In the age of digital, where screens rule our lives The appeal of tangible printed products hasn't decreased. In the case of educational materials project ideas, artistic or simply to add an individual touch to the area, Home Loan Rebate In Income Tax Limit have become a valuable resource. Through this post, we'll take a dive in the world of "Home Loan Rebate In Income Tax Limit," exploring the different types of printables, where they are available, and how they can enrich various aspects of your lives.

Get Latest Home Loan Rebate In Income Tax Limit Below

Home Loan Rebate In Income Tax Limit

Home Loan Rebate In Income Tax Limit -

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can however be made only in the year when the property was purchased

Printables for free include a vast selection of printable and downloadable documents that can be downloaded online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and more. The benefit of Home Loan Rebate In Income Tax Limit is their versatility and accessibility.

More of Home Loan Rebate In Income Tax Limit

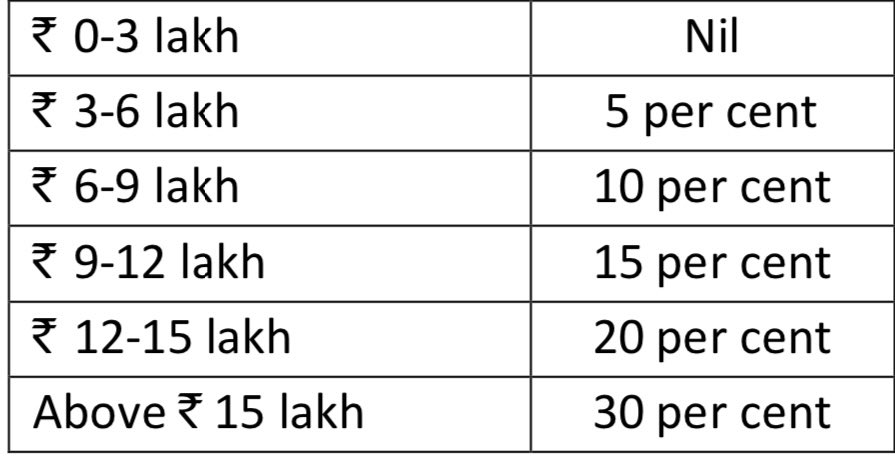

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

You can claim income tax rebates on your ongoing Home Loan by following these steps Calculate the tax deduction that you are eligible for Ensure that you have all the documents required to prove the ownership of the property along with a Home Loan certificate with interest and principal details

If you re repaying Home Loans for multiple properties you can claim an income tax return filing exemption on the principal amount for all loans However the total maximum limit of exemption during Income Tax Return ITR filings remains at INR 1 5 lakhs

Home Loan Rebate In Income Tax Limit have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization This allows you to modify the templates to meet your individual needs be it designing invitations and schedules, or even decorating your house.

-

Educational Value: Education-related printables at no charge are designed to appeal to students from all ages, making these printables a powerful device for teachers and parents.

-

Simple: The instant accessibility to an array of designs and templates is time-saving and saves effort.

Where to Find more Home Loan Rebate In Income Tax Limit

Stock Loan Rebate Definition

Stock Loan Rebate Definition

The maximum tax deduction allowed under Section 80C for principal repayment of your Home Loan is Rs 1 5 Lakh This is the net exemption and also includes rebates incurred through PPF accounts tax saving funds equity mutual funds National Savings Certificate Senior Citizens Saving Scheme etc

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a

Since we've got your interest in printables for free We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Home Loan Rebate In Income Tax Limit suitable for many motives.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing Home Loan Rebate In Income Tax Limit

Here are some innovative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Loan Rebate In Income Tax Limit are an abundance filled with creative and practical information that cater to various needs and preferences. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the vast collection that is Home Loan Rebate In Income Tax Limit today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printables to make commercial products?

- It's based on specific terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Home Loan Rebate In Income Tax Limit?

- Some printables may have restrictions in use. You should read the terms and conditions offered by the author.

-

How do I print Home Loan Rebate In Income Tax Limit?

- You can print them at home with your printer or visit the local print shops for better quality prints.

-

What program is required to open printables for free?

- The majority of printables are with PDF formats, which can be opened using free programs like Adobe Reader.

Home Loan Tax Rebate

Latest Income Tax Rebate On Home Loan 2023

Check more sample of Home Loan Rebate In Income Tax Limit below

Latest Income Tax Rebate On Home Loan 2023

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Priyanshi Sharma On Twitter Budget2023 Exemption For Rebate In

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Interim Budget 2019 Income Tax Limit Raised No Tax For People Earning

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can however be made only in the year when the property was purchased

https://cleartax.in/s/section-80eea-deduction-affordable-housing

If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal repayment up to Rs 1 5 lakh under Section 80C

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can however be made only in the year when the property was purchased

If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal repayment up to Rs 1 5 lakh under Section 80C

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Interim Budget 2019 Income Tax Limit Raised No Tax For People Earning

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

New Income Tax Slabs Rate Updates Rebate Limit Increased To Rs 7

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

How To Deal With An Income Tax Notice Wealthzi