In the age of digital, where screens dominate our lives but the value of tangible printed materials isn't diminishing. For educational purposes or creative projects, or just adding an individual touch to the space, Home Loan Income Tax Benefit Rules have proven to be a valuable source. Here, we'll take a dive in the world of "Home Loan Income Tax Benefit Rules," exploring their purpose, where they are, and ways they can help you improve many aspects of your life.

Get Latest Home Loan Income Tax Benefit Rules Below

Home Loan Income Tax Benefit Rules

Home Loan Income Tax Benefit Rules -

How tax deductions help homeowners Should you claim the mortgage interest deduction Should the deduction affect your home buying decision Politics behind mortgage tax deductions Who

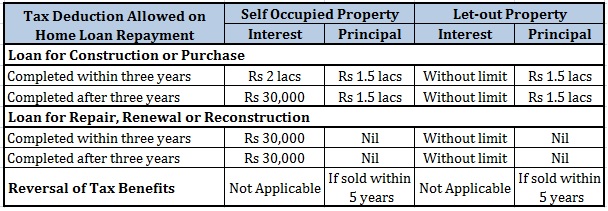

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Home Loan Income Tax Benefit Rules cover a large array of printable documents that can be downloaded online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. The great thing about Home Loan Income Tax Benefit Rules lies in their versatility and accessibility.

More of Home Loan Income Tax Benefit Rules

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

If you are applying for a home loan to purchase a new home you must know the ways to avail tax benefits on the second home loan Under Section 80C of the Income Tax

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced in

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization It is possible to tailor printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making them an essential tool for parents and educators.

-

Accessibility: immediate access numerous designs and templates saves time and effort.

Where to Find more Home Loan Income Tax Benefit Rules

Home Loan Jargon Explained Wisebuy Home Loans

Home Loan Jargon Explained Wisebuy Home Loans

Sections 121 to 148 of the Income Tax Earnings Pensions Act 2003 ITEPA provide for calculating the cash equivalent of the benefit of a company car which is made

This publication discusses the rules for deducting home mortgage interest Part I contains general information on home mortgage interest including points It also explains how to report deductible interest on your tax return Part II explains

We've now piqued your interest in printables for free Let's see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of objectives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide selection of subjects, starting from DIY projects to party planning.

Maximizing Home Loan Income Tax Benefit Rules

Here are some inventive ways in order to maximize the use of Home Loan Income Tax Benefit Rules:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Home Loan Income Tax Benefit Rules are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and pursuits. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the plethora of Home Loan Income Tax Benefit Rules and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can print and download these items for free.

-

Can I use the free templates for commercial use?

- It's determined by the specific usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions in their usage. Be sure to read these terms and conditions as set out by the creator.

-

How do I print printables for free?

- You can print them at home using an printer, or go to a local print shop for premium prints.

-

What software do I need to run Home Loan Income Tax Benefit Rules?

- Most PDF-based printables are available in PDF format. They can be opened with free software like Adobe Reader.

Benefits Of Housing Loan Income Tax CA Inter CA Umesh Bhat YouTube

Home Loan Income Tax Benefit

Check more sample of Home Loan Income Tax Benefit Rules below

Ask Development Pay Slip 2022 Download

Your Money Tips To Boost Your Home Loan Eligibility Studywudy

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

Tax Benefit On Home Loan And HRA Both

Income Tax Benefits On Housing Loan In India

How Much Tax Can You Save With Your Home Loan Income Tax Season FY19

https://www.nerdwallet.com › article › t…

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

https://www.forbes.com › advisor › mort…

Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit

Tax Benefit On Home Loan And HRA Both

Your Money Tips To Boost Your Home Loan Eligibility Studywudy

Income Tax Benefits On Housing Loan In India

How Much Tax Can You Save With Your Home Loan Income Tax Season FY19

20151209 Tax Benefits On A Home Loan Personal Finance Plan

TAX BENEFITS WHILE AVAILING HOME LOANS PO Tools

TAX BENEFITS WHILE AVAILING HOME LOANS PO Tools

House Loan Repayment Calculator 2022 Calculate Your Home Loan Repayment