In this digital age, with screens dominating our lives The appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons or creative projects, or simply to add an individual touch to the home, printables for free have become an invaluable source. The following article is a take a dive deeper into "Home Loan Interest Amount For Tax Exemption," exploring what they are, how they are available, and what they can do to improve different aspects of your lives.

Get Latest Home Loan Interest Amount For Tax Exemption Below

Home Loan Interest Amount For Tax Exemption

Home Loan Interest Amount For Tax Exemption -

Verkko 11 tammik 2023 nbsp 0183 32 Section 80C Deduction Available for Property construction property purchase Can be claimed for Self occupied rented deemed to be rented properties

Verkko 13 jouluk 2022 nbsp 0183 32 You are entitled to deductions for the interest on a loan taken for major repairs This deduction is similar to deductions on usual home loan interest expenses In 2022 you can deduct 5 of the interest Starting 2023 tax rules no longer allow deductions for paid interest expenses of home loans

Printables for free cover a broad assortment of printable material that is available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages and more. The value of Home Loan Interest Amount For Tax Exemption is their flexibility and accessibility.

More of Home Loan Interest Amount For Tax Exemption

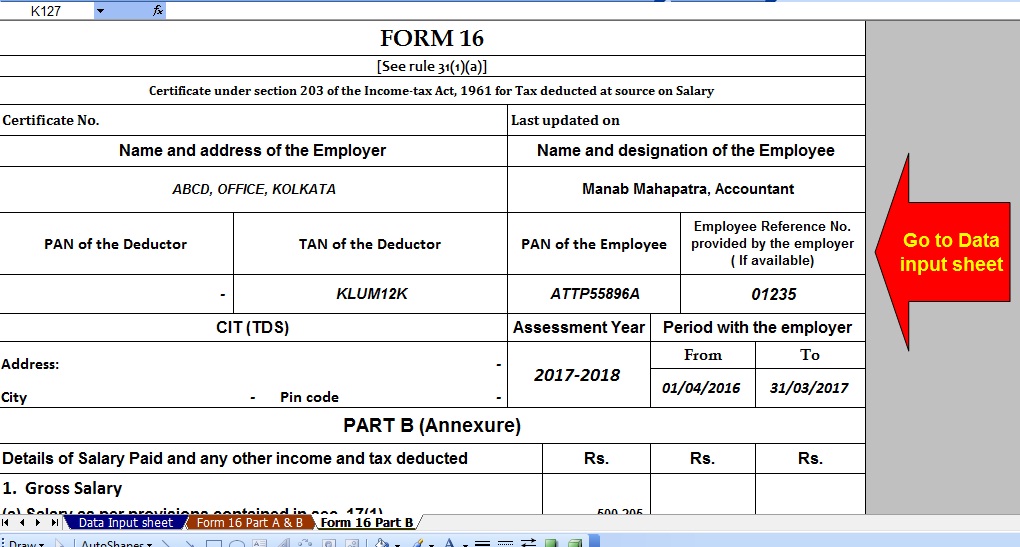

How To Calculate Interest On Housing Loan For Income Tax Haiper

How To Calculate Interest On Housing Loan For Income Tax Haiper

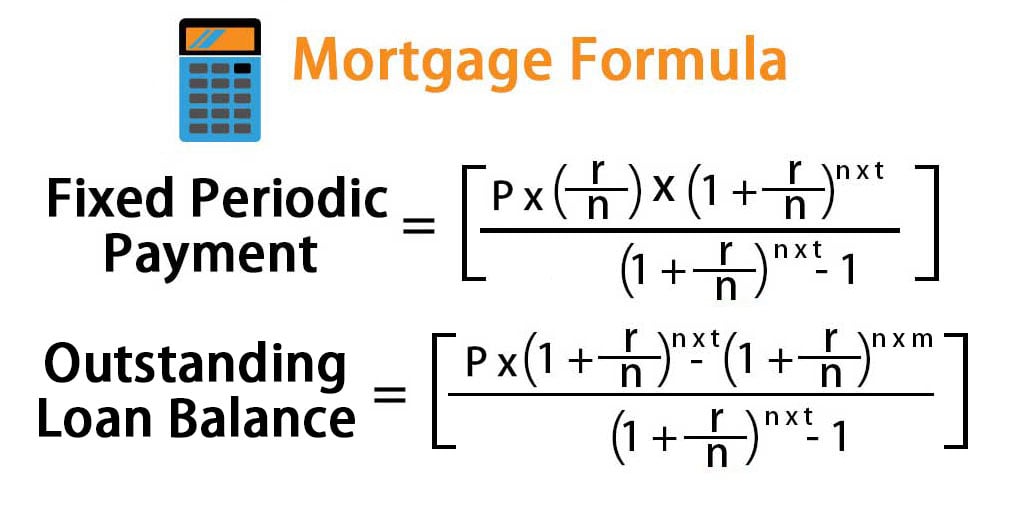

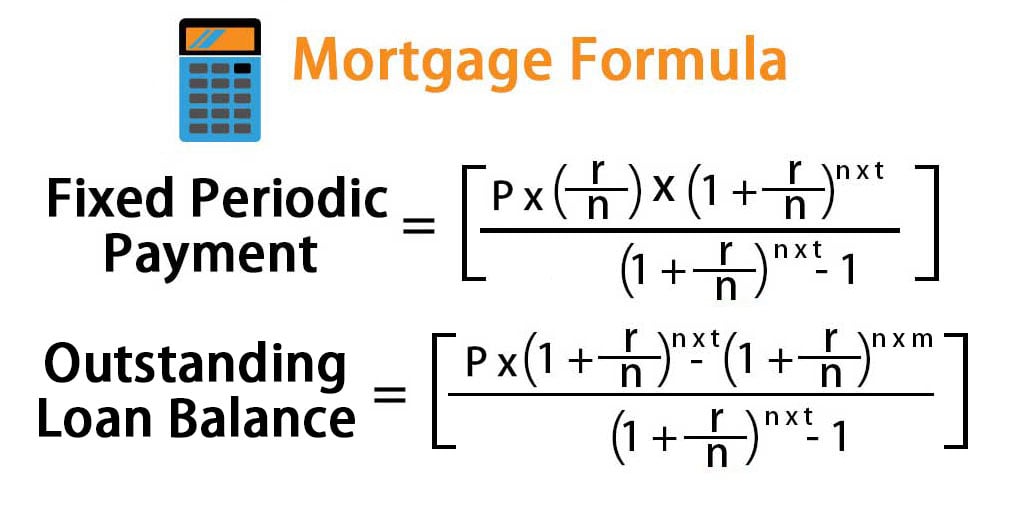

Verkko 31 toukok 2022 nbsp 0183 32 2 Section 24 b Tax Deduction On Interest Paid You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when the

Verkko 22 syysk 2023 nbsp 0183 32 In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: You can tailor print-ready templates to your specific requirements whether it's making invitations and schedules, or decorating your home.

-

Educational Benefits: These Home Loan Interest Amount For Tax Exemption can be used by students of all ages, which makes the perfect instrument for parents and teachers.

-

Accessibility: The instant accessibility to an array of designs and templates can save you time and energy.

Where to Find more Home Loan Interest Amount For Tax Exemption

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Exemption In Income Tax Home Sweet Home

Verkko 30 hein 228 k 2022 nbsp 0183 32 The interest portion of the EMI paid for a FY can be claimed as a deduction from taxpayers total income up to a maximum of INR 2 lakh under section 24 b of Act Further the principal portion

Verkko 20 lokak 2023 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b To boost affordable housing segment

If we've already piqued your curiosity about Home Loan Interest Amount For Tax Exemption Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Home Loan Interest Amount For Tax Exemption suitable for many uses.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Home Loan Interest Amount For Tax Exemption

Here are some ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to reinforce learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Loan Interest Amount For Tax Exemption are an abundance of practical and innovative resources that satisfy a wide range of requirements and interest. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the endless world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printables for commercial uses?

- It's all dependent on the terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Home Loan Interest Amount For Tax Exemption?

- Certain printables might have limitations on usage. Always read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using either a printer or go to a local print shop to purchase top quality prints.

-

What program is required to open Home Loan Interest Amount For Tax Exemption?

- The majority of printables are as PDF files, which is open with no cost software such as Adobe Reader.

Uncle Sam Has Increased The Amount You Can Pass On To Your Heirs

Update 2019 Federal Estate Tax Exemption Odgers Law Group

Check more sample of Home Loan Interest Amount For Tax Exemption below

SBI Advises Tax Exemption Limit To 1 Lakh U S 80TTB For Senior Citizens

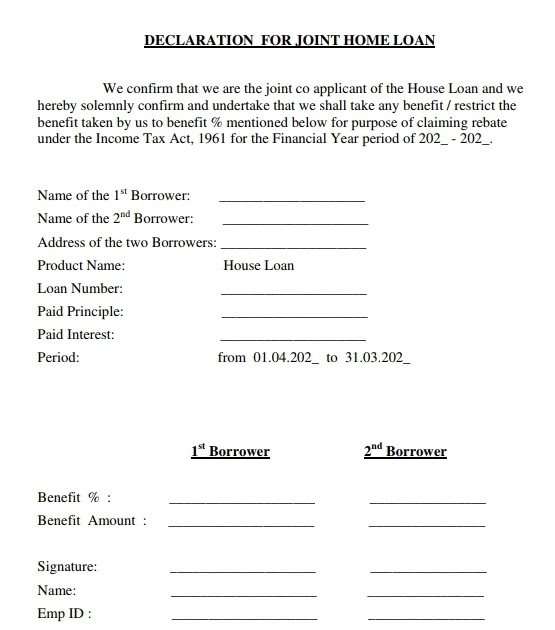

Trending News Joint Home Loan With Wife Has Many Advantages Low

Home Loan Interest Home Loan Interest Exemption Section

Payroll What Is The Meaning Of Maximum Amount For Tax Exempted Rule

26 Requirements For Mortgage HiyaSarena

Discover The Latest Federal Estate Tax Exemption Increase For 2023

https://www.vero.fi/.../deductions/tax_credit_on_interest_payments

Verkko 13 jouluk 2022 nbsp 0183 32 You are entitled to deductions for the interest on a loan taken for major repairs This deduction is similar to deductions on usual home loan interest expenses In 2022 you can deduct 5 of the interest Starting 2023 tax rules no longer allow deductions for paid interest expenses of home loans

https://cleartax.in/s/home-loan-tax-benefits

Verkko 15 kes 228 k 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Verkko 13 jouluk 2022 nbsp 0183 32 You are entitled to deductions for the interest on a loan taken for major repairs This deduction is similar to deductions on usual home loan interest expenses In 2022 you can deduct 5 of the interest Starting 2023 tax rules no longer allow deductions for paid interest expenses of home loans

Verkko 15 kes 228 k 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Payroll What Is The Meaning Of Maximum Amount For Tax Exempted Rule

Trending News Joint Home Loan With Wife Has Many Advantages Low

26 Requirements For Mortgage HiyaSarena

Discover The Latest Federal Estate Tax Exemption Increase For 2023

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Tax Exemption Applications Withdrawn US Legal Forms

Tax Exemption Applications Withdrawn US Legal Forms

Request Letter For Tax Exemption And Certificate SemiOffice Com