In the digital age, when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes as well as creative projects or simply adding the personal touch to your space, Health Insurance Deduction In Income Tax India are a great source. This article will take a dive deeper into "Health Insurance Deduction In Income Tax India," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Health Insurance Deduction In Income Tax India Below

Health Insurance Deduction In Income Tax India

Health Insurance Deduction In Income Tax India -

According to the Section 80D of the Income Tax Act the Hindu Undivided Families HUFs are allowed to deduct the amount of health insurance premium paid for the health of any member of the HUF from the total income

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups

Health Insurance Deduction In Income Tax India include a broad range of downloadable, printable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. One of the advantages of Health Insurance Deduction In Income Tax India is in their variety and accessibility.

More of Health Insurance Deduction In Income Tax India

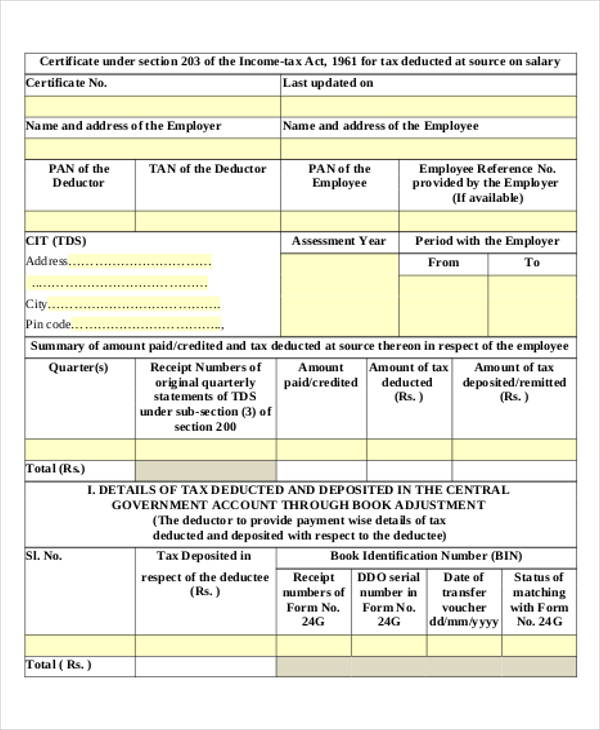

Material Requirement Form House Rent Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to 50 000 per fiscal year for senior citizens aged 60 years and above

Term Insurance Tax Benefits Under Section 80D Section 80D allows Hindu Undivided Family HUF or individuals to deduct their health insurance premiums from their taxable income Additionally certain term plans are eligible for tax benefits under Section 80D

The Health Insurance Deduction In Income Tax India have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: We can customize printing templates to your own specific requirements such as designing invitations and schedules, or even decorating your home.

-

Educational Value Free educational printables can be used by students from all ages, making them a great aid for parents as well as educators.

-

Affordability: The instant accessibility to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Health Insurance Deduction In Income Tax India

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Section 80D allows individuals and Hindu Undivided Families HUF to claim deductions on certain expenses done towards medical health insurance premiums from their taxable income A person can claim deductions on the cost of health insurance and the cost of a preventative health examination for themselves their spouse their dependent children

Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children

After we've peaked your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Health Insurance Deduction In Income Tax India for different purposes.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Health Insurance Deduction In Income Tax India

Here are some innovative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Health Insurance Deduction In Income Tax India are an abundance of practical and innovative resources that meet a variety of needs and hobbies. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the wide world of Health Insurance Deduction In Income Tax India today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printables for commercial use?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using Health Insurance Deduction In Income Tax India?

- Some printables may come with restrictions regarding usage. Always read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with the printer, or go to an in-store print shop to get high-quality prints.

-

What program do I need in order to open printables for free?

- Many printables are offered in the format PDF. This can be opened using free software, such as Adobe Reader.

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Check more sample of Health Insurance Deduction In Income Tax India below

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Employee Income Tax Deduction Form 2023 Employeeform

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Anything To Everything Income Tax Guide For Individuals Including

Mattina Kent Gibbons ClientLine Newsletter December 2019 Health

Income Tax 80c Deduction Fy 2021 22 TAX

https://tax2win.in/guide/section-80d-deduction...

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups

https://www.forbesindia.com/article/explainers/...

Learn how to maximise the tax benefits and savings using health or medical insurance under section 80D of the Income Tax Act By Forbes India Published Jul 8 2024 06 10 03 PM IST

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups

Learn how to maximise the tax benefits and savings using health or medical insurance under section 80D of the Income Tax Act By Forbes India Published Jul 8 2024 06 10 03 PM IST

Anything To Everything Income Tax Guide For Individuals Including

Employee Income Tax Deduction Form 2023 Employeeform

Mattina Kent Gibbons ClientLine Newsletter December 2019 Health

Income Tax 80c Deduction Fy 2021 22 TAX

NPS Deduction In Income Tax 2023 Guide InstaFiling

Standard Deduction In Income Tax 2022

Standard Deduction In Income Tax 2022

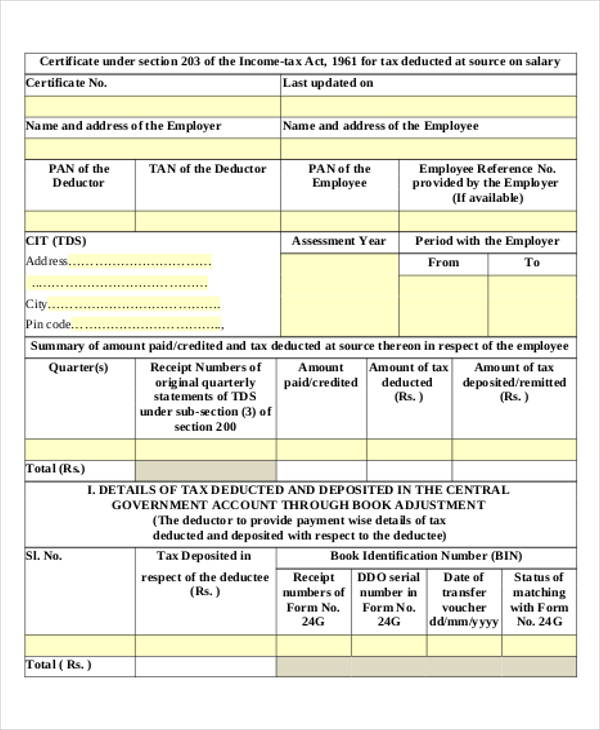

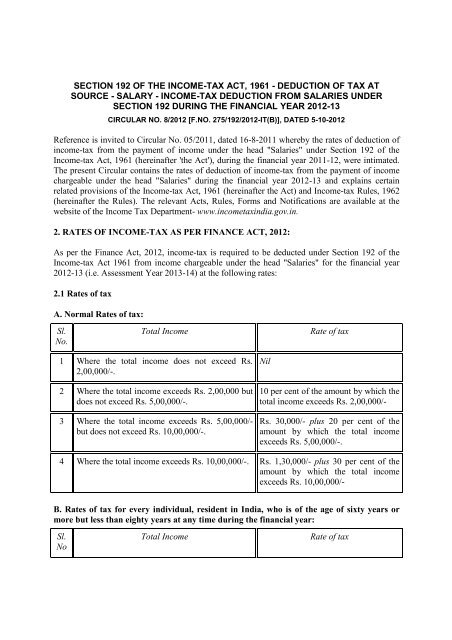

Income tax Deduction From Salaries Under Section