In a world where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or just adding personal touches to your space, Hawaii Solar Tax Credit Form are now an essential source. In this article, we'll take a dive into the world "Hawaii Solar Tax Credit Form," exploring their purpose, where to find them, and how they can enrich various aspects of your daily life.

Get Latest Hawaii Solar Tax Credit Form Below

Hawaii Solar Tax Credit Form

Hawaii Solar Tax Credit Form -

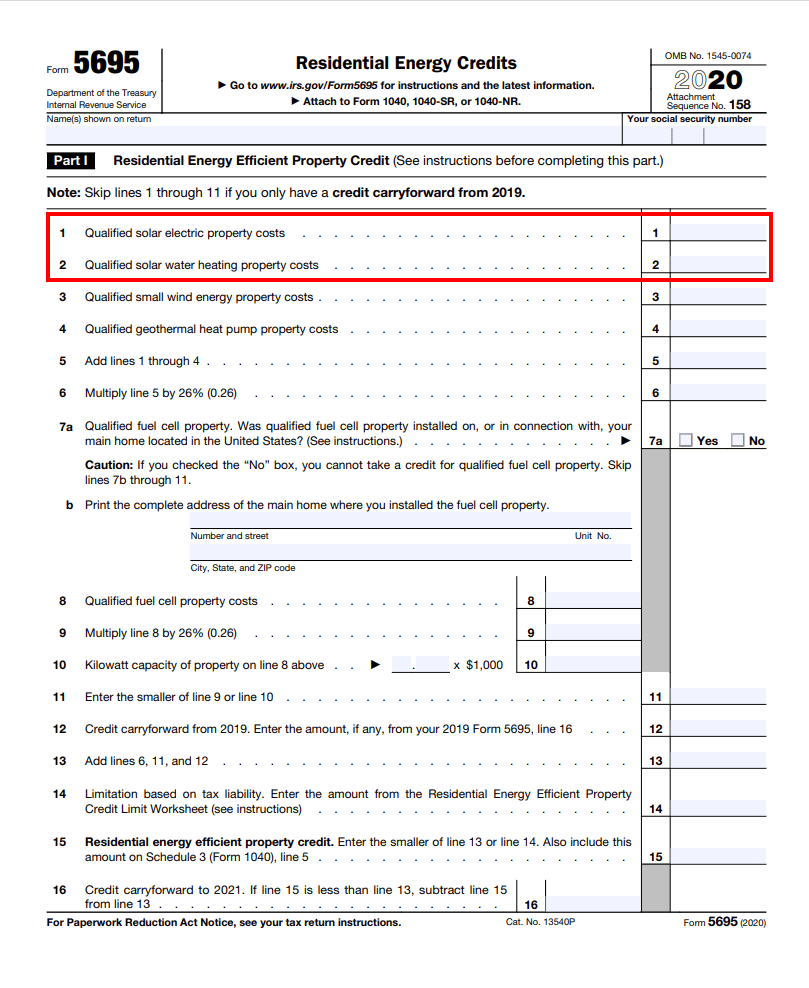

Eligible homeowners including renters for certain expenditures may be eligible for federal tax credits for energy and other efficient appliance purchases Products eligible for federal tax credits include solar panels for electricity home backup power battery storage capacity greater than 3 kWh solar water heating products and other

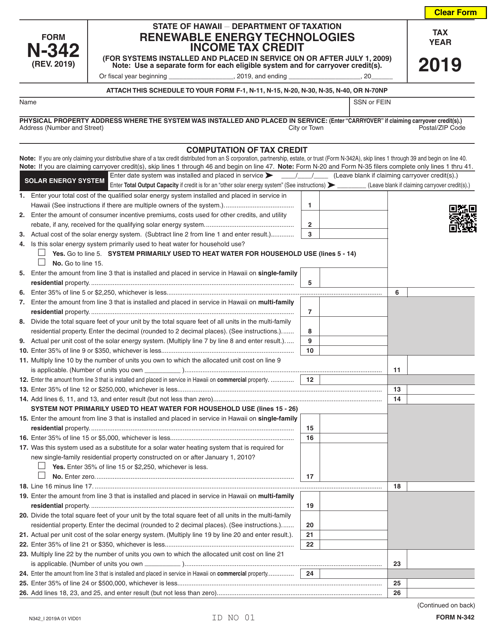

Effective January 2 2014 Tax Information Release No 2022 02 PDF Updated Guidance Relating to the Renewable Energy Technologies Income Tax Credit RETITC Forms Shortcut to Form N 342 and instructions Form N 342A Form N 342B and instructions and Form N 342C and instructions

The Hawaii Solar Tax Credit Form are a huge collection of printable items that are available online at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The great thing about Hawaii Solar Tax Credit Form lies in their versatility as well as accessibility.

More of Hawaii Solar Tax Credit Form

2020 Guide To Hawaii Solar Panels Incentives Rebates And Tax Credits

2020 Guide To Hawaii Solar Panels Incentives Rebates And Tax Credits

The Renewable Energy Technologies Income Tax Credit RETITC is a Hawai i State tax credit that allows individuals or corporations to claim an income tax credit for up to 35 percent of the total cost for a solar PV solar space heating or solar thermal water heating system subject to cap amounts and up to 20 percent of the cost for wind

File Form N 342 with your Hawaii tax return To claim the Hawaii solar tax credit you must include Form N 342 with your annual Hawaii state tax return This form allows you to calculate and claim the credit The key pieces of information needed on Form N 342 include Date the solar system was installed and placed in service Total cost of

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization There is the possibility of tailoring the templates to meet your individual needs for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them an invaluable tool for teachers and parents.

-

An easy way to access HTML0: immediate access an array of designs and templates reduces time and effort.

Where to Find more Hawaii Solar Tax Credit Form

How Does Hawaii Solar Tax Credit Work

How Does Hawaii Solar Tax Credit Work

Form N 342 is a Hawaii Corporate Income Tax form States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar for dollar reduction of tax liability Some common tax credits apply to many taxpayers while others only apply to extremely specific situations

Hawaii Solar Tax Credit Explained The Hawaii state solar tax credit is known as the Renewable Energy technologies Income Tax credit or RETITC When applied the credit directly reduces the amount of income tax that you owe for a year

After we've peaked your interest in printables for free Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Hawaii Solar Tax Credit Form for a variety uses.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Hawaii Solar Tax Credit Form

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Hawaii Solar Tax Credit Form are a treasure trove filled with creative and practical information that cater to various needs and interest. Their availability and versatility make them a wonderful addition to any professional or personal life. Explore the vast collection of Hawaii Solar Tax Credit Form to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can print and download these resources at no cost.

-

Does it allow me to use free printouts for commercial usage?

- It's based on specific terms of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Hawaii Solar Tax Credit Form?

- Certain printables could be restricted regarding their use. Be sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using either a printer at home or in a local print shop for more high-quality prints.

-

What program do I require to open printables free of charge?

- Most printables come with PDF formats, which is open with no cost software, such as Adobe Reader.

The Homeowner s Short Guide To The Hawaii Solar Tax Credit

Form N 342 Download Fillable PDF Or Fill Online Renewable Energy

Check more sample of Hawaii Solar Tax Credit Form below

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Letters Hawaii Solar Tax Credit In Danger Of Reduction An Obama

https://tax.hawaii.gov/geninfo/renewable

Effective January 2 2014 Tax Information Release No 2022 02 PDF Updated Guidance Relating to the Renewable Energy Technologies Income Tax Credit RETITC Forms Shortcut to Form N 342 and instructions Form N 342A Form N 342B and instructions and Form N 342C and instructions

https://files.hawaii.gov/tax/forms/2020/n342a_i.pdf

TOTAL AND DISTRIBUTIVE SHARE OF RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT WIND POWERED ENERGY SYSTEM DISTRIBUTIVE SHARE OF TAX CREDIT Form N 342A Rev 2020 P age 2 21 Actual per unit cost of the solar energy system Multiply line 19 by line 20 21 22 Enter 35 of line 21 or 350

Effective January 2 2014 Tax Information Release No 2022 02 PDF Updated Guidance Relating to the Renewable Energy Technologies Income Tax Credit RETITC Forms Shortcut to Form N 342 and instructions Form N 342A Form N 342B and instructions and Form N 342C and instructions

TOTAL AND DISTRIBUTIVE SHARE OF RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT WIND POWERED ENERGY SYSTEM DISTRIBUTIVE SHARE OF TAX CREDIT Form N 342A Rev 2020 P age 2 21 Actual per unit cost of the solar energy system Multiply line 19 by line 20 21 22 Enter 35 of line 21 or 350

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Letters Hawaii Solar Tax Credit In Danger Of Reduction An Obama

NJ Solar Tax Credit Explained

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

Tax Credit ITC Sungenia Solar