In this age of technology, when screens dominate our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education as well as creative projects or just adding a personal touch to your area, Higher Education Exemption In Income Tax are now a vital resource. We'll dive in the world of "Higher Education Exemption In Income Tax," exploring what they are, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Higher Education Exemption In Income Tax Below

Higher Education Exemption In Income Tax

Higher Education Exemption In Income Tax -

The tax relief concerning the income from work performed in the country of study only applies if the student is studying in a university or other higher education institution in their country of residence A higher education institution corresponds to Finnish universities and universities of applied sciences

The six month rule only applies to wage income which means that for example a person s scholarship and other grants are not tax exempt income under the above provision The above provision also does not apply to

Printables for free cover a broad assortment of printable, downloadable items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and many more. The appeal of printables for free lies in their versatility and accessibility.

More of Higher Education Exemption In Income Tax

Latest Edition Of Under The Dome Released E News West Virginia

Latest Edition Of Under The Dome Released E News West Virginia

The bottom line Total Saving through Education tax The exempted income equals INR 159600 after adding CEA Hostel Allowance and Tuition fee limit i e 1 5 lakhs Hence you can avail of the total benefit of INR 159600

Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student

Higher Education Exemption In Income Tax have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize the design to meet your needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Use: These Higher Education Exemption In Income Tax cater to learners of all ages, which makes the perfect tool for parents and teachers.

-

The convenience of immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more Higher Education Exemption In Income Tax

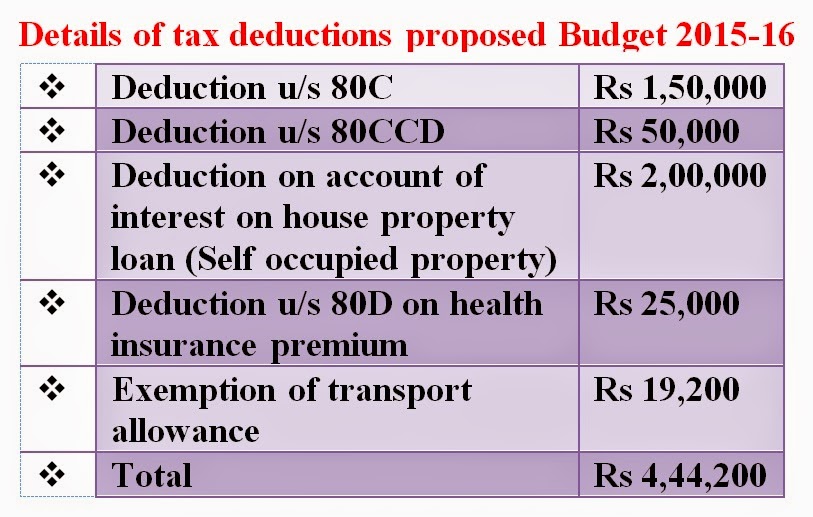

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

The Income Tax Act allows tax benefits for a loan taken for higher education when certain conditions are met Tax benefits have been laid down under Section 80E of the Income Tax Act

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit

In the event that we've stirred your curiosity about Higher Education Exemption In Income Tax Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in Higher Education Exemption In Income Tax for different applications.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Higher Education Exemption In Income Tax

Here are some innovative ways that you can make use of Higher Education Exemption In Income Tax:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to aid in learning at your home and in class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Higher Education Exemption In Income Tax are a treasure trove of practical and imaginative resources designed to meet a range of needs and interest. Their accessibility and versatility make them a fantastic addition to any professional or personal life. Explore the vast collection of Higher Education Exemption In Income Tax today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these materials for free.

-

Can I utilize free printables for commercial uses?

- It's based on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables might have limitations regarding usage. Be sure to read these terms and conditions as set out by the creator.

-

How can I print Higher Education Exemption In Income Tax?

- Print them at home with printing equipment or visit a local print shop for higher quality prints.

-

What program do I need in order to open printables free of charge?

- The majority are printed in the format of PDF, which is open with no cost software such as Adobe Reader.

HRA Exemption Calculator For Income Tax Benefits Calculation And

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Check more sample of Higher Education Exemption In Income Tax below

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Income Tax Exemption On Educational Loan For Higher Education Abroad

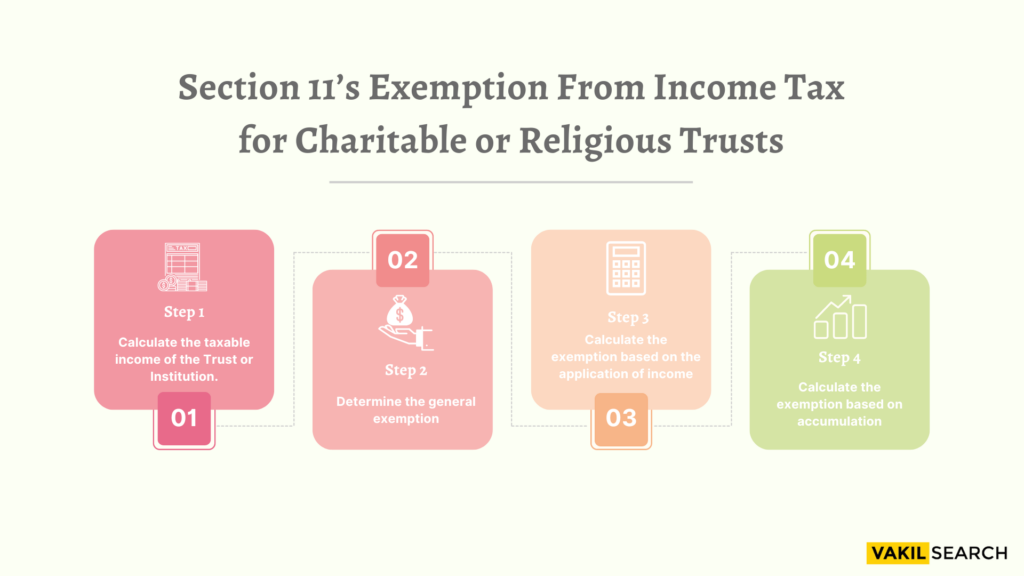

Section 11 Income Tax Act Exemptions For Charitable Trusts

Income Tax Slabs

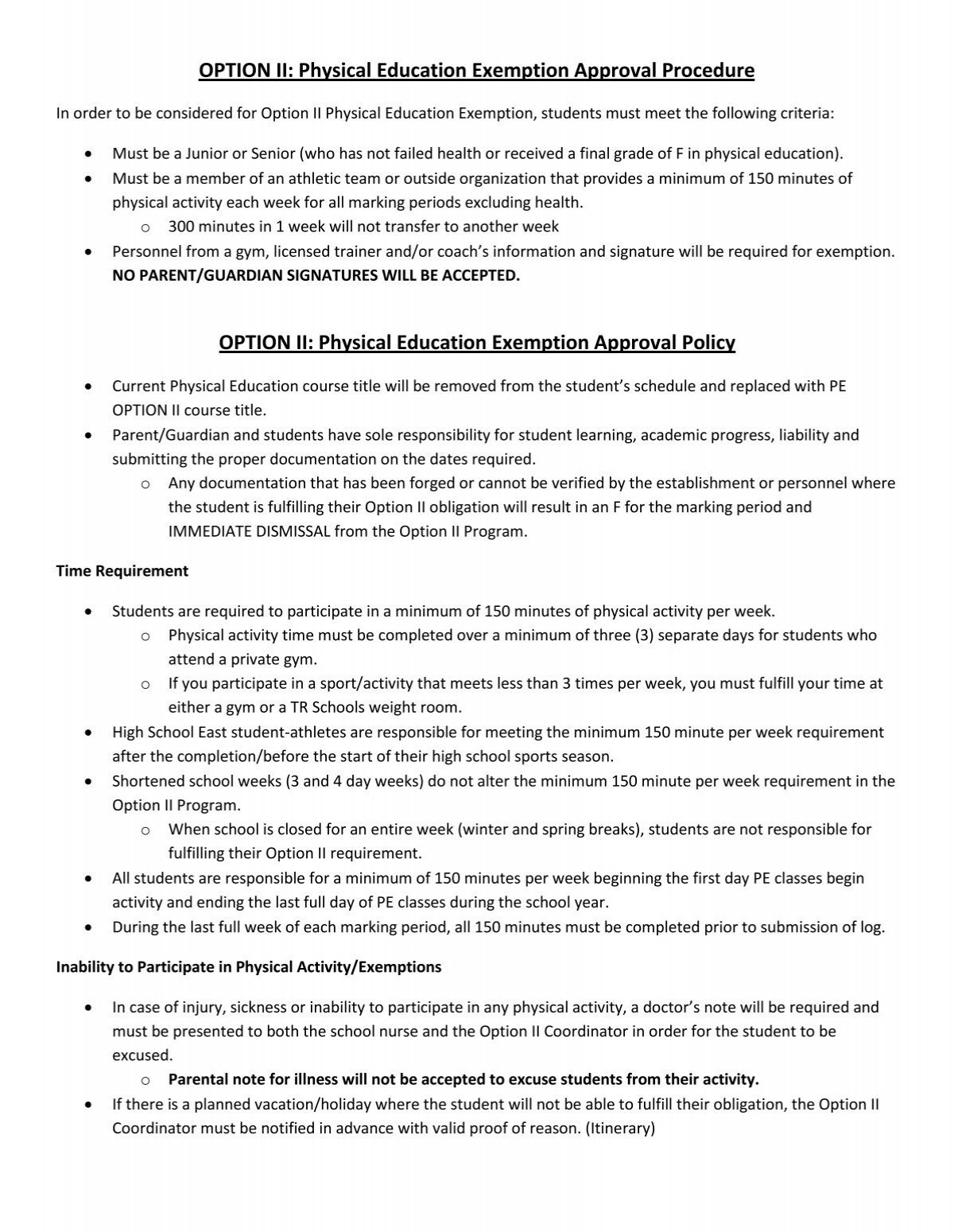

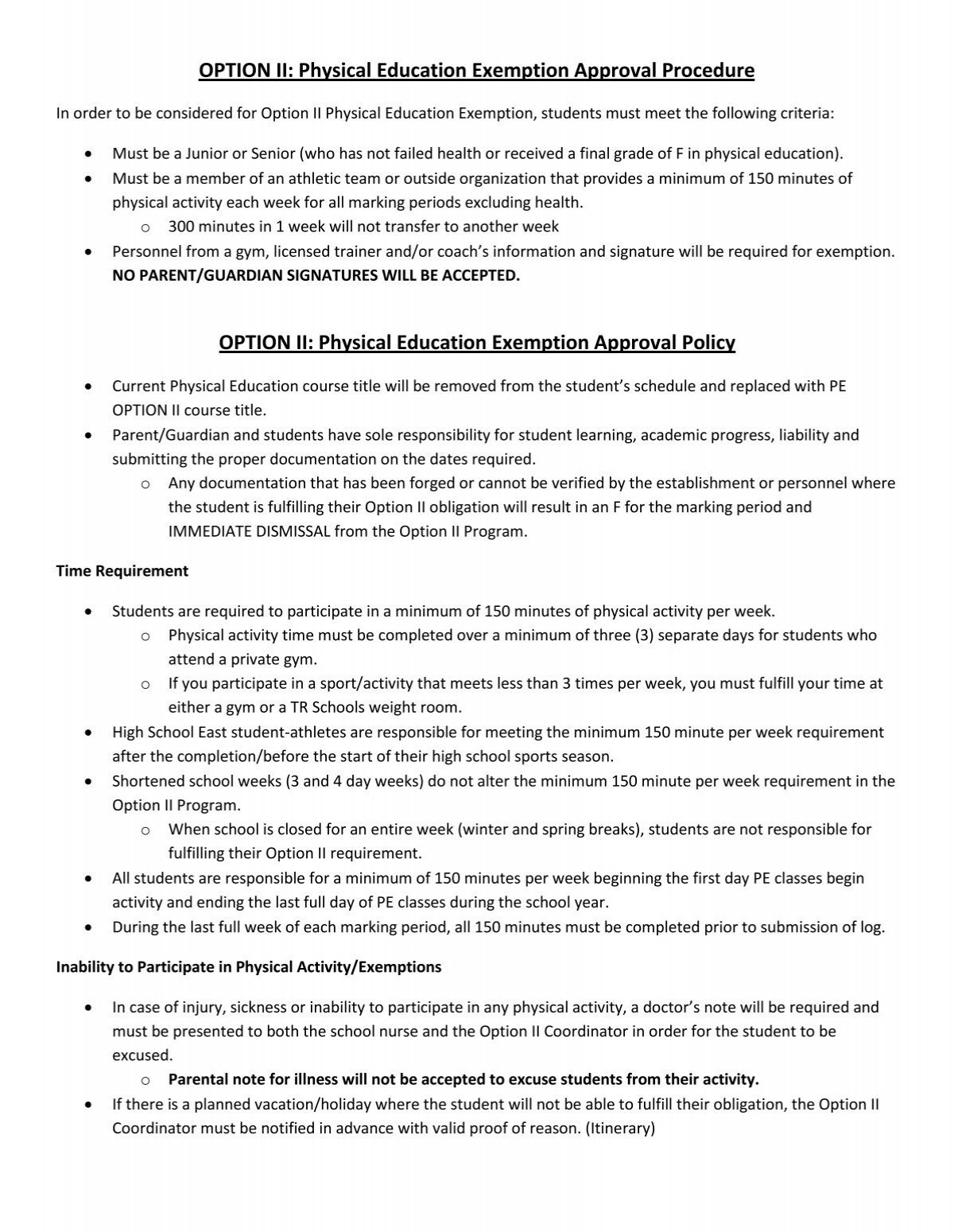

OPTION II Physical Education Exemption Approval Procedure

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

https://www.vero.fi/en/detailed-guidance/guidance/...

The six month rule only applies to wage income which means that for example a person s scholarship and other grants are not tax exempt income under the above provision The above provision also does not apply to

https://www.vero.fi/en/detailed-guidance/guidance/...

The tax relief concerning the income from work performed in the country of study only applies if the student is studying in a university or other institute of higher education in the student s home country

The six month rule only applies to wage income which means that for example a person s scholarship and other grants are not tax exempt income under the above provision The above provision also does not apply to

The tax relief concerning the income from work performed in the country of study only applies if the student is studying in a university or other institute of higher education in the student s home country

Income Tax Slabs

Income Tax Exemption On Educational Loan For Higher Education Abroad

OPTION II Physical Education Exemption Approval Procedure

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

Quality Assurance Hot selling Products 1 NIP BAY DE NOC LURE CO THE

Budget 2023 Know In 10 Points What Are The Expectations From The

Budget 2023 Know In 10 Points What Are The Expectations From The

Exemptions Still Available In New Tax Regime with English Subtitles