In the age of digital, with screens dominating our lives The appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply adding personal touches to your space, Home Loan Interest Benefit In Tax have become a valuable resource. Through this post, we'll take a dive deep into the realm of "Home Loan Interest Benefit In Tax," exploring what they are, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Home Loan Interest Benefit In Tax Below

Home Loan Interest Benefit In Tax

Home Loan Interest Benefit In Tax -

Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers FY 2019 20 onwards Maximum tax deduction allowed under Section 80EEA is Rs 1 50 000 This incentive would be over and above the tax deduction of Rs 2 00 000 under Section 24 and Rs 1 50 000 under Section 80C Conditions for availing deduction

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of a house to claim a tax deduction If it is taken for the construction of a house then it must be completed within five years from the end of the financial year in which the loan was taken

The Home Loan Interest Benefit In Tax are a huge array of printable materials that are accessible online for free cost. They come in many types, like worksheets, coloring pages, templates and much more. The value of Home Loan Interest Benefit In Tax is in their versatility and accessibility.

More of Home Loan Interest Benefit In Tax

What Is A Home Loan Loyalty Tax And Am I Paying It Nano Digital Home

What Is A Home Loan Loyalty Tax And Am I Paying It Nano Digital Home

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Section 80EE allows benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

The Home Loan Interest Benefit In Tax have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization There is the possibility of tailoring designs to suit your personal needs in designing invitations and schedules, or even decorating your house.

-

Educational Use: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them an invaluable tool for parents and educators.

-

The convenience of Instant access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Home Loan Interest Benefit In Tax

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions States that assess an income tax also may allow

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate

After we've peaked your interest in Home Loan Interest Benefit In Tax We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Home Loan Interest Benefit In Tax designed for a variety objectives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Home Loan Interest Benefit In Tax

Here are some ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Home Loan Interest Benefit In Tax are an abundance of fun and practical tools which cater to a wide range of needs and needs and. Their access and versatility makes them a wonderful addition to both professional and personal life. Explore the vast array of Home Loan Interest Benefit In Tax right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can download and print these materials for free.

-

Can I utilize free printables to make commercial products?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Home Loan Interest Benefit In Tax?

- Some printables may come with restrictions regarding usage. Check these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home with an printer, or go to a local print shop for superior prints.

-

What program is required to open printables at no cost?

- Most PDF-based printables are available in the format PDF. This is open with no cost software such as Adobe Reader.

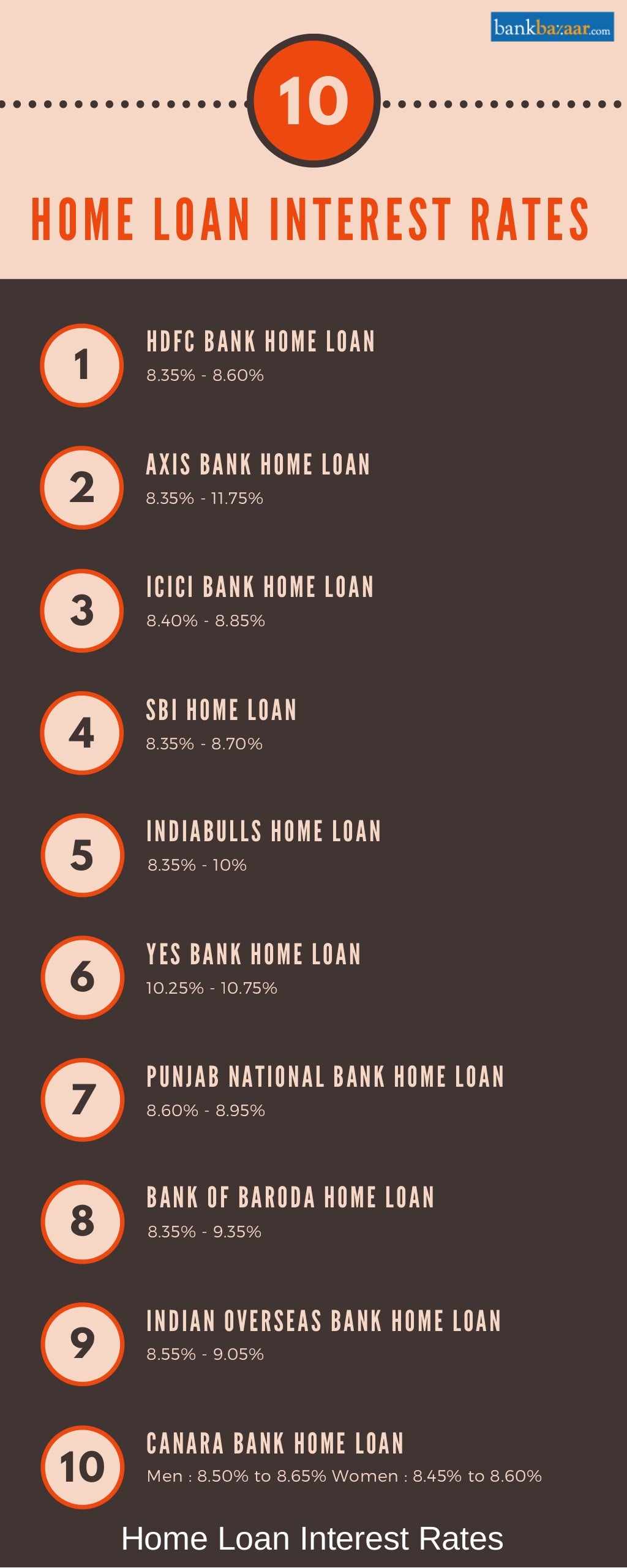

Best Home Loan Rates

Home Loan Interest Rates 2021 Best Home Loan 6 85 In India EMI

Check more sample of Home Loan Interest Benefit In Tax below

Home Loan Lowest Interest Rate

How To Get Home Loan Interest Back YouTube

Home Loan Offer Check Best Interest Rates From These Banks

Pin On Property Finance

Home Loan Interest Rates How To Reduce Home Loan Interest Burden

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

https:// cleartax.in /s/home-loan-tax-benefits

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of a house to claim a tax deduction If it is taken for the construction of a house then it must be completed within five years from the end of the financial year in which the loan was taken

https:// cleartax.in /s/home-loan-tax-benefit

Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of a house to claim a tax deduction If it is taken for the construction of a house then it must be completed within five years from the end of the financial year in which the loan was taken

Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Pin On Property Finance

How To Get Home Loan Interest Back YouTube

Home Loan Interest Rates How To Reduce Home Loan Interest Burden

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

Home Loan Interest Rates

Home Loan Interest Rate Home Sweet Home

Home Loan Interest Rate Home Sweet Home

Home Loan Interest Rates List 2023 Of All Banks New Updated