In this age of electronic devices, where screens dominate our lives, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education project ideas, artistic or simply adding personal touches to your area, Home Improvement Tax Deductions 2022 are now an essential source. We'll take a dive into the sphere of "Home Improvement Tax Deductions 2022," exploring the different types of printables, where they are available, and how they can be used to enhance different aspects of your lives.

Get Latest Home Improvement Tax Deductions 2022 Below

Home Improvement Tax Deductions 2022

Home Improvement Tax Deductions 2022 -

In general home improvements aren t tax deductible but there are three main exceptions capital improvements energy efficient improvements and improvements related to medical care Capital Improvements and Taxes A capital improvement is something that adds value to a home extends its useful life or adapts it for a new use

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost basis of your home You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425

Home Improvement Tax Deductions 2022 include a broad assortment of printable materials online, at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Home Improvement Tax Deductions 2022

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Updated 02 03 2023 Fact Checked It s that time of year again tax time If you own a home and you ve renovated it recently you might wonder if any of the changes you made are tax

Home Improvement Tax Deductions 2022 have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Worth: Printing educational materials for no cost provide for students of all ages, which makes them a vital instrument for parents and teachers.

-

Easy to use: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more Home Improvement Tax Deductions 2022

Best Home Improvement Tax Deductions To Put Money Back Into Your Pocket

Best Home Improvement Tax Deductions To Put Money Back Into Your Pocket

Table of Contents Can I Get a Tax Deduction for Home Improvements Home improvements in general are not typically deductible on your federal income taxes in the United States However there are certain situations where you may be eligible for tax credits or deductions related to home improvements

What are tax deductions and do I qualify for them Photo istockphoto Although some tax deductions and credits already were in place for home improvement and energy savings the

Now that we've ignited your curiosity about Home Improvement Tax Deductions 2022 Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Home Improvement Tax Deductions 2022 for a variety motives.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to party planning.

Maximizing Home Improvement Tax Deductions 2022

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Home Improvement Tax Deductions 2022 are a treasure trove filled with creative and practical information for a variety of needs and hobbies. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the endless world of Home Improvement Tax Deductions 2022 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Improvement Tax Deductions 2022 truly cost-free?

- Yes they are! You can download and print these items for free.

-

Can I make use of free printing templates for commercial purposes?

- It's all dependent on the terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions in use. Make sure to read the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home using an printer, or go to the local print shop for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printed documents are in PDF format. They is open with no cost software like Adobe Reader.

Itemized Deductions 2022

2018 Home Improvement Deductions Know Before Filing Your Taxes

Check more sample of Home Improvement Tax Deductions 2022 below

Are Home Improvements Tax Deductible AppliancePartsPros Blog

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

Top 3 Home Improvement Tax Deductions SolvIt Home Services

Can Airbnb Hosts Claim A Home Improvement Tax Deduction

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

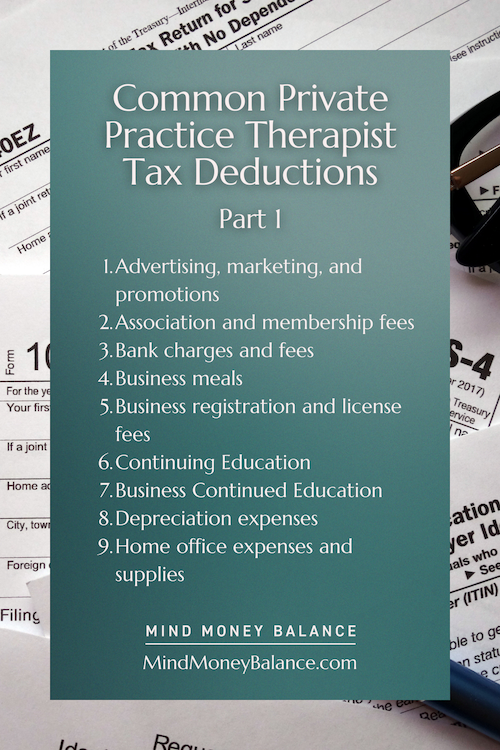

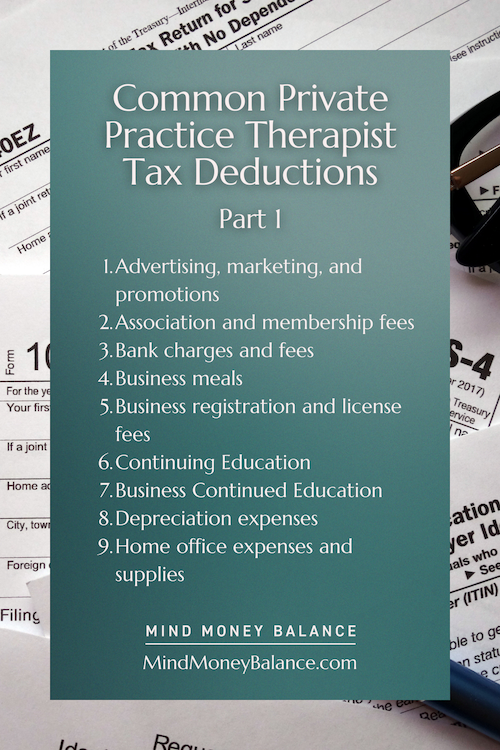

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

.png)

https://www.irs.gov/publications/p530

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost basis of your home You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost basis of your home You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Can Airbnb Hosts Claim A Home Improvement Tax Deduction

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

.png)

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Texas Home Improvement Deductions Tax Credits Texas Capital Forum

What Home Improvements Are Tax Deductible Budget Dumpster In 2021

What Home Improvements Are Tax Deductible Budget Dumpster In 2021

5 Tax Deductions When Selling A Home Did You Take Them All