In the age of digital, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply to add a personal touch to your area, Home Loan Interest Deduction Limit can be an excellent resource. This article will take a dive into the sphere of "Home Loan Interest Deduction Limit," exploring their purpose, where to find them, and how they can improve various aspects of your lives.

Get Latest Home Loan Interest Deduction Limit Below

Home Loan Interest Deduction Limit

Home Loan Interest Deduction Limit -

Deductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16 2017 and 750 000 for homes bought after that date Buying a home has

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024 tax

Printables for free cover a broad variety of printable, downloadable materials online, at no cost. The resources are offered in a variety forms, like worksheets coloring pages, templates and much more. The value of Home Loan Interest Deduction Limit lies in their versatility and accessibility.

More of Home Loan Interest Deduction Limit

Home Loan Interest Deduction Procedure To Claim HomeCapital

Home Loan Interest Deduction Procedure To Claim HomeCapital

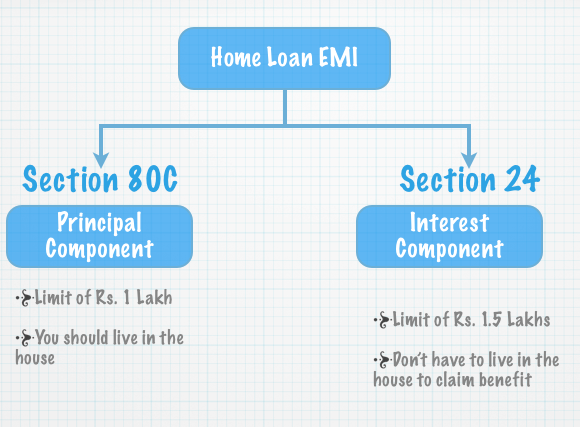

The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year This benefit is on the interest paid on the home loan and is not part of Section 80C of the Income Tax Act 1961

Accordingly a new Section 80EEA has been inserted to allow for an interest deduction from AY 2020 21 FY 2019 20 The older provision of Section 80EE allowed a deduction of up to Rs 50 000 for interest paid by first time home buyers for loans sanctioned from a financial institution between 1 April 2016 and 31 March 2017

Home Loan Interest Deduction Limit have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor printing templates to your own specific requirements such as designing invitations making your schedule, or even decorating your house.

-

Educational Value Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a useful instrument for parents and teachers.

-

Easy to use: Quick access to a plethora of designs and templates can save you time and energy.

Where to Find more Home Loan Interest Deduction Limit

Student Loan Interest Deduction Worksheet

Student Loan Interest Deduction Worksheet

If you do claim the deduction you ll get a bigger tax break the higher your income and the larger your mortgage up to the 750 000 limit Faster easier mortgage lending Check your

The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750 000 of their loan principal The Tax Cuts and Jobs Act TCJA

After we've peaked your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Home Loan Interest Deduction Limit suitable for many goals.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- This is a great resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Limit

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Loan Interest Deduction Limit are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and desires. Their availability and versatility make them an essential part of both personal and professional life. Explore the vast collection of Home Loan Interest Deduction Limit and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Home Loan Interest Deduction Limit?

- Some printables may contain restrictions on their use. Be sure to review these terms and conditions as set out by the author.

-

How can I print Home Loan Interest Deduction Limit?

- Print them at home with either a printer or go to any local print store for high-quality prints.

-

What program is required to open Home Loan Interest Deduction Limit?

- The majority of PDF documents are provided in the format of PDF, which can be opened with free programs like Adobe Reader.

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

HOME LOAN BUDGET 2019 HOME LOAN TAX BENEFIT HOUSE LOAN INTEREST

Check more sample of Home Loan Interest Deduction Limit below

Student Loan Interest Deduction Limit 2023

Student Loan Interest Deduction Limit 2023

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Student Loan Interest Deduction Definition

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Student Loan Interest Deduction Limit 2023

https://www.nerdwallet.com/article/taxes/mortgage...

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024 tax

https://www.irs.gov/publications/p936

Home mortgage interest You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that mortgage interest on your 2024 tax

Home mortgage interest You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

Student Loan Interest Deduction Limit 2023

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Student Loan Interest Deduction Limit 2023

Home Loan Mortgage Interest Tax Deduction For 2015 2016

Budget 2023 Realtors Body Seeks Rise In Deduction Limit On Home Loan

Budget 2023 Realtors Body Seeks Rise In Deduction Limit On Home Loan

Home Loan Interest Home Loan Interest Deduction Under Which Section