In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed products hasn't decreased. If it's to aid in education project ideas, artistic or simply to add an individual touch to the space, Hmrc Payment For Vat are a great resource. The following article is a dive into the sphere of "Hmrc Payment For Vat," exploring what they are, how you can find them, and how they can enrich various aspects of your life.

Get Latest Hmrc Payment For Vat Below

Hmrc Payment For Vat

Hmrc Payment For Vat -

HMRC no longer accepts cheque or postal order payments when a business submits an online VAT return The cleared funds must be in HMRC s bank account by the deadline If the

How to pay your VAT bill including online by card or Direct Debit from your bank with HMRC s bank details by standing order or at your bank or building society

Hmrc Payment For Vat offer a wide selection of printable and downloadable materials online, at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and more. The beauty of Hmrc Payment For Vat is in their variety and accessibility.

More of Hmrc Payment For Vat

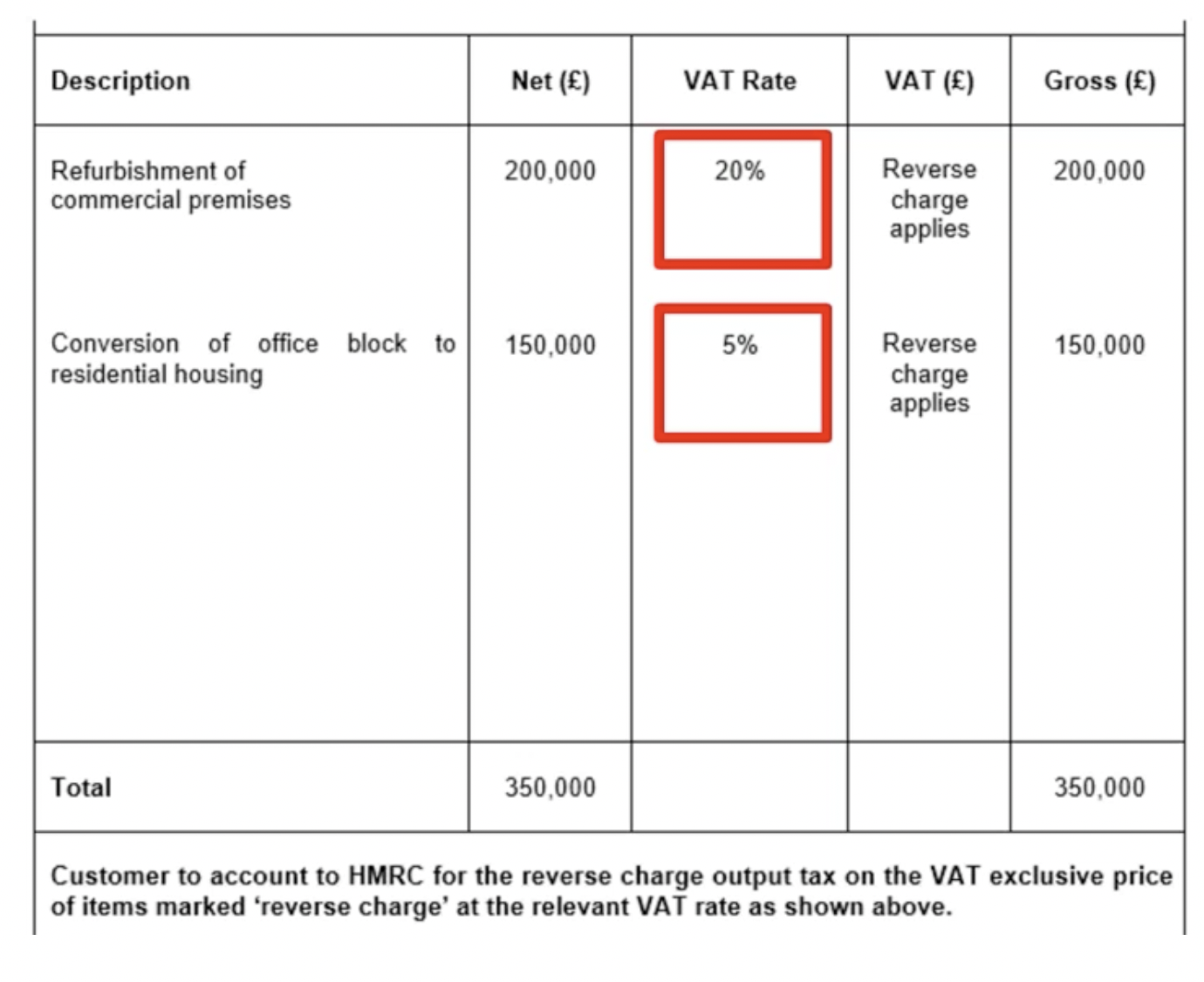

VAT Reverse Charge For Construction All You Need To Know

VAT Reverse Charge For Construction All You Need To Know

Then you must select the pay by bank account option After this you will be directed to sign into your bank account and approve the payment What happens if your VAT bill payment is late

To set up a VAT payment plan the business needs to Be VAT registered Have filed its latest VAT Return Owe 20k or less Is within 28 days of the payment deadline Does not have any other

Hmrc Payment For Vat have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor print-ready templates to your specific requirements whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them an invaluable tool for teachers and parents.

-

Simple: instant access various designs and templates cuts down on time and efforts.

Where to Find more Hmrc Payment For Vat

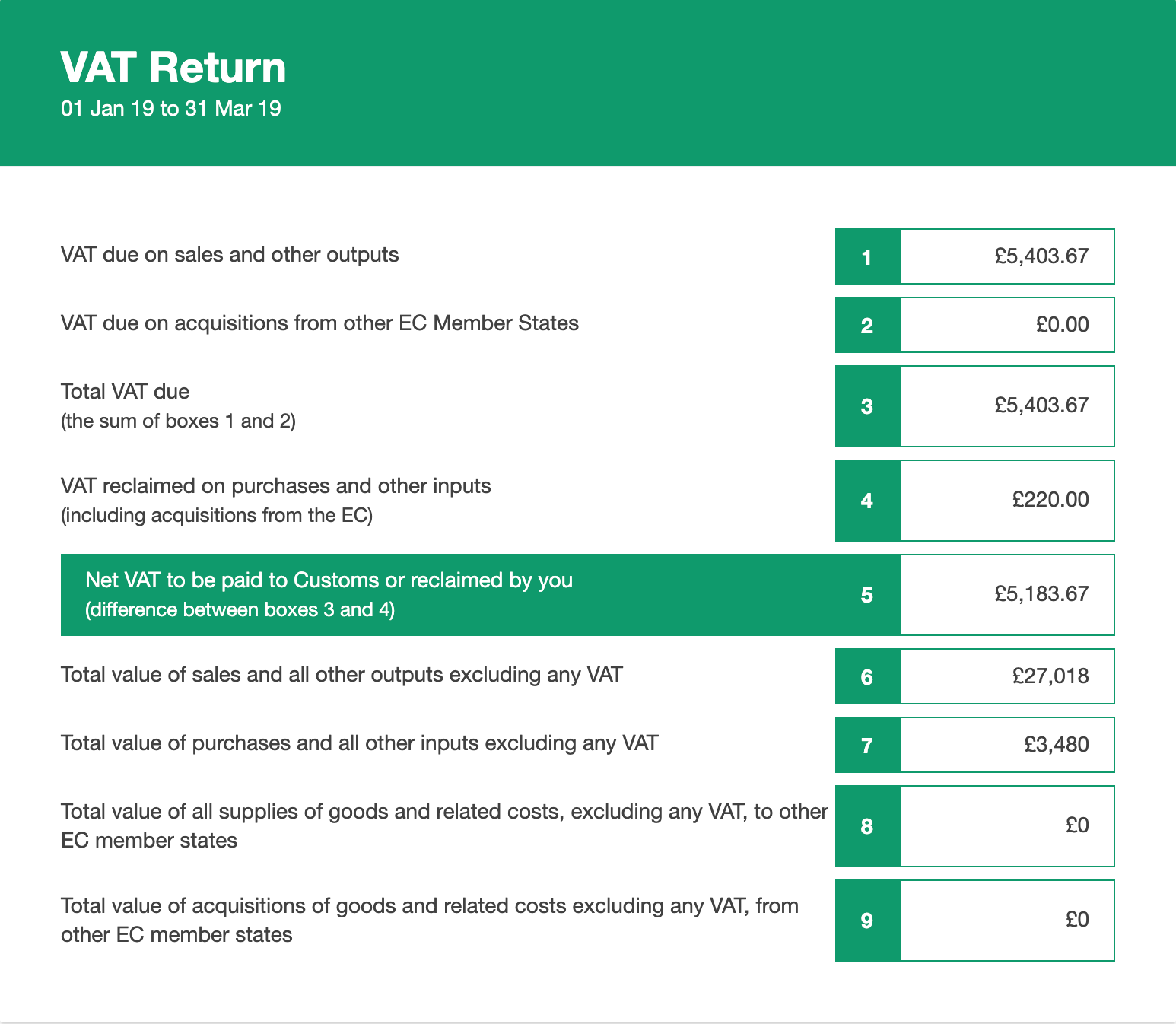

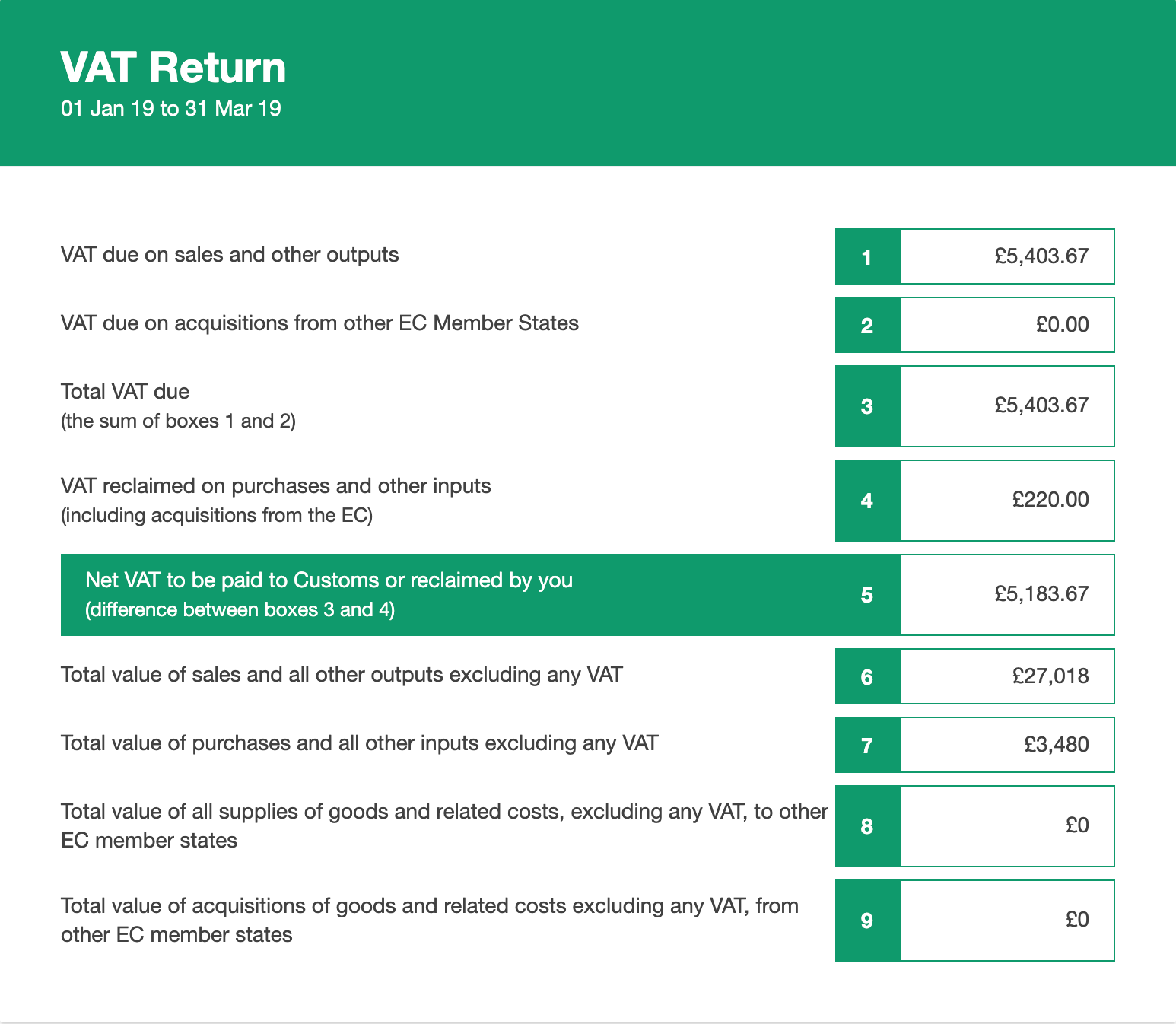

Che Cos Una Dichiarazione IVA FreeAgent I m Running

Che Cos Una Dichiarazione IVA FreeAgent I m Running

The balancing payment for that quarters VAT liability will be settled when the business submits its VAT return payment POA must be made electronically and the cleared funds reach HMRC s

If you can t pay your VAT on time or in full you should contact HMRC s Payment Support Service on 0300 200 3835 immediately to make them aware of the situation By contacting HMRC

Now that we've piqued your interest in printables for free, let's explore where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Hmrc Payment For Vat for all applications.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Hmrc Payment For Vat

Here are some ideas how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Hmrc Payment For Vat are an abundance of useful and creative resources that meet a variety of needs and passions. Their access and versatility makes them a valuable addition to both personal and professional life. Explore the vast collection that is Hmrc Payment For Vat today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Hmrc Payment For Vat truly cost-free?

- Yes, they are! You can download and print these items for free.

-

Can I download free printouts for commercial usage?

- It's determined by the specific rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions on their use. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to an area print shop for top quality prints.

-

What software do I need in order to open printables at no cost?

- Many printables are offered in the format PDF. This is open with no cost software, such as Adobe Reader.

HMRC Reaches Milestone As 1bn In UK Tax Paid Through Open Banking

Understanding My Payslip What Is HMRC Payment NIERS Reliasys

Check more sample of Hmrc Payment For Vat below

Cis And Vat Reversal Invoice Template SexiezPicz Web Porn

Exp Code On Invoice Hybridlasopa

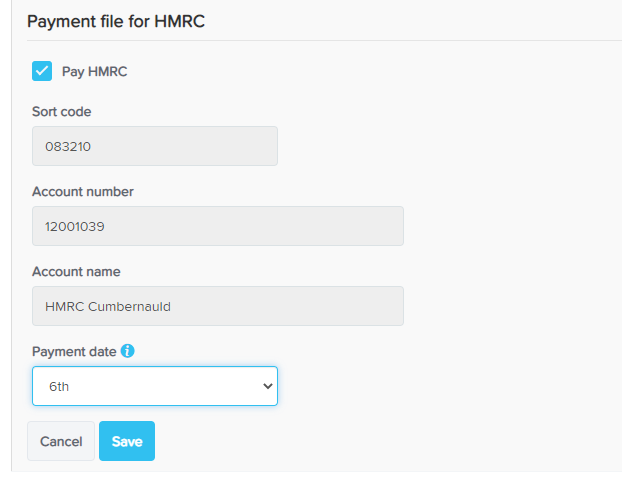

HMRC Payment File Your Payroll UK

Received A Letter From HMRC Following These Tips Will Help You Avoid

UK Payroll Tax Calendar 2022 2023 Shape Payroll

Zimra Vat 7 Return Form Atlantacaqwe

https://www.gov.uk/pay-vat/by-debit-or-credit-card-online

How to pay your VAT bill including online by card or Direct Debit from your bank with HMRC s bank details by standing order or at your bank or building society

https://www.gov.uk/pay-vat/bank-details

Learn how to pay your VAT bill to HMRC by bank transfer online card payment Direct Debit standing order or at your bank Find the bank details reference number and processing times for

How to pay your VAT bill including online by card or Direct Debit from your bank with HMRC s bank details by standing order or at your bank or building society

Learn how to pay your VAT bill to HMRC by bank transfer online card payment Direct Debit standing order or at your bank Find the bank details reference number and processing times for

Received A Letter From HMRC Following These Tips Will Help You Avoid

Exp Code On Invoice Hybridlasopa

UK Payroll Tax Calendar 2022 2023 Shape Payroll

Zimra Vat 7 Return Form Atlantacaqwe

Hmrc Vat

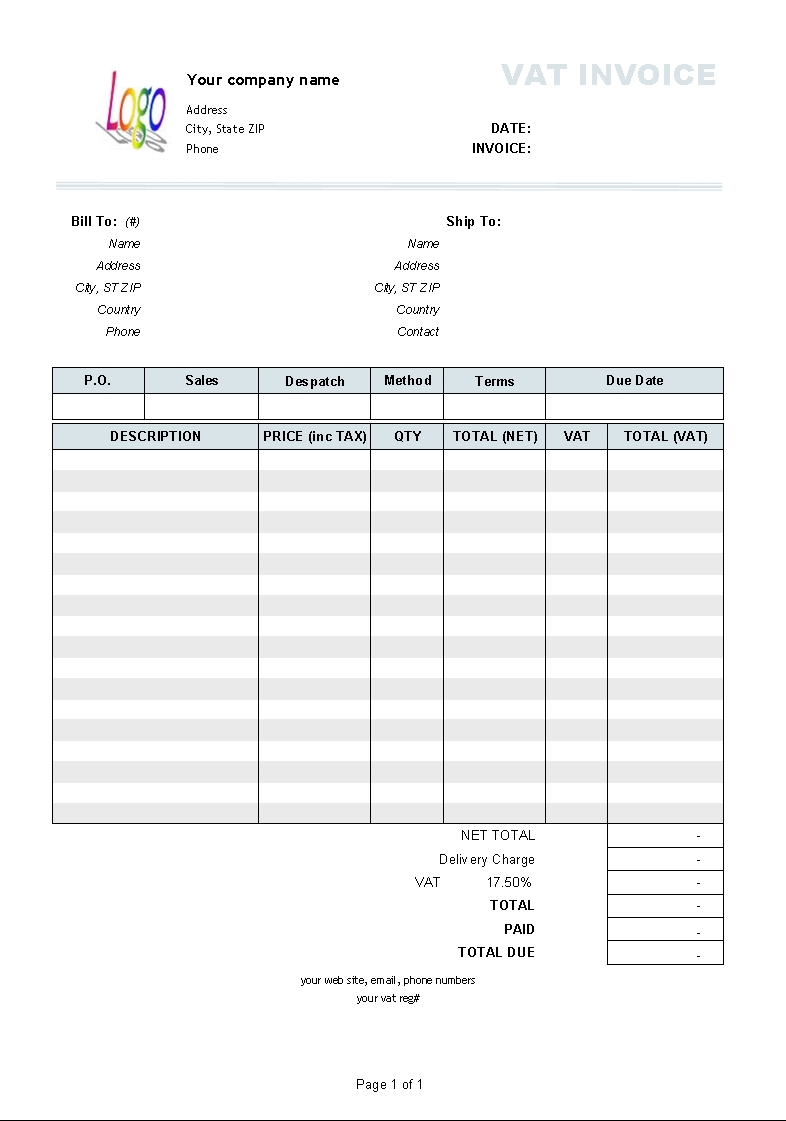

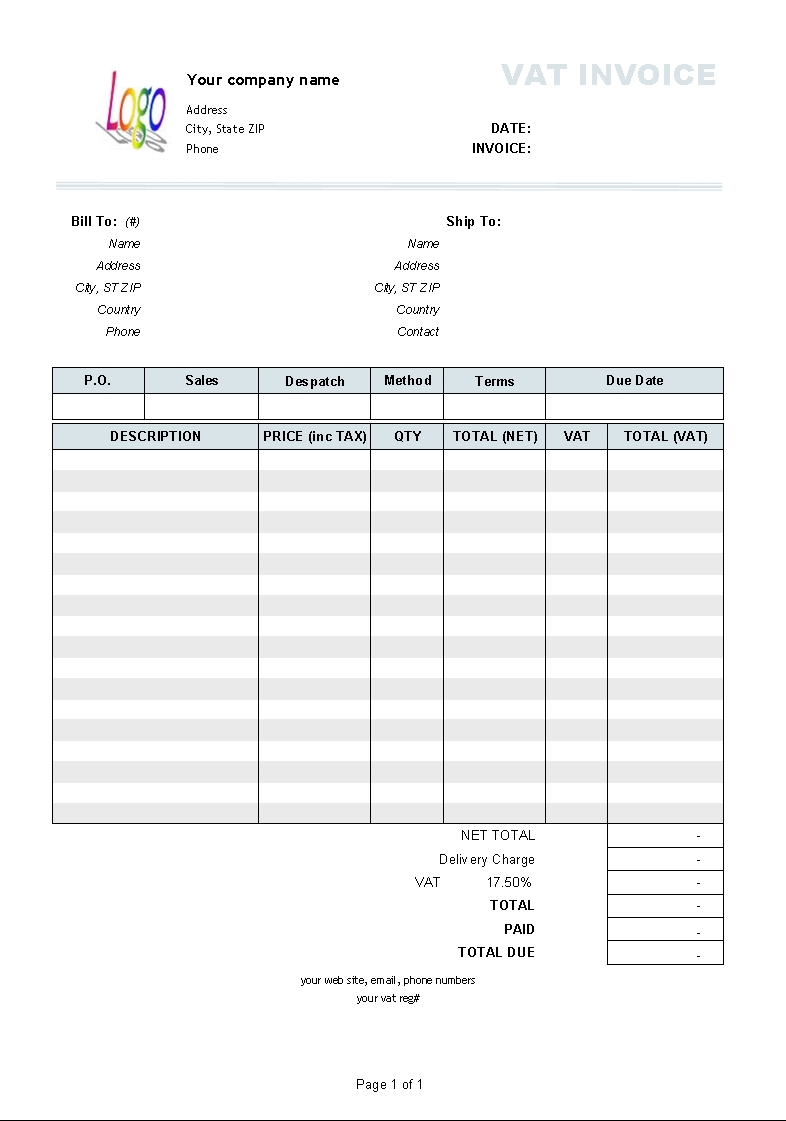

Hmrc Vat Invoices Invoice Template Ideas

Hmrc Vat Invoices Invoice Template Ideas

VAT HMRC Payment Loan Lime Consultancy Business Finance Brokers