In the digital age, where screens dominate our lives however, the attraction of tangible printed objects isn't diminished. For educational purposes for creative projects, simply adding personal touches to your area, Health Insurance Deduction Under Income Tax Act are now a vital source. We'll dive into the world "Health Insurance Deduction Under Income Tax Act," exploring what they are, how they are, and how they can improve various aspects of your life.

Get Latest Health Insurance Deduction Under Income Tax Act Below

Health Insurance Deduction Under Income Tax Act

Health Insurance Deduction Under Income Tax Act -

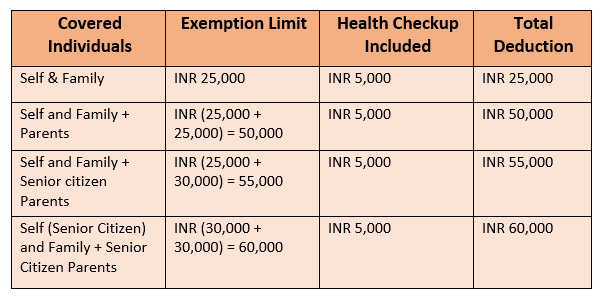

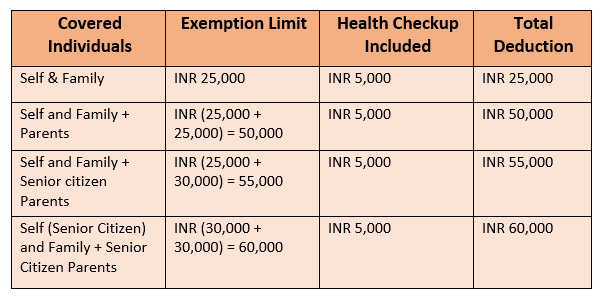

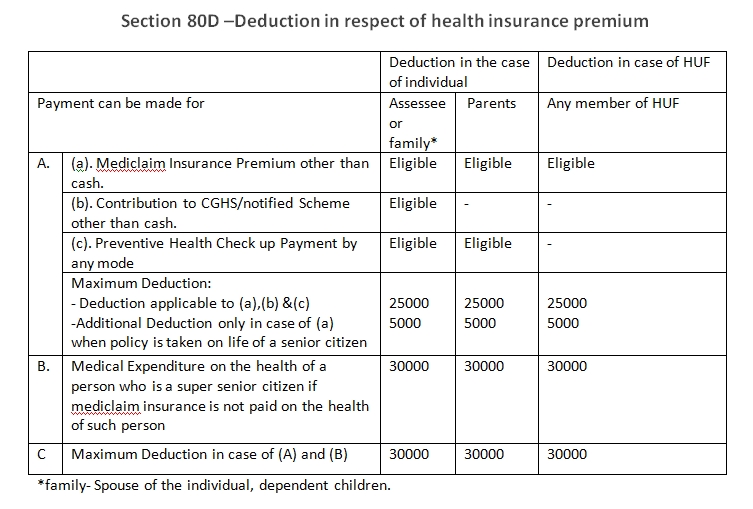

Section 80D of the Income Tax Act allows tax deductions on health insurance premiums paid for yourself your family and your parents Investments covered under Section 80D include health insurance premiums preventive health check ups and health based riders which promote preventive healthcare and make health coverage more affordable

According to the Section 80D of the Income Tax Act the Hindu Undivided Families HUFs are allowed to deduct the amount of health insurance premium paid for the health of any member of the HUF from the total income The maximum 80d deduction allowed is

Printables for free include a vast assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Health Insurance Deduction Under Income Tax Act

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to urge people to

Under Section 80D tax deduction can be claimed on premium paid on health insurance Who is covered for tax deduction Individual health insurance Family health insurance self spouse

Health Insurance Deduction Under Income Tax Act have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: You can tailor the templates to meet your individual needs such as designing invitations or arranging your schedule or even decorating your house.

-

Education Value Educational printables that can be downloaded for free cater to learners of all ages. This makes them a useful instrument for parents and teachers.

-

Accessibility: immediate access numerous designs and templates will save you time and effort.

Where to Find more Health Insurance Deduction Under Income Tax Act

Preventive Check Up 80d Wkcn

Preventive Check Up 80d Wkcn

Income Tax Deduction for Health Insurance Medical Expenses The deduction under Section 80D can be claimed for health insurance premiums contributions to the Central Government Health Scheme and expenses incurred for preventive health checkups

Health insurance policyholders are eligible to benefit under Section 80D of the Income Tax Act 1961 which reduces yearly income tax burdens Policyholders pay premiums towards their own and their family members health insurance policies

If we've already piqued your interest in Health Insurance Deduction Under Income Tax Act Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Health Insurance Deduction Under Income Tax Act for a variety needs.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Health Insurance Deduction Under Income Tax Act

Here are some fresh ways that you can make use of Health Insurance Deduction Under Income Tax Act:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Health Insurance Deduction Under Income Tax Act are an abundance of useful and creative resources that satisfy a wide range of requirements and pursuits. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the world of Health Insurance Deduction Under Income Tax Act today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can print and download these files for free.

-

Can I download free printables for commercial use?

- It depends on the specific usage guidelines. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright problems with Health Insurance Deduction Under Income Tax Act?

- Some printables may come with restrictions concerning their use. Always read the conditions and terms of use provided by the creator.

-

How do I print Health Insurance Deduction Under Income Tax Act?

- Print them at home using printing equipment or visit a local print shop to purchase more high-quality prints.

-

What program is required to open printables at no cost?

- Most printables come in PDF format. These is open with no cost software like Adobe Reader.

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

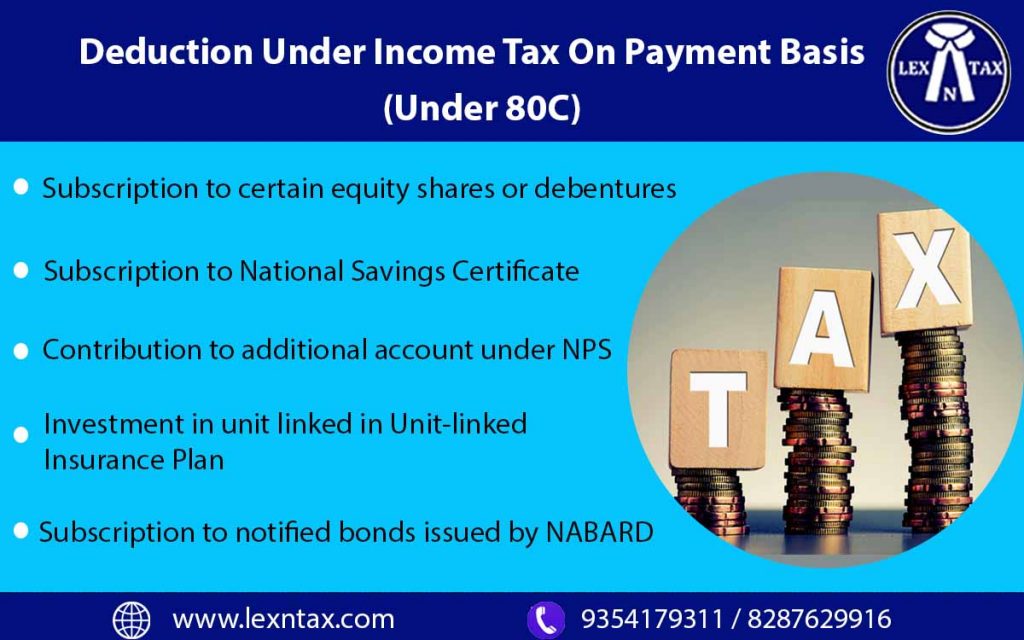

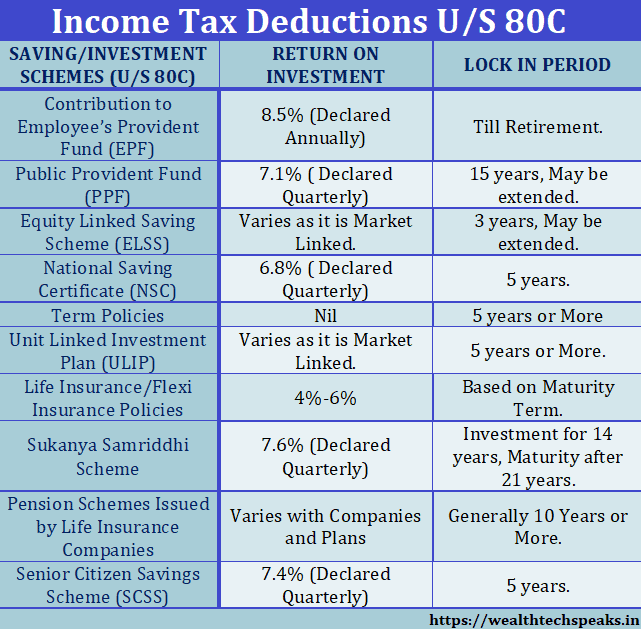

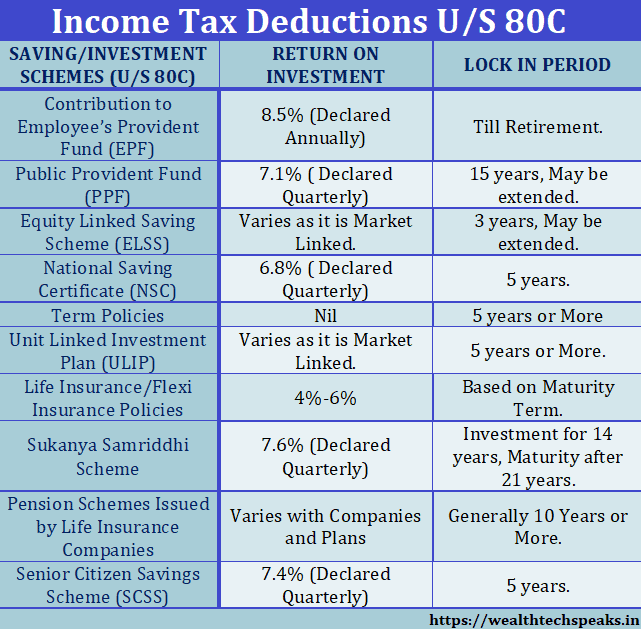

Income Tax Deduction Under 80C Lex N Tax Associates

Check more sample of Health Insurance Deduction Under Income Tax Act below

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Medical Expenses Deduction Under Income Tax Act 2023 Update

Anything To Everything Income Tax Guide For Individuals Including

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

Income Tax 80c Deduction Fy 2021 22 TAX

Deduction Under Chapter Vi A How Much Can I Deduct Under Chapter Vi A

https://www.acko.com/health-insurance/section80d-deductions

According to the Section 80D of the Income Tax Act the Hindu Undivided Families HUFs are allowed to deduct the amount of health insurance premium paid for the health of any member of the HUF from the total income The maximum 80d deduction allowed is

https://www.hdfclife.com/insurance-knowledge...

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs 50 000 You can also claim an extra Rs 5 000 for preventive health check ups

According to the Section 80D of the Income Tax Act the Hindu Undivided Families HUFs are allowed to deduct the amount of health insurance premium paid for the health of any member of the HUF from the total income The maximum 80d deduction allowed is

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs 50 000 You can also claim an extra Rs 5 000 for preventive health check ups

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

Medical Expenses Deduction Under Income Tax Act 2023 Update

Income Tax 80c Deduction Fy 2021 22 TAX

Deduction Under Chapter Vi A How Much Can I Deduct Under Chapter Vi A

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Donation To Political Party Get Deduction Under Income Tax 80GGB

Donation To Political Party Get Deduction Under Income Tax 80GGB

India News Crypto Mining Costs Not To Be Included As Deduction Under