In this age of technology, with screens dominating our lives and the appeal of physical printed items hasn't gone away. Whether it's for educational purposes for creative projects, simply adding an extra personal touch to your home, printables for free have proven to be a valuable source. Through this post, we'll dive to the depths of "Germany Annual Vat Return Deadline 2023," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Germany Annual Vat Return Deadline 2023 Below

Germany Annual Vat Return Deadline 2023

Germany Annual Vat Return Deadline 2023 -

Declaration for the calendar year 2023 submission deadline by 02 06 2025 Declaration for calendar year 2024 submission deadline until 30 04 2026 Declaration for the calendar year 2025 submission deadline by 01 03 2027

The annual summary VAT returns is filed for a complete calendar year The due date to submit the German annual VAT return is 31 July of the following year In case this return is filed by a recognised tax consultant the due date is shifted to 28 February of the second following year

Germany Annual Vat Return Deadline 2023 encompass a wide range of printable, free material that is available online at no cost. These resources come in many types, such as worksheets templates, coloring pages and much more. One of the advantages of Germany Annual Vat Return Deadline 2023 lies in their versatility and accessibility.

More of Germany Annual Vat Return Deadline 2023

Kilkenny Comedy Club Launch Night AKA

Kilkenny Comedy Club Launch Night AKA

Germany Deadline Extension for the 2021 Annual VAT Returns to 31 October 2022 The German Ministry of Finance clarified the extension of the annual VAT return deadlines for the taxation periods 2020 to 2024 as part of the tax relief measures relating to the COVID 19 and the Ukraine crises Generally the deadlines are

For example the annual VAT return for 2022 is normally due by July 31st 2023 But the payment deadline will be extended to February 28 2024 if submitted by a recognized tax advisor However the deadlines for submitting

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor printed materials to meet your requirements whether it's making invitations planning your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost provide for students from all ages, making them a vital aid for parents as well as educators.

-

Accessibility: Access to a variety of designs and templates can save you time and energy.

Where to Find more Germany Annual Vat Return Deadline 2023

2021 Annual VAT Recovery Rate Review

2021 Annual VAT Recovery Rate Review

The annual German VAT return which provides final summaries of a year s VAT information is generally due by 31 July This means 2021 s annual return is due by the end of this month July 2022 However more time has now been provided for the Steuererkarung For 2021 the deadline is extended until to 31 October 2022

In Germany freelancers who charge VAT to their clients must periodically submit their incoming and outgoing VAT to the tax office every month every quarter or once a year The general deadline for submitting the monthly advance VAT return is the 10th day of the following month

We hope we've stimulated your interest in printables for free we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Germany Annual Vat Return Deadline 2023 suitable for many goals.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free as well as flashcards and other learning tools.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing Germany Annual Vat Return Deadline 2023

Here are some creative ways to make the most use of Germany Annual Vat Return Deadline 2023:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Germany Annual Vat Return Deadline 2023 are an abundance of practical and imaginative resources which cater to a wide range of needs and preferences. Their access and versatility makes these printables a useful addition to each day life. Explore the vast array of Germany Annual Vat Return Deadline 2023 today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Germany Annual Vat Return Deadline 2023 really completely free?

- Yes, they are! You can download and print these materials for free.

-

Can I use the free templates for commercial use?

- It's determined by the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with Germany Annual Vat Return Deadline 2023?

- Certain printables could be restricted concerning their use. Check the conditions and terms of use provided by the author.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in a local print shop for more high-quality prints.

-

What software is required to open printables free of charge?

- The majority of printed documents are as PDF files, which can be opened using free programs like Adobe Reader.

German Annual VAT Return Filing Extension Vatcalc

11 Ways To Be Prepared For The VAT Return Deadline Inatecservices

Check more sample of Germany Annual Vat Return Deadline 2023 below

Beware Sting In VAT Annual Accounting Scheme Purlieus Consulting

Endings And Beginnings Year end Tax Reminders And Tax Changes In 2023

UAE VAT Return Deadline On 28 June 2018 BSA Middle East Law Firm

Germany Annual VAT Returns New Deadlines And Interest Rules

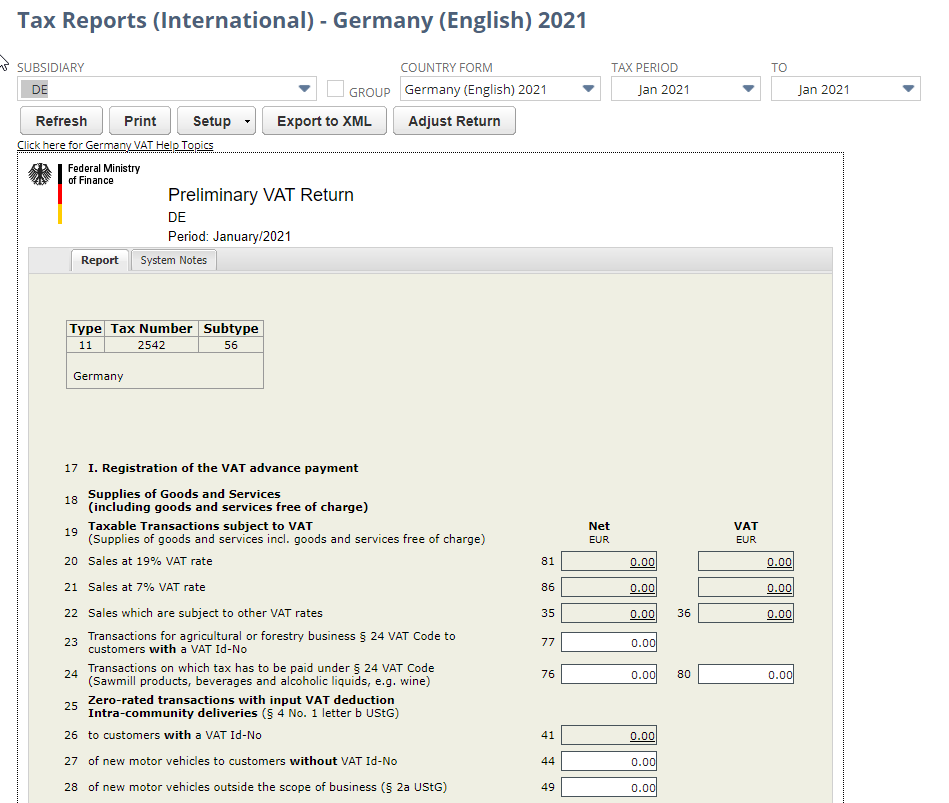

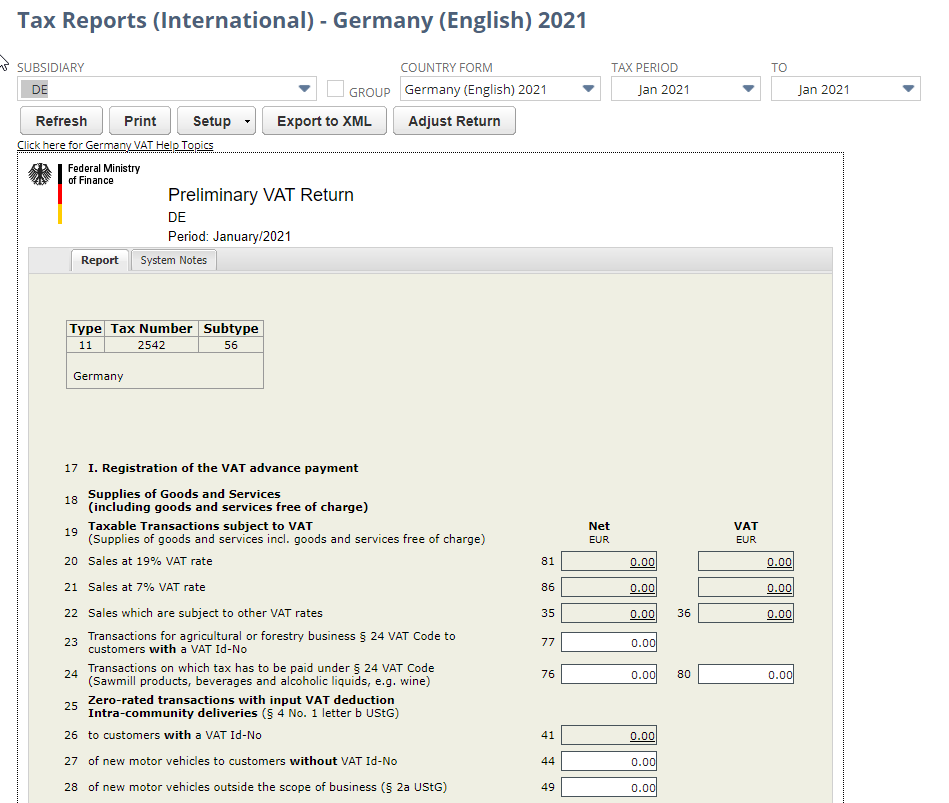

NetSuite Applications Suite Germany VAT Report

VAT Annual Accounting Scheme Accountants Etc

https://marosavat.com/manual/vat/germany/returns

The annual summary VAT returns is filed for a complete calendar year The due date to submit the German annual VAT return is 31 July of the following year In case this return is filed by a recognised tax consultant the due date is shifted to 28 February of the second following year

https://marosavat.com/annual-vat-returns-germany

What is the deadline for submission The Annual VAT return in Germany is generally submitted by 31 July of the year following the reporting period In case this return is filed by a recognised tax consultant appointed as such by the German tax authorities the due date may be shifted to the end of February of the second following year

The annual summary VAT returns is filed for a complete calendar year The due date to submit the German annual VAT return is 31 July of the following year In case this return is filed by a recognised tax consultant the due date is shifted to 28 February of the second following year

What is the deadline for submission The Annual VAT return in Germany is generally submitted by 31 July of the year following the reporting period In case this return is filed by a recognised tax consultant appointed as such by the German tax authorities the due date may be shifted to the end of February of the second following year

Germany Annual VAT Returns New Deadlines And Interest Rules

Endings And Beginnings Year end Tax Reminders And Tax Changes In 2023

NetSuite Applications Suite Germany VAT Report

VAT Annual Accounting Scheme Accountants Etc

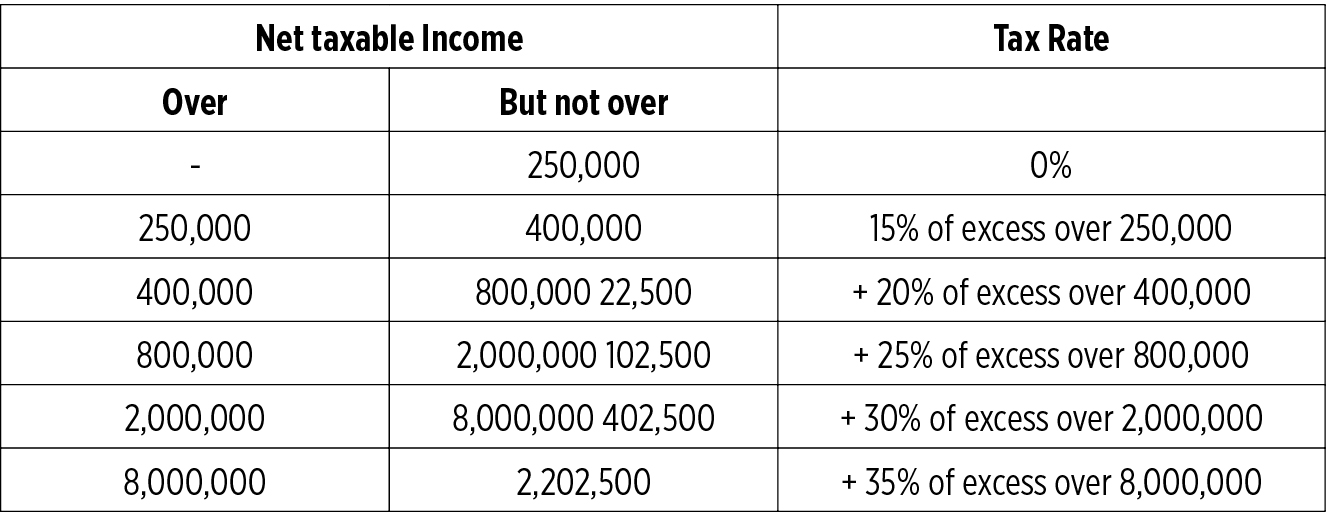

Annual Income Tax Return Filing For Calendar Year 2022 Guidelines RMC

Police And Fire VAT The 35 Million Annual VAT Cost Faced Flickr

Police And Fire VAT The 35 Million Annual VAT Cost Faced Flickr

VAT Return Dates Payment Deadlines Goselfemployed co