In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed products hasn't decreased. In the case of educational materials as well as creative projects or simply to add a personal touch to your space, Home Improvement Tax Deduction are now a useful source. This article will dive into the world of "Home Improvement Tax Deduction," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your life.

Get Latest Home Improvement Tax Deduction Below

Home Improvement Tax Deduction

Home Improvement Tax Deduction -

Learn how the Inflation Reduction Act of 2022 changed the tax credit for energy efficient home improvements and residential clean energy property Find out

Learn how to save money on your taxes by deducting energy efficient upgrades cosmetic improvements or business related decorating Find out the caps limits and requirements for different types

Printables for free include a vast range of printable, free materials available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. The benefit of Home Improvement Tax Deduction lies in their versatility as well as accessibility.

More of Home Improvement Tax Deduction

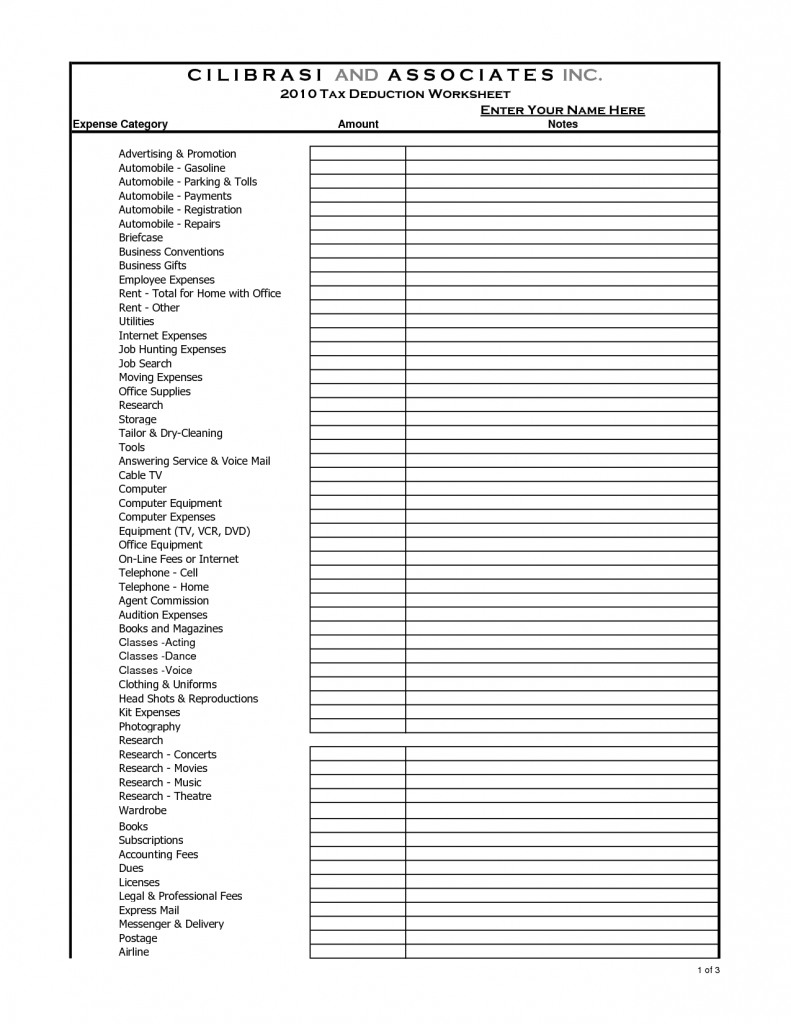

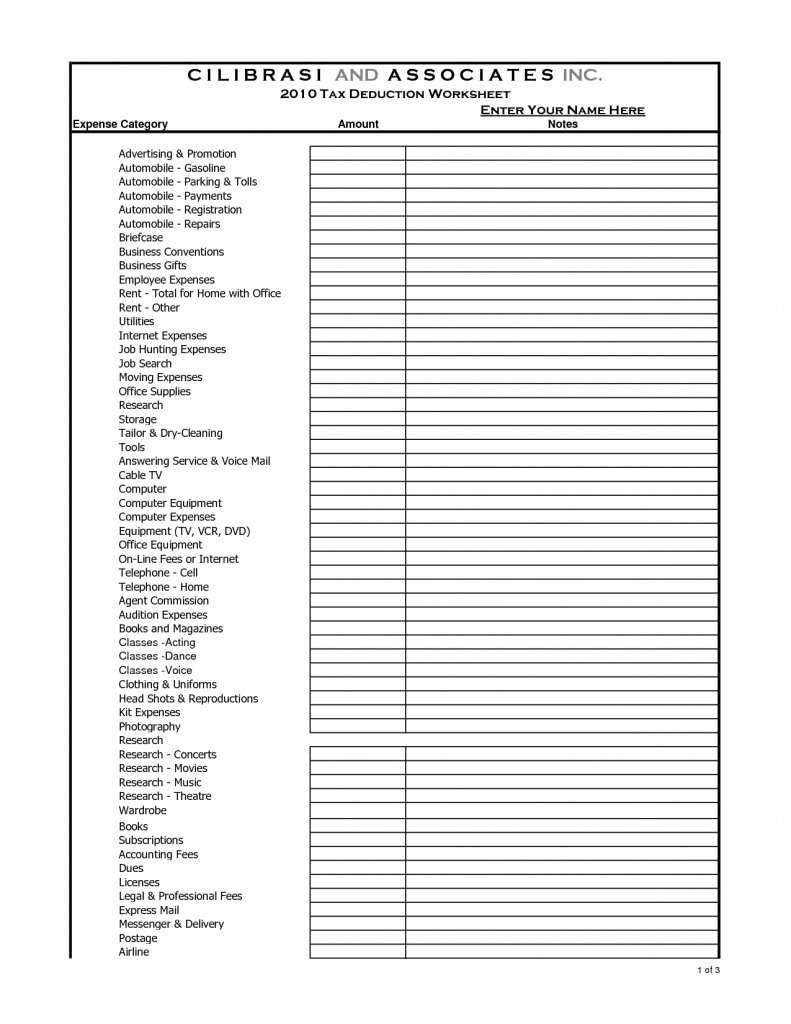

Itemized Deduction Worksheet Template Free

Itemized Deduction Worksheet Template Free

Learn about the tax benefits and credits for home improvement energy efficiency mortgage interest and more Find out what s new and what s expired for 2023 tax returns

Are Home Improvements Tax Deductible You typically can t deduct home improvements but a few updates come with tax benefits such as credits for energy efficient improvements Here s how

Home Improvement Tax Deduction have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: We can customize print-ready templates to your specific requirements whether you're designing invitations and schedules, or even decorating your house.

-

Educational Impact: Downloads of educational content for free are designed to appeal to students of all ages. This makes them an essential tool for teachers and parents.

-

The convenience of Access to a plethora of designs and templates will save you time and effort.

Where to Find more Home Improvement Tax Deduction

7 Home Improvement Tax Deductions INFOGRAPHIC

7 Home Improvement Tax Deductions INFOGRAPHIC

You can claim the home improvement credit by attaching Form 5695 to your tax return What is the energy efficient home improvement credit The energy efficient home improvement credit can

Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the

We hope we've stimulated your interest in printables for free we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Home Improvement Tax Deduction designed for a variety applications.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide selection of subjects, that range from DIY projects to party planning.

Maximizing Home Improvement Tax Deduction

Here are some ways of making the most of Home Improvement Tax Deduction:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Home Improvement Tax Deduction are a treasure trove of useful and creative resources for a variety of needs and preferences. Their access and versatility makes them a great addition to each day life. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Improvement Tax Deduction truly gratis?

- Yes you can! You can download and print these tools for free.

-

Can I download free printing templates for commercial purposes?

- It's determined by the specific terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Home Improvement Tax Deduction?

- Some printables may contain restrictions in their usage. Be sure to review the terms of service and conditions provided by the designer.

-

How can I print Home Improvement Tax Deduction?

- You can print them at home using the printer, or go to the local print shop for higher quality prints.

-

What program will I need to access printables that are free?

- The majority of printed documents are in PDF format. These can be opened using free software, such as Adobe Reader.

Home Improvement Tax Deduction Credits TGUC Financial

7 Home Improvement Tax Deductions For Your House YouTube

Check more sample of Home Improvement Tax Deduction below

Are You Aware Of Home Improvement Tax Deduction

Make Sure To Take These Home Improvement Tax Deductions For 2016

Best Home Improvement Tax Deductions To Put Money Back Into Your Pocket

Home Improvement Tax Deduction Credits TGUC Financial

Can Airbnb Hosts Claim A Home Improvement Tax Deduction

Are Home Improvements Tax Deductible AppliancePartsPros Blog

https://www.realsimple.com/are-home …

Learn how to save money on your taxes by deducting energy efficient upgrades cosmetic improvements or business related decorating Find out the caps limits and requirements for different types

https://www.irs.gov/credits-deductions/energy...

Learn how to claim a tax credit for qualified energy efficient improvements to your home after Jan 1 2023 Find out the credit amounts limits requirements and eligible

Learn how to save money on your taxes by deducting energy efficient upgrades cosmetic improvements or business related decorating Find out the caps limits and requirements for different types

Learn how to claim a tax credit for qualified energy efficient improvements to your home after Jan 1 2023 Find out the credit amounts limits requirements and eligible

Home Improvement Tax Deduction Credits TGUC Financial

Make Sure To Take These Home Improvement Tax Deductions For 2016

Can Airbnb Hosts Claim A Home Improvement Tax Deduction

Are Home Improvements Tax Deductible AppliancePartsPros Blog

Reporting Your Home Improvement Tax Deduction A Guide House Improvement

10 Tax Deductions For Home Improvements HowStuffWorks

10 Tax Deductions For Home Improvements HowStuffWorks

Home Improvement Ideas For The Spring Season Home Improvement Tax