In a world where screens rule our lives, the charm of tangible printed material hasn't diminished. Be it for educational use and creative work, or just adding some personal flair to your area, Hmrc Vat Return Submission Dates can be an excellent resource. This article will dive to the depths of "Hmrc Vat Return Submission Dates," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Hmrc Vat Return Submission Dates Below

Hmrc Vat Return Submission Dates

Hmrc Vat Return Submission Dates -

The deadline for submitting your VAT return is usually one calendar month and seven days after the end of the accounting period This includes the time for your payment to reach HMRC so enough time needs to be

Find out when your VAT returns are due send an Annual Accounting Scheme VAT return if your accounting period started before 1 November 2022 set up a Direct Debit to pay VAT

Hmrc Vat Return Submission Dates provide a diverse variety of printable, downloadable materials that are accessible online for free cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and many more. The appeal of printables for free lies in their versatility and accessibility.

More of Hmrc Vat Return Submission Dates

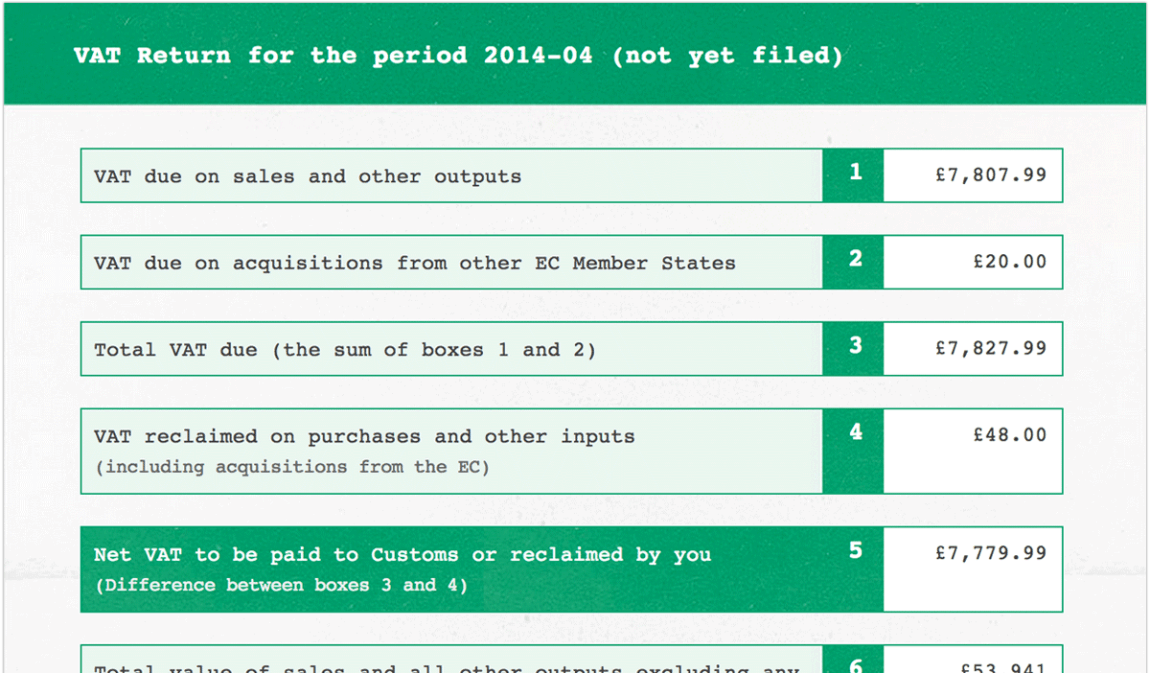

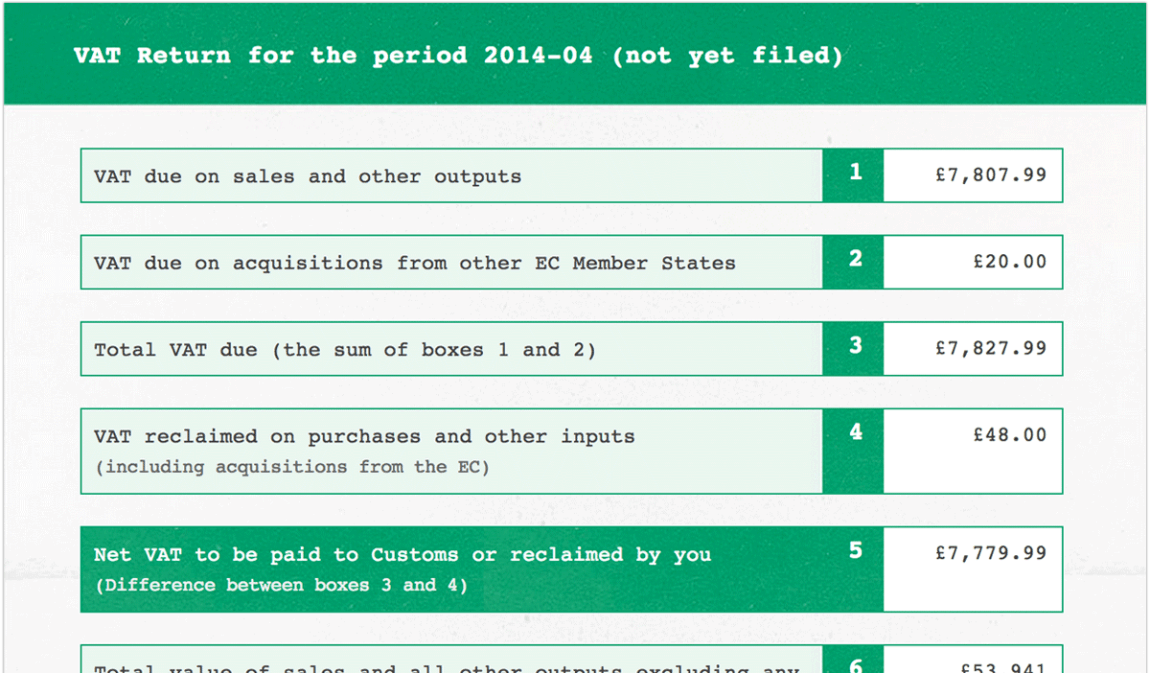

VAT Return Submission Online For Construction VAT Return 9 1

VAT Return Submission Online For Construction VAT Return 9 1

You should check your VAT return submission and payment deadline in your HMRC online account As a general rule the due date to submit and pay VAT

All of HMRC s key tax dates are right here including deadlines for self assessment submitting VAT returns MTD deadlines monthly PAYE dates and the

Hmrc Vat Return Submission Dates have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor printing templates to your own specific requirements whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Downloads of educational content for free can be used by students from all ages, making them a useful resource for educators and parents.

-

The convenience of You have instant access a plethora of designs and templates will save you time and effort.

Where to Find more Hmrc Vat Return Submission Dates

Co To Jest Deklaracja VAT FreeAgent I m Running

Co To Jest Deklaracja VAT FreeAgent I m Running

A VAT Return specifies how much VAT a corporation must pay or be repaid by HM Revenue and Customs HMRC VAT is subject to various dates thresholds

When your VAT return is due When the payment must arrive in HMRC s account Monthly and Quarterly Returns If you pay your VAT monthly or quarterly the deadline for

Now that we've piqued your interest in printables for free We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Hmrc Vat Return Submission Dates for all motives.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a broad variety of topics, that range from DIY projects to planning a party.

Maximizing Hmrc Vat Return Submission Dates

Here are some ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Hmrc Vat Return Submission Dates are an abundance of innovative and useful resources that cater to various needs and preferences. Their accessibility and flexibility make them a valuable addition to your professional and personal life. Explore the many options of Hmrc Vat Return Submission Dates today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can download and print these documents for free.

-

Can I utilize free printables for commercial purposes?

- It depends on the specific rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright issues with Hmrc Vat Return Submission Dates?

- Certain printables might have limitations on use. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print Hmrc Vat Return Submission Dates?

- Print them at home using either a printer at home or in a local print shop for superior prints.

-

What program must I use to open printables free of charge?

- A majority of printed materials are as PDF files, which can be opened with free programs like Adobe Reader.

VAT Return Submission And Payment To UAE Tax Authority YouTube

Zero VAT Return Submission Online 2022 Zero Value Added Tax Return

Check more sample of Hmrc Vat Return Submission Dates below

Online VAT Return Submission Process YouTube

FreeAgent VAT Online Submission 1Stop Accountants

Understanding HMRC s Penalty Points For Late VAT Return Submission A

VAT Return Submission Change Quarterly Monthly VAT Returns Clear

Changes To HMRC Penalties For Late VAT Return Submission

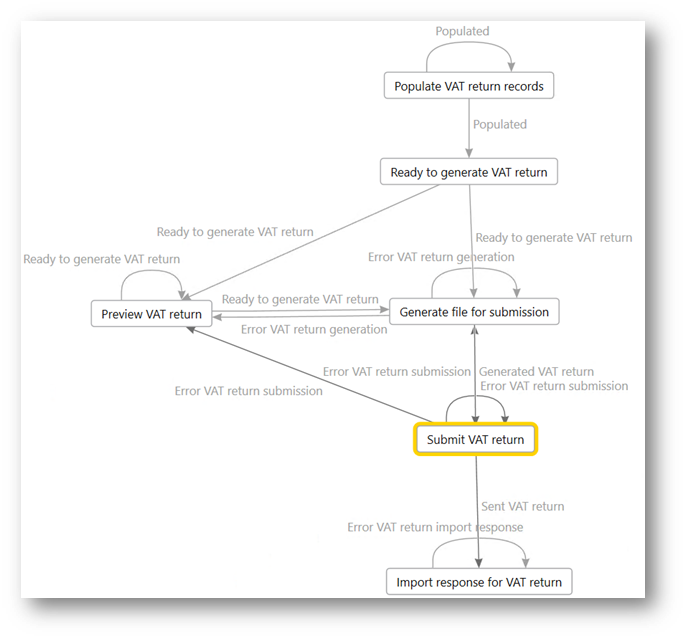

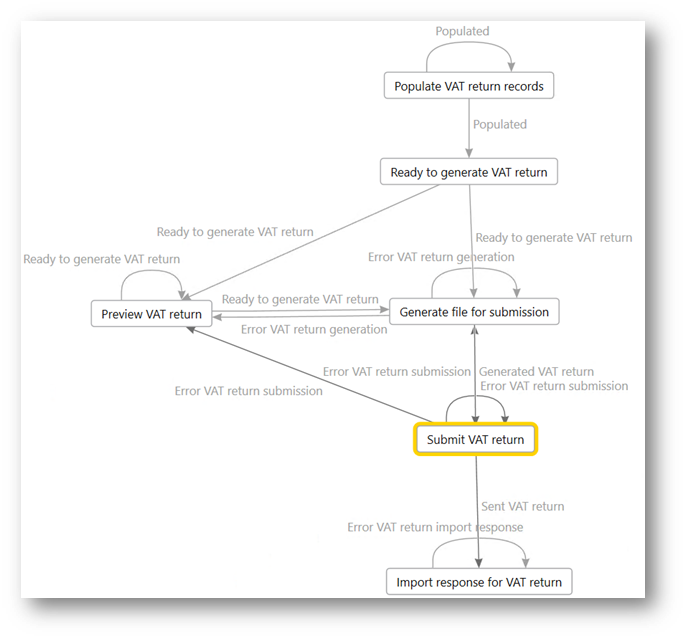

Submit A VAT Return To HMRC s MTD Web Service Finance Dynamics 365

https://www.gov.uk/sign-in-vat-account

Find out when your VAT returns are due send an Annual Accounting Scheme VAT return if your accounting period started before 1 November 2022 set up a Direct Debit to pay VAT

https://www.gov.uk/hmrc-internal-manuals/vat-accounting/vatac1300

The standard deadline for submitting a VAT return is provided by regulation 25 1 of the VAT Regulations 1995 and is the last day of the month following the end of the return

Find out when your VAT returns are due send an Annual Accounting Scheme VAT return if your accounting period started before 1 November 2022 set up a Direct Debit to pay VAT

The standard deadline for submitting a VAT return is provided by regulation 25 1 of the VAT Regulations 1995 and is the last day of the month following the end of the return

VAT Return Submission Change Quarterly Monthly VAT Returns Clear

FreeAgent VAT Online Submission 1Stop Accountants

Changes To HMRC Penalties For Late VAT Return Submission

Submit A VAT Return To HMRC s MTD Web Service Finance Dynamics 365

Freeagent Accountants PFC Accountants

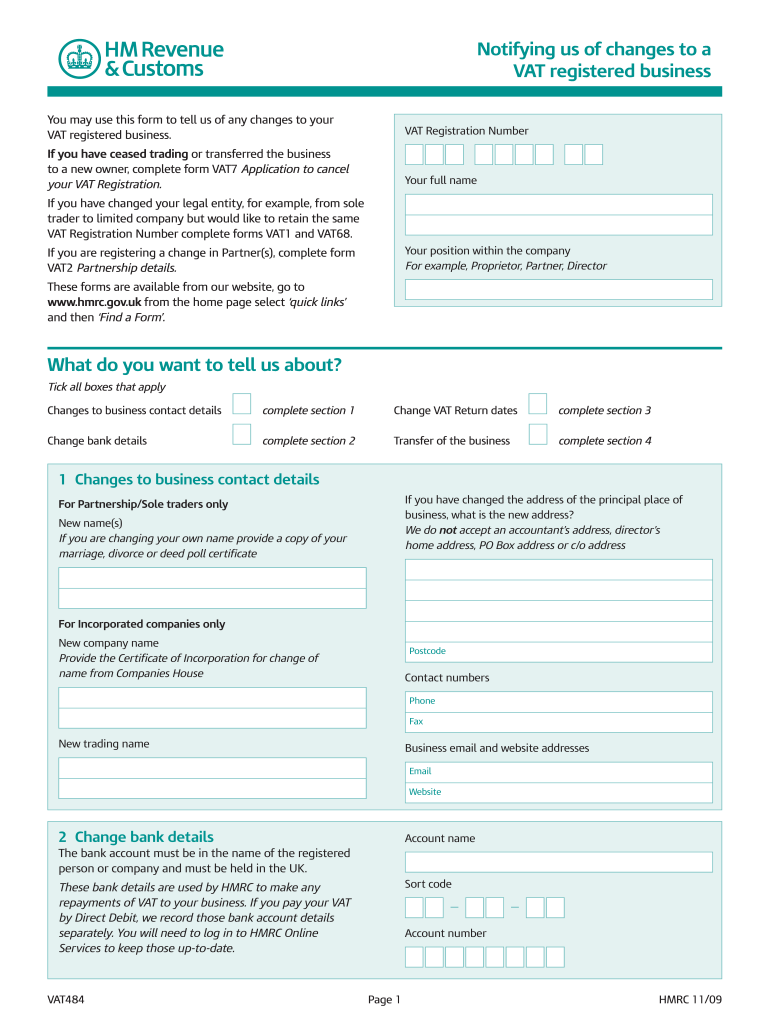

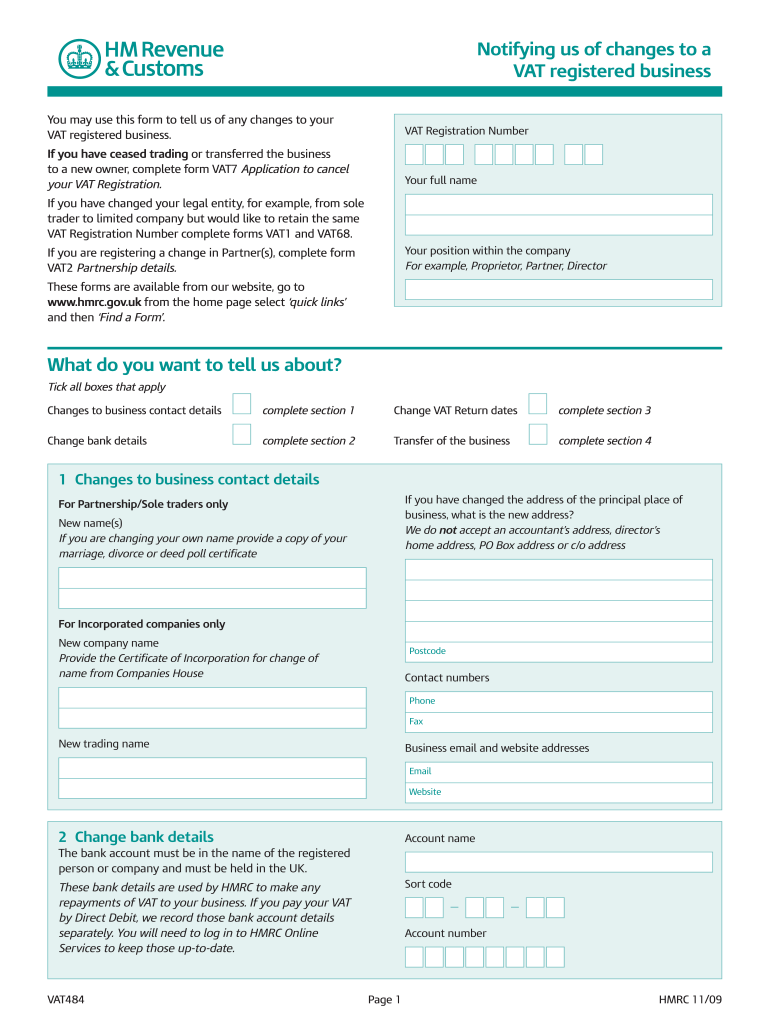

Vat484 Fill Out And Sign Printable PDF Template SignNow

Vat484 Fill Out And Sign Printable PDF Template SignNow

VAT Online Service Vat Service Hmrc Tax Accountant Tax Accountants VAT