In this age of technology, in which screens are the norm The appeal of tangible printed material hasn't diminished. If it's to aid in education and creative work, or simply adding an extra personal touch to your area, Health Insurance Premium Tax Credit have become an invaluable source. For this piece, we'll dive deeper into "Health Insurance Premium Tax Credit," exploring the different types of printables, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Health Insurance Premium Tax Credit Below

Health Insurance Premium Tax Credit

Health Insurance Premium Tax Credit -

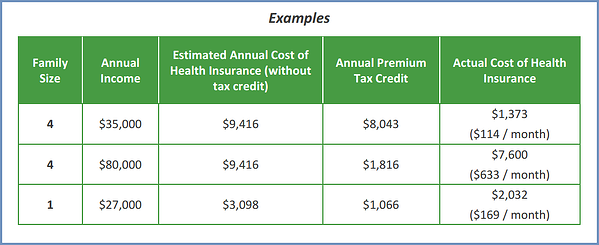

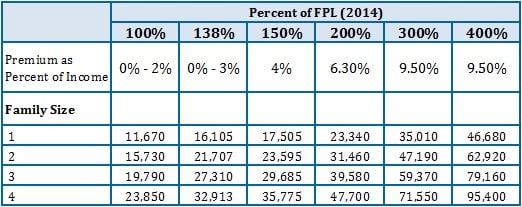

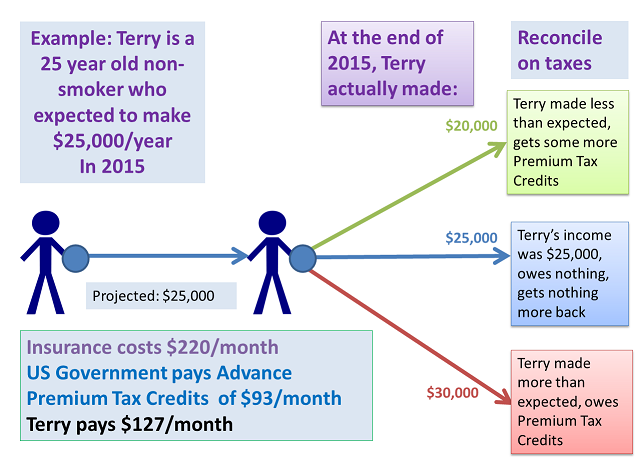

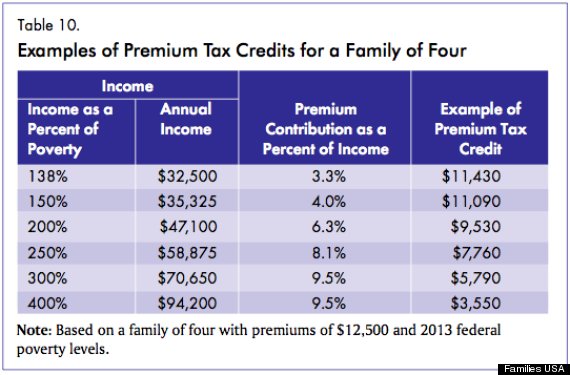

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Health Insurance Premium Tax Credit encompass a wide assortment of printable content that can be downloaded from the internet at no cost. They come in many types, such as worksheets coloring pages, templates and more. The appealingness of Health Insurance Premium Tax Credit lies in their versatility as well as accessibility.

More of Health Insurance Premium Tax Credit

Health Insurance Marketplace Advance Premium Tax Credit YouTube

Health Insurance Marketplace Advance Premium Tax Credit YouTube

The Premium Tax Credit is a tax credit intended to subsidize the purchase of health plans offered through the federal and state health benefit exchanges The size of your credit will depend

The premium tax credit helps lower income Americans pay for health insurance but if you re not careful you could end up owing money at tax time Designed to help people who aren t insured

The Health Insurance Premium Tax Credit have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: You can tailor printing templates to your own specific requirements, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a valuable tool for parents and educators.

-

An easy way to access HTML0: Quick access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Health Insurance Premium Tax Credit

2019 IRS Health Insurance Premium Tax Credit Reconciliation YouTube

2019 IRS Health Insurance Premium Tax Credit Reconciliation YouTube

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put on your Marketplace application

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace

We've now piqued your curiosity about Health Insurance Premium Tax Credit we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Health Insurance Premium Tax Credit for various motives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Health Insurance Premium Tax Credit

Here are some ideas of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Health Insurance Premium Tax Credit are a treasure trove of fun and practical tools that cater to various needs and interest. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the wide world of Health Insurance Premium Tax Credit to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Health Insurance Premium Tax Credit really completely free?

- Yes they are! You can print and download these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It's dependent on the particular usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with Health Insurance Premium Tax Credit?

- Certain printables could be restricted on their use. Check the terms and regulations provided by the creator.

-

How do I print Health Insurance Premium Tax Credit?

- You can print them at home with either a printer at home or in an in-store print shop to get the highest quality prints.

-

What software do I need to run printables for free?

- A majority of printed materials are as PDF files, which can be opened with free programs like Adobe Reader.

How To Calculate Pre Tax Benefits Jerica Cobbs

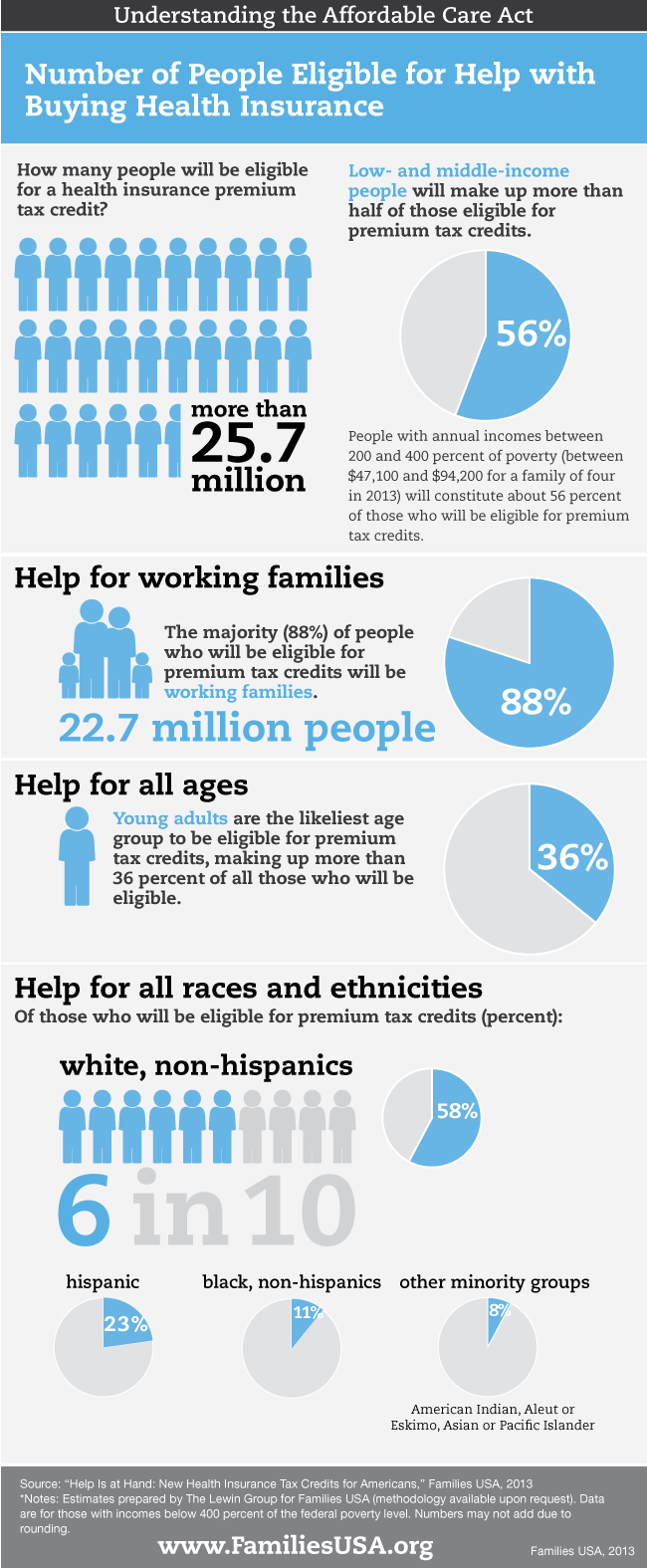

Premium Tax Credits By The Numbers Families Usa

Check more sample of Health Insurance Premium Tax Credit below

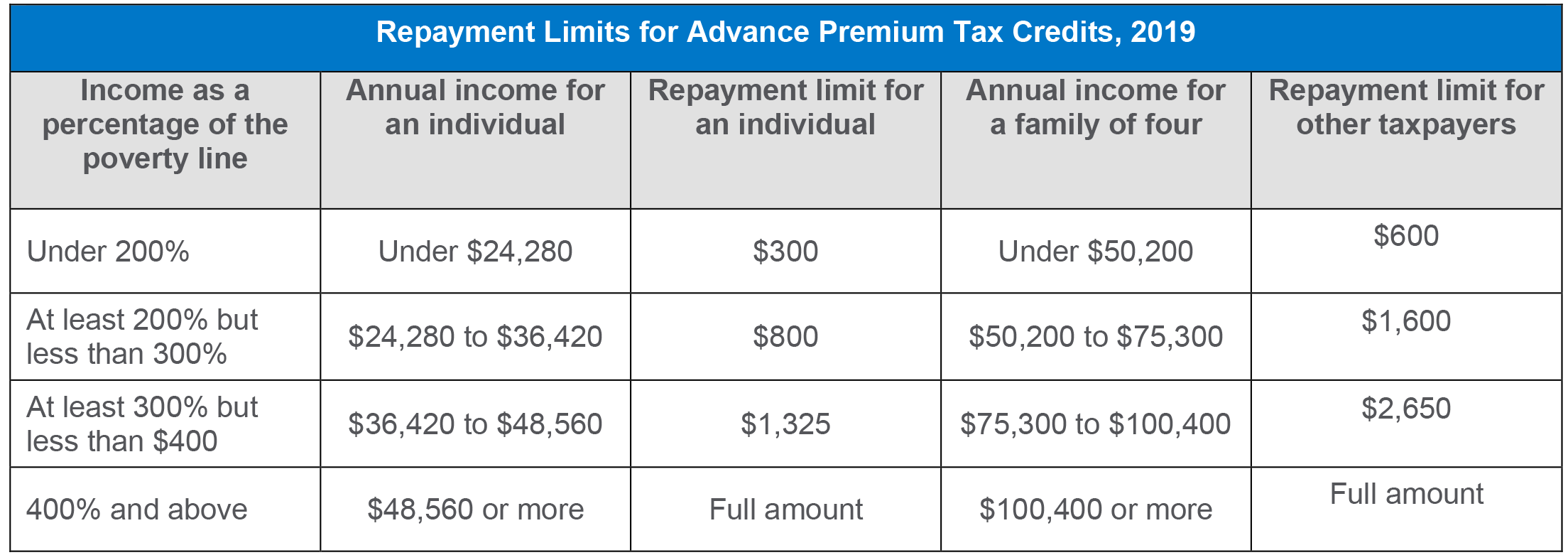

Repayment Limits For Premium Tax Credits 2019 KFF

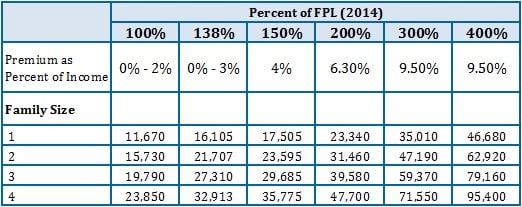

What Are The Federal Subsidies For Health Insurance

2023 Medicare Premiums And Open Enrollment

FAQs Health Insurance Premium Tax Credits

Health Insurance Premium Tax Credit Income Limits What Are They

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

FAQs Health Insurance Premium Tax Credits

What Are The Federal Subsidies For Health Insurance

Health Insurance Premium Tax Credit Income Limits What Are They

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare

What Kind Of Health Insurance Can I Buy With A Premium Tax Credit

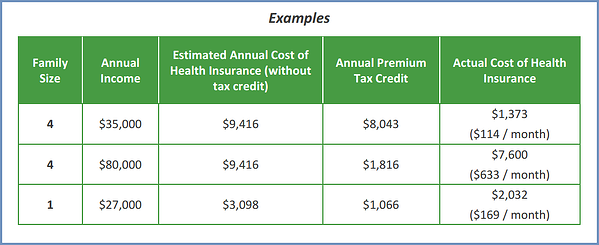

How Do I Calculate My Health Insurance Premium And Tax Credit

How Do I Calculate My Health Insurance Premium And Tax Credit

Obamacare Subsidies Target Young Working People Report HuffPost