In this age of technology, when screens dominate our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or simply adding personal touches to your space, Home Loan Interest Deduction Section In Itr 1 have become an invaluable resource. We'll take a dive deeper into "Home Loan Interest Deduction Section In Itr 1," exploring the benefits of them, where you can find them, and how they can improve various aspects of your life.

Get Latest Home Loan Interest Deduction Section In Itr 1 Below

Home Loan Interest Deduction Section In Itr 1

Home Loan Interest Deduction Section In Itr 1 -

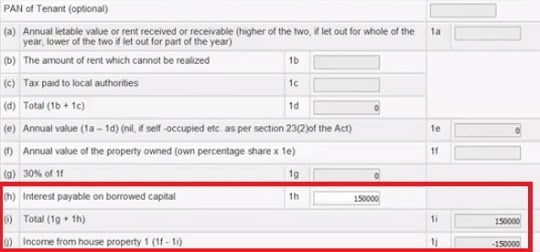

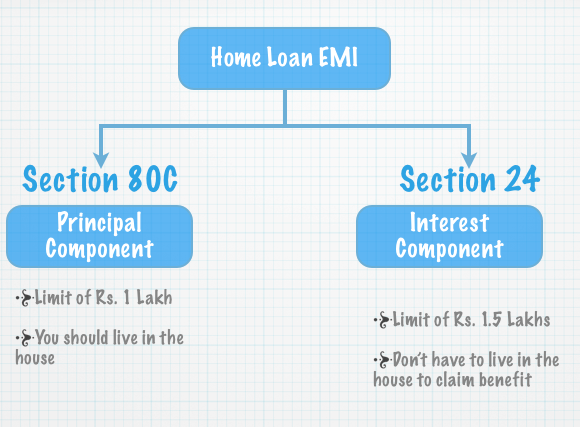

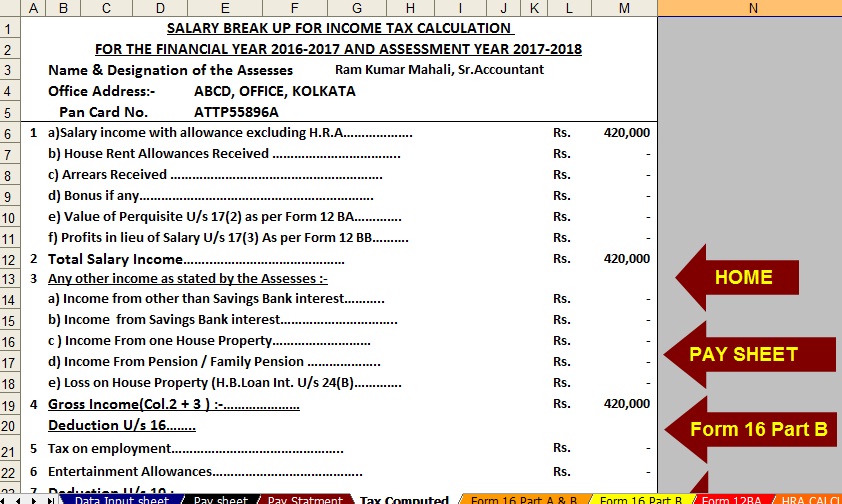

Where to fill home loan interest in ITR 1 You can claim home loan interest deduction on your Income Tax Return ITR under Section 24 of the Income Tax Act 1961 You can also claim it under two categories Deduction on Self Occupied Property

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head

Home Loan Interest Deduction Section In Itr 1 encompass a wide assortment of printable, downloadable materials that are accessible online for free cost. These printables come in different forms, like worksheets coloring pages, templates and much more. The appealingness of Home Loan Interest Deduction Section In Itr 1 lies in their versatility as well as accessibility.

More of Home Loan Interest Deduction Section In Itr 1

Home Loan Interest Deduction Procedure To Claim HomeCapital

Home Loan Interest Deduction Procedure To Claim HomeCapital

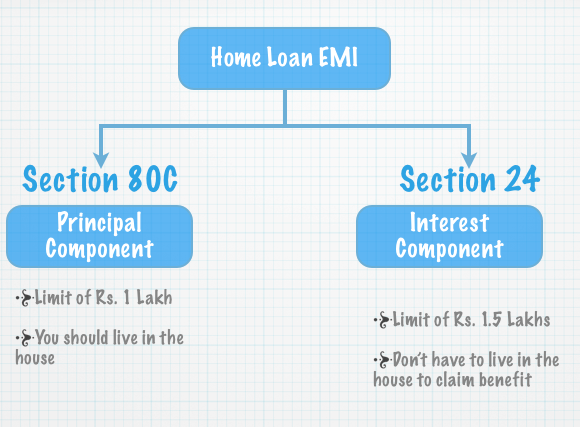

How to claim housing loan interest in ITR 1 You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your employer

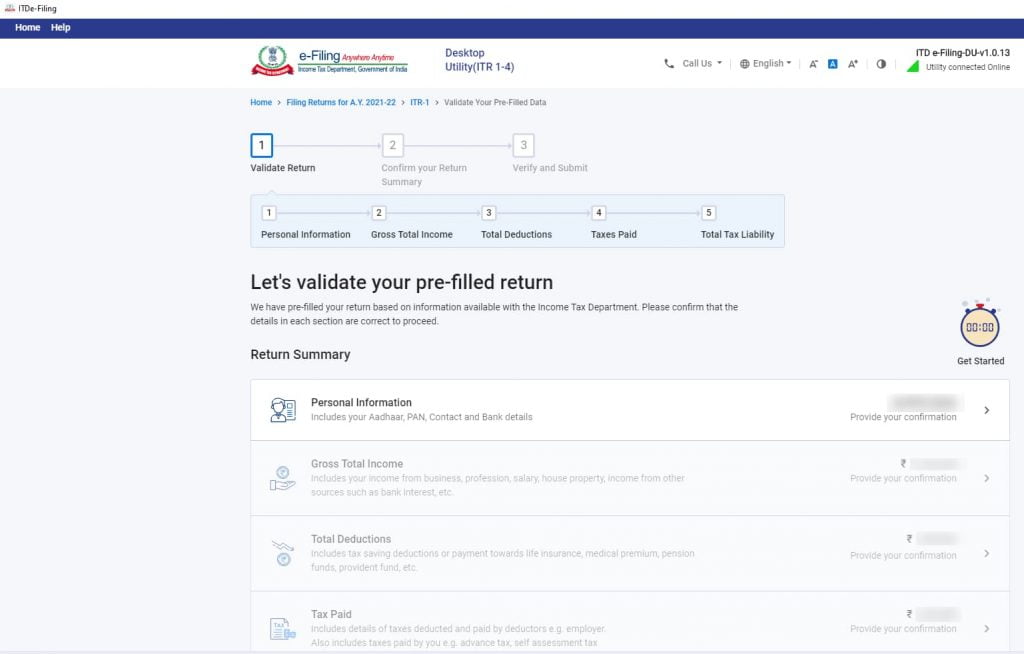

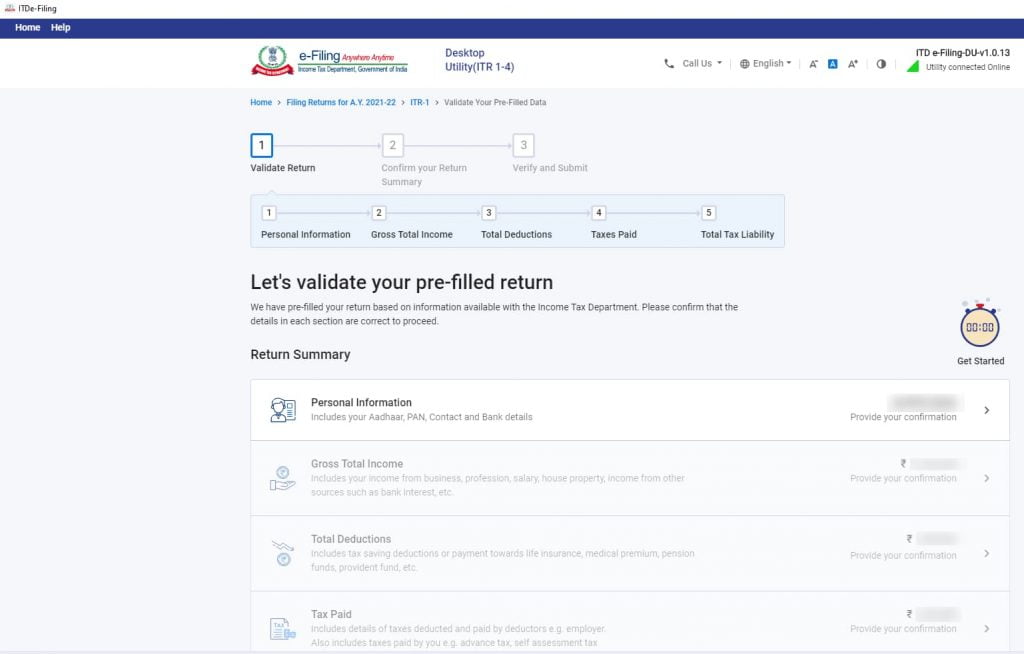

These instructions are guidelines to help the taxpayers for filling the particulars in Income tax Return Form 1 for the Assessment Year 2021 22 relating to the Financial Year 2020 21 In case of any doubt please refer to relevant provisions of

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization You can tailor printing templates to your own specific requirements whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Free educational printables provide for students of all ages, making them a vital tool for teachers and parents.

-

Accessibility: Access to a plethora of designs and templates saves time and effort.

Where to Find more Home Loan Interest Deduction Section In Itr 1

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

The tax deduction on home loan interest is subject to a maximum limit per person per financial year under Section 24 b of the Income Tax Act So if the interest paid exceeds this limit individuals can only claim a maximum deduction

Under Section 80EE there is a provision for an additional deduction of Rs 50 000 for first time homeowners for interest on their housing loans The value of the property should be less than or equal to Rs 50 lakhs and the amount of

Now that we've ignited your curiosity about Home Loan Interest Deduction Section In Itr 1 Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Home Loan Interest Deduction Section In Itr 1 to suit a variety of motives.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast range of interests, from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Section In Itr 1

Here are some fresh ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Loan Interest Deduction Section In Itr 1 are an abundance of practical and imaginative resources that meet a variety of needs and preferences. Their availability and versatility make them a great addition to both professional and personal lives. Explore the vast array of Home Loan Interest Deduction Section In Itr 1 today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables could be restricted regarding usage. Check the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit an in-store print shop to get superior prints.

-

What software do I require to view printables at no cost?

- Most printables come as PDF files, which is open with no cost software such as Adobe Reader.

How To Fill Housing Loan Interest And Principal In Income Tax Return

How To Claim Deduction U s 80TTA In ITR 1 For AY 2022 23 II Show 80 TTA

Check more sample of Home Loan Interest Deduction Section In Itr 1 below

Pre Construction Home Loan Interest And ITR

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

TAXATION OF HOME LOAN INTEREST DEDUCTION UNDER SECTION 80EE OF IT ACT

Home Loan Interest Home Loan Interest Deduction Under Which Section

Corporate Itr Filing Tabitomo

Section 80TTA How You Can Claim Tax Deduction

https://financialcontrol.in/where-to-show-housing...

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to penetrate interest paid on home loan under exemption head

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also

Home Loan Interest Home Loan Interest Deduction Under Which Section

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Corporate Itr Filing Tabitomo

Section 80TTA How You Can Claim Tax Deduction

Process Of Filing ITR 1 Under New Income Tax E Filing Portal 2 0

Where To Show Rental Income In ITR 1 Sahaj Form House Property Income

Where To Show Rental Income In ITR 1 Sahaj Form House Property Income

Home Loan Interest Home Loan Interest Deduction Under Which Section