Today, where screens dominate our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. For educational purposes for creative projects, simply to add a personal touch to your home, printables for free can be an excellent source. Through this post, we'll dive in the world of "Home Office Tax Deduction Calculator," exploring the different types of printables, where they are, and how they can be used to enhance different aspects of your life.

Get Latest Home Office Tax Deduction Calculator Below

Home Office Tax Deduction Calculator

Home Office Tax Deduction Calculator -

If you have wage income you will automatically receive a 750 deduction The Tax Administration makes the deduction on your behalf However the deduction may not exceed your wage income amount If you work from home the calculation of a home office deduction is generally formula based

It merely simplifies the calculation and recordkeeping requirements of the allowable deduction Highlights of the simplified option Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable home related itemized deductions claimed in full on Schedule A For example Mortgage interest real

Home Office Tax Deduction Calculator cover a large assortment of printable resources available online for download at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages and much more. The great thing about Home Office Tax Deduction Calculator lies in their versatility as well as accessibility.

More of Home Office Tax Deduction Calculator

Home Office Tax Deduction For Small Businesses MileIQ

Home Office Tax Deduction For Small Businesses MileIQ

How to calculate your home office tax deduction You can determine the value of your home office deduction using one of two methods Simplified method With the simplified option

Home office calculator Our Home office calculator will take between 5 and 20 minutes to use What you can do with this calculator This calculator covers the 2013 14 to 2022 23 income years You can use either the revised fixed rate method or actual cost method to work out your deduction

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization You can tailor the templates to meet your individual needs when it comes to designing invitations and schedules, or decorating your home.

-

Educational value: Educational printables that can be downloaded for free can be used by students from all ages, making them a vital source for educators and parents.

-

Affordability: You have instant access various designs and templates saves time and effort.

Where to Find more Home Office Tax Deduction Calculator

The Home Office Deduction TurboTax Tax Tips Videos

The Home Office Deduction TurboTax Tax Tips Videos

If you qualify there are two ways to calculate the home office deduction Under the actual expense method you essentially multiply the expenses of operating your home by the

Share If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area You need to figure out the percentage of your home devoted to your business activities utilities repairs and depreciation

Now that we've ignited your interest in printables for free Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Home Office Tax Deduction Calculator to suit a variety of uses.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad variety of topics, everything from DIY projects to planning a party.

Maximizing Home Office Tax Deduction Calculator

Here are some creative ways of making the most of Home Office Tax Deduction Calculator:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Home Office Tax Deduction Calculator are an abundance of innovative and useful resources catering to different needs and pursuits. Their availability and versatility make them an essential part of your professional and personal life. Explore the endless world of Home Office Tax Deduction Calculator to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Office Tax Deduction Calculator truly free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I download free printables for commercial uses?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright violations with Home Office Tax Deduction Calculator?

- Certain printables could be restricted in use. Be sure to review these terms and conditions as set out by the designer.

-

How can I print Home Office Tax Deduction Calculator?

- Print them at home using your printer or visit a print shop in your area for high-quality prints.

-

What program must I use to open Home Office Tax Deduction Calculator?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadshe

![]()

Who Can Take The Home Office Tax Deduction

Check more sample of Home Office Tax Deduction Calculator below

Does Your Workstation Qualify For A Home Office Tax Deduction Xidax

Home Office Tax Deduction Calculator Uk

Home Office Tax Deduction Guide Balboa Capital

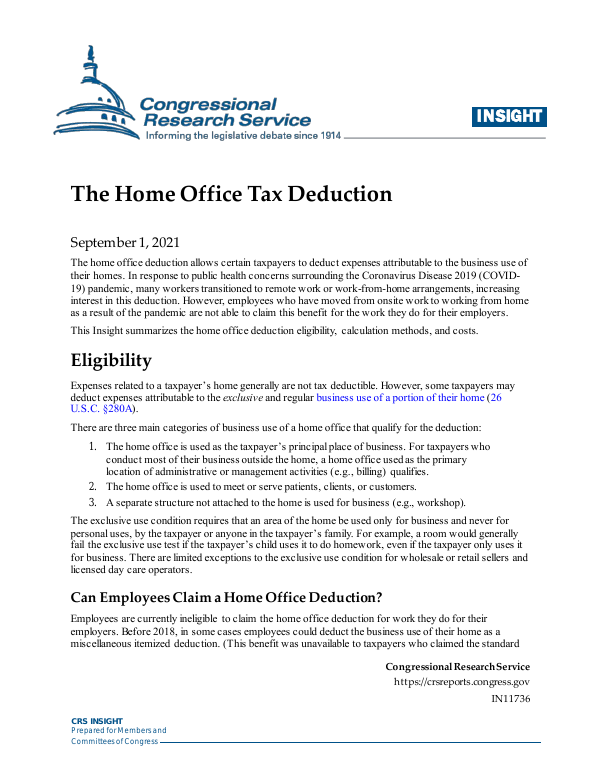

The Home Office Tax Deduction EveryCRSReport

What Is The Home Office Tax Deduction

Home Office Tax Deduction In 2022 New Updates TaxAct

www.irs.gov/.../simplified-option-for-home-office-deduction

It merely simplifies the calculation and recordkeeping requirements of the allowable deduction Highlights of the simplified option Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable home related itemized deductions claimed in full on Schedule A For example Mortgage interest real

www.forbes.com/advisor/taxes/how-to-deduct...

There are two options available to claim the home office deduction the simplified option and the regular method The simplified option is a quick and easy way to determine your home

It merely simplifies the calculation and recordkeeping requirements of the allowable deduction Highlights of the simplified option Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable home related itemized deductions claimed in full on Schedule A For example Mortgage interest real

There are two options available to claim the home office deduction the simplified option and the regular method The simplified option is a quick and easy way to determine your home

The Home Office Tax Deduction EveryCRSReport

Home Office Tax Deduction Calculator Uk

What Is The Home Office Tax Deduction

Home Office Tax Deduction In 2022 New Updates TaxAct

Insurance Company Home Office Tax Deduction

What Method Should I Use To Calculate My Home Office Tax Deduction

What Method Should I Use To Calculate My Home Office Tax Deduction

Renovate Home Office Tax Deduction YouTube