In the digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education and creative work, or simply to add an individual touch to your home, printables for free have proven to be a valuable source. This article will take a dive to the depths of "Healthcare Gov Not Showing Tax Credit," exploring what they are, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest Healthcare Gov Not Showing Tax Credit Below

Healthcare Gov Not Showing Tax Credit

Healthcare Gov Not Showing Tax Credit -

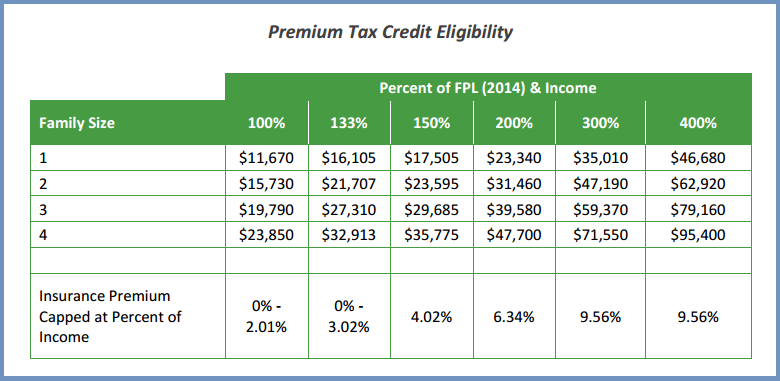

There are two ways to get the credit If you qualify for advance payments of the premium tax credit APTC you can choose to have amounts paid directly to the insurance provider to help cover your

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Healthcare Gov Not Showing Tax Credit cover a large collection of printable documents that can be downloaded online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and more. The appealingness of Healthcare Gov Not Showing Tax Credit lies in their versatility as well as accessibility.

More of Healthcare Gov Not Showing Tax Credit

January Child Tax Credit

January Child Tax Credit

For tax years 2021 and 2022 the American Rescue Plan of 2021 ARPA temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer is not allowed a premium tax credit if his or her households income is above 400 of the Federal Poverty Line

You can choose to receive the entire benefit when you claim the PTC on your tax return However whether you chose to get advanced payments or claim the credit on the tax return you must file a federal income tax return even if otherwise not required to file and include a completed Form 8962 Premium Tax Credit

Healthcare Gov Not Showing Tax Credit have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Modifications: We can customize printables to your specific needs in designing invitations making your schedule, or decorating your home.

-

Educational Benefits: The free educational worksheets provide for students of all ages, which makes them an invaluable aid for parents as well as educators.

-

The convenience of Quick access to a myriad of designs as well as templates saves time and effort.

Where to Find more Healthcare Gov Not Showing Tax Credit

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

This tool will get you the information you need to file your taxes by figuring out your premium tax credits

It is 33 130 for a family of four living in Alaska and 30 480 for a family in Hawaii It s a bit surprising how much money you can make and still qualify for the credit said Tom Gibson

We hope we've stimulated your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of uses.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide spectrum of interests, that range from DIY projects to planning a party.

Maximizing Healthcare Gov Not Showing Tax Credit

Here are some innovative ways ensure you get the very most of Healthcare Gov Not Showing Tax Credit:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Healthcare Gov Not Showing Tax Credit are an abundance of practical and imaginative resources catering to different needs and interest. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the endless world of Healthcare Gov Not Showing Tax Credit now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Healthcare Gov Not Showing Tax Credit really completely free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables for commercial purposes?

- It's based on specific usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues with Healthcare Gov Not Showing Tax Credit?

- Some printables may have restrictions in their usage. Be sure to read the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home with an printer, or go to the local print shop for better quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in the format PDF. This is open with no cost programs like Adobe Reader.

HealthCare gov Special Enrollment Period Can Help Clients Get Insurance

Orders Not Showing Tax At Checkout The Seller Community

Check more sample of Healthcare Gov Not Showing Tax Credit below

The Last Embassy ACA Obamacare What Was The Total Price Of Healthcare

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

Orders Not Showing Tax At Checkout The Seller Community

Kamala Is The VP LetsWinThis KHive On Twitter RT POTUS

Donald Trump Imgflip

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

https://www.healthcare.gov/taxes

Use Form 1095 A to complete IRS tax Form 8962 and reconcile your 2023 premium tax credit when you file your 2023 taxes if you qualified for or used the premium tax credit Once you do you may Owe taxes if you used more of the premium tax credit

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Use Form 1095 A to complete IRS tax Form 8962 and reconcile your 2023 premium tax credit when you file your 2023 taxes if you qualified for or used the premium tax credit Once you do you may Owe taxes if you used more of the premium tax credit

Kamala Is The VP LetsWinThis KHive On Twitter RT POTUS

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

Donald Trump Imgflip

Why Is Invoice Not Showing Tax showing Incorrect Tax Vify

FAQs Health Insurance Premium Tax Credits

PDF Invoice Not Showing Tax Percentage Tax Rates Issue 854

PDF Invoice Not Showing Tax Percentage Tax Rates Issue 854

Weekly portfolio Discussion Thread 10 30 Through 11 5 R M1Finance