In a world where screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. For educational purposes project ideas, artistic or simply to add an individual touch to your space, Gst Input Tax Credit On Air Conditioner are now an essential resource. We'll dive into the world of "Gst Input Tax Credit On Air Conditioner," exploring what they are, where they are, and how they can add value to various aspects of your lives.

Get Latest Gst Input Tax Credit On Air Conditioner Below

Gst Input Tax Credit On Air Conditioner

Gst Input Tax Credit On Air Conditioner -

Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim ITC seen in updated rules and law amendments highlighted Time limits and examples are

Understand the eligibility of Input Tax Credit ITC under GST law for HVAC systems lifts and similar equipment Examine legal provisions and rulings to determine if ITC applies to these immovable property components

Gst Input Tax Credit On Air Conditioner encompass a wide assortment of printable, downloadable materials online, at no cost. These resources come in many types, like worksheets, templates, coloring pages, and many more. The benefit of Gst Input Tax Credit On Air Conditioner lies in their versatility as well as accessibility.

More of Gst Input Tax Credit On Air Conditioner

Input Tax Credit Meaning Conditions To Avail Documents Required

Input Tax Credit Meaning Conditions To Avail Documents Required

The input tax credit is not admissible on Air conditioning and Cooling systems and Ventilation systems as this is blocked credit falling under Section 17 5 c CGST Act

With effect from 01 01 2021 section 16 4 of the CGST Act 2017 was amended vide the Finance Act 2020 so as to delink the date of issuance of debit note from the date of issuance of the

Gst Input Tax Credit On Air Conditioner have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: This allows you to modify printables to fit your particular needs when it comes to designing invitations and schedules, or even decorating your home.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners of all ages. This makes the perfect tool for teachers and parents.

-

An easy way to access HTML0: instant access various designs and templates, which saves time as well as effort.

Where to Find more Gst Input Tax Credit On Air Conditioner

New GST Input Tax Credit Rules Tally FAQ News Announcements Blog

New GST Input Tax Credit Rules Tally FAQ News Announcements Blog

Eligible to avail input tax credit in respect of the said input service of transportation of goods Section 16 of the CGST Act lays down the eligibility and conditions for taking input tax credit

What is the GST effect on air conditioner Previously consumer durables were subject to two significant taxes VAT and excise duty The aggregat e rate was approximately 23 Now the new GST rate on air

Since we've got your curiosity about Gst Input Tax Credit On Air Conditioner Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Gst Input Tax Credit On Air Conditioner for various objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Gst Input Tax Credit On Air Conditioner

Here are some unique ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Gst Input Tax Credit On Air Conditioner are a treasure trove filled with creative and practical information designed to meet a range of needs and needs and. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the plethora of Gst Input Tax Credit On Air Conditioner and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printables for commercial use?

- It's determined by the specific terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Gst Input Tax Credit On Air Conditioner?

- Certain printables might have limitations in use. Be sure to read the terms and conditions set forth by the creator.

-

How can I print Gst Input Tax Credit On Air Conditioner?

- You can print them at home with the printer, or go to the local print shop for premium prints.

-

What program is required to open printables free of charge?

- A majority of printed materials are in the PDF format, and is open with no cost software like Adobe Reader.

GST Input Tax Credit Understanding Section 16 Of The GST Act

GST Input Tax Credit On Loyalty Vouchers By Myntra Logitax

Check more sample of Gst Input Tax Credit On Air Conditioner below

Can You Claim Input Tax Credit On Travel

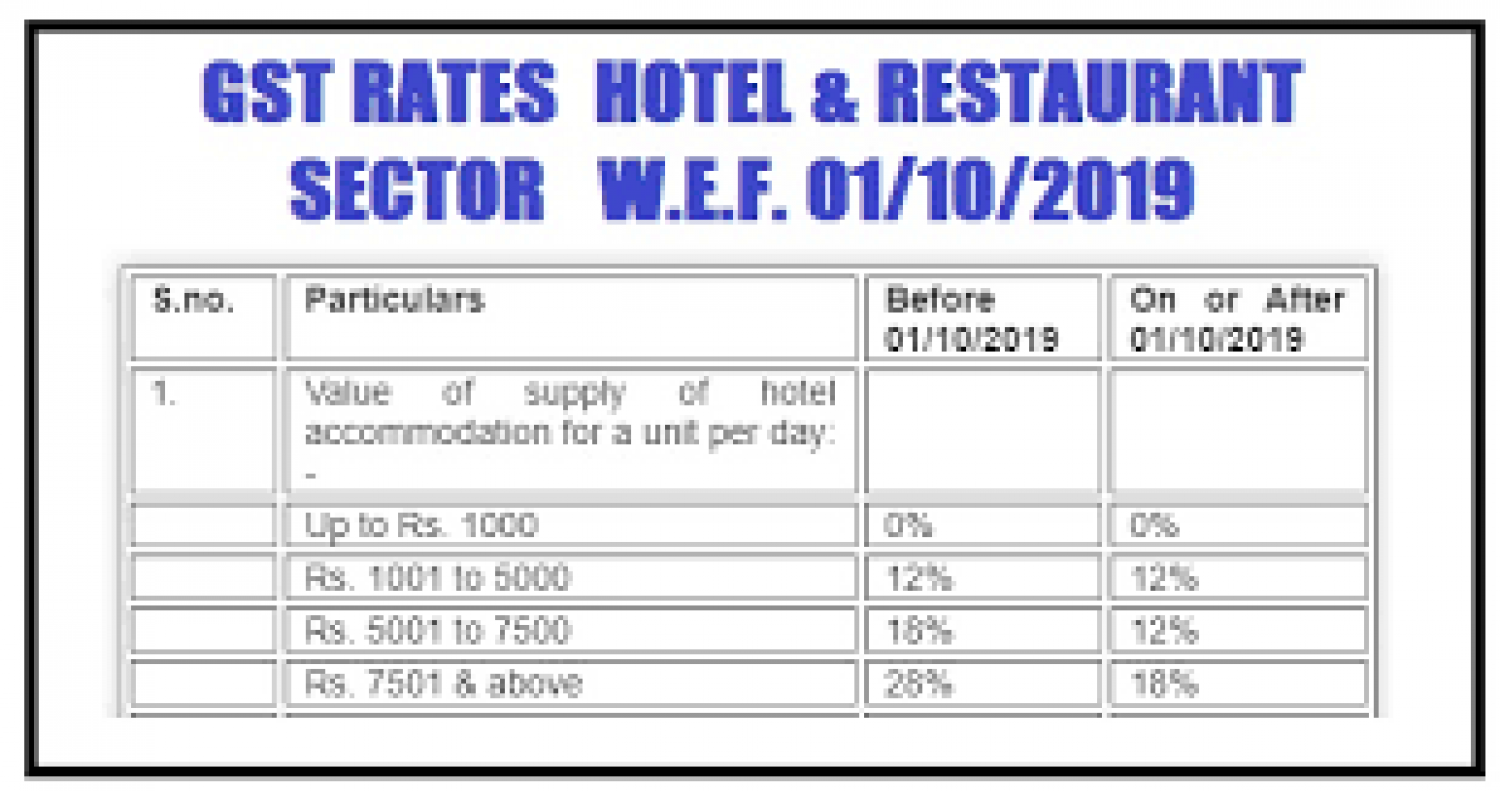

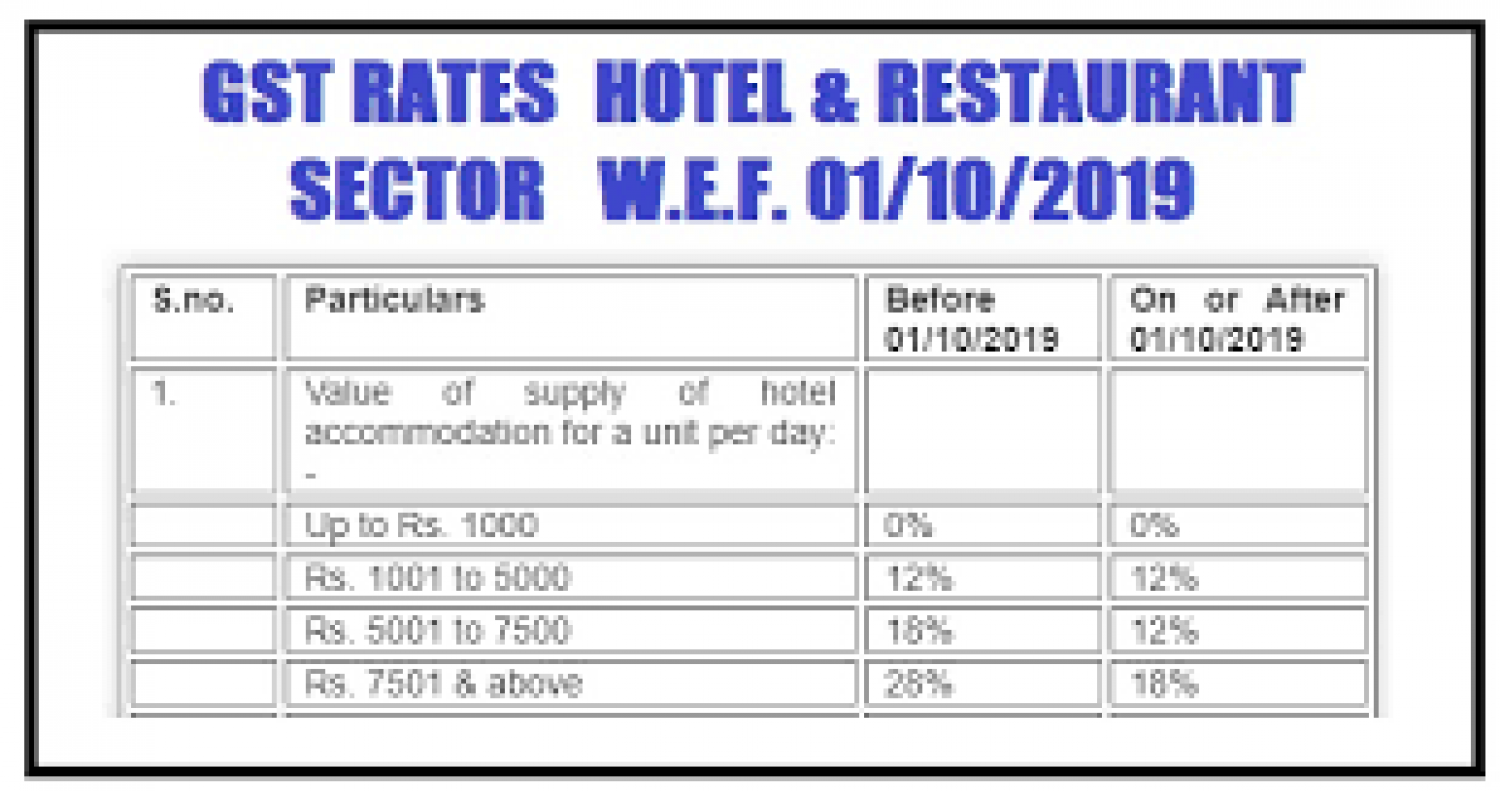

Gst On Hotels Restaurant Industry Gst On Hotel

Articles

Join Our 3 Days LIVE GST Course On GST Input Tax Credit ITC By CA

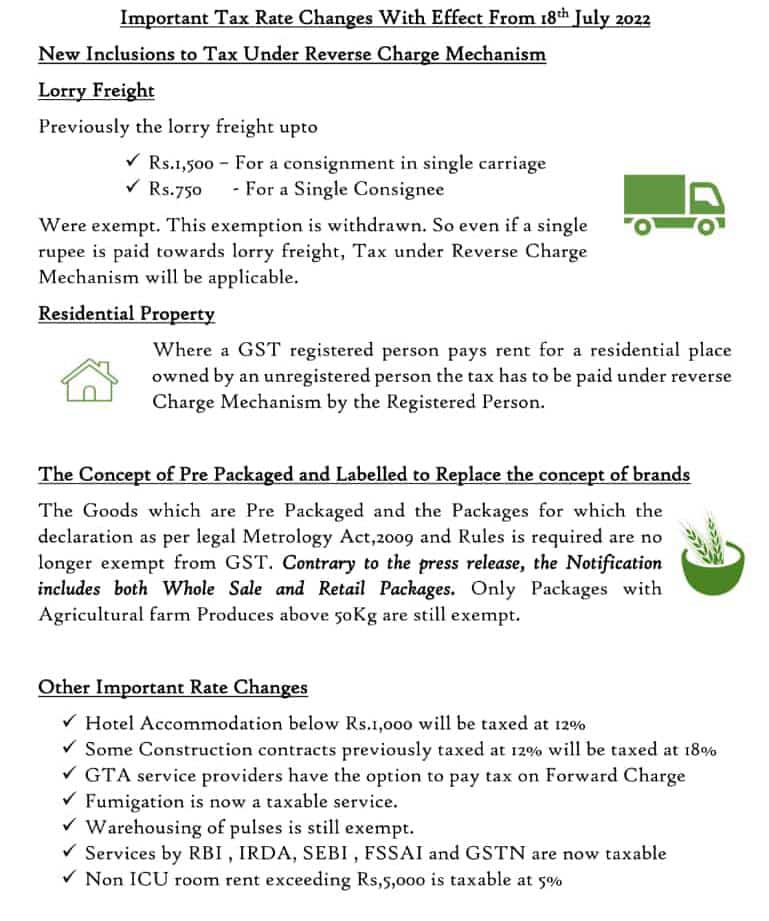

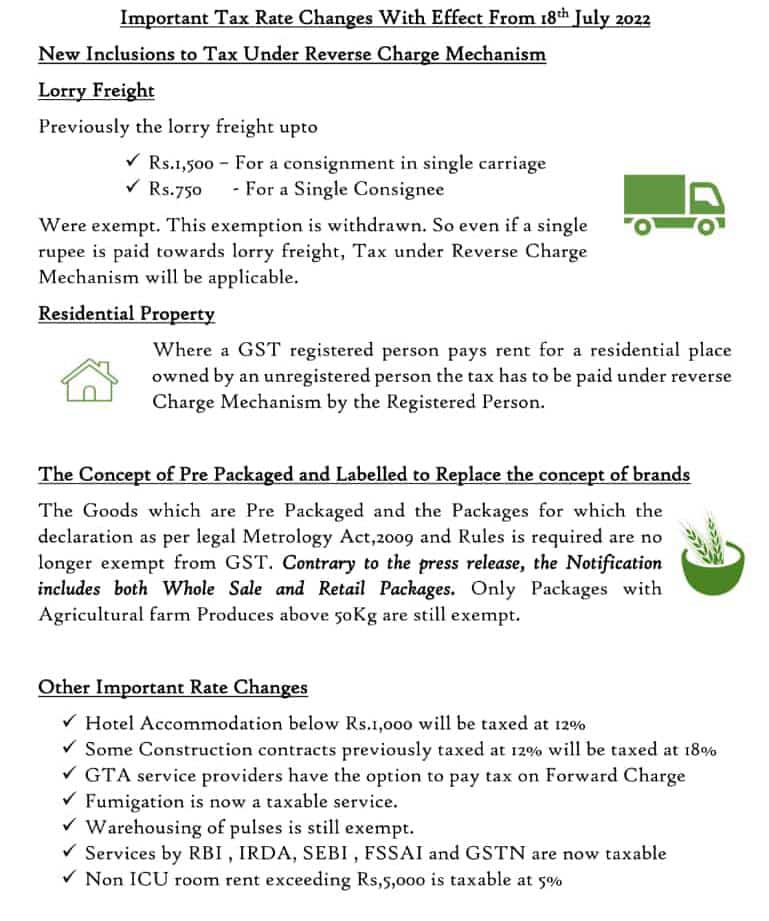

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

GST Input TAX Credit Set OFF YouTube

https://taxguru.in/goods-and-service-tax…

Understand the eligibility of Input Tax Credit ITC under GST law for HVAC systems lifts and similar equipment Examine legal provisions and rulings to determine if ITC applies to these immovable property components

https://piceapp.com/blogs/gst-input-tax-credit-on-air-conditioner

Unlock the benefits of GST input tax credit for air conditioners Explore our comprehensive guide to understand eligibility and enhance your tax efficiency

Understand the eligibility of Input Tax Credit ITC under GST law for HVAC systems lifts and similar equipment Examine legal provisions and rulings to determine if ITC applies to these immovable property components

Unlock the benefits of GST input tax credit for air conditioners Explore our comprehensive guide to understand eligibility and enhance your tax efficiency

Join Our 3 Days LIVE GST Course On GST Input Tax Credit ITC By CA

Gst On Hotels Restaurant Industry Gst On Hotel

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

GST Input TAX Credit Set OFF YouTube

Guide To Claiming GST Input Tax Credit On Existing Closing Stock

Know Whether You Can Claim Input Tax Credit On Food

Know Whether You Can Claim Input Tax Credit On Food

Show Cause Notice Set Aside As It Did Not Disclose Any Intelligible