In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed materials hasn't faded away. If it's to aid in education, creative projects, or simply adding personal touches to your home, printables for free have proven to be a valuable resource. Here, we'll dive through the vast world of "Gst Refund Application Process," exploring the benefits of them, where to locate them, and how they can enhance various aspects of your lives.

Get Latest Gst Refund Application Process Below

Gst Refund Application Process

Gst Refund Application Process -

1 Login to GST portal for filing refund application under refunds section 2 Navigate toServices Refunds Application for Refund option 3 Select the reason of Refund

The process lets you retrieve the funds conveniently by visiting the official GST website and applying for it However you may get confused by the steps if you re a first timer The

Printables for free include a vast range of downloadable, printable material that is available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages and many more. The appeal of printables for free lies in their versatility and accessibility.

More of Gst Refund Application Process

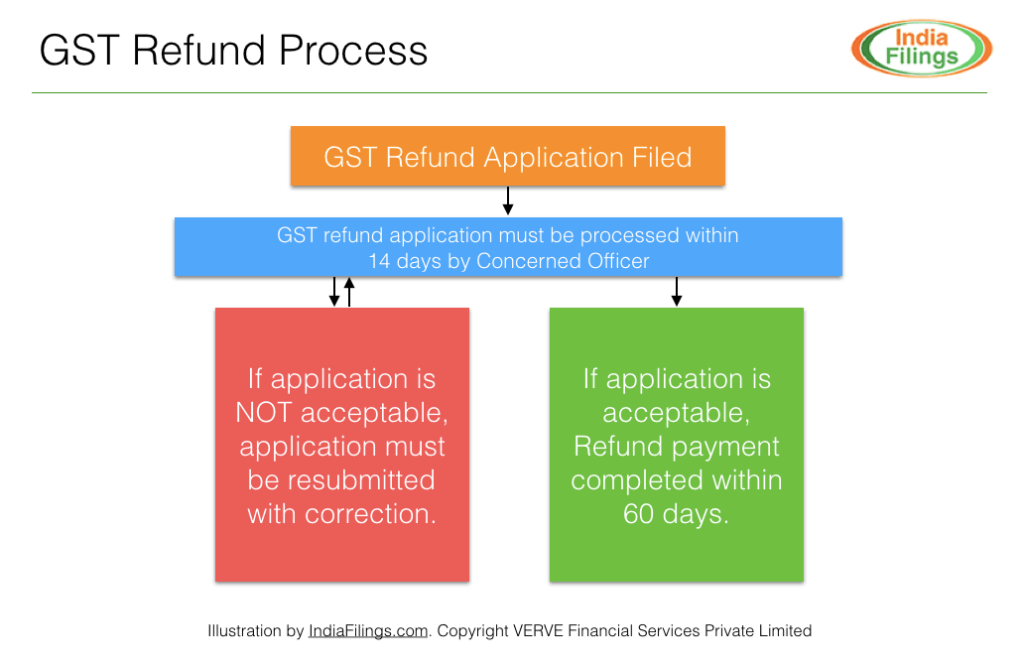

GST Refund Process And Online Applicaiton Filing Procedure

GST Refund Process And Online Applicaiton Filing Procedure

For the taxpayers seeking the GST refund a set application is to be followed Let us have a look at the GST refund procedure below STEP 1 They need to

A person claiming refund of tax or interest or any other amount paid must file an application for refund in Form GST RFD 1 before the expiry of 2 years from the

The Gst Refund Application Process have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make printed materials to meet your requirements such as designing invitations to organize your schedule or decorating your home.

-

Educational Use: Free educational printables provide for students of all ages. This makes the perfect instrument for parents and teachers.

-

Simple: instant access a plethora of designs and templates helps save time and effort.

Where to Find more Gst Refund Application Process

GST Refund Key Points To Keep In Mind HSCO

GST Refund Key Points To Keep In Mind HSCO

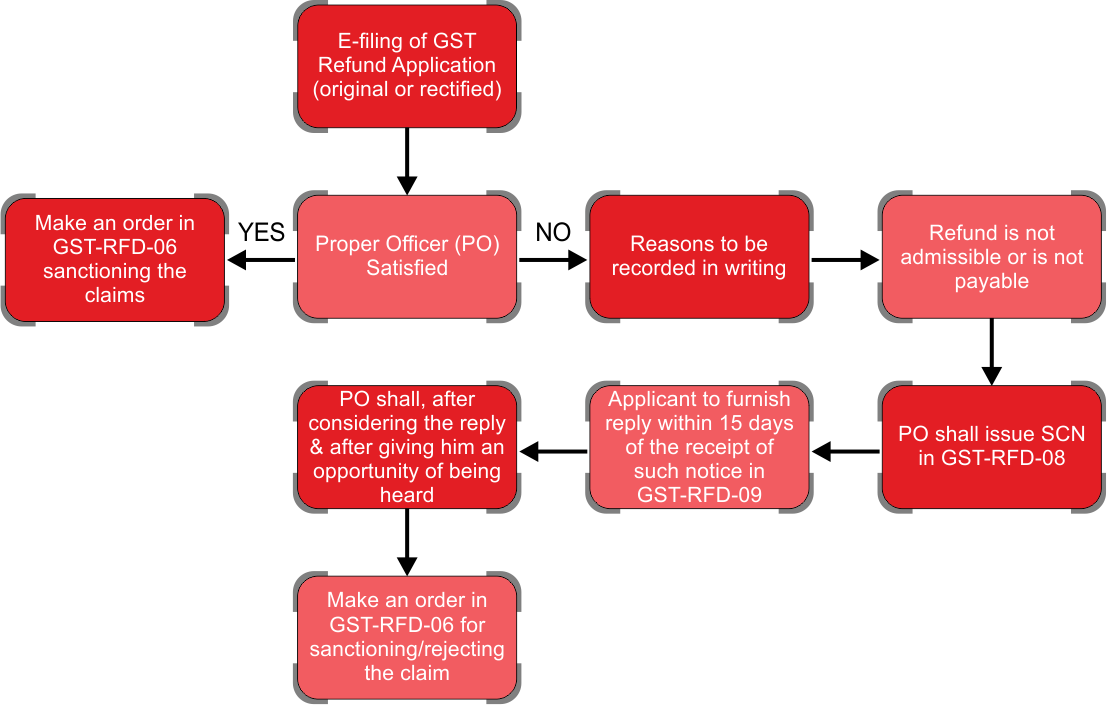

What is the procedure for refund 1 File for GST RFD 01 along with the required documents in Annexure 1 to the form 2 The assessee shall receive an acknowledgement in GST RFD 02 if there

The refund application has to be made in Form RFD 01 within 2 years from relevant date The form should also be certified by a Chartered Accountant You can file your returns very easily using

If we've already piqued your interest in Gst Refund Application Process We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Gst Refund Application Process for various goals.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast spectrum of interests, that range from DIY projects to party planning.

Maximizing Gst Refund Application Process

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Gst Refund Application Process are an abundance filled with creative and practical information that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them a valuable addition to both professional and personal life. Explore the endless world of Gst Refund Application Process to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can download and print these files for free.

-

Can I make use of free printouts for commercial usage?

- It depends on the specific rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using Gst Refund Application Process?

- Certain printables may be subject to restrictions in use. You should read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home using printing equipment or visit any local print store for more high-quality prints.

-

What program will I need to access printables at no cost?

- A majority of printed materials are as PDF files, which can be opened using free software, such as Adobe Reader.

GST Refund Meaning Process Komplytek Blogs

How To Claim Gst Refund In Malaysia RivertaroSchmidt

Check more sample of Gst Refund Application Process below

GST Refund Key Points To Keep In Mind HSCO

Notice For Rejection Of GST Refund In Form RFD08 Notice For GST

HC Directs Dept To Consider GST Refund Application On Merits

Andhra Pradesh High Court Quashes Rejection Of GST Refund Application

Refiling Incorrect Nil GST Refund Application Blog

BIG CHANGE GST REFUND APPLICATION ADDITIONAL INFORMATION CIRCULAR No

https://fi.money/blog/posts/step-by-step-guide-to-gst-refund-claims

The process lets you retrieve the funds conveniently by visiting the official GST website and applying for it However you may get confused by the steps if you re a first timer The

https://gsthero.com/gst-refund-process-a-detailed...

GST refund process is online patterned depending upon the type of case A taxpayer can claim the GST Refund within the defined time frame only Although

The process lets you retrieve the funds conveniently by visiting the official GST website and applying for it However you may get confused by the steps if you re a first timer The

GST refund process is online patterned depending upon the type of case A taxpayer can claim the GST Refund within the defined time frame only Although

Andhra Pradesh High Court Quashes Rejection Of GST Refund Application

Notice For Rejection Of GST Refund In Form RFD08 Notice For GST

Refiling Incorrect Nil GST Refund Application Blog

BIG CHANGE GST REFUND APPLICATION ADDITIONAL INFORMATION CIRCULAR No

Loophole In GST Refund Application On Portal ITATOrders in Blog

Refund Process Under GST Refund Application Under RFD 01 GST Refund

Refund Process Under GST Refund Application Under RFD 01 GST Refund

Tips To Upload Multiple Invoices With GST Refund Application