In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses as well as creative projects or just adding an element of personalization to your space, Home Loan Interest Deduction Section India can be an excellent source. With this guide, you'll dive to the depths of "Home Loan Interest Deduction Section India," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Home Loan Interest Deduction Section India Below

Home Loan Interest Deduction Section India

Home Loan Interest Deduction Section India -

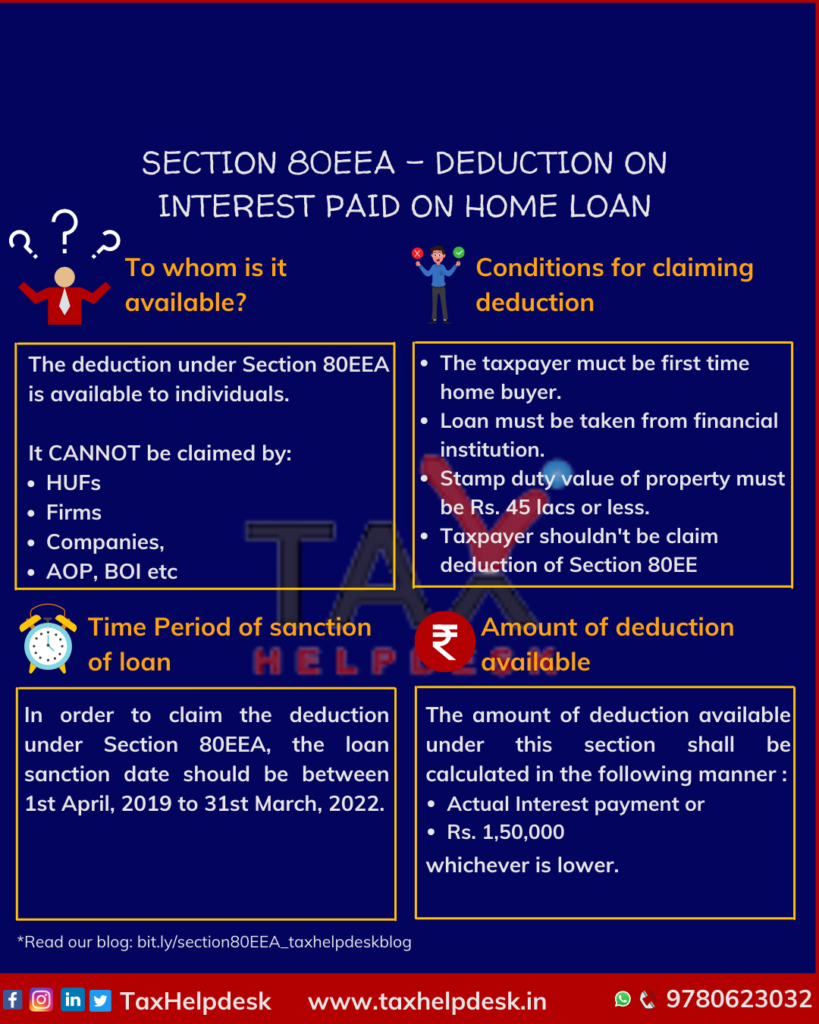

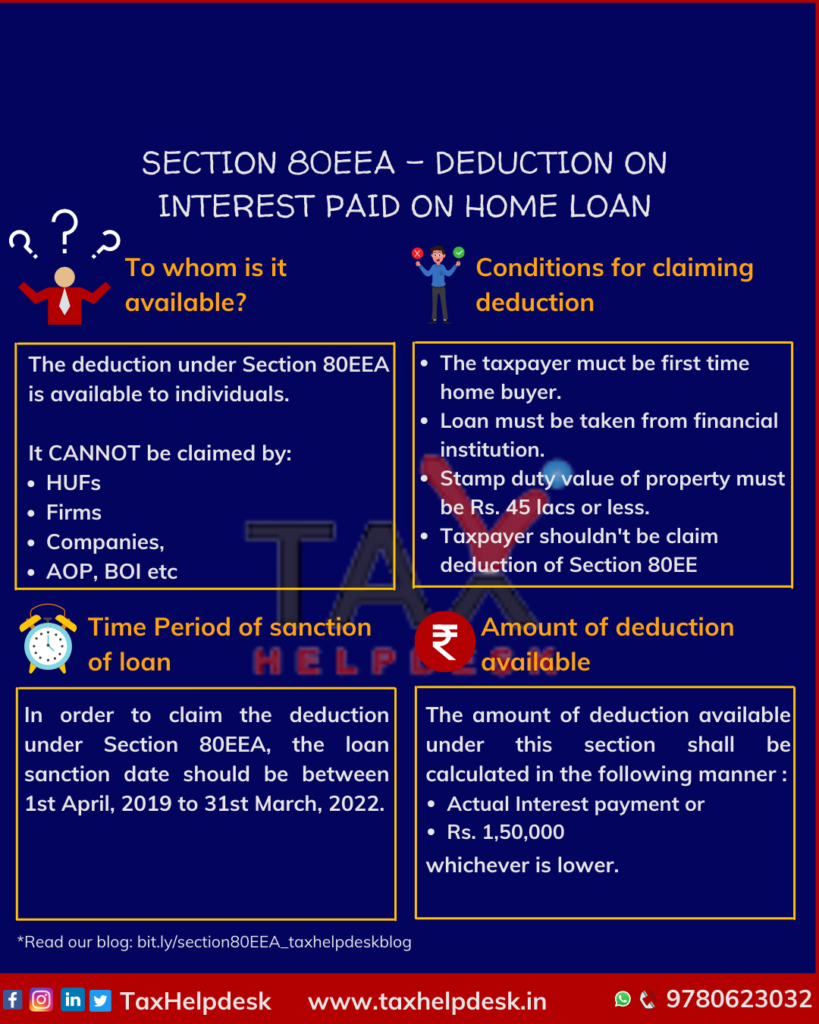

To provide interest deduction on home loans section 80EEA has been introduced The older provision of Section 80EE allowed a deduction of up to Rs 50 000 for interest paid to first time home buyers for loans sanctioned from a financial institution between 1 April 2016 and 31 March 2017

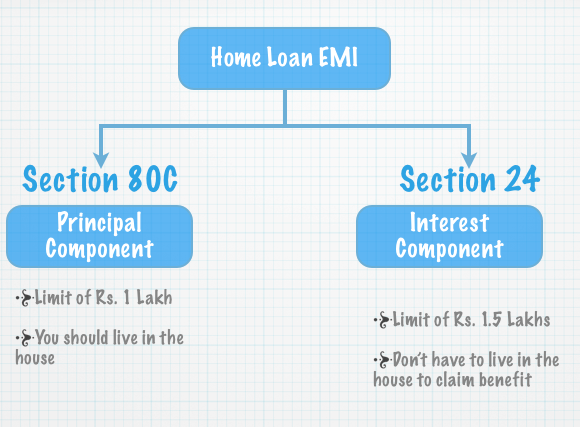

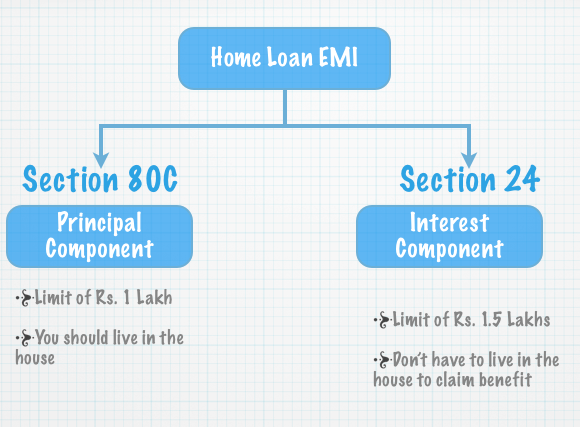

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction

The Home Loan Interest Deduction Section India are a huge range of downloadable, printable items that are available online at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and much more. The beauty of Home Loan Interest Deduction Section India is in their variety and accessibility.

More of Home Loan Interest Deduction Section India

Home Loan Interest Deduction Procedure To Claim HomeCapital

Home Loan Interest Deduction Procedure To Claim HomeCapital

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can individually claim Rs

Under Section 80EE taxpayers can claim a deduction of up to Rs 50 000 on the interest paid on home loans This is in addition to the deduction available under Section 24 b which allows a maximum deduction of Rs 2 lakh per financial year

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printing templates to your own specific requirements whether you're designing invitations, organizing your schedule, or decorating your home.

-

Education Value Free educational printables provide for students of all ages, making these printables a powerful tool for parents and teachers.

-

The convenience of immediate access an array of designs and templates cuts down on time and efforts.

Where to Find more Home Loan Interest Deduction Section India

HOME LOAN BUDGET 2019 HOME LOAN TAX BENEFIT HOUSE LOAN INTEREST

HOME LOAN BUDGET 2019 HOME LOAN TAX BENEFIT HOUSE LOAN INTEREST

Section 80EE Tax deduction against home loan interest payment This section helps first time buyers get tax benefits Section 80EE of the Income Tax Act allows additional benefits for first time homebuyers in India if they borrow funds from a bank to purchase a home

The Indian Income Tax Act provides a tax deduction of up to Rs 1 5 lakhs per financial year for interest paid on home loans taken for purchasing or constructing an affordable house This deduction is available under Section 80EEA of the Income Tax Act and is in addition to the existing tax benefits available under Section 80C and Section 24

In the event that we've stirred your interest in printables for free we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Home Loan Interest Deduction Section India suitable for many objectives.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Section India

Here are some ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Home Loan Interest Deduction Section India are a treasure trove of innovative and useful resources which cater to a wide range of needs and preferences. Their availability and versatility make them an essential part of both professional and personal lives. Explore the vast array of Home Loan Interest Deduction Section India today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can print and download these documents for free.

-

Can I make use of free templates for commercial use?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Home Loan Interest Deduction Section India?

- Some printables may contain restrictions in use. You should read the terms and regulations provided by the author.

-

How can I print Home Loan Interest Deduction Section India?

- Print them at home with printing equipment or visit the local print shop for the highest quality prints.

-

What program do I need in order to open printables at no cost?

- The majority of printed documents are in PDF format. They is open with no cost software such as Adobe Reader.

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Check more sample of Home Loan Interest Deduction Section India below

Section 80EE Income Tax Deduction For Interest On Home Loan

Home Loan Interest Home Loan Interest Deduction Under Which Section

TAXATION OF HOME LOAN INTEREST DEDUCTION UNDER SECTION 80EE OF IT ACT

Section 80EEA Deduction On The Home Loan Interest

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a

Section 80EEA Deduction On The Home Loan Interest

Home Loan Interest Home Loan Interest Deduction Under Which Section

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Ladies Tax Planning CANNOT Be Easier Than This

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

Home Loan Mortgage Interest Tax Deduction For 2015 2016