In this age of technology, where screens have become the dominant feature of our lives, the charm of tangible printed materials hasn't faded away. For educational purposes in creative or artistic projects, or simply to add some personal flair to your home, printables for free have become a valuable source. With this guide, you'll take a dive into the sphere of "Home Loan Interest In Income Tax Return," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Home Loan Interest In Income Tax Return Below

Home Loan Interest In Income Tax Return

Home Loan Interest In Income Tax Return -

Learn how to deduct mortgage interest on your taxes if you itemize and follow certain guidelines Find out the current limit what qualifies and what doesn t and how to claim the deduction

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

Home Loan Interest In Income Tax Return cover a large range of printable, free materials that are accessible online for free cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and more. The beauty of Home Loan Interest In Income Tax Return is their flexibility and accessibility.

More of Home Loan Interest In Income Tax Return

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as a deduction

Learn how to deduct the interest you pay on your home mortgage from your taxable income Find out the eligibility criteria deduction limits qualified expenses and how to report them on

Home Loan Interest In Income Tax Return have risen to immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor the templates to meet your individual needs whether it's making invitations making your schedule, or even decorating your home.

-

Educational Use: These Home Loan Interest In Income Tax Return offer a wide range of educational content for learners of all ages. This makes them a valuable aid for parents as well as educators.

-

An easy way to access HTML0: Access to numerous designs and templates is time-saving and saves effort.

Where to Find more Home Loan Interest In Income Tax Return

How To Fill Housing Loan Interest And Principal In Income Tax Return

How To Fill Housing Loan Interest And Principal In Income Tax Return

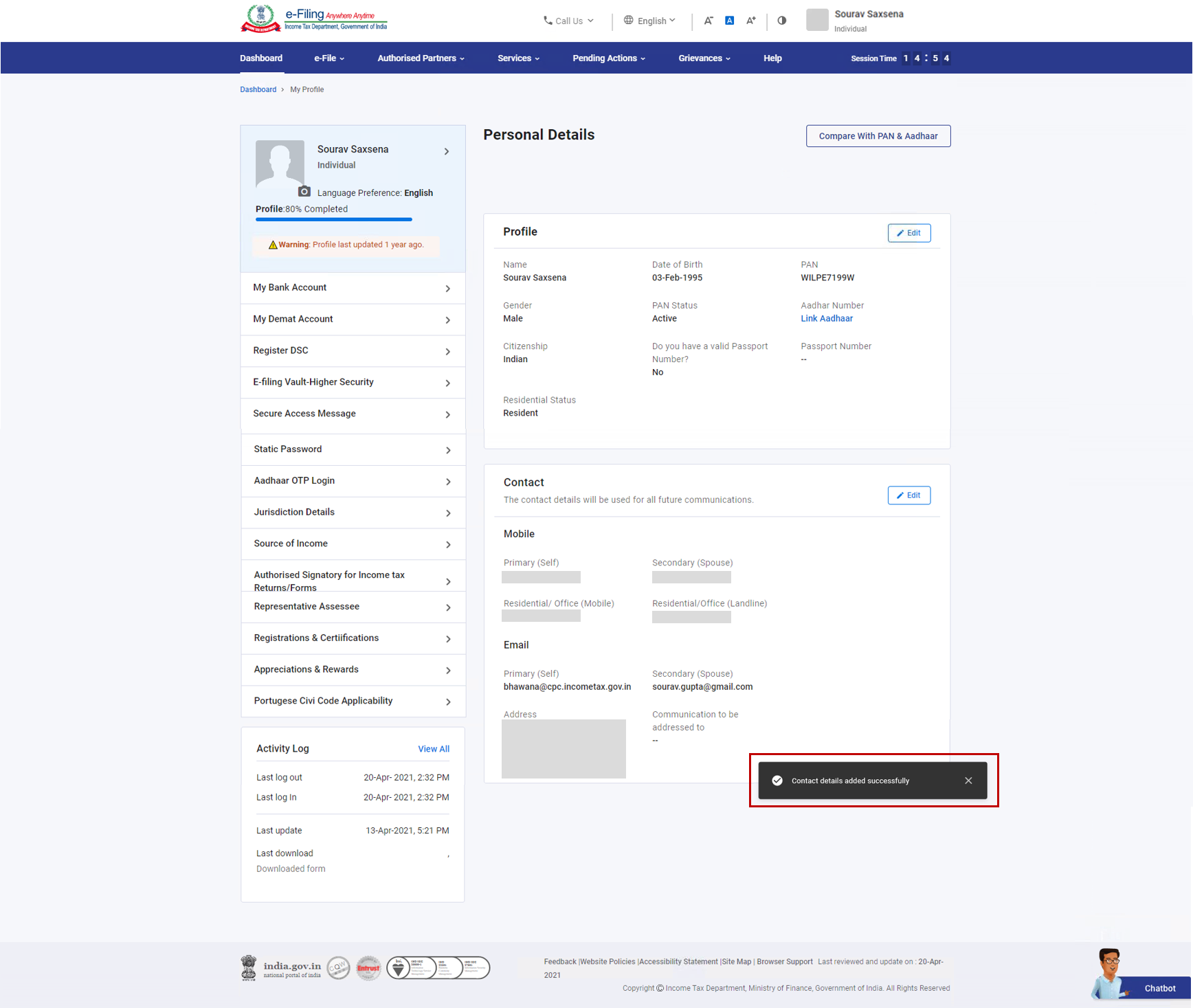

Understanding how to claim home loan interest in ITR Income Tax Return can significantly reduce your tax burden putting more money back in your pocket This guide explains the process in simple steps and explains key terms like Section 24 b so that you can confidently claim your ITR home loan interest deductions

By filing under you can get an annual deduction on your home loan interest amount and some much needed relief on the tax on your home loan You can also look into the benefits of Section 24 of the Income Tax Act

Now that we've piqued your interest in Home Loan Interest In Income Tax Return Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Home Loan Interest In Income Tax Return for all reasons.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Home Loan Interest In Income Tax Return

Here are some new ways to make the most of Home Loan Interest In Income Tax Return:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Loan Interest In Income Tax Return are a treasure trove of innovative and useful resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can print and download these items for free.

-

Can I use the free printouts for commercial usage?

- It's based on the terms of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Home Loan Interest In Income Tax Return?

- Some printables could have limitations on usage. Always read the terms and condition of use as provided by the author.

-

How can I print Home Loan Interest In Income Tax Return?

- Print them at home with printing equipment or visit an in-store print shop to get top quality prints.

-

What program will I need to access printables that are free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software, such as Adobe Reader.

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of Home Loan Interest In Income Tax Return below

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

How To Become A Tax Consultant

My Photo Frame Cheap Buy Save 47 Jlcatj gob mx

Joint Home Loan Declaration Form For Income Tax Savings And Non

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

Where To Mention Home Loan Interest In ITR 1 NoBroker Forum

https://cleartax.in › steps-claim-interest-home-loan-deduction

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

https://cleartax.in › home-loan-tax-benefit

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Joint Home Loan Declaration Form For Income Tax Savings And Non

How To Become A Tax Consultant

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

Where To Mention Home Loan Interest In ITR 1 NoBroker Forum

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Where To Show Housing Loan Interest In ITR 1 Financial Control

Where To Show Housing Loan Interest In ITR 1 Financial Control

Joint Home Loan Declaration Form For Income Tax Savings And Non