In a world where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials and creative work, or simply adding the personal touch to your area, Home Improvements Income Tax Deductions have become a valuable source. For this piece, we'll dive through the vast world of "Home Improvements Income Tax Deductions," exploring their purpose, where they are available, and how they can be used to enhance different aspects of your life.

Get Latest Home Improvements Income Tax Deductions Below

Home Improvements Income Tax Deductions

Home Improvements Income Tax Deductions -

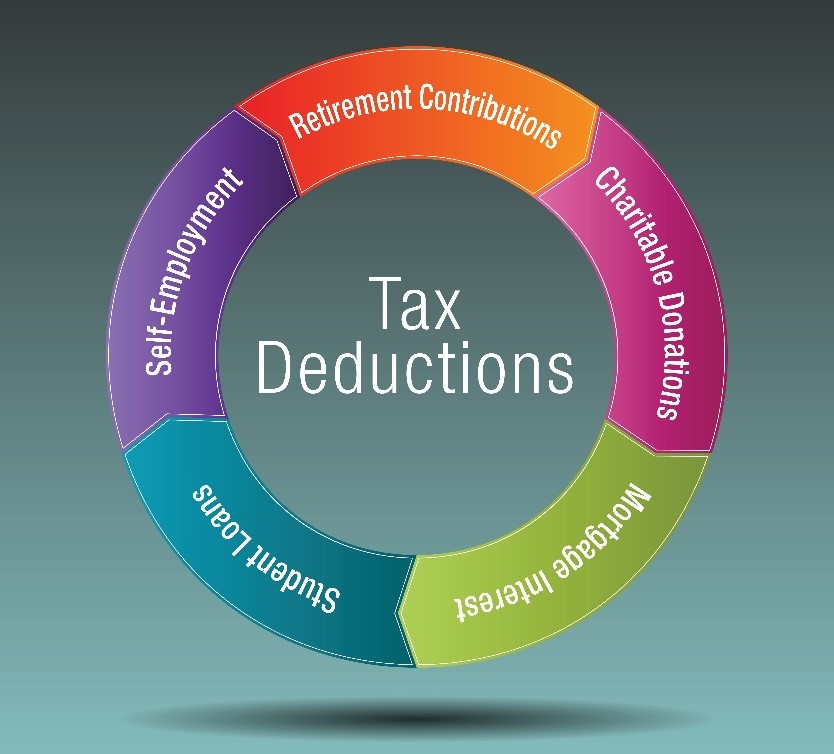

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

The IRS defines a capital improvement as an improvement that Adds to the value of your home Prolongs the useful life of your home Adapts your home to new uses A capital improvement is tax

Home Improvements Income Tax Deductions encompass a wide array of printable materials online, at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages and many more. One of the advantages of Home Improvements Income Tax Deductions is in their variety and accessibility.

More of Home Improvements Income Tax Deductions

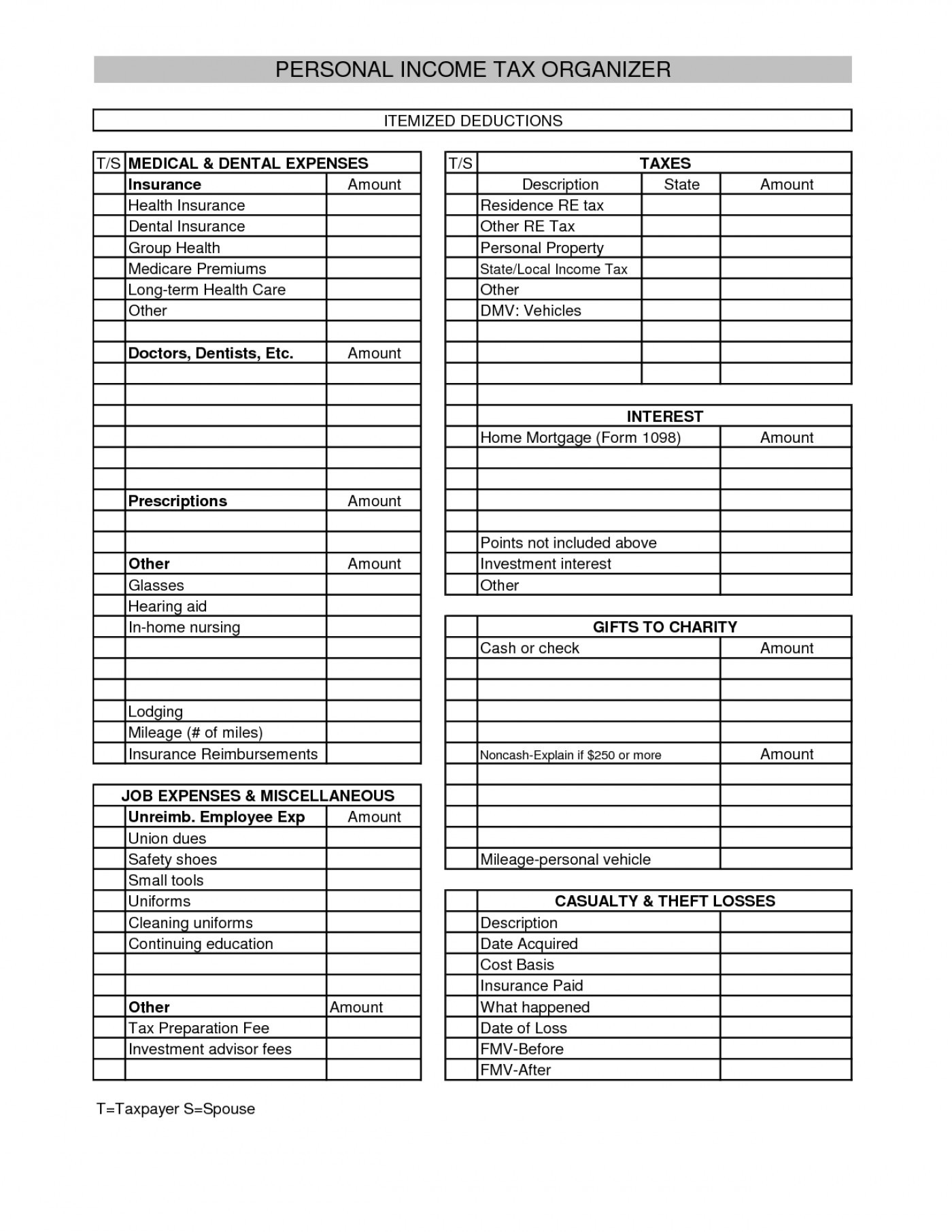

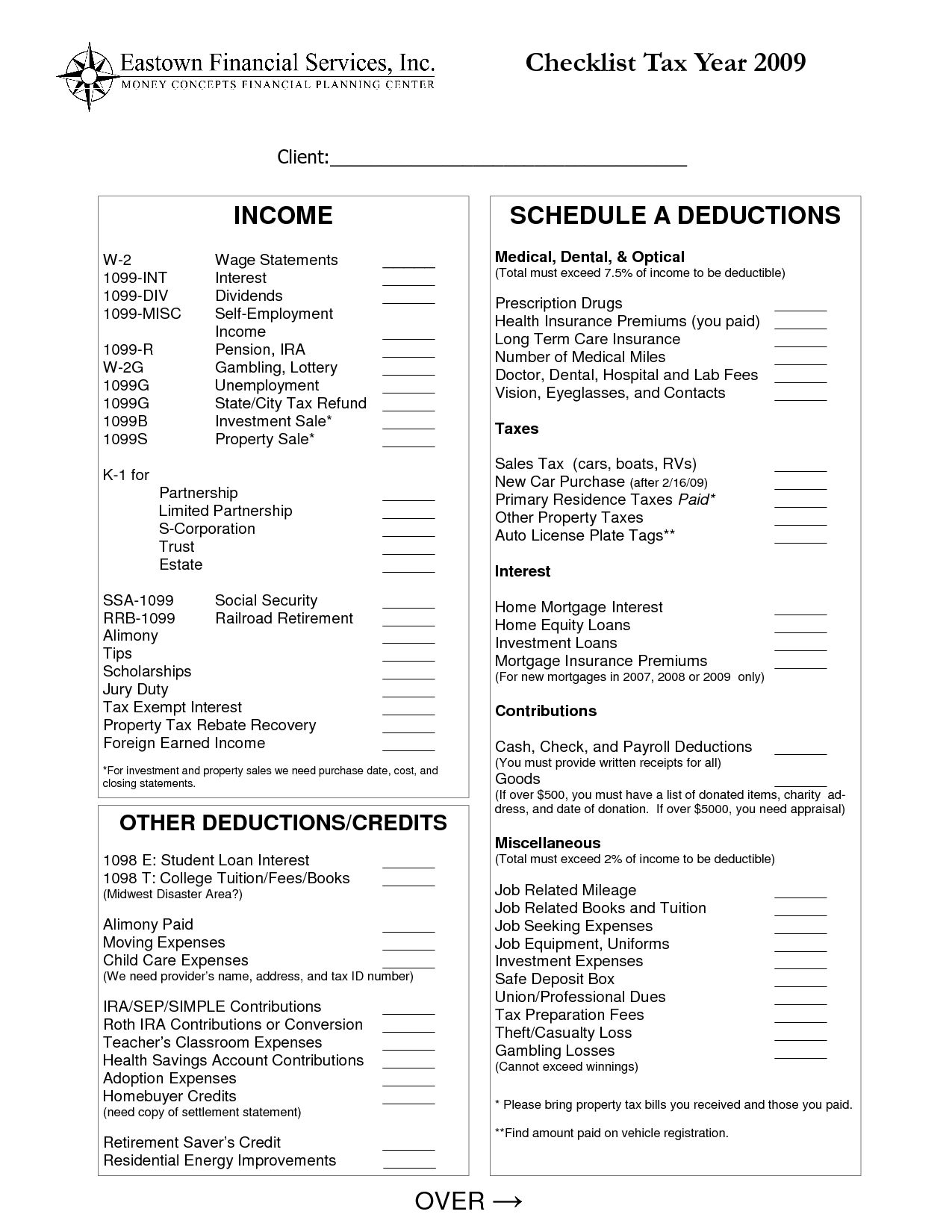

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a tax professional before digging

Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize the design to meet your needs such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a valuable resource for educators and parents.

-

Affordability: immediate access a variety of designs and templates saves time and effort.

Where to Find more Home Improvements Income Tax Deductions

7 Home Improvement Tax Deductions INFOGRAPHIC

7 Home Improvement Tax Deductions INFOGRAPHIC

What Home Improvements Are Tax Deductible in 2024 Homeowners can potentially qualify for an Energy Efficiency Home Improvement Credit of up to 3 200 for energy efficient improvements made

Home improvements add value style and safety to your home but most home improvements do not qualify for tax deductions There are a few exceptions such as energy efficiency

Now that we've ignited your interest in printables for free Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Home Improvements Income Tax Deductions for different objectives.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast selection of subjects, that range from DIY projects to planning a party.

Maximizing Home Improvements Income Tax Deductions

Here are some ways ensure you get the very most use of Home Improvements Income Tax Deductions:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Improvements Income Tax Deductions are a treasure trove of useful and creative resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the plethora of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can download and print the resources for free.

-

Can I use the free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using Home Improvements Income Tax Deductions?

- Certain printables could be restricted regarding usage. Make sure you read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using your printer or visit a print shop in your area for more high-quality prints.

-

What software do I need to open printables at no cost?

- The majority of printables are in the format PDF. This is open with no cost software such as Adobe Reader.

3 Tax Deductions For Home Improvements

Home Improvement Tax Deductions Bob Vila Radio Bob Vila

Check more sample of Home Improvements Income Tax Deductions below

Deductible Tax Home Improvements

Deductible Tax Home Improvements

Want An Even Bigger Refund Go For Tax Credits Over Deductions

School Toilet Bag Moos Negro Padded Black 23 X 12 8 Cm

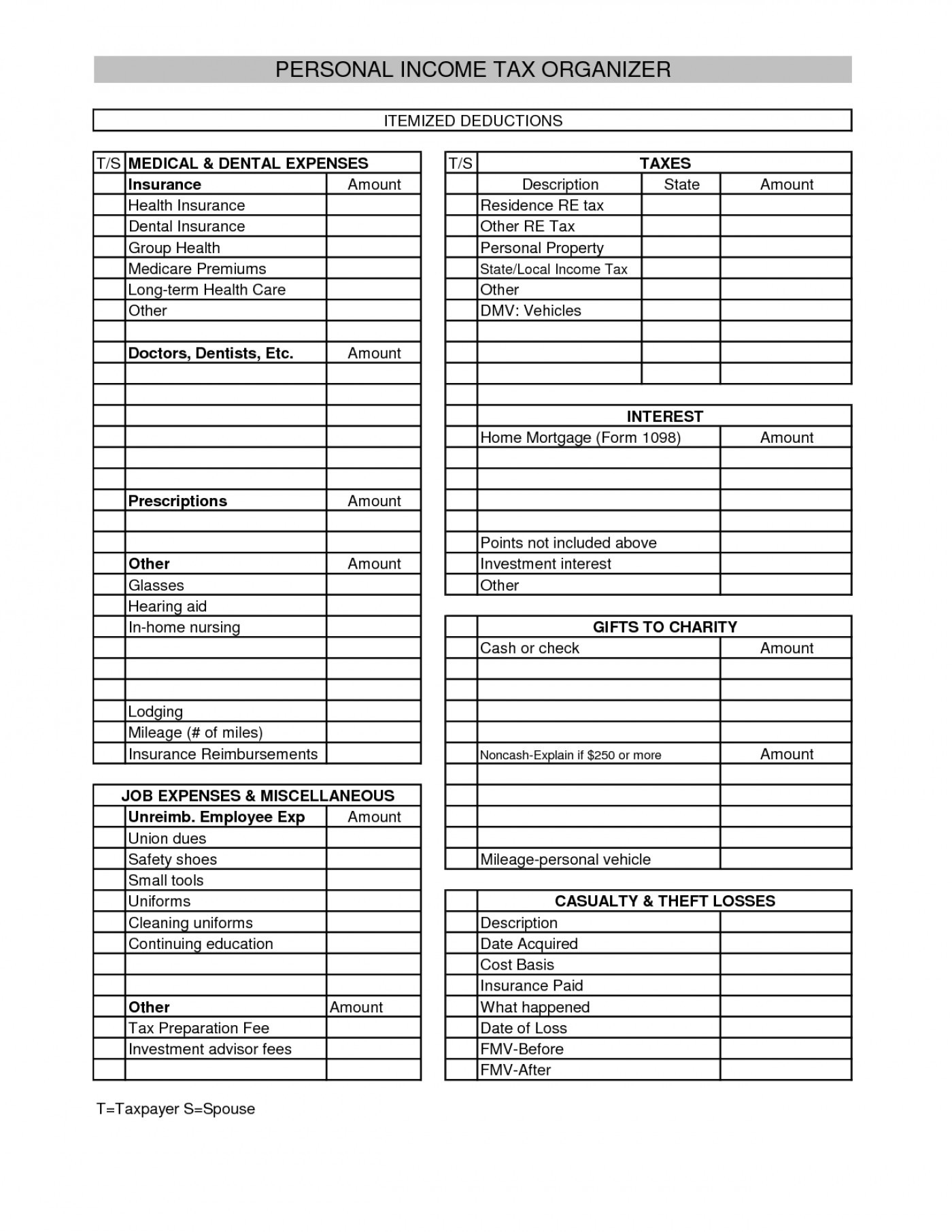

Printable Itemized Deductions Worksheet

Small Business Tax Deductions Deductible Expenses

https://www.consumeraffairs.com › finance › what-home...

The IRS defines a capital improvement as an improvement that Adds to the value of your home Prolongs the useful life of your home Adapts your home to new uses A capital improvement is tax

https://www.irs.gov › publications

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040

The IRS defines a capital improvement as an improvement that Adds to the value of your home Prolongs the useful life of your home Adapts your home to new uses A capital improvement is tax

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040

School Toilet Bag Moos Negro Padded Black 23 X 12 8 Cm

Deductible Tax Home Improvements

Printable Itemized Deductions Worksheet

Small Business Tax Deductions Deductible Expenses

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Income Tax 80c Deduction Fy 2021 22 TAX

Income Tax 80c Deduction Fy 2021 22 TAX

Printable Itemized Deductions Worksheet