In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses in creative or artistic projects, or simply adding a personal touch to your space, Home Loan Interest Claim Limit are now a useful resource. We'll dive through the vast world of "Home Loan Interest Claim Limit," exploring their purpose, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Home Loan Interest Claim Limit Below

Home Loan Interest Claim Limit

Home Loan Interest Claim Limit -

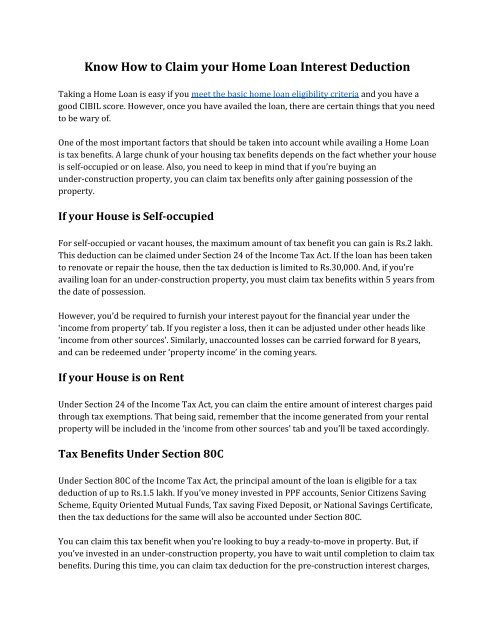

The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year This benefit is on the interest paid on the home loan and is not part of

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Home Loan Interest Claim Limit offer a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and much more. The benefit of Home Loan Interest Claim Limit lies in their versatility as well as accessibility.

More of Home Loan Interest Claim Limit

Application For Home Loan Interest Certificate Home Loan Application

Application For Home Loan Interest Certificate Home Loan Application

Deduction of Interest on Home Loan for the property Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside in the

As mentioned under the newly inserted section 80EEA of the Income Tax Act the government has extended the limit of deduction up to Rs 1 50 000 applicable to the interest paid by any individual on the

Home Loan Interest Claim Limit have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: There is the possibility of tailoring the design to meet your needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: These Home Loan Interest Claim Limit can be used by students from all ages, making them a useful aid for parents as well as educators.

-

Accessibility: immediate access a variety of designs and templates will save you time and effort.

Where to Find more Home Loan Interest Claim Limit

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

Deductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16 2017 and 750 000 for homes bought after that date Buying a home has

This itemized deduction allows homeowners to subtract mortgage interest from their taxable income lowering the amount of taxes they owe Homeowners can also claim the deduction on loans for

We've now piqued your interest in printables for free We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Home Loan Interest Claim Limit for all objectives.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a wide range of interests, from DIY projects to party planning.

Maximizing Home Loan Interest Claim Limit

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free for teaching at-home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Home Loan Interest Claim Limit are an abundance of practical and imaginative resources catering to different needs and preferences. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the vast collection of Home Loan Interest Claim Limit today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Loan Interest Claim Limit really for free?

- Yes you can! You can print and download these files for free.

-

Can I use the free printing templates for commercial purposes?

- It's based on the rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Home Loan Interest Claim Limit?

- Certain printables might have limitations in use. Make sure you read the terms of service and conditions provided by the author.

-

How do I print Home Loan Interest Claim Limit?

- You can print them at home using any printer or head to the local print shop for better quality prints.

-

What program will I need to access printables free of charge?

- Most PDF-based printables are available in the PDF format, and is open with no cost programs like Adobe Reader.

Home Loan Interest Rate Home Sweet Home

Know How To Claim Your Home Loan Interest Deduction

Check more sample of Home Loan Interest Claim Limit below

5 Banks Offering Lowest Home Loan Interest Rates

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Budget 2013 Will Exempt Limit On Home Loans Be Hiked

Basic Exemption Limit Budget 2023 Can Help The Middle Class Indian In

Can You Claim Deduction Of Interest Payments On Home Loan For Under

Is Integrated Shield Plan Necessary In Singapore PZL Blog Singapore

https://cleartax.in/s/home-loan-tax-benefit

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you

Basic Exemption Limit Budget 2023 Can Help The Middle Class Indian In

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Can You Claim Deduction Of Interest Payments On Home Loan For Under

Is Integrated Shield Plan Necessary In Singapore PZL Blog Singapore

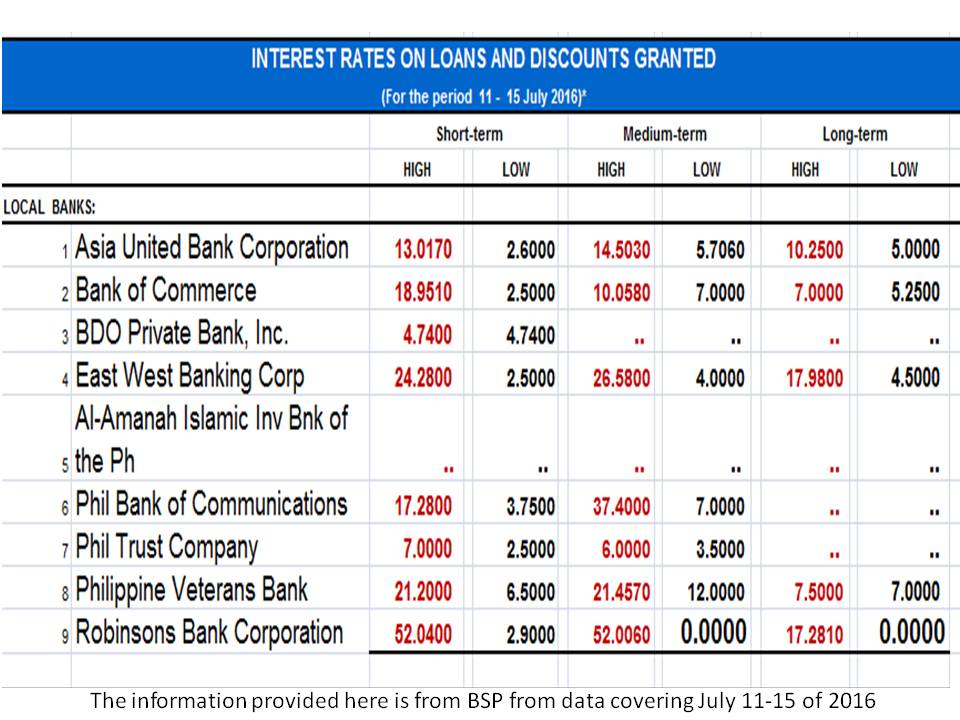

Comparison Of Interest Rates On Loans From Different Banks In Philippines

TV Insurance Compare Cheap Television Cover And Warranties

TV Insurance Compare Cheap Television Cover And Warranties

NEW PAG IBIG HOME LOAN INTEREST RATES PAG IBIG OFFERS ITS LOWEST HOME