In this age of electronic devices, where screens rule our lives but the value of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons and creative work, or simply adding the personal touch to your home, printables for free are a great source. Here, we'll take a dive into the world of "Home Loan Interest Deduction Section In Itr2," exploring what they are, how to locate them, and how they can improve various aspects of your daily life.

Get Latest Home Loan Interest Deduction Section In Itr2 Below

Home Loan Interest Deduction Section In Itr2

Home Loan Interest Deduction Section In Itr2 -

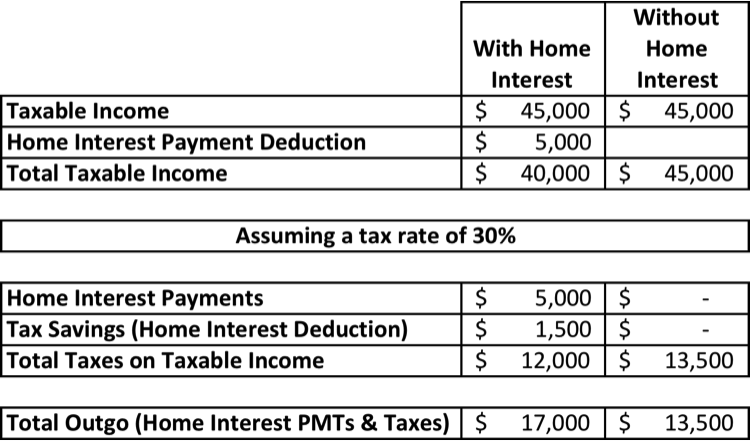

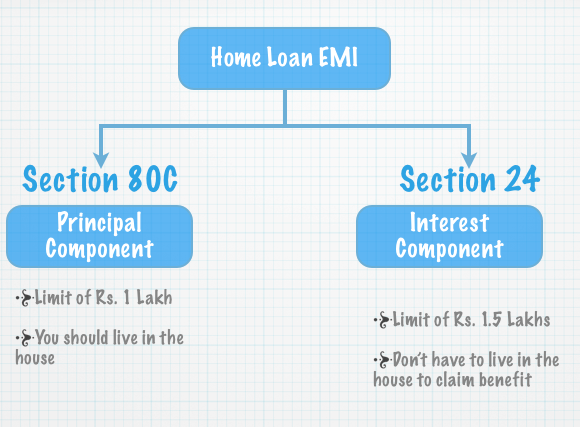

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also

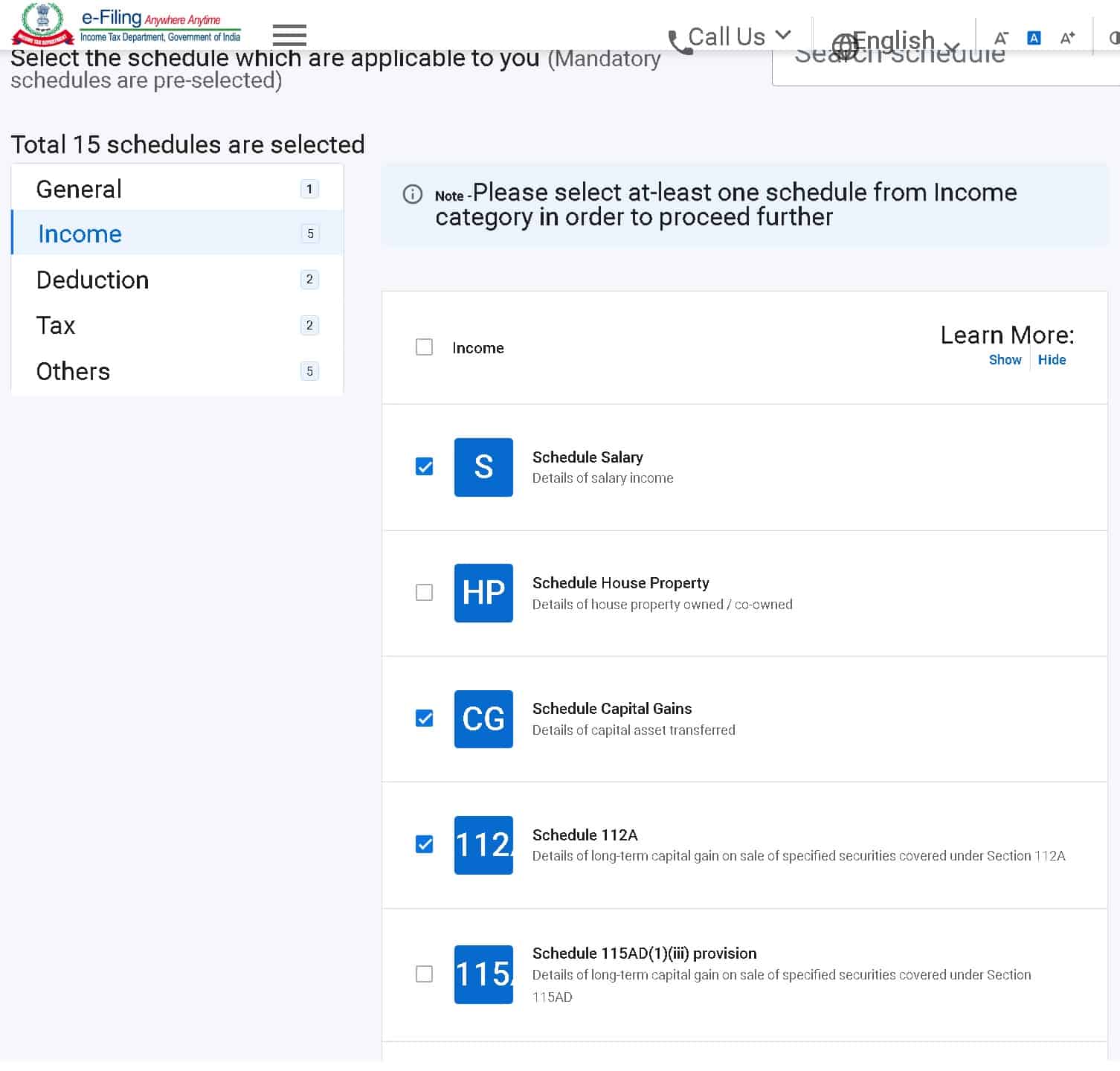

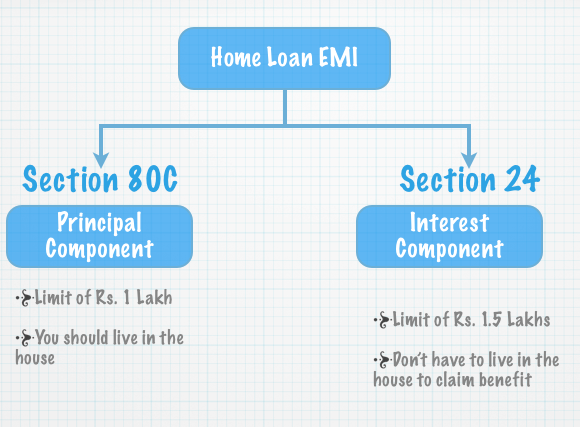

The pre filling and filing of ITR 2 service is available to registered users on the e Filing portal This service enables individual taxpayers and HUFs to file ITR 2 through the e Filing portal This user manual covers the process for filing ITR 2 through online mode

Printables for free include a vast assortment of printable materials available online at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and many more. The attraction of printables that are free lies in their versatility and accessibility.

More of Home Loan Interest Deduction Section In Itr2

80TTB In ITR2 A Y 22 23 80ttb Deduction In ITR2 A Y 22 23 How To

80TTB In ITR2 A Y 22 23 80ttb Deduction In ITR2 A Y 22 23 How To

Here Mr X can claim actual home loan interest paid of Rs 2 5 lakh as a deduction for the let out property Mr X can also claim a deduction of up to Rs 1 5 lakh for principal repayment under section 80C which will be the aggregate of all home loan repayments

Self occupied property Provide details of property and interest paid on housing loan if any Let out property Provide details of the property such as an address rent received during the year municipal taxes paid and interest paid on housing loan if any

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: The Customization feature lets you tailor print-ready templates to your specific requirements for invitations, whether that's creating them or arranging your schedule or even decorating your home.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, making them a useful tool for parents and teachers.

-

Easy to use: Instant access to various designs and templates cuts down on time and efforts.

Where to Find more Home Loan Interest Deduction Section In Itr2

How To Show Dividend Income In Itr2 For A Y 21 22 Dividend Income

How To Show Dividend Income In Itr2 For A Y 21 22 Dividend Income

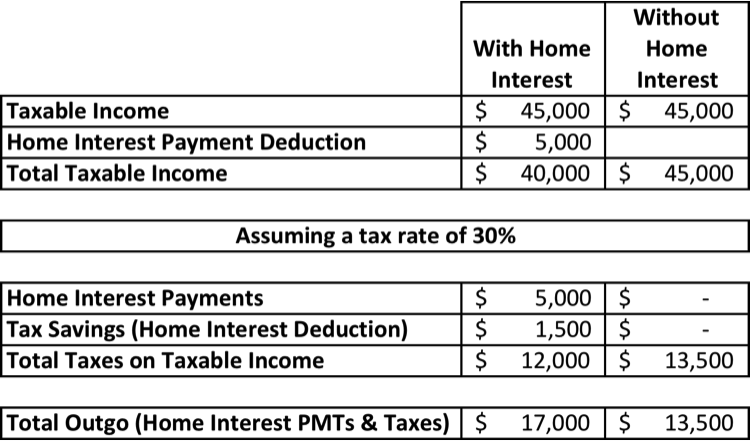

Check the amount of Interest on loan you are claiming under section 24b Interest upto Rs 2 lakhs is allowed as deduction during the current year Any interest above Rs 2 00 000 shall be carried forward to next financial year

Under Section 24 of the Income Tax Act a taxable individual can claim deduction on payment of interest for a home loan The property must be self occupied and maximum deduction allowed is Rs 2 lakhs

In the event that we've stirred your curiosity about Home Loan Interest Deduction Section In Itr2 we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Home Loan Interest Deduction Section In Itr2 for various objectives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Section In Itr2

Here are some ideas to make the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Home Loan Interest Deduction Section In Itr2 are a treasure trove of innovative and useful resources which cater to a wide range of needs and needs and. Their accessibility and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast collection of Home Loan Interest Deduction Section In Itr2 to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download the resources for free.

-

Are there any free printables for commercial uses?

- It's based on the conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Check the terms and regulations provided by the designer.

-

How can I print Home Loan Interest Deduction Section In Itr2?

- You can print them at home with any printer or head to an area print shop for the highest quality prints.

-

What program do I need to open printables for free?

- Many printables are offered with PDF formats, which can be opened with free software such as Adobe Reader.

How To Enter Mutual Fund And Share Capital Gains In ITR2 or ITR3

How To Show Investments In ITR2 In Tamil Savings Section In ITR2 In

Check more sample of Home Loan Interest Deduction Section In Itr2 below

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

How To Fill Section 17 1 17 2 Of ITR2 FY2021 22 AY2022 23

Step by step Guide To Enter MF And Share Capital Gains In ITR2 or ITR3

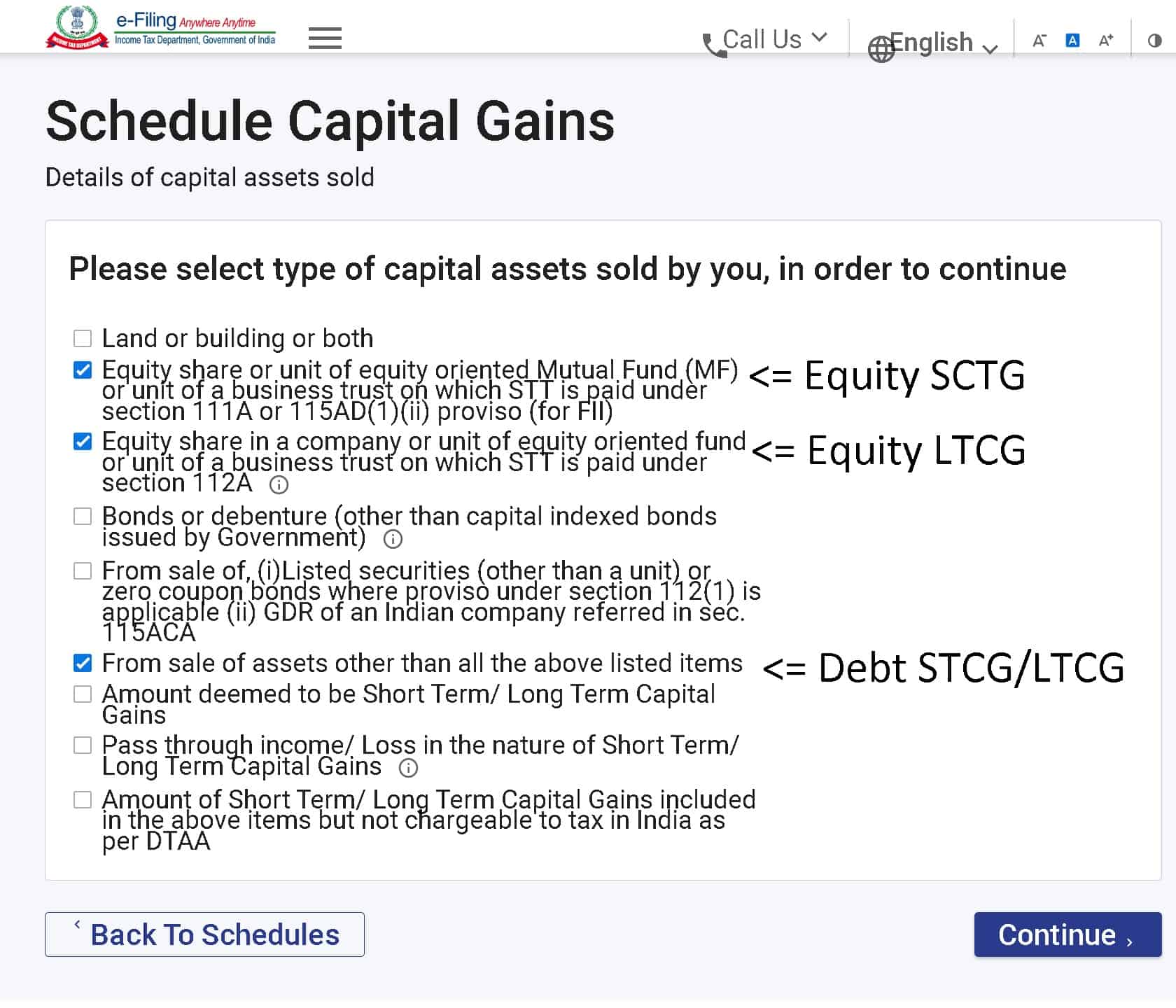

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Home Loan Interest Home Loan Interest Deduction Under Which Section

TAXATION OF HOME LOAN INTEREST DEDUCTION UNDER SECTION 80EE OF IT ACT

https://www.incometax.gov.in › iec › foportal › help

The pre filling and filing of ITR 2 service is available to registered users on the e Filing portal This service enables individual taxpayers and HUFs to file ITR 2 through the e Filing portal This user manual covers the process for filing ITR 2 through online mode

https://www.youtube.com › watch

Tax Filing Home loan details in ITR2 When you are filing your Income tax returns using Form ITR 2 how do you need to provide the Interest and Principal components more

The pre filling and filing of ITR 2 service is available to registered users on the e Filing portal This service enables individual taxpayers and HUFs to file ITR 2 through the e Filing portal This user manual covers the process for filing ITR 2 through online mode

Tax Filing Home loan details in ITR2 When you are filing your Income tax returns using Form ITR 2 how do you need to provide the Interest and Principal components more

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

How To Fill Section 17 1 17 2 Of ITR2 FY2021 22 AY2022 23

Home Loan Interest Home Loan Interest Deduction Under Which Section

TAXATION OF HOME LOAN INTEREST DEDUCTION UNDER SECTION 80EE OF IT ACT

Section 80EEA Deduction On The Home Loan Interest

How To File CSV Template In Itr2 A Y 21 22 How To File Schedule 112A A

How To File CSV Template In Itr2 A Y 21 22 How To File Schedule 112A A

Home Loan Interest Home Loan Interest Deduction Under Which Section