In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes or creative projects, or simply to add an individual touch to the space, Home Loan Interest Rebate Limit In Income Tax are a great source. For this piece, we'll dive into the sphere of "Home Loan Interest Rebate Limit In Income Tax," exploring the different types of printables, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Home Loan Interest Rebate Limit In Income Tax Below

Home Loan Interest Rebate Limit In Income Tax

Home Loan Interest Rebate Limit In Income Tax -

You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home loan tax benefits are available over and above the existing exemption of Rs 2 lakh under Section 24 b

Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and

Home Loan Interest Rebate Limit In Income Tax cover a large array of printable items that are available online at no cost. These materials come in a variety of forms, like worksheets coloring pages, templates and much more. The great thing about Home Loan Interest Rebate Limit In Income Tax lies in their versatility as well as accessibility.

More of Home Loan Interest Rebate Limit In Income Tax

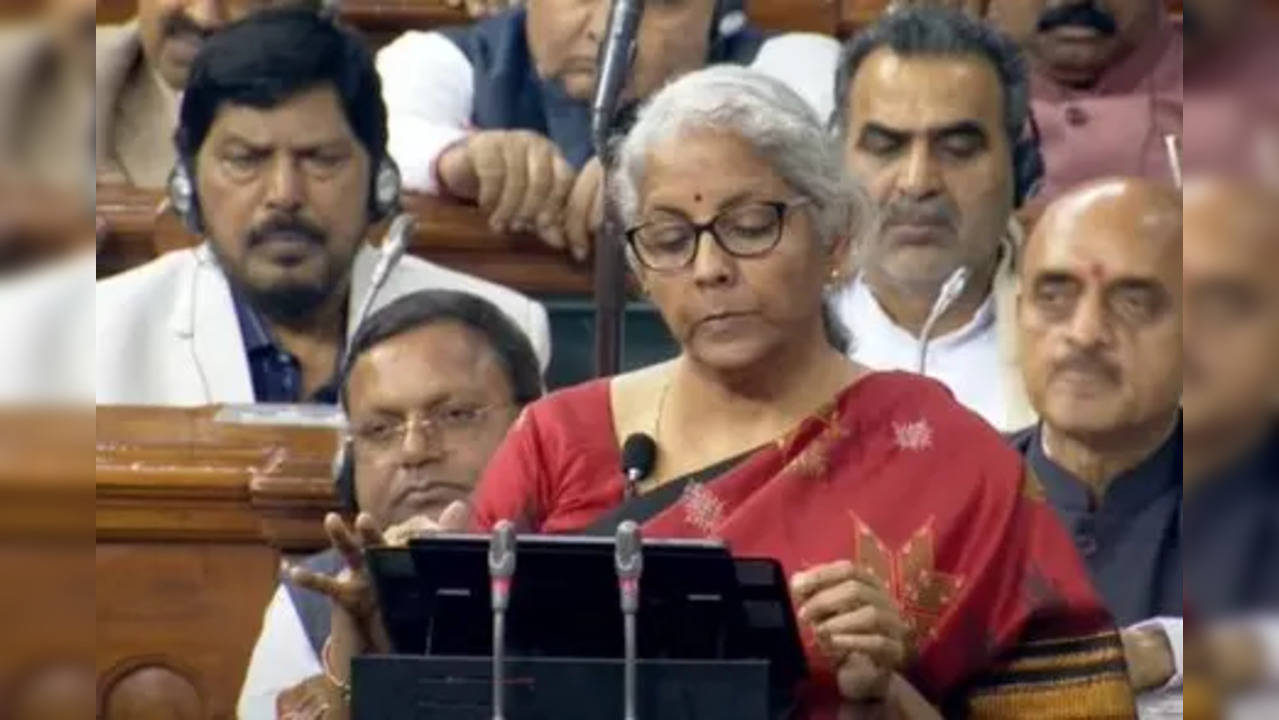

Budget 2023 Summary Of Direct Tax Proposals

Budget 2023 Summary Of Direct Tax Proposals

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per

All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments Every home loan borrower should be aware of

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: You can tailor designs to suit your personal needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Education-related printables at no charge cater to learners of all ages, which makes them an essential tool for parents and educators.

-

Convenience: Fast access various designs and templates is time-saving and saves effort.

Where to Find more Home Loan Interest Rebate Limit In Income Tax

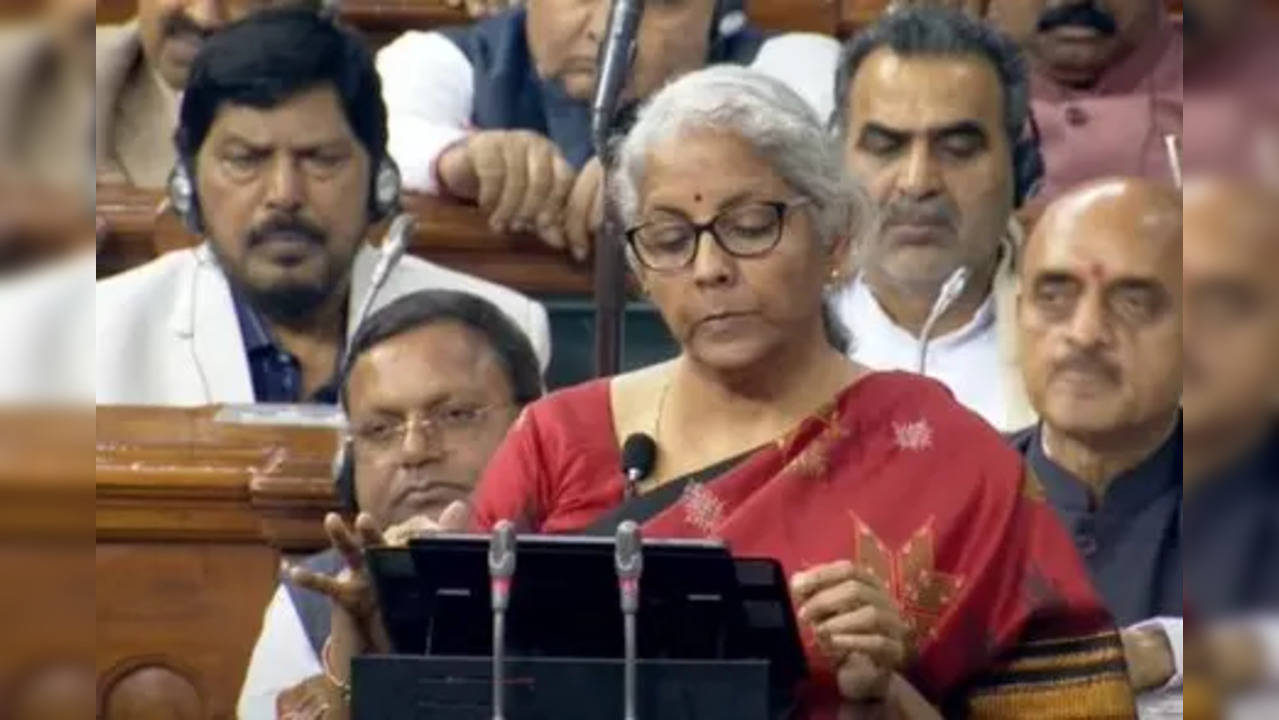

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Section 80EE of the Income Tax Act Under this section you can claim a tax benefit of up to Rs 50 000 on the Home Loan interest component It can be beneficial to identify which components of your Home Loans can be taxed and which can be eligible for a rebate

Now that we've ignited your interest in Home Loan Interest Rebate Limit In Income Tax Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Home Loan Interest Rebate Limit In Income Tax suitable for many objectives.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Home Loan Interest Rebate Limit In Income Tax

Here are some creative ways for you to get the best use of Home Loan Interest Rebate Limit In Income Tax:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Home Loan Interest Rebate Limit In Income Tax are a treasure trove filled with creative and practical information that meet a variety of needs and interest. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the wide world that is Home Loan Interest Rebate Limit In Income Tax today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Loan Interest Rebate Limit In Income Tax truly for free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free printables to make commercial products?

- It is contingent on the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in Home Loan Interest Rebate Limit In Income Tax?

- Some printables may have restrictions in use. Make sure to read the terms and conditions provided by the author.

-

How do I print Home Loan Interest Rebate Limit In Income Tax?

- You can print them at home with the printer, or go to the local print shop for more high-quality prints.

-

What software must I use to open printables for free?

- Most PDF-based printables are available in the format of PDF, which is open with no cost software such as Adobe Reader.

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

X Wallet Interest Rebate For Selected Existing Customers Father s Day

Check more sample of Home Loan Interest Rebate Limit In Income Tax below

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

Fortune India Business News Strategy Finance And Corporate Insight

Mobile App St Paul s Garda Credit Union

How To Write A Letter For Repayment Of Loan Alice Writing

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

New Income Tax Slabs Rate Updates Rebate Limit Increased To Rs 7

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time home buyers under Section 80EE and

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

How To Write A Letter For Repayment Of Loan Alice Writing

Fortune India Business News Strategy Finance And Corporate Insight

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

New Income Tax Slabs Rate Updates Rebate Limit Increased To Rs 7

Annual Dividends Loan Interest Rebates Wexford Credit Union Ltd

Budget 2023 Expectations Common Man Expect 80C Limit Increase Home Loan

Budget 2023 Expectations Common Man Expect 80C Limit Increase Home Loan

Easter Draw Mon 11th April St Paul s Garda Credit Union