Today, with screens dominating our lives, the charm of tangible printed objects hasn't waned. Whatever the reason, whether for education such as creative projects or simply to add an element of personalization to your home, printables for free are now an essential source. This article will dive deeper into "Home Improvement Loan Eligible For Tax Benefit," exploring what they are, how to get them, as well as how they can improve various aspects of your daily life.

Get Latest Home Improvement Loan Eligible For Tax Benefit Below

Home Improvement Loan Eligible For Tax Benefit

Home Improvement Loan Eligible For Tax Benefit -

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs 30 000 per annum

Interest that is payable on loans taken for home improvement are tax deductible up to Rs 30 000 per annum There are some simple steps that are needed to apply for a home improvement loan and to get the tax benefits

Home Improvement Loan Eligible For Tax Benefit cover a large assortment of printable documents that can be downloaded online at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and much more. One of the advantages of Home Improvement Loan Eligible For Tax Benefit is in their variety and accessibility.

More of Home Improvement Loan Eligible For Tax Benefit

Loan Imgflip

Loan Imgflip

Generally a home improvement loan and the interest you pay are not tax deductible However energy efficiency updates to your home may qualify for tax credits that reduce your tax

Interest from home improvement loans can be tax deductible if the loan is secured by your home used for significant improvements and the amount falls below certain thresholds 375 000 for single filers 750 000 for joint filers

Home Improvement Loan Eligible For Tax Benefit have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: We can customize the design to meet your needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Downloads of educational content for free cater to learners from all ages, making the perfect instrument for parents and teachers.

-

Accessibility: Instant access to many designs and templates can save you time and energy.

Where to Find more Home Improvement Loan Eligible For Tax Benefit

Are Your Federal Student Loan Eligible For Forgiveness

Are Your Federal Student Loan Eligible For Forgiveness

If you ve made any home upgrades that improve the home s energy efficiency you may qualify for a federal tax credit For example you can claim solar panels new windows more efficient appliances solar water heaters and geothermal heat pumps on your yearly tax return

Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the lesser of 30 of the sum of amounts paid for qualifying home

Now that we've piqued your interest in printables for free, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Home Improvement Loan Eligible For Tax Benefit suitable for many goals.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Home Improvement Loan Eligible For Tax Benefit

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Home Improvement Loan Eligible For Tax Benefit are a treasure trove of useful and creative resources for a variety of needs and interest. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the world of Home Improvement Loan Eligible For Tax Benefit today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I make use of free templates for commercial use?

- It's based on the conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted on use. Be sure to read these terms and conditions as set out by the designer.

-

How can I print Home Improvement Loan Eligible For Tax Benefit?

- You can print them at home with printing equipment or visit a local print shop to purchase better quality prints.

-

What program do I need to run printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened with free software, such as Adobe Reader.

Home Loan Top Up Interest Rates Eligibility Tax Benefits Tata Capital

Kadambathur Plot Real Estate Development Builders And Developers

Check more sample of Home Improvement Loan Eligible For Tax Benefit below

Is Your Massage School Loan Eligible For Debt Forgiveness

How To Pay Loan Online UnderstandLoans

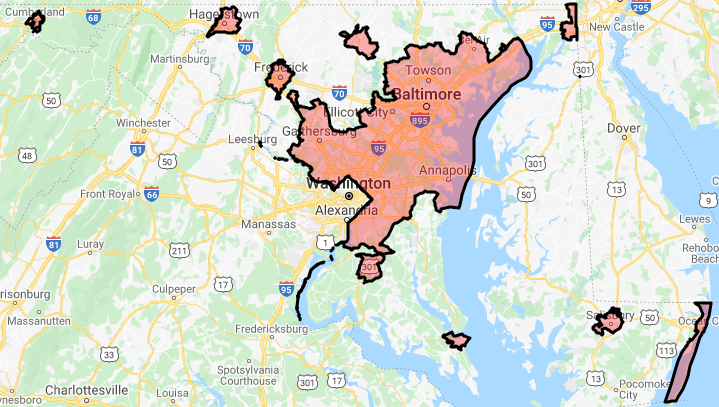

Maryland USDA Properties

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

EduIo 8 0 On Twitter Your Parents Had You For Tax Benefit

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.bankbazaar.com/tax/tax-deductions-on...

Interest that is payable on loans taken for home improvement are tax deductible up to Rs 30 000 per annum There are some simple steps that are needed to apply for a home improvement loan and to get the tax benefits

https://loantap.in/blog/what-are-the-tax-benefits...

What are the tax benefits of taking a home renovation loan The speciality of home renovation loans is that you can claim tax benefits on the interest paid Section 24 of the Income Tax Act 1961 provides that you can avail a deduction of up to Rs 30 000 per annum on home renovation loans

Interest that is payable on loans taken for home improvement are tax deductible up to Rs 30 000 per annum There are some simple steps that are needed to apply for a home improvement loan and to get the tax benefits

What are the tax benefits of taking a home renovation loan The speciality of home renovation loans is that you can claim tax benefits on the interest paid Section 24 of the Income Tax Act 1961 provides that you can avail a deduction of up to Rs 30 000 per annum on home renovation loans

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Pay Loan Online UnderstandLoans

EduIo 8 0 On Twitter Your Parents Had You For Tax Benefit

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

TV Tuesday Tax Benefit From Eligible Home Improvement YouTube

The 17 EVs Eligible For Tax Credits Newsmax

The 17 EVs Eligible For Tax Credits Newsmax

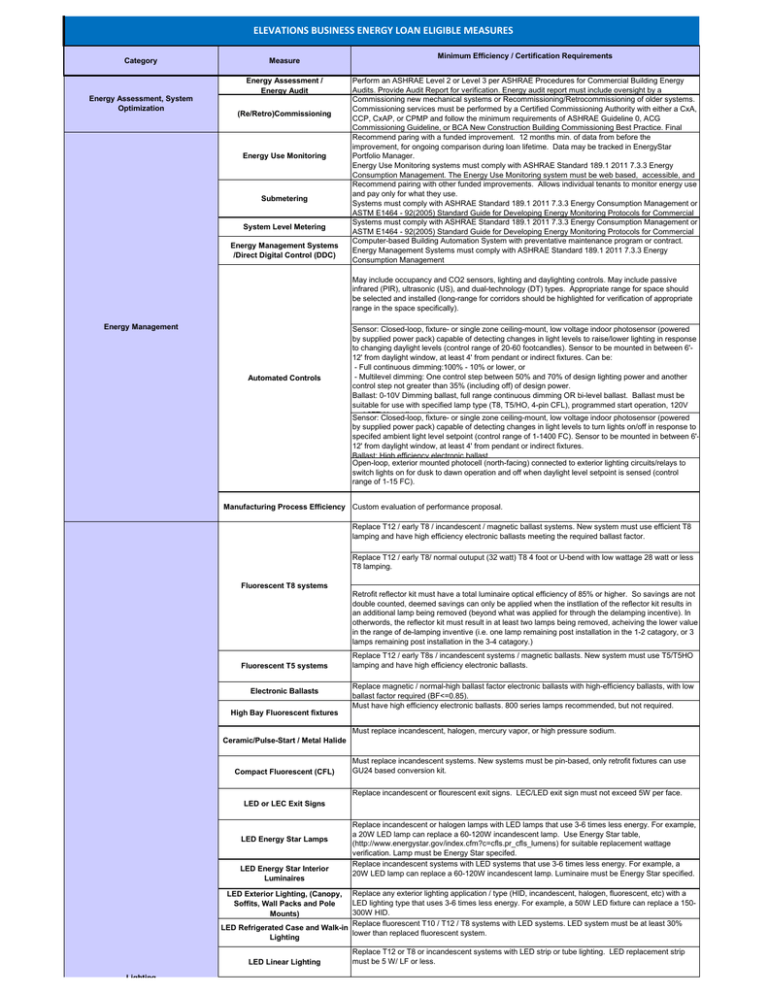

ELEVATIONS BUSINESS ENERGY LOAN ELIGIBLE MEASURES