In the digital age, where screens rule our lives it's no wonder that the appeal of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or simply adding personal touches to your area, Gas Mileage Tax Deduction Calculator are now a useful source. We'll dive to the depths of "Gas Mileage Tax Deduction Calculator," exploring the benefits of them, where to find them, and how they can add value to various aspects of your life.

Get Latest Gas Mileage Tax Deduction Calculator Below

Gas Mileage Tax Deduction Calculator

Gas Mileage Tax Deduction Calculator -

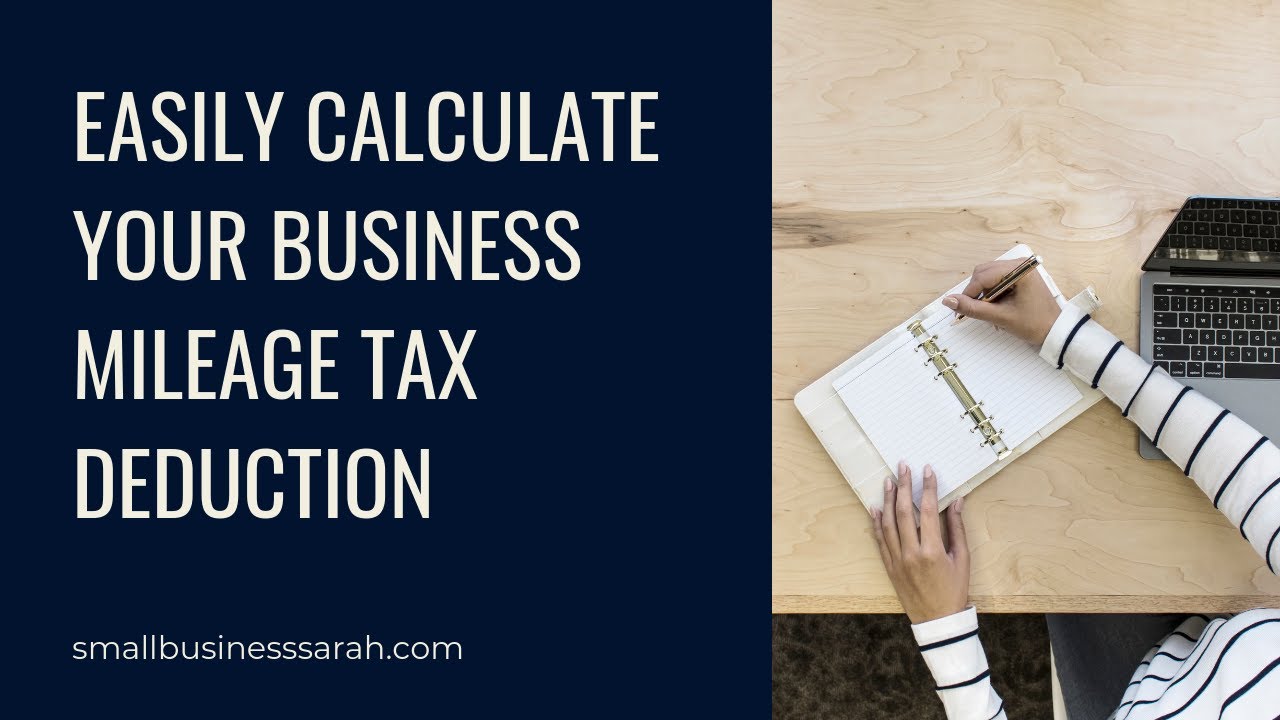

For 2024 the IRS standard mileage rates are 0 67 per mile for business 0 21 per mile for medical or moving and 0 14 per mile for charity If you drive for your business or plan to rack up

Steps to Claim the Deduction 1 Keep accurate records to support your claim You must either keep track of your vehicle expenses or keep a mileage log 2 Report Income and Expenses On Schedule C report your self employment income and deduct your business expenses including the mileage deduction 3 File Your Tax Return

Gas Mileage Tax Deduction Calculator offer a wide selection of printable and downloadable materials online, at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and many more. One of the advantages of Gas Mileage Tax Deduction Calculator lies in their versatility and accessibility.

More of Gas Mileage Tax Deduction Calculator

Business Use Of Vehicle Tax Deductions

Business Use Of Vehicle Tax Deductions

Use the provided HMRC mileage claim calculator to determine how much you can receive in reimbursement for your business driving To calculate this you will need the number of miles you have driven for business purposes and then multiply it by the standard HMRC rates

Current Tax Deductible Mileage Rates How much you can deduct for mileage depends on the type of driving you did Business mileage is most common but you can also deduct mileage

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Individualization You can tailor printing templates to your own specific requirements whether it's making invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Education-related printables at no charge provide for students of all ages, which makes them a great aid for parents as well as educators.

-

Easy to use: The instant accessibility to a variety of designs and templates saves time and effort.

Where to Find more Gas Mileage Tax Deduction Calculator

Use The Sales Tax Deduction Calculator Simple Accounting

Use The Sales Tax Deduction Calculator Simple Accounting

Calculate the deduction by multiplying the total actual expenses incurred gas maintenance oil by the business use percentage 600 42 8 256 8 Following the actual expenses method you can deduct 256 8 as your mileage tax deduction for the month Read more about the standard and actual expenses methods here

The IRS offers two ways of calculating the cost of using your vehicle in your business The actual expenses method or Standard mileage rate method Each method has its advantages and disadvantages and they often produce vastly different results

Since we've got your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Gas Mileage Tax Deduction Calculator for various needs.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing Gas Mileage Tax Deduction Calculator

Here are some ways in order to maximize the use use of Gas Mileage Tax Deduction Calculator:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Gas Mileage Tax Deduction Calculator are a treasure trove of useful and creative resources that cater to various needs and preferences. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the endless world of Gas Mileage Tax Deduction Calculator today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these free resources for no cost.

-

Are there any free printables for commercial uses?

- It's based on the usage guidelines. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with Gas Mileage Tax Deduction Calculator?

- Certain printables could be restricted regarding their use. Be sure to review the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to the local print shops for the highest quality prints.

-

What software do I require to view printables for free?

- Most PDF-based printables are available as PDF files, which can be opened using free programs like Adobe Reader.

Mileage Tax Deduction Rate Change

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

Check more sample of Gas Mileage Tax Deduction Calculator below

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

Easily Calculate Your Business Mileage Tax Deduction YouTube

Mileage Logbook Tracker Vehicle Mileage Tracking Business Etsy

Free Mileage Log Template IRS Compliant Excel PDF

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

Gas Mileage Log And Mileage Calculator For Excel Mileage Chart Mileage

https://www.mileagewise.com/mileage-deduction-guide

Steps to Claim the Deduction 1 Keep accurate records to support your claim You must either keep track of your vehicle expenses or keep a mileage log 2 Report Income and Expenses On Schedule C report your self employment income and deduct your business expenses including the mileage deduction 3 File Your Tax Return

https://www.irs.gov/tax-professionals/standard-mileage-rates

Find standard mileage rates to calculate the deduction for using your car for business charitable medical or moving purposes

Steps to Claim the Deduction 1 Keep accurate records to support your claim You must either keep track of your vehicle expenses or keep a mileage log 2 Report Income and Expenses On Schedule C report your self employment income and deduct your business expenses including the mileage deduction 3 File Your Tax Return

Find standard mileage rates to calculate the deduction for using your car for business charitable medical or moving purposes

Free Mileage Log Template IRS Compliant Excel PDF

Easily Calculate Your Business Mileage Tax Deduction YouTube

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

Gas Mileage Log And Mileage Calculator For Excel Mileage Chart Mileage

How To Claim The Standard Mileage Deduction Get It Back

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

Mileage Tax Deduction Vs Reimbursement For Automobile Expenses