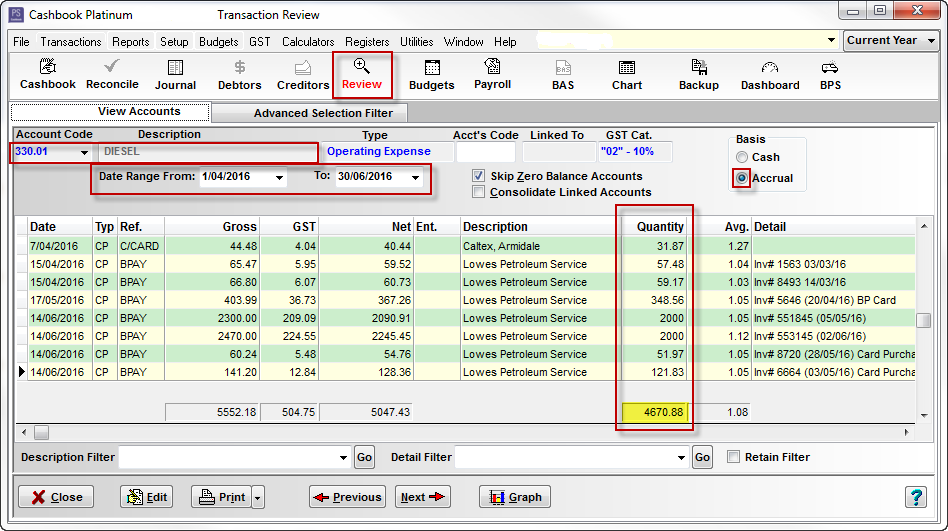

Fuel Tax Credit Computation Telematics Fleetcare

Fuel Tax Credit Computation Telematics Fleetcare

To claim fuel tax credits with Form 4136 you must Have paid federal excise taxes on fuels Have proof of tax amounts paid Have used fuels for nontaxable purposes You cannot claim a credit for fuel used for personal reasons The table below outlines common eligible and ineligible uses Eligible Uses Business vehicles driven off

Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving particularly for transportation construction or agriculture businesses where fuel consumption is high

Now that we've ignited your curiosity about Fuel Tax Credit Form Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Fuel Tax Credit Form for various reasons.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Fuel Tax Credit Form

Here are some ideas for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Fuel Tax Credit Form are a treasure trove of fun and practical tools catering to different needs and pursuits. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the plethora of Fuel Tax Credit Form to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Fuel Tax Credit Form truly cost-free?

- Yes they are! You can print and download the resources for free.

-

Does it allow me to use free printouts for commercial usage?

- It's dependent on the particular terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with Fuel Tax Credit Form?

- Certain printables may be subject to restrictions regarding usage. Be sure to check the terms and conditions provided by the author.

-

How can I print Fuel Tax Credit Form?

- You can print them at home with printing equipment or visit a print shop in your area for more high-quality prints.

-

What software will I need to access Fuel Tax Credit Form?

- Many printables are offered in the PDF format, and is open with no cost programs like Adobe Reader.

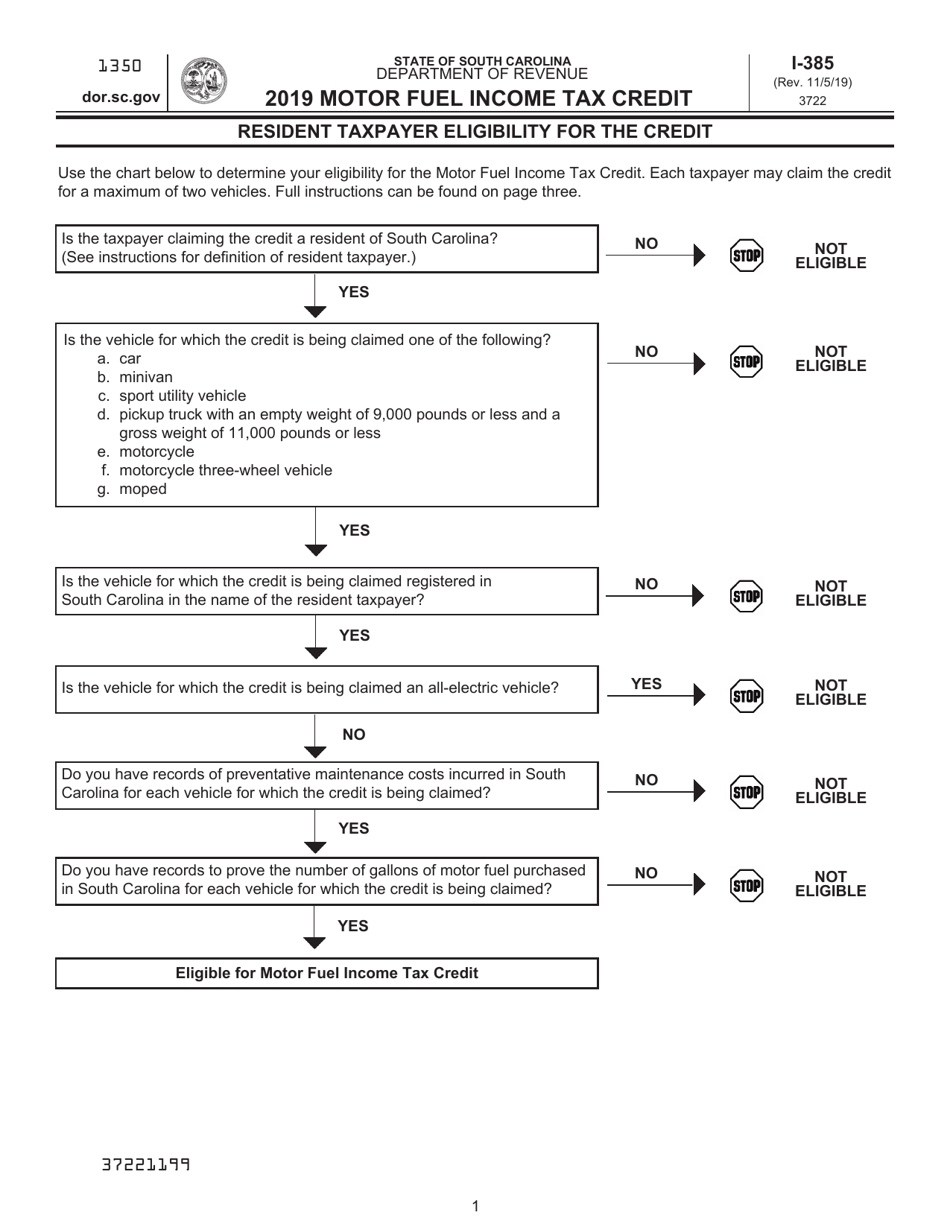

Form I 385 2019 Fill Out Sign Online And Download Printable PDF

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Check more sample of Fuel Tax Credit Form below

Fuel Tax Credit Eligibility Form 4136 How To Claim

Calculating Fuel Tax Credit Manually PS Support

Fuel Tax Credit Calculator Banlaw

IRS Form 4136 2019 Fill Out Sign Online And Download Fillable PDF

Fuel Tax Credit Definition

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Accountancy Group Fuel Tax Credit Changes Accountancy Group

https://www.ato.gov.au/forms-and-instructions/fuel...

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

https://www.irs.gov/pub/irs-pdf/f4136.pdf

Department of the Treasury Internal Revenue Service Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2023 Attachment Sequence No 79 Name as shown on your income tax return Taxpayer identification number 4136 Caution

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

Department of the Treasury Internal Revenue Service Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2023 Attachment Sequence No 79 Name as shown on your income tax return Taxpayer identification number 4136 Caution

IRS Form 4136 2019 Fill Out Sign Online And Download Fillable PDF

Calculating Fuel Tax Credit Manually PS Support

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

Accountancy Group Fuel Tax Credit Changes Accountancy Group

Fuel Tax Credit Atotaxrates info

Form 4136 Credit For Federal Tax Paid On Fuel

Form 4136 Credit For Federal Tax Paid On Fuel

Restoring The Fuel Tax Credit Survey