In this age of electronic devices, in which screens are the norm The appeal of tangible printed objects isn't diminished. Be it for educational use project ideas, artistic or simply to add the personal touch to your area, Home Loan Rebate In Income Tax New Regime are now a vital resource. In this article, we'll take a dive in the world of "Home Loan Rebate In Income Tax New Regime," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Home Loan Rebate In Income Tax New Regime Below

Home Loan Rebate In Income Tax New Regime

Home Loan Rebate In Income Tax New Regime -

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

With revisions in tax policies applicants now face critical decisions regarding which income tax regime to opt for and its implications on home loan repayments Understanding these changes is crucial for making informed decisions

Printables for free cover a broad selection of printable and downloadable resources available online for download at no cost. They come in many forms, like worksheets templates, coloring pages, and more. The benefit of Home Loan Rebate In Income Tax New Regime is in their versatility and accessibility.

More of Home Loan Rebate In Income Tax New Regime

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

The new tax regime proposes that taxpayers servicing the home loan for a self occupied property can no longer claim income tax benefit on interest payment under Section 24 of the ITA Thus such a rule reduces your tax saving potential by up to Rs 2 lakh

As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if the taxable income is less than or equal to Rs 7 lakhs

Home Loan Rebate In Income Tax New Regime have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: We can customize printables to your specific needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Value These Home Loan Rebate In Income Tax New Regime provide for students of all ages, which makes them an essential tool for teachers and parents.

-

Affordability: Quick access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Home Loan Rebate In Income Tax New Regime

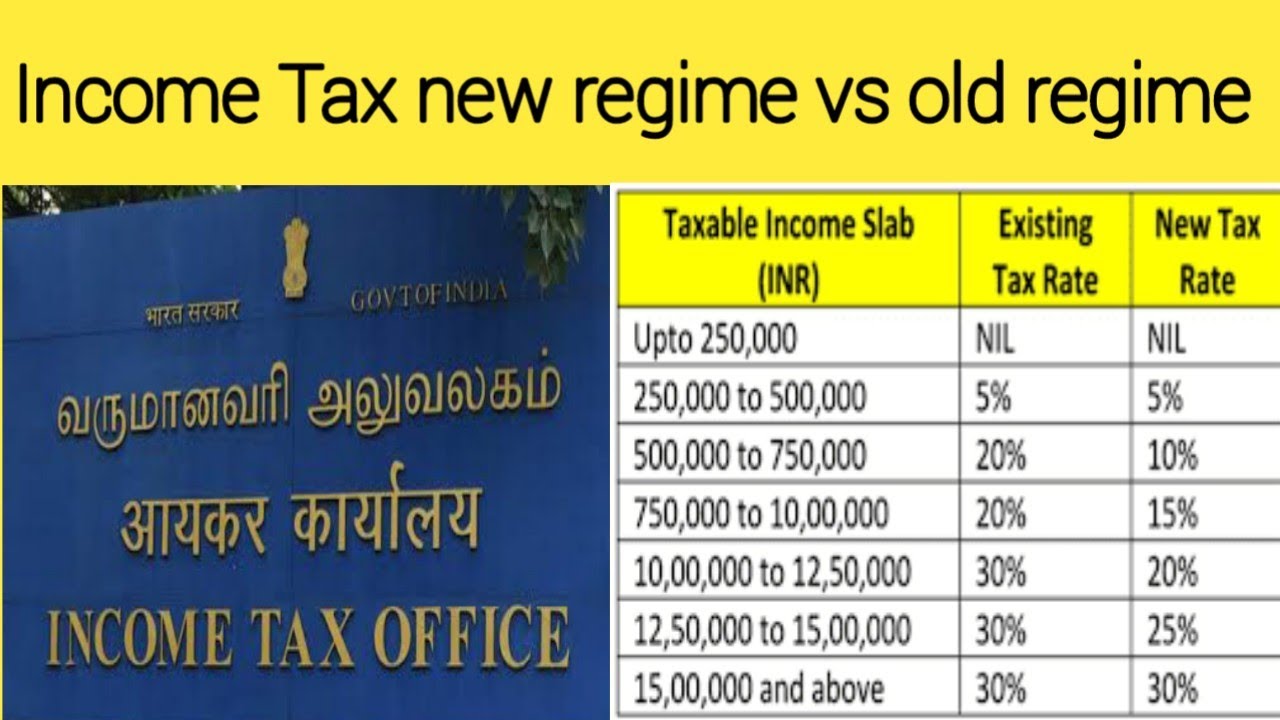

Income Tax New Regime Vs Old Regime YouTube

Income Tax New Regime Vs Old Regime YouTube

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Tax advantages encompass exempt employer contributions to PF and NPS deductible interest on home loan for let out property and tax free reimbursements New tax regime simplifies tax

Now that we've piqued your curiosity about Home Loan Rebate In Income Tax New Regime Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Home Loan Rebate In Income Tax New Regime for a variety objectives.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Home Loan Rebate In Income Tax New Regime

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Home Loan Rebate In Income Tax New Regime are a treasure trove with useful and creative ideas which cater to a wide range of needs and preferences. Their accessibility and flexibility make them a wonderful addition to your professional and personal life. Explore the many options of Home Loan Rebate In Income Tax New Regime now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can download and print these documents for free.

-

Can I use the free templates for commercial use?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with Home Loan Rebate In Income Tax New Regime?

- Certain printables could be restricted on use. Make sure to read these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for better quality prints.

-

What software do I require to view printables for free?

- A majority of printed materials are in PDF format, which is open with no cost software, such as Adobe Reader.

Latest Income Tax Rebate On Home Loan 2023

Income Tax New Regime Vs Old Regime shorts budget2023 income

Check more sample of Home Loan Rebate In Income Tax New Regime below

Home Loan Tax Rebate

Latest Income Tax Rebate On Home Loan 2023

How To Save Income Tax Tax Saving Income Tax New Regime Old Regime

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

https://www.godrejcapital.com › media-blog › knowledge...

With revisions in tax policies applicants now face critical decisions regarding which income tax regime to opt for and its implications on home loan repayments Understanding these changes is crucial for making informed decisions

https://www.incometax.gov.in › iec › foportal › sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500

With revisions in tax policies applicants now face critical decisions regarding which income tax regime to opt for and its implications on home loan repayments Understanding these changes is crucial for making informed decisions

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

Latest Income Tax Rebate On Home Loan 2023

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

Income Tax Slab For The A Y 2024 25

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New

How To Choose Between The New And Old Income Tax Regimes Chandan