In this age of technology, where screens dominate our lives The appeal of tangible printed materials hasn't faded away. Be it for educational use, creative projects, or just adding an individual touch to your home, printables for free can be an excellent source. Through this post, we'll take a dive into the world of "Health Insurance Tax Benefit 80d Limit," exploring their purpose, where they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Health Insurance Tax Benefit 80d Limit Below

Health Insurance Tax Benefit 80d Limit

Health Insurance Tax Benefit 80d Limit -

Under Section 80D tax deduction can be claimed on premium paid on health insurance Who is covered for tax deduction Individual health insurance Family health insurance self spouse

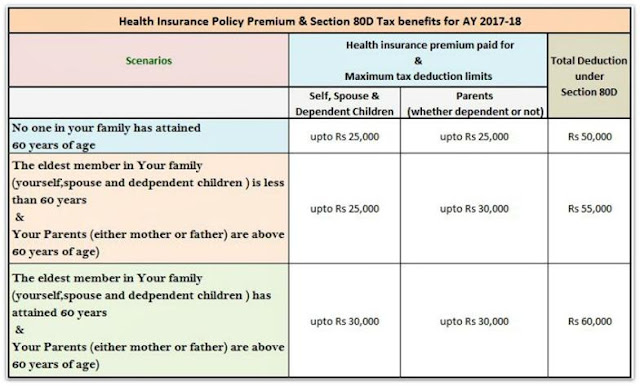

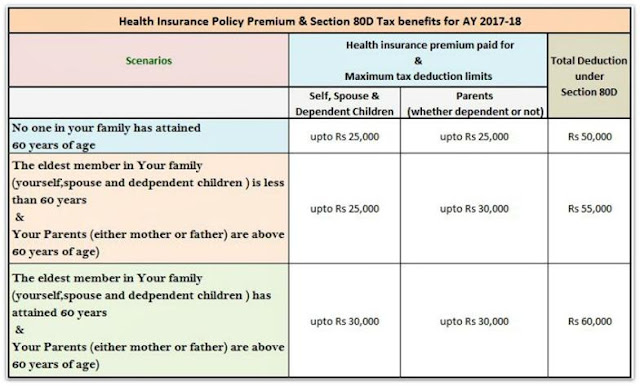

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs 50 000 You can also claim an extra Rs 5 000 for preventive health check ups

Health Insurance Tax Benefit 80d Limit include a broad assortment of printable resources available online for download at no cost. These printables come in different types, such as worksheets templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Health Insurance Tax Benefit 80d Limit

Under Section 80D Deduction I Health Insurance Tax Benefit I Save Tax U

Under Section 80D Deduction I Health Insurance Tax Benefit I Save Tax U

Under Section 80D if a person is a senior citizen 60 years or above then the maximum deduction limit for the Health Insurance premiums paid is Rs 50 000 This helps them manage medical costs efficiently

If you purchase health insurance you can avail deductions up to Rs 25 000 under Section 80D for yourself and your family Rs 50 000 if the insured is 60 years or older and up to Rs 25 000 Rs 50 000 if the insured is 60 years or older for your parents

Health Insurance Tax Benefit 80d Limit have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements in designing invitations planning your schedule or even decorating your house.

-

Educational Impact: Downloads of educational content for free cater to learners from all ages, making them a vital instrument for parents and teachers.

-

Simple: Fast access numerous designs and templates saves time and effort.

Where to Find more Health Insurance Tax Benefit 80d Limit

Tax Benefits Under Section 80D Health Insurance Policies Health

Tax Benefits Under Section 80D Health Insurance Policies Health

Section 80D covers premiums paid for self spouse dependent children and parents with varying limits For individuals and parents below 60 years the deduction is capped at INR 25 000 For senior citizens the limit rises to INR 50 000

Understanding Health Insurance Tax Benefit 80D As discussed above section 80D of the Income Tax Act of 1961 offers deductions for premiums paid towards the best health insurance policy The deductions are available for individuals

We've now piqued your interest in Health Insurance Tax Benefit 80d Limit Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Health Insurance Tax Benefit 80d Limit designed for a variety uses.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Health Insurance Tax Benefit 80d Limit

Here are some innovative ways that you can make use use of Health Insurance Tax Benefit 80d Limit:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Health Insurance Tax Benefit 80d Limit are an abundance of fun and practical tools that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them an essential part of the professional and personal lives of both. Explore the endless world of Health Insurance Tax Benefit 80d Limit right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these items for free.

-

Are there any free printouts for commercial usage?

- It is contingent on the specific rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download Health Insurance Tax Benefit 80d Limit?

- Some printables could have limitations on their use. Make sure to read the terms and regulations provided by the creator.

-

How can I print printables for free?

- You can print them at home using any printer or head to an in-store print shop to get higher quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printed documents are in PDF format. They can be opened using free software like Adobe Reader.

Section 80D Deduction In Respect Of Health Or Medical Insurance

Preventive Check Up 80d Wkcn

Check more sample of Health Insurance Tax Benefit 80d Limit below

ITR How To Claim Tax Deduction Benefit On Health Insurance Under

Section 80D Deduction Health Insurance Tax Benefit Save Tax Under

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

How Health Insurance Tax Benefits 2016 Can Ease Your Pain

Health Insurance Sec 80D Tax Deduction FY 2020 21 AY 2021 22

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

https://www.hdfclife.com › insurance-knowledge...

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs 50 000 You can also claim an extra Rs 5 000 for preventive health check ups

https://tax2win.in › guide

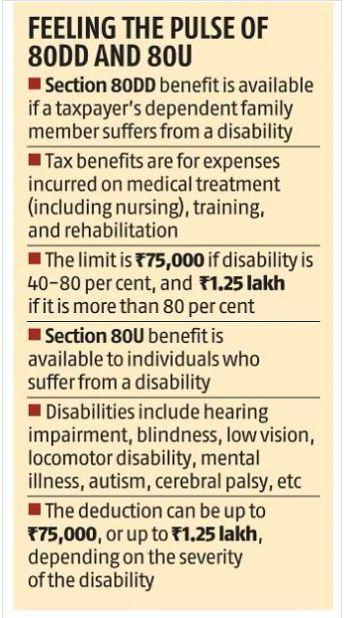

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases to Rs 50 000 You can also claim an extra Rs 5 000 for preventive health check ups

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

How Health Insurance Tax Benefits 2016 Can Ease Your Pain

Section 80D Deduction Health Insurance Tax Benefit Save Tax Under

Health Insurance Sec 80D Tax Deduction FY 2020 21 AY 2021 22

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

80D Limit Available Opt For Health Check Rediff Get Ahead

80D Limit Available Opt For Health Check Rediff Get Ahead

Tax Saving On Health Insurance Section 80D Detailed Guide For FY