In a world where screens dominate our lives but the value of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add some personal flair to your home, printables for free can be an excellent source. With this guide, you'll dive deeper into "Home Loan Interest Deduction Under Section 24 B Limit," exploring what they are, how they are, and the ways that they can benefit different aspects of your life.

Get Latest Home Loan Interest Deduction Under Section 24 B Limit Below

Home Loan Interest Deduction Under Section 24 B Limit

Home Loan Interest Deduction Under Section 24 B Limit -

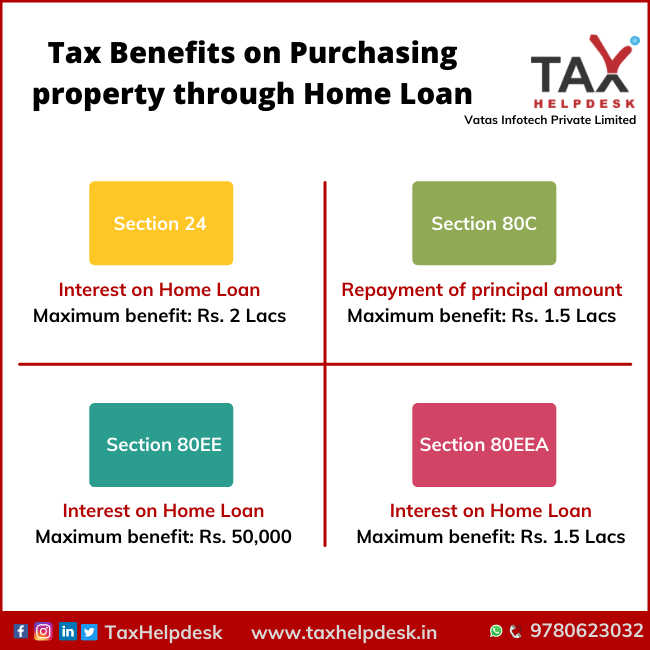

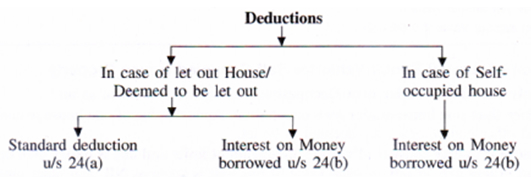

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income

Home loan borrowers who have let out their property can claim any amount paid as interest as a deduction under Section 24 B of the Income Tax Act 1961

The Home Loan Interest Deduction Under Section 24 B Limit are a huge variety of printable, downloadable materials available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Home Loan Interest Deduction Under Section 24 B Limit

Home Loan Interest Deduction Procedure To Claim HomeCapital

Home Loan Interest Deduction Procedure To Claim HomeCapital

Is There Any Specific Type of Loan to Claim Deduction Under Section 24B No Section 24B of the Income Tax Act allows a taxpayer to claim deduction on interest irrespective

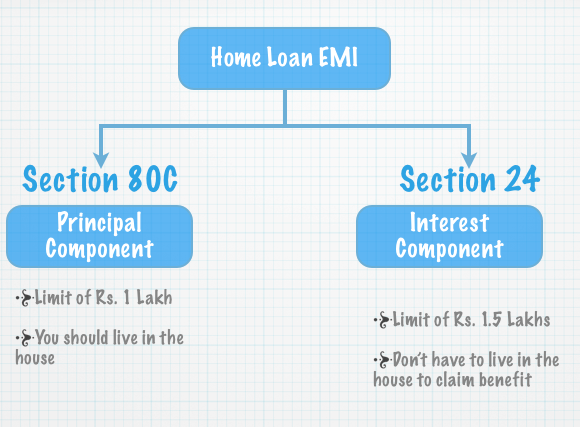

Homebuyers can claim a deduction on the interest paid on their home loan under section 24 b of the Income Tax Act 1961 A housing loan can be taken either

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs whether it's making invitations to organize your schedule or even decorating your house.

-

Educational value: These Home Loan Interest Deduction Under Section 24 B Limit offer a wide range of educational content for learners from all ages, making the perfect tool for parents and educators.

-

Convenience: Instant access to numerous designs and templates will save you time and effort.

Where to Find more Home Loan Interest Deduction Under Section 24 B Limit

Tax Benefits On Home Loan 2022 2023

Tax Benefits On Home Loan 2022 2023

As a homeowner you can claim a deduction of up to INR 2 lakh on your home loan s interest if you are self occupying the house You can also claim this

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

If we've already piqued your interest in printables for free, let's explore where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Home Loan Interest Deduction Under Section 24 B Limit to suit a variety of purposes.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast variety of topics, starting from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Under Section 24 B Limit

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Loan Interest Deduction Under Section 24 B Limit are an abundance filled with creative and practical information that satisfy a wide range of requirements and desires. Their availability and versatility make these printables a useful addition to the professional and personal lives of both. Explore the world that is Home Loan Interest Deduction Under Section 24 B Limit today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can download and print these files for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues with Home Loan Interest Deduction Under Section 24 B Limit?

- Some printables could have limitations on their use. Be sure to check these terms and conditions as set out by the creator.

-

How do I print printables for free?

- Print them at home with either a printer at home or in the local print shop for more high-quality prints.

-

What program do I need to open printables for free?

- A majority of printed materials are in the format of PDF, which can be opened with free programs like Adobe Reader.

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Check more sample of Home Loan Interest Deduction Under Section 24 B Limit below

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Tax Benefits Of Home Loan Section 24 Section 80C Section 80EEA

Interest On Housing Loan Interest Deduction On Home Loan Tax Saving

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Income Tax Benefits On Home Loan Loanfasttrack

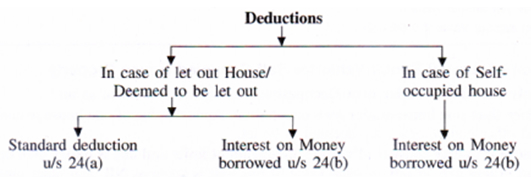

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

https://www. financialexpress.com /money/income-tax...

Home loan borrowers who have let out their property can claim any amount paid as interest as a deduction under Section 24 B of the Income Tax Act 1961

https:// taxguru.in /income-tax/deduction-inter…

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016 31 st March 2017 The value for the property

Home loan borrowers who have let out their property can claim any amount paid as interest as a deduction under Section 24 B of the Income Tax Act 1961

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016 31 st March 2017 The value for the property

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Tax Benefits Of Home Loan Section 24 Section 80C Section 80EEA

Income Tax Benefits On Home Loan Loanfasttrack

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Home Loan Interest Home Loan Interest Deduction Under Which Section

Why The New Income Tax Regime Has Few Takers

Why The New Income Tax Regime Has Few Takers

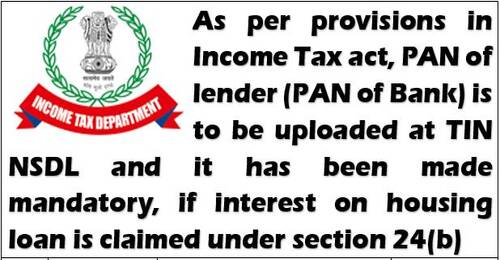

PAN Of Lender PAN Of Bank Required If Interest On Housing Loan Is