In this age of electronic devices, where screens have become the dominant feature of our lives however, the attraction of tangible printed items hasn't gone away. No matter whether it's for educational uses and creative work, or just adding personal touches to your area, Hmrc Vat Quarter Dates are now an essential resource. With this guide, you'll take a dive deeper into "Hmrc Vat Quarter Dates," exploring what they are, where they are available, and how they can enrich various aspects of your life.

Get Latest Hmrc Vat Quarter Dates Below

Hmrc Vat Quarter Dates

Hmrc Vat Quarter Dates -

The end date for the October quarter would be October 31st and you would need to send in the return and payment by 7th December You can see guidance here Send a VAT

Check your VAT Return and payment deadlines in your HM Revenue and Customs HMRC online account VAT Return deadline There are 12 months in your VAT accounting period

Printables for free cover a broad array of printable documents that can be downloaded online at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The attraction of printables that are free is in their variety and accessibility.

More of Hmrc Vat Quarter Dates

UK s Big Nine Office Markets See Strongest Performance In Three Years

UK s Big Nine Office Markets See Strongest Performance In Three Years

Quarterly VAT return dates By default you will submit your advance VAT returns on a quarterly basis and pay your VAT accordingly four times a year At the end of each quarter you submit your advance VAT

You can also use the HMRC s online VAT calculator to work out your VAT quarter All you need to do is enter your VAT registration date and the calculator will tell you when your VAT quarter begins and ends

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: This allows you to modify the templates to meet your individual needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Value: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a useful device for teachers and parents.

-

Affordability: The instant accessibility to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Hmrc Vat Quarter Dates

Full List Of Cost Of Living Payment Dates For DWP And HMRC Claimants

Full List Of Cost Of Living Payment Dates For DWP And HMRC Claimants

Monthly and Quarterly Returns If you pay your VAT monthly or quarterly the deadline for submitting your return and paying any VAT you owe is one calendar month and seven days

The deadline for submitting your return online is usually one calendar month and 7 days after the end of an accounting period This is also the deadline for paying HMRC You need to

Now that we've ignited your interest in Hmrc Vat Quarter Dates, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Hmrc Vat Quarter Dates for different uses.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast selection of subjects, starting from DIY projects to party planning.

Maximizing Hmrc Vat Quarter Dates

Here are some ideas ensure you get the very most use of Hmrc Vat Quarter Dates:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Hmrc Vat Quarter Dates are an abundance of useful and creative resources that cater to various needs and hobbies. Their access and versatility makes them a great addition to your professional and personal life. Explore the wide world of Hmrc Vat Quarter Dates and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can download and print these free resources for no cost.

-

Do I have the right to use free printouts for commercial usage?

- It depends on the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues with Hmrc Vat Quarter Dates?

- Certain printables could be restricted regarding their use. Be sure to check the terms and condition of use as provided by the author.

-

How can I print printables for free?

- You can print them at home with either a printer or go to any local print store for higher quality prints.

-

What software must I use to open printables free of charge?

- The majority of printables are in the format PDF. This can be opened using free software, such as Adobe Reader.

MTD For VAT Key Dates For Your Business Xero UK

HMRC Vacancy Snapshot

Check more sample of Hmrc Vat Quarter Dates below

Dates And Deadlines For VAT Payments To HMRC Invoice Funding

Postponed VAT With Currency Gains loss

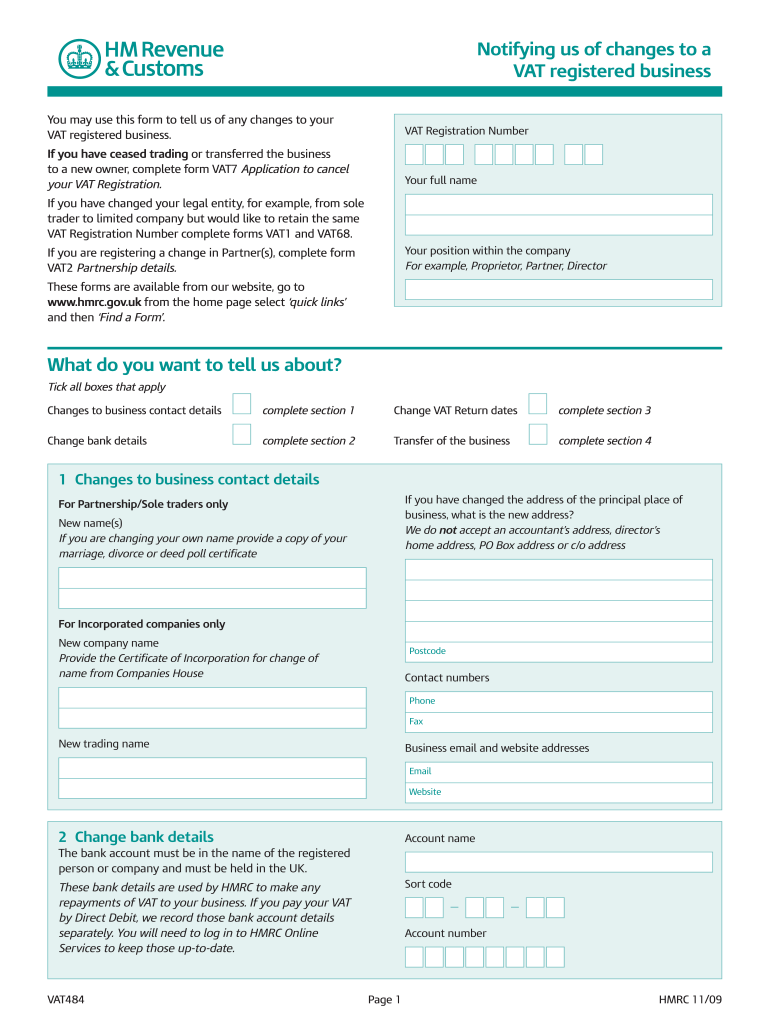

Vat484 Fill Out And Sign Printable PDF Template SignNow

How To Pay HMRC VAT Corporation Tax Online Details And Guide

Design Team Submit Planning Application For HMRC s Pilgrim s Quarter

VAT Calculation Worksheet Problem Manager Forum

https://www.gov.uk › vat-annual-accounting-scheme › ...

Check your VAT Return and payment deadlines in your HM Revenue and Customs HMRC online account VAT Return deadline There are 12 months in your VAT accounting period

https://frontedgeaccountants.co.uk

Most businesses will follow one of three standard VAT quarter schedules Each quarter must be followed by a return which is due one month and seven days after the end of the quarter

Check your VAT Return and payment deadlines in your HM Revenue and Customs HMRC online account VAT Return deadline There are 12 months in your VAT accounting period

Most businesses will follow one of three standard VAT quarter schedules Each quarter must be followed by a return which is due one month and seven days after the end of the quarter

How To Pay HMRC VAT Corporation Tax Online Details And Guide

Postponed VAT With Currency Gains loss

Design Team Submit Planning Application For HMRC s Pilgrim s Quarter

VAT Calculation Worksheet Problem Manager Forum

Sole Trader Accounting Software QuickBooks UK

Hmrc Vat Payment Dates

Hmrc Vat Payment Dates

VAT Return Dates Payment Deadlines Goselfemployed co