Today, when screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes such as creative projects or simply adding a personal touch to your area, Homestead Rebate And Property Tax Deduction can be an excellent source. Here, we'll take a dive to the depths of "Homestead Rebate And Property Tax Deduction," exploring the different types of printables, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Homestead Rebate And Property Tax Deduction Below

Homestead Rebate And Property Tax Deduction

Homestead Rebate And Property Tax Deduction -

Web Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction Only a

Web A It s not as straightforward as you might expect The Homestead Rebate is something the IRS would call an itemized deduction recovery said Laurie Wolfe a certified financial

Homestead Rebate And Property Tax Deduction cover a large range of downloadable, printable material that is available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and many more. The benefit of Homestead Rebate And Property Tax Deduction is in their variety and accessibility.

More of Homestead Rebate And Property Tax Deduction

2021 2023 Form VT HS 122 HI 144 Fill Online Printable Fillable

2021 2023 Form VT HS 122 HI 144 Fill Online Printable Fillable

Web 31 mars 2023 nbsp 0183 32 For the 2022 tax year the standard deduction ranges from 12 950 to 25 900 for joint filers Deduct your property taxes in the year you pay them Sounds simple but it can be tricky

Web 15 mars 2022 nbsp 0183 32 In 2006 the IRS issued guidance specifically for New Jersey residents in IRS News Release No NJ 2206 03 stating that New Jersey taxpayers would report the

The Homestead Rebate And Property Tax Deduction have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Benefits: Downloads of educational content for free provide for students of all ages, making the perfect instrument for parents and teachers.

-

Easy to use: instant access a variety of designs and templates saves time and effort.

Where to Find more Homestead Rebate And Property Tax Deduction

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet

Web 24 janv 2020 nbsp 0183 32 The idea is to issue property tax exemptions to qualified homeowners again those owners suffering a disability loss of a spouse or personal bankruptcy thus saving them money on potentially

Web Homestead Deduction and Senior Citizen or Disabled Property Owner Tax Relief This benefit reduces your real property s assessed value by 84 000 savings of 714 00

Now that we've piqued your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Homestead Rebate And Property Tax Deduction for a variety goals.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide spectrum of interests, everything from DIY projects to planning a party.

Maximizing Homestead Rebate And Property Tax Deduction

Here are some unique ways in order to maximize the use of Homestead Rebate And Property Tax Deduction:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home for the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Homestead Rebate And Property Tax Deduction are an abundance of innovative and useful resources for a variety of needs and interest. Their accessibility and versatility make them a valuable addition to both professional and personal life. Explore the wide world of Homestead Rebate And Property Tax Deduction today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download these files for free.

-

Does it allow me to use free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Homestead Rebate And Property Tax Deduction?

- Some printables may contain restrictions on usage. Always read the conditions and terms of use provided by the creator.

-

How do I print Homestead Rebate And Property Tax Deduction?

- Print them at home with printing equipment or visit a local print shop to purchase top quality prints.

-

What program do I require to view printables free of charge?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software, such as Adobe Reader.

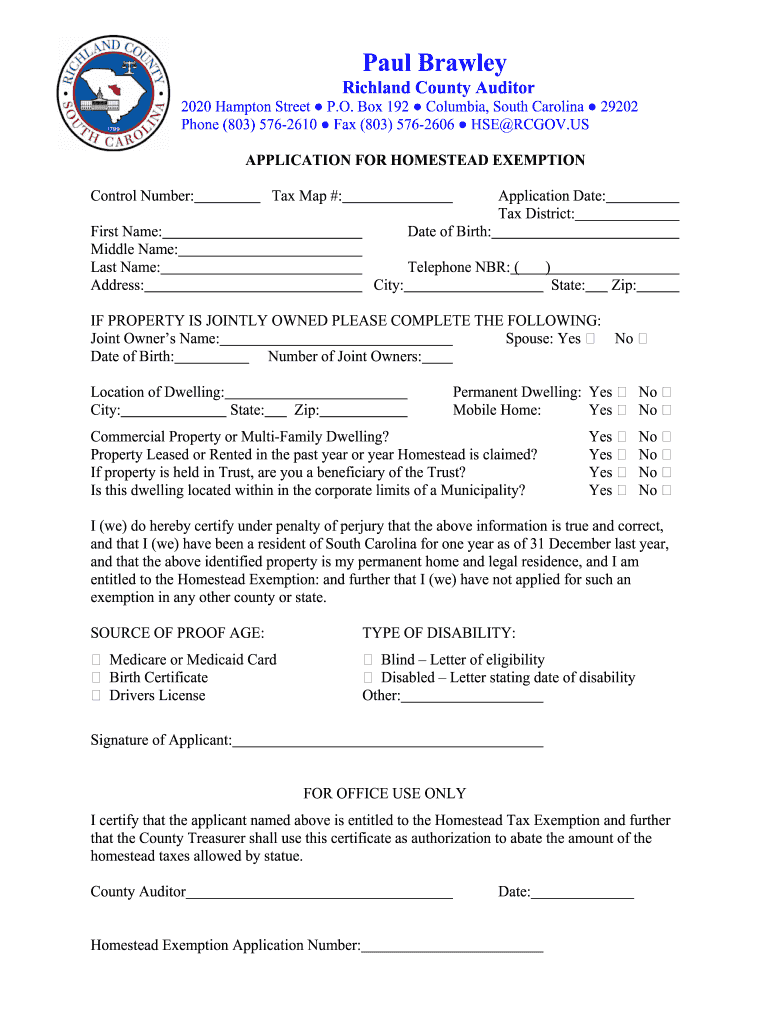

Berkeley County Property Tax Homestead Exemption ZDOLLZ ExemptForm

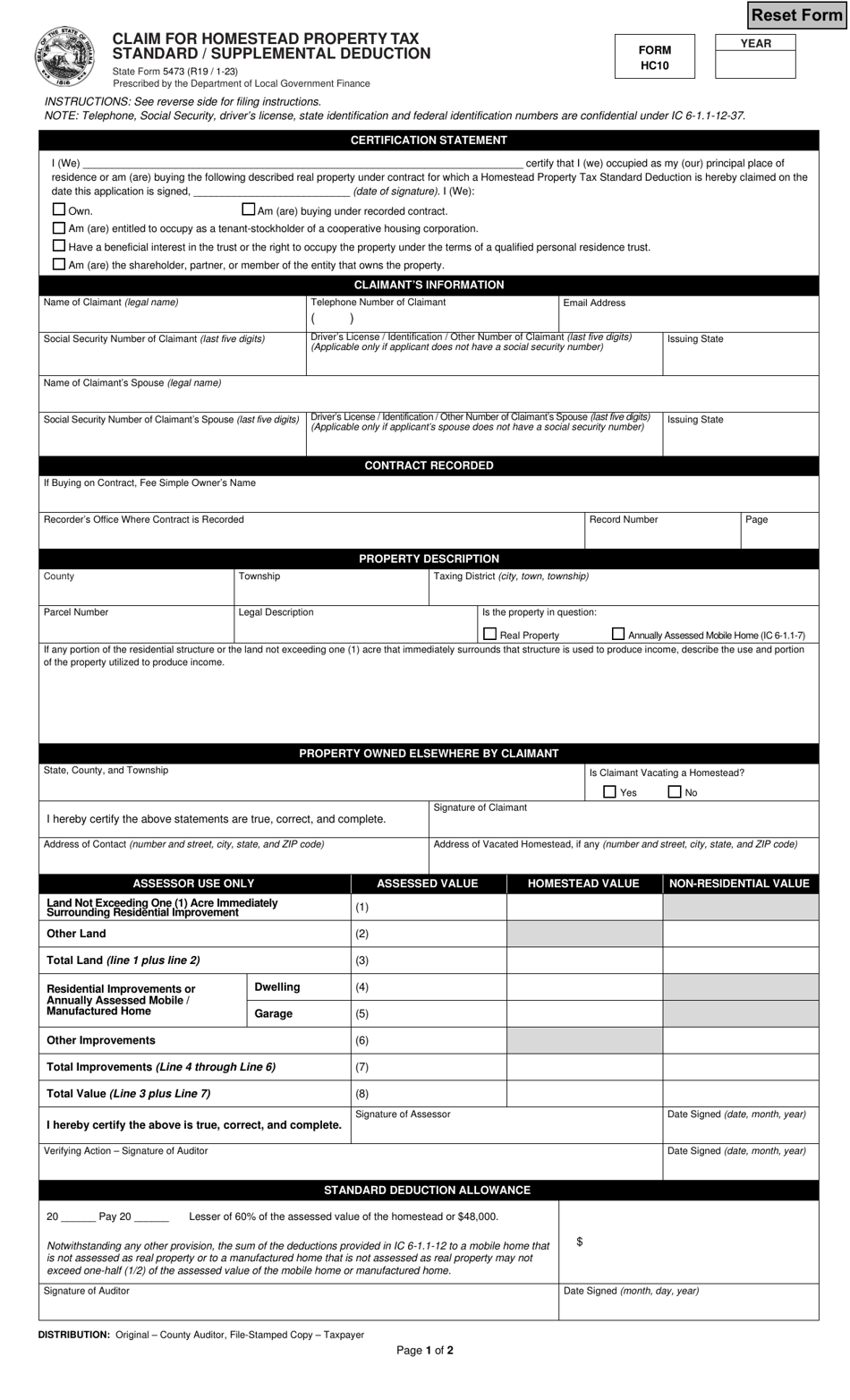

State Form 5473 HC10 Download Fillable PDF Or Fill Online Claim For

Check more sample of Homestead Rebate And Property Tax Deduction below

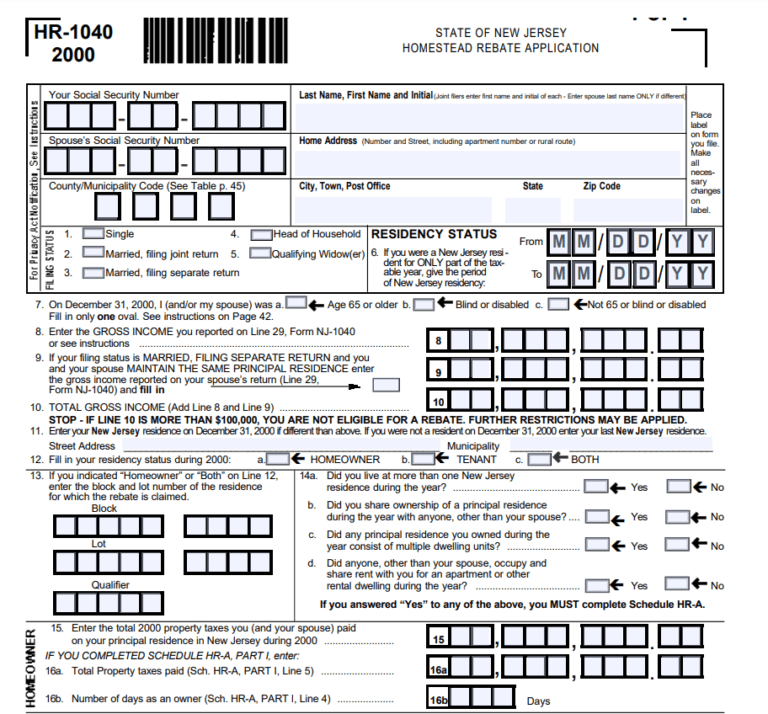

File Nj Homestead Rebate Form Online Application Printable Rebate Form

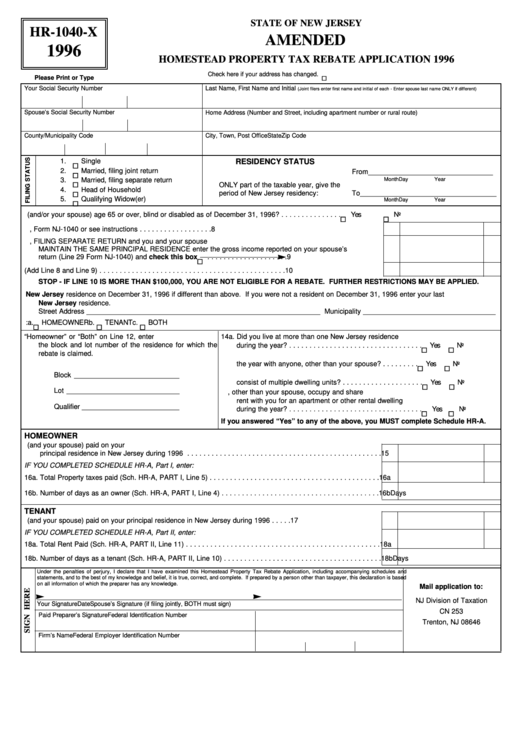

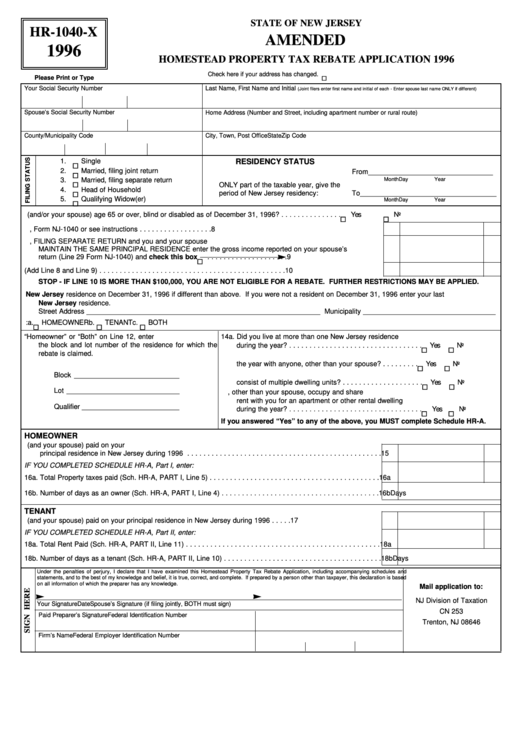

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Property Tax Rebate New York State Printable Rebate Form

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

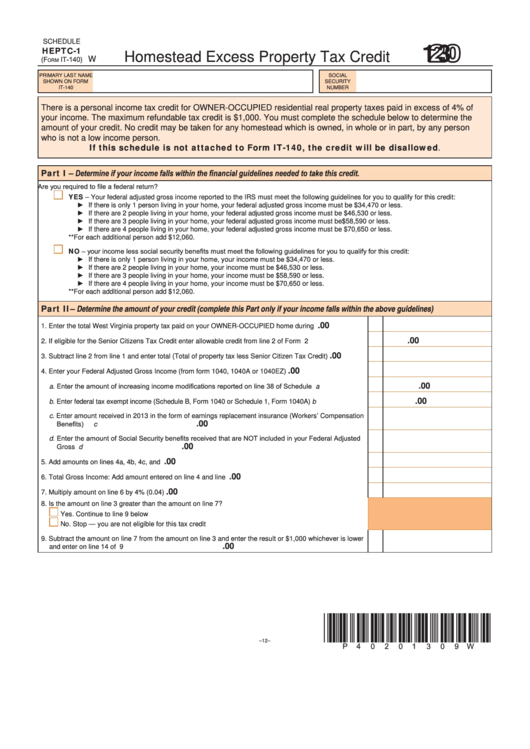

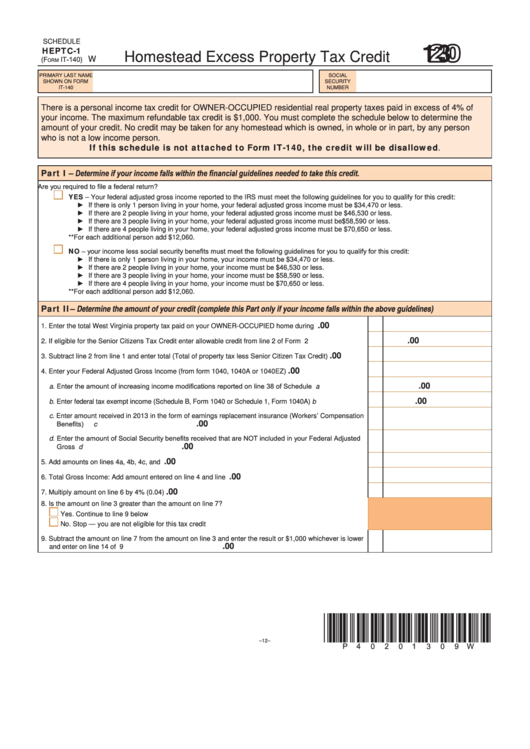

Fillable Schedule Heptc 1 Form It 140 Homestead Excess Property Tax

https://njmoneyhelp.com/2019/03/happens-homestead-rebate-tax-return

Web A It s not as straightforward as you might expect The Homestead Rebate is something the IRS would call an itemized deduction recovery said Laurie Wolfe a certified financial

https://en.wikipedia.org/wiki/Homestead_exemption

A homestead exemption is most often on only a fixed monetary amount such as the first 50 000 of the assessed value The remainder is taxed at the normal rate A home valued at 150 000 would then be taxed on only 100 000 and a home valued at 75 000 would then be taxed on only 25 000 The exemption is generally intended to turn the property tax into a progressive tax In some plac

Web A It s not as straightforward as you might expect The Homestead Rebate is something the IRS would call an itemized deduction recovery said Laurie Wolfe a certified financial

A homestead exemption is most often on only a fixed monetary amount such as the first 50 000 of the assessed value The remainder is taxed at the normal rate A home valued at 150 000 would then be taxed on only 100 000 and a home valued at 75 000 would then be taxed on only 25 000 The exemption is generally intended to turn the property tax into a progressive tax In some plac

Property Tax Rebate New York State Printable Rebate Form

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Fillable Schedule Heptc 1 Form It 140 Homestead Excess Property Tax

Real Estate Tax Deduction To Mine And Beyond

Pin On Realtor Tips

Pin On Realtor Tips

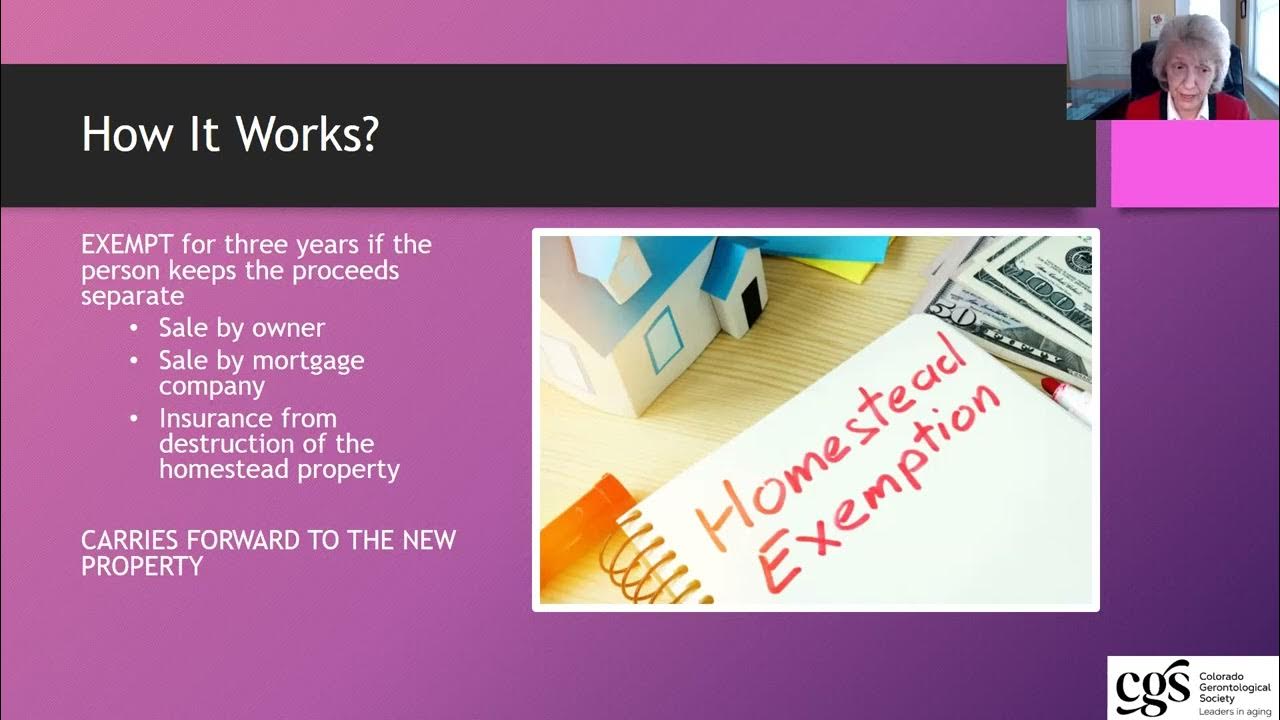

Aging In Place Property Taxes Homestead Exemptions Rebates And