In this digital age, in which screens are the norm The appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or simply to add the personal touch to your home, printables for free are now a useful source. Here, we'll dive into the world of "Gst Refund Application Status," exploring what they are, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Gst Refund Application Status Below

Gst Refund Application Status

Gst Refund Application Status -

Application is Approved Registration ID and password emailed to Applicant Rejected Application is Rejected by tax officer Withdrawn Application is withdrawn by the Applicant Tax payer Cancelled on Request of Taxpayer Registration is cancelled on request of taxpayer Cancelled Suo Moto

Login to the GST Portal Navigate to Services Track Application Status Select the Refund option Enter ARN or Filing Year Click SEARCH to track your refund application after logging into the GST Portal You can track your refund application after logging into the GST Portal through ARN or Filing Year of the refund application 3

Gst Refund Application Status include a broad selection of printable and downloadable materials online, at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. The beauty of Gst Refund Application Status is in their variety and accessibility.

More of Gst Refund Application Status

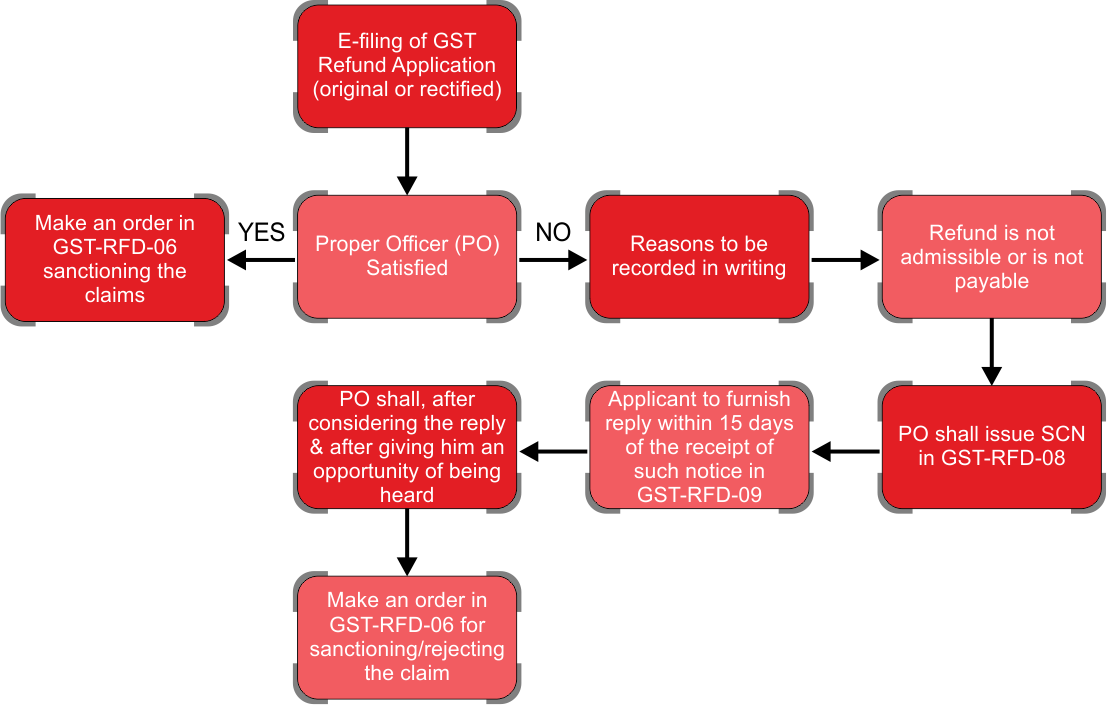

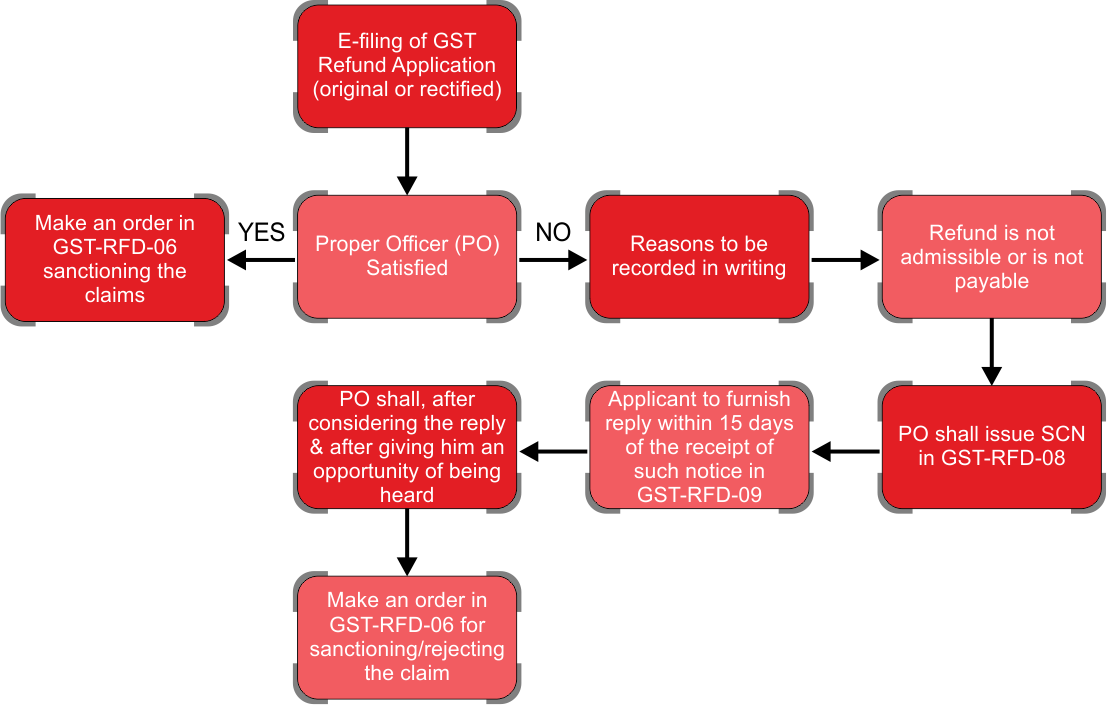

GST Refund Process And Online Applicaiton Filing Procedure

GST Refund Process And Online Applicaiton Filing Procedure

i To track your submitted refund application login to the GST Portal and navigate to Services Refunds Track Application Status command ii Track Application Status page is displayed Select the Filing Year from the drop down list or enter the ARN then click the SEARCH button

Track the status of your GST application online with your ARN or SRN number

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: This allows you to modify printed materials to meet your requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Education-related printables at no charge provide for students of all ages, which makes them a useful tool for teachers and parents.

-

It's easy: immediate access the vast array of design and templates will save you time and effort.

Where to Find more Gst Refund Application Status

How To Track GST Refund Application Status

How To Track GST Refund Application Status

1 Access the https www gst gov in URL The GST Home page is displayed Click the Services Track Application Status option 2 Track Application Status page is displayed Select the Refund option from the Module drop

The first step is to visit the GST Portal Once this is done log in to your account with valid credentials The next step is to choose the Refunds option under the Services tab Then click on Track Application Status 3 Choose the financial year for which the refund application has to be filed or enter the ARN of the refund application

In the event that we've stirred your interest in Gst Refund Application Status and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Gst Refund Application Status for different uses.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide variety of topics, everything from DIY projects to planning a party.

Maximizing Gst Refund Application Status

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Gst Refund Application Status are a treasure trove with useful and creative ideas catering to different needs and hobbies. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the plethora of Gst Refund Application Status today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can download and print these files for free.

-

Can I download free printables to make commercial products?

- It's all dependent on the terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with Gst Refund Application Status?

- Some printables may come with restrictions regarding their use. Be sure to review the terms and condition of use as provided by the creator.

-

How do I print Gst Refund Application Status?

- You can print them at home using an printer, or go to an in-store print shop to get top quality prints.

-

What software do I need in order to open printables for free?

- The majority of printed documents are as PDF files, which can be opened using free software such as Adobe Reader.

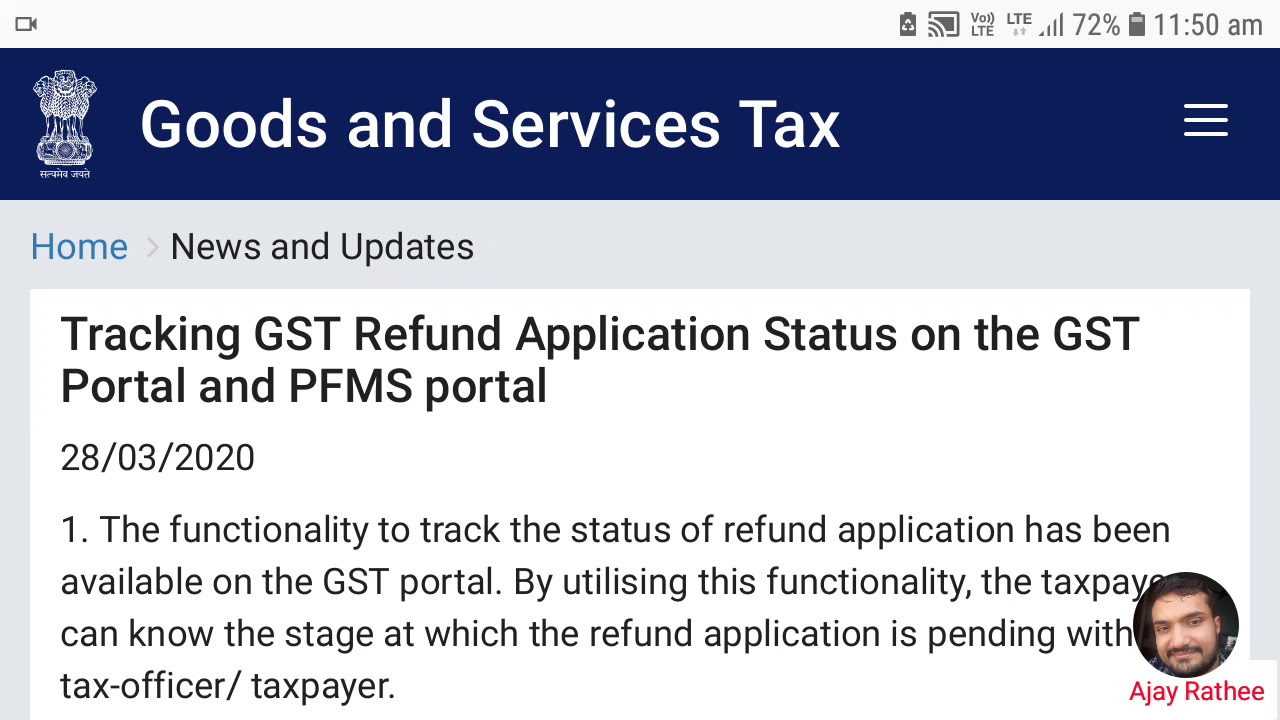

GSTN Issues Advisory On Tracking GST Refund Application Status On GST

GSTN Issued Advisory On Tracking Of GST Refund Application Status On

Check more sample of Gst Refund Application Status below

Steps To Track GST Refund Application GST Refund Application Status

Notice For Rejection Of GST Refund In Form RFD08 Notice For GST

Tracking GST Refund Application Status On GST PFMS Portal

Refiling Incorrect Nil GST Refund Application Blog

GST Refund Key Points To Keep In Mind HSCO

How To Track GST Refund Application Status

https://tutorial.gst.gov.in/userguide/refund/Track_Refund_Status_faq.htm

Login to the GST Portal Navigate to Services Track Application Status Select the Refund option Enter ARN or Filing Year Click SEARCH to track your refund application after logging into the GST Portal You can track your refund application after logging into the GST Portal through ARN or Filing Year of the refund application 3

https://cleartax.in/s/gst-refund-status

1 Visit the GST Portal and login to your account with valid credentials 2 Go to Services Refunds Track Application Status 3 Select the relevant financial year for which the refund application was filed or enter the ARN of the refund application The search results will be displayed 4

Login to the GST Portal Navigate to Services Track Application Status Select the Refund option Enter ARN or Filing Year Click SEARCH to track your refund application after logging into the GST Portal You can track your refund application after logging into the GST Portal through ARN or Filing Year of the refund application 3

1 Visit the GST Portal and login to your account with valid credentials 2 Go to Services Refunds Track Application Status 3 Select the relevant financial year for which the refund application was filed or enter the ARN of the refund application The search results will be displayed 4

Refiling Incorrect Nil GST Refund Application Blog

Notice For Rejection Of GST Refund In Form RFD08 Notice For GST

GST Refund Key Points To Keep In Mind HSCO

How To Track GST Refund Application Status

Loophole In GST Refund Application On Portal ITATOrders in Blog

Tracking GST Refund Application Status On The GST Portal And PFMS

Tracking GST Refund Application Status On The GST Portal And PFMS

Eligibility To File A GST Refund Application Where NIL Return Has