In a world where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education and creative work, or simply to add an individual touch to the home, printables for free have become an invaluable resource. Here, we'll dive deep into the realm of "Hmrc Paye Ni Payment Due Dates," exploring what they are, how to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Hmrc Paye Ni Payment Due Dates Below

Hmrc Paye Ni Payment Due Dates

Hmrc Paye Ni Payment Due Dates -

PAYE Due Dates 3 minute read If you re paying salaries to employees or directors you need to register for PAYE and pay your PAYE bill to HMRC Monthly payments are due

The quarter dates are 5 July amount due by 22 July 5 October amount due by 22 October 5 January amount due by 22 January

Hmrc Paye Ni Payment Due Dates include a broad selection of printable and downloadable materials online, at no cost. These resources come in many designs, including worksheets coloring pages, templates and more. One of the advantages of Hmrc Paye Ni Payment Due Dates is in their versatility and accessibility.

More of Hmrc Paye Ni Payment Due Dates

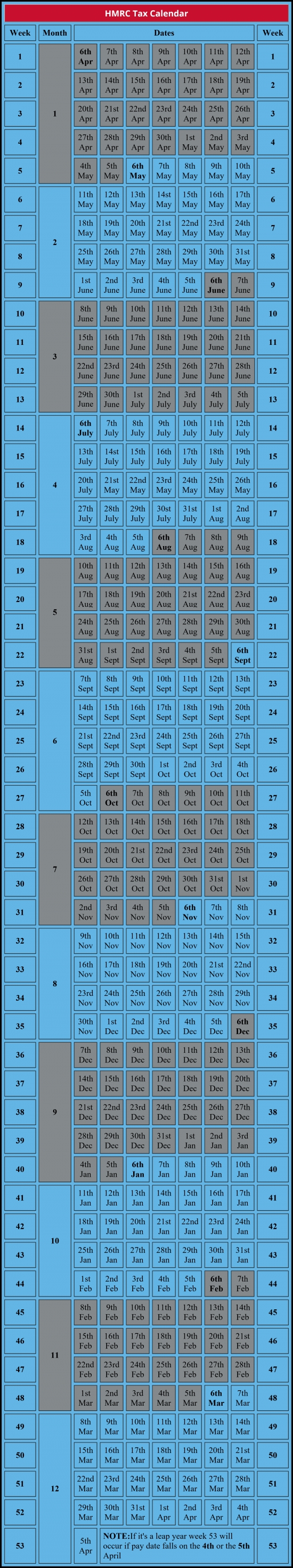

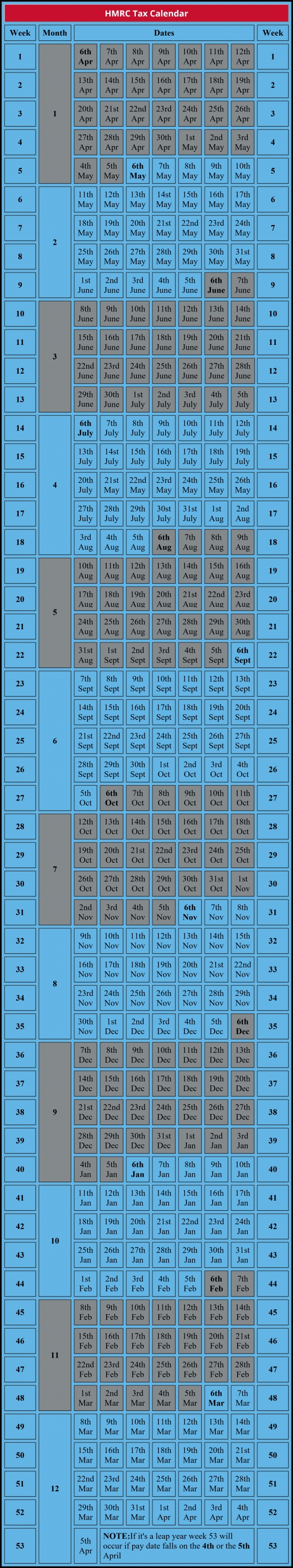

Hmrc Paye Calendar 2019 2020

Hmrc Paye Calendar 2019 2020

22nd of every month deadline to pay PAYE and NIC liabilities to HMRC if you re paying electronically If the amount payable is under 1500 you may be able to

22nd April Deadline for online payment of PAYE and NICs etc to HMRC s Accounts Office May 2023 3rd May P46 car paper submissions company car changes in the period 6th Jan 5th April

Hmrc Paye Ni Payment Due Dates have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: They can make printables to fit your particular needs such as designing invitations to organize your schedule or even decorating your home.

-

Educational Value: Education-related printables at no charge provide for students of all ages, making them a vital source for educators and parents.

-

Accessibility: Access to various designs and templates, which saves time as well as effort.

Where to Find more Hmrc Paye Ni Payment Due Dates

HMRC Confirms 2022 23 NI Rates Activpayroll

HMRC Confirms 2022 23 NI Rates Activpayroll

Payment of quarterly PAYE NI contributions must be received by Electronic payment Quarter 1 must be cleared by HMRC s bank account by 22 nd July quarter 2 by 22 nd

March 2024 1 March 2024 New Advisory Fuel Rates AFR applies for company car users 6 March 2024 Chancellor to deliver Spring Budget 2024 7 March

Now that we've piqued your interest in Hmrc Paye Ni Payment Due Dates Let's see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Hmrc Paye Ni Payment Due Dates for various uses.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast range of topics, that includes DIY projects to planning a party.

Maximizing Hmrc Paye Ni Payment Due Dates

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Hmrc Paye Ni Payment Due Dates are an abundance of practical and innovative resources which cater to a wide range of needs and interest. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast world of Hmrc Paye Ni Payment Due Dates and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can download and print these materials for free.

-

Can I use the free printables for commercial use?

- It's based on the usage guidelines. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with Hmrc Paye Ni Payment Due Dates?

- Some printables may have restrictions on use. Always read the terms and condition of use as provided by the creator.

-

How can I print Hmrc Paye Ni Payment Due Dates?

- You can print them at home with an printer, or go to any local print store for superior prints.

-

What software will I need to access printables for free?

- Many printables are offered in the format PDF. This is open with no cost software such as Adobe Reader.

Employer S Paye Reference On Payslip EMPLOYMENT JKX

PAYE NI Cap For SME R D Tax Credits What You Need To Know News YesTax

Check more sample of Hmrc Paye Ni Payment Due Dates below

A Printable Calendar With The Words Payment Due Dates And Month By

UK Payroll Tax Calendar 2022 2023 Shape Payroll

PAYE Payment Reference For HMRC Goselfemployed co

HMRC PAYE Payments My Insolvency YouTube

Income Tax Bands 2022 23 Kitchen Cabinet

Paying PAYE Deductions To HMRC How To Make The Payment And More

https://informi.co.uk/finance/national-insuran…

The quarter dates are 5 July amount due by 22 July 5 October amount due by 22 October 5 January amount due by 22 January

https://www.hmrc.gov.uk/gds/nim/attachments/reports1.pdf

Step one correct earlier errors Work out what your next correct payment date should be Check whether this new correct date means that the payment date your last FPS

The quarter dates are 5 July amount due by 22 July 5 October amount due by 22 October 5 January amount due by 22 January

Step one correct earlier errors Work out what your next correct payment date should be Check whether this new correct date means that the payment date your last FPS

HMRC PAYE Payments My Insolvency YouTube

UK Payroll Tax Calendar 2022 2023 Shape Payroll

Income Tax Bands 2022 23 Kitchen Cabinet

Paying PAYE Deductions To HMRC How To Make The Payment And More

HMRC PAYE NI Tax Inspections Explained Contractor Calculator

Important Information About Payments Due Under PAYE Settlement

Important Information About Payments Due Under PAYE Settlement

How Can I Work Out My Payment Reference When Paying PAYE To HMRC