In a world where screens have become the dominant feature of our lives, the charm of tangible printed materials isn't diminishing. For educational purposes and creative work, or just adding personal touches to your area, Green Energy Tax Credits Inflation Reduction Act are now a vital resource. In this article, we'll dive through the vast world of "Green Energy Tax Credits Inflation Reduction Act," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Green Energy Tax Credits Inflation Reduction Act Below

Green Energy Tax Credits Inflation Reduction Act

Green Energy Tax Credits Inflation Reduction Act -

Clean Energy Tax Provisions in the Inflation Reduction Act Clean Energy The White House The Inflation Reduction Act includes some two dozen tax provisions that will save

Credits and deductions under the Inflation Reduction Act of 2022 The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities

Green Energy Tax Credits Inflation Reduction Act provide a diverse collection of printable material that is available online at no cost. They come in many designs, including worksheets templates, coloring pages and more. The great thing about Green Energy Tax Credits Inflation Reduction Act lies in their versatility as well as accessibility.

More of Green Energy Tax Credits Inflation Reduction Act

10 Benefits Of Clean Energy In The Cut Inflation Act Energgy

10 Benefits Of Clean Energy In The Cut Inflation Act Energgy

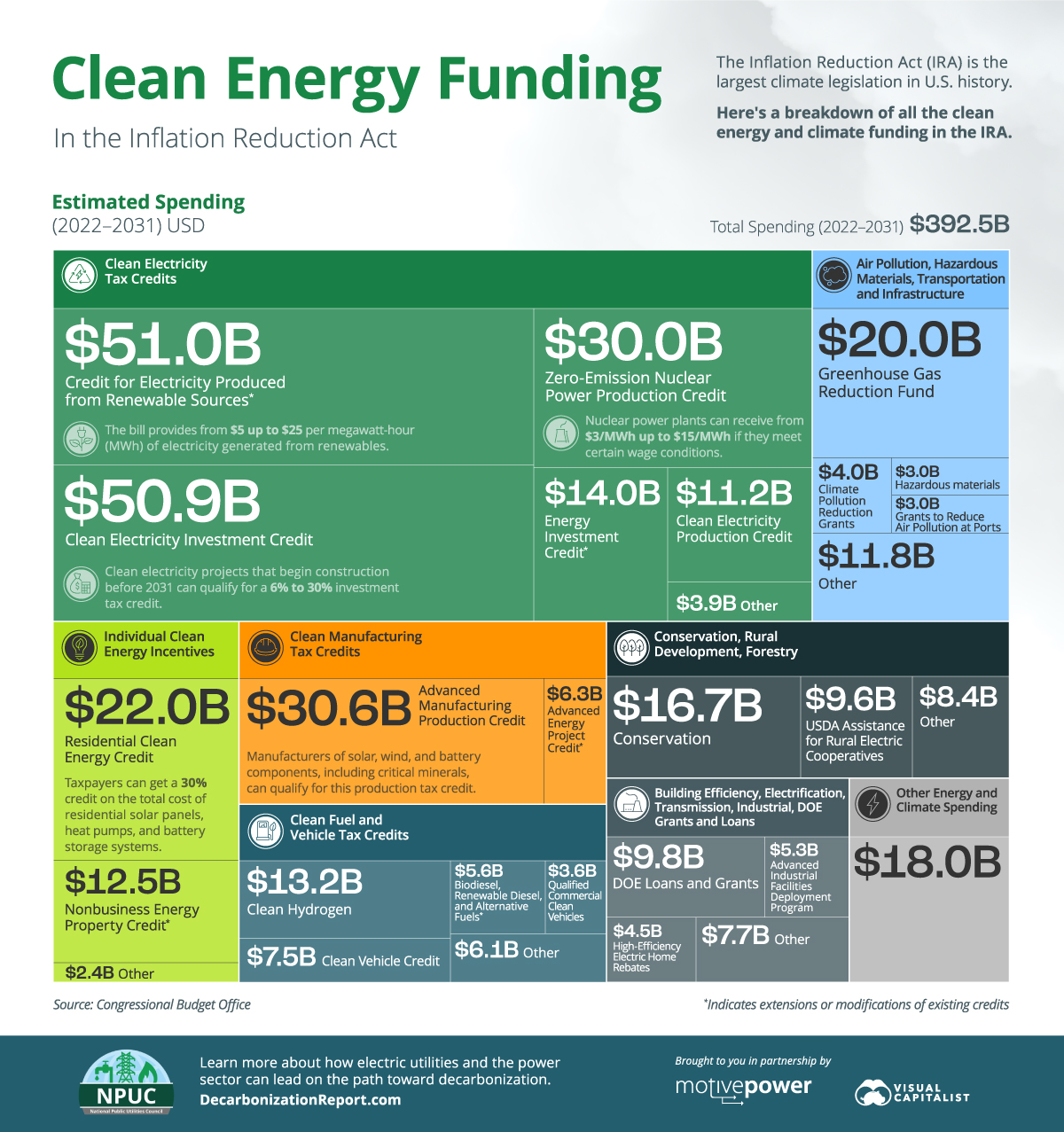

Last updated on October 25 2023 The Inflation Reduction Act of 2022 IRA is the most significant climate legislation in U S history IRA s provisions will finance green power lower costs through tax credits reduce emissions and advance environmental justice

Projects selected for tax credits under the Qualifying Advanced Energy Project Tax Credit 48C funded by President Biden s Inflation Reduction Act span across large medium and small businesses and state and local governments all of which must meet prevailing wage and apprenticeship requirements to receive a 30

Green Energy Tax Credits Inflation Reduction Act have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages. This makes them a great instrument for parents and teachers.

-

It's easy: Access to numerous designs and templates is time-saving and saves effort.

Where to Find more Green Energy Tax Credits Inflation Reduction Act

Tax Credits More Your Guide To The Inflation Reduction Act

Tax Credits More Your Guide To The Inflation Reduction Act

The Inflation Reduction Act allows for some clean energy tax credits to be bought or sold one time to a third party The agencies first issued proposed rules last June Eleven green energy credits can be transferred including the credits for zero emission nuclear power production clean hydrogen production and the advanced manufacturing

This guidebook provides an overview of the clean energy climate mitigation and resilience agriculture and conservation related investment programs in President Biden s Inflation Reduction

We've now piqued your curiosity about Green Energy Tax Credits Inflation Reduction Act We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Green Energy Tax Credits Inflation Reduction Act for different goals.

- Explore categories such as home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast spectrum of interests, from DIY projects to planning a party.

Maximizing Green Energy Tax Credits Inflation Reduction Act

Here are some creative ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Green Energy Tax Credits Inflation Reduction Act are an abundance of innovative and useful resources designed to meet a range of needs and passions. Their availability and versatility make them a great addition to both professional and personal life. Explore the endless world of Green Energy Tax Credits Inflation Reduction Act to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial use?

- It's determined by the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Green Energy Tax Credits Inflation Reduction Act?

- Some printables may contain restrictions in their usage. You should read the terms and conditions offered by the author.

-

How can I print Green Energy Tax Credits Inflation Reduction Act?

- Print them at home with an printer, or go to the local print shop for more high-quality prints.

-

What program do I require to view printables that are free?

- The majority are printed in PDF format. They is open with no cost programs like Adobe Reader.

Refundability And Transferability Of The Clean Energy Tax Credits In

A Guide To Green Energy Tax Credits Under The Inflation Reduction Act

Check more sample of Green Energy Tax Credits Inflation Reduction Act below

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

What s In The Inflation Reduction Act And What s Next For Its

Inflation Reduction Act L Electric Vehicle Tax Credits GM Advisory Group

Home Energy Improvements Lead To Real Savings Infographic Solar

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Inflation Reduction Act Business Tax Incentives Virginia CPA

https://www.irs.gov/credits-and-deductions-under...

Credits and deductions under the Inflation Reduction Act of 2022 The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Credits and deductions under the Inflation Reduction Act of 2022 The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Home Energy Improvements Lead To Real Savings Infographic Solar

What s In The Inflation Reduction Act And What s Next For Its

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Inflation Reduction Act Business Tax Incentives Virginia CPA

Renewable Energy Tax Credits And The Inflation Reduction Act SmartBrief

Inflation Reduction Act Nevada Arizona Energy Tax Credits

Inflation Reduction Act Nevada Arizona Energy Tax Credits

Breaking Down Clean Energy Funding In The Inflation Reduction Act