In a world where screens rule our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons as well as creative projects or just adding an individual touch to your space, Home Improvement Energy Tax Credits are now a vital resource. This article will dive into the sphere of "Home Improvement Energy Tax Credits," exploring their purpose, where to find them and how they can enrich various aspects of your life.

Get Latest Home Improvement Energy Tax Credits Below

Home Improvement Energy Tax Credits

Home Improvement Energy Tax Credits -

Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual

Home Improvement Energy Tax Credits offer a wide array of printable resources available online for download at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages, and much more. The appeal of printables for free is in their versatility and accessibility.

More of Home Improvement Energy Tax Credits

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

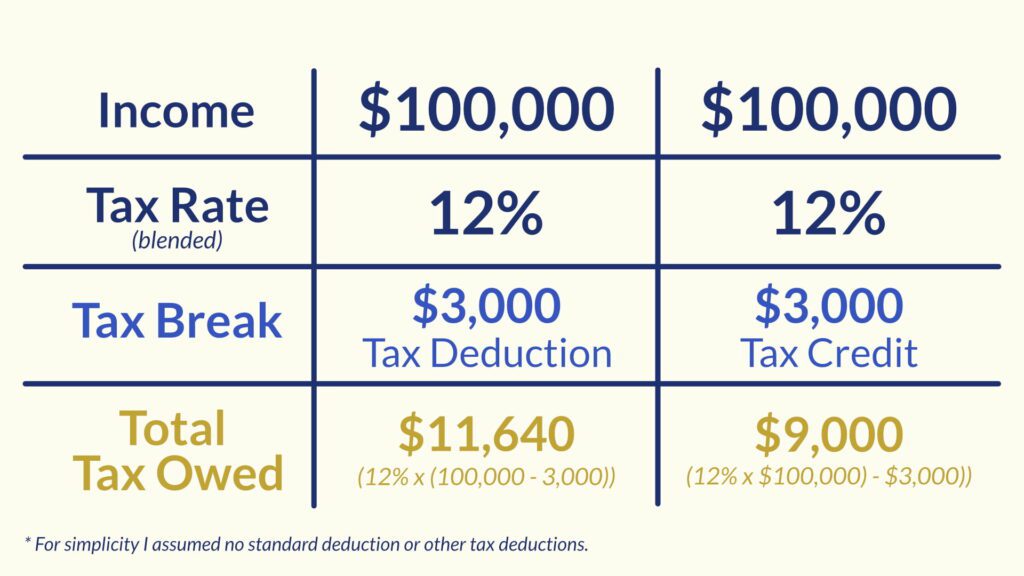

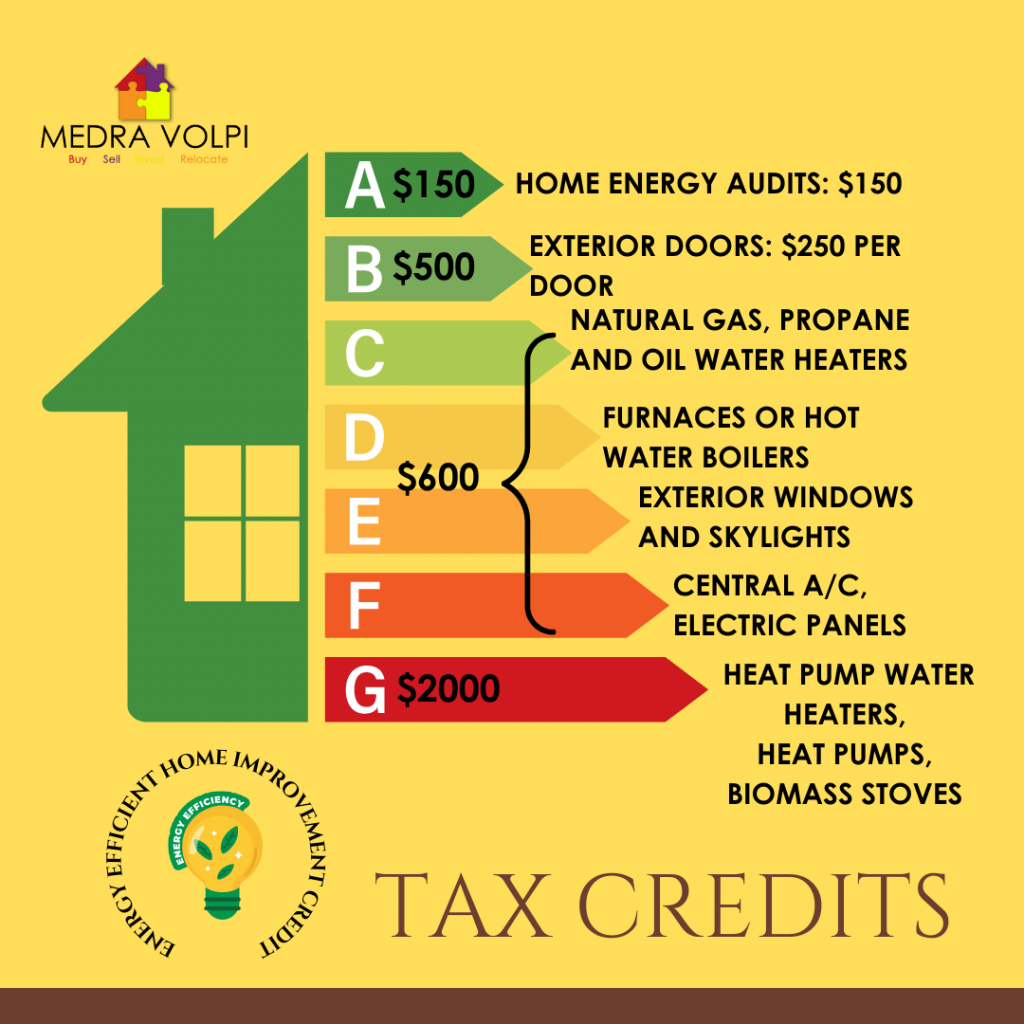

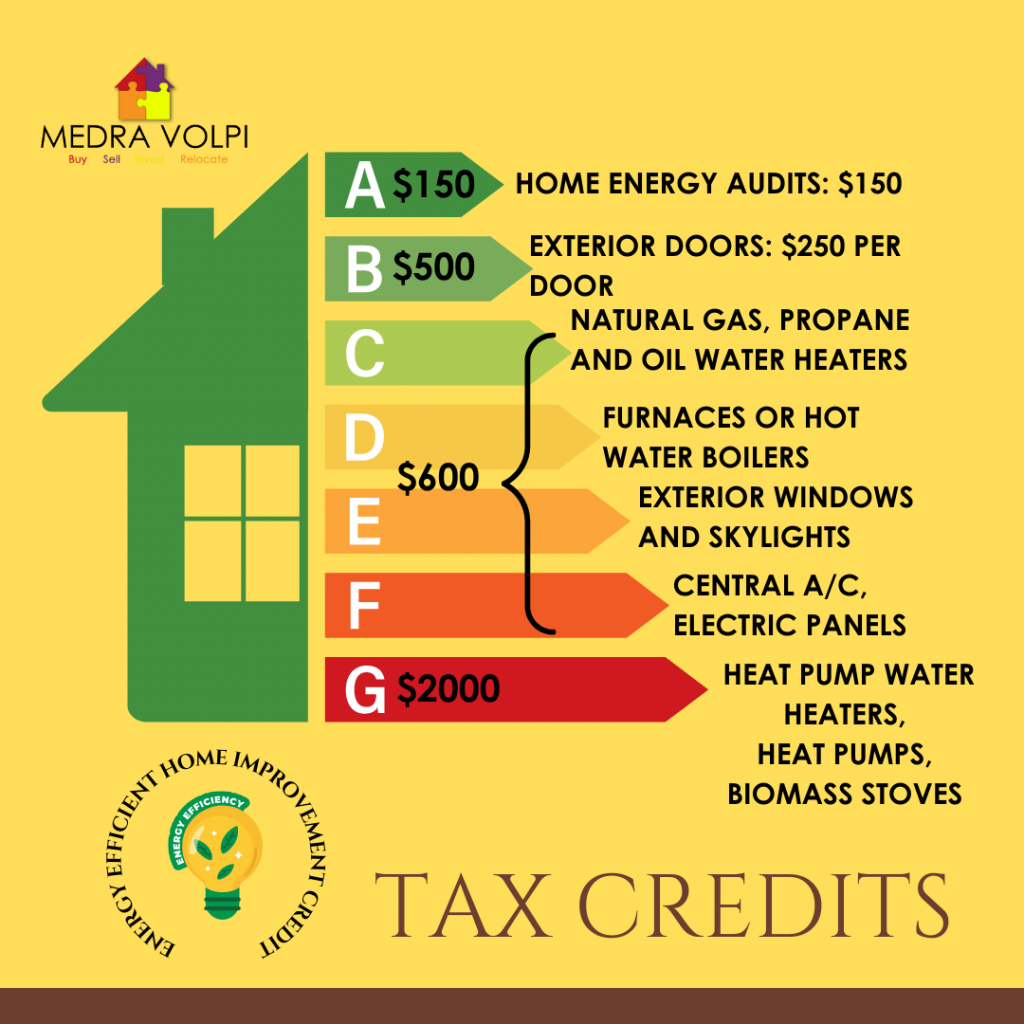

The maximum credit amount is 1 200 for home improvements and 2 000 for heat pumps and biomass stoves or boilers Previously the credit was capped at a

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30

Home Improvement Energy Tax Credits have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements in designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making them a valuable aid for parents as well as educators.

-

The convenience of You have instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Home Improvement Energy Tax Credits

Save With New Home Improvement Energy Tax Credits For 2023

Save With New Home Improvement Energy Tax Credits For 2023

Individuals can claim a nonrefundable credit for a tax year in an amount equal to 30 of the sum of 1 the amount paid or incurred by the taxpayer for qualified energy

How the Tax Credits Work for Homeowners Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000

We hope we've stimulated your curiosity about Home Improvement Energy Tax Credits We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Home Improvement Energy Tax Credits for a variety objectives.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Home Improvement Energy Tax Credits

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Home Improvement Energy Tax Credits are an abundance filled with creative and practical information which cater to a wide range of needs and hobbies. Their access and versatility makes them a great addition to both professional and personal lives. Explore the wide world of Home Improvement Energy Tax Credits today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these files for free.

-

Can I use free templates for commercial use?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with Home Improvement Energy Tax Credits?

- Certain printables could be restricted regarding their use. Always read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using an printer, or go to an area print shop for the highest quality prints.

-

What program do I need in order to open Home Improvement Energy Tax Credits?

- The majority are printed with PDF formats, which is open with no cost software like Adobe Reader.

Save With New Home Improvement Energy Tax Credits For 2023

Save With New Home Improvement Energy Tax Credits For 2023

Check more sample of Home Improvement Energy Tax Credits below

Rachel Lucas Joystiq

Home Improvement Energy Efficient Tax Credits 2023 RSC Heating Air

Energy Tax Credits For Home Improvements In 2023

Green Energy Tax Credits For Home Improvement Energy Efficiency

Home Energy Improvements Lead To Real Savings Infographic Solar

Maximizing Your Tax Savings Understanding Energy Tax Credits For Home

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual

https://turbotax.intuit.com/tax-tips/home...

Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual

Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the

Green Energy Tax Credits For Home Improvement Energy Efficiency

Home Improvement Energy Efficient Tax Credits 2023 RSC Heating Air

Home Energy Improvements Lead To Real Savings Infographic Solar

Maximizing Your Tax Savings Understanding Energy Tax Credits For Home

Tourshabana Green Energy Tax Credits For Home Improvement

Energy Efficient Home Improvement Credits In 2023 SVA

Energy Efficient Home Improvement Credits In 2023 SVA

Green Energy Tax Credits For Home Improvement Energy Efficiency