In this day and age where screens rule our lives and the appeal of physical printed material hasn't diminished. No matter whether it's for educational uses such as creative projects or simply adding an individual touch to the area, House Rent Allowance Deduction Under Section can be an excellent source. Through this post, we'll dive into the world "House Rent Allowance Deduction Under Section," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest House Rent Allowance Deduction Under Section Below

House Rent Allowance Deduction Under Section

House Rent Allowance Deduction Under Section -

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

House Rent Allowance Deduction Under Section encompass a wide array of printable materials online, at no cost. These printables come in different forms, like worksheets templates, coloring pages, and many more. The beauty of House Rent Allowance Deduction Under Section is in their variety and accessibility.

More of House Rent Allowance Deduction Under Section

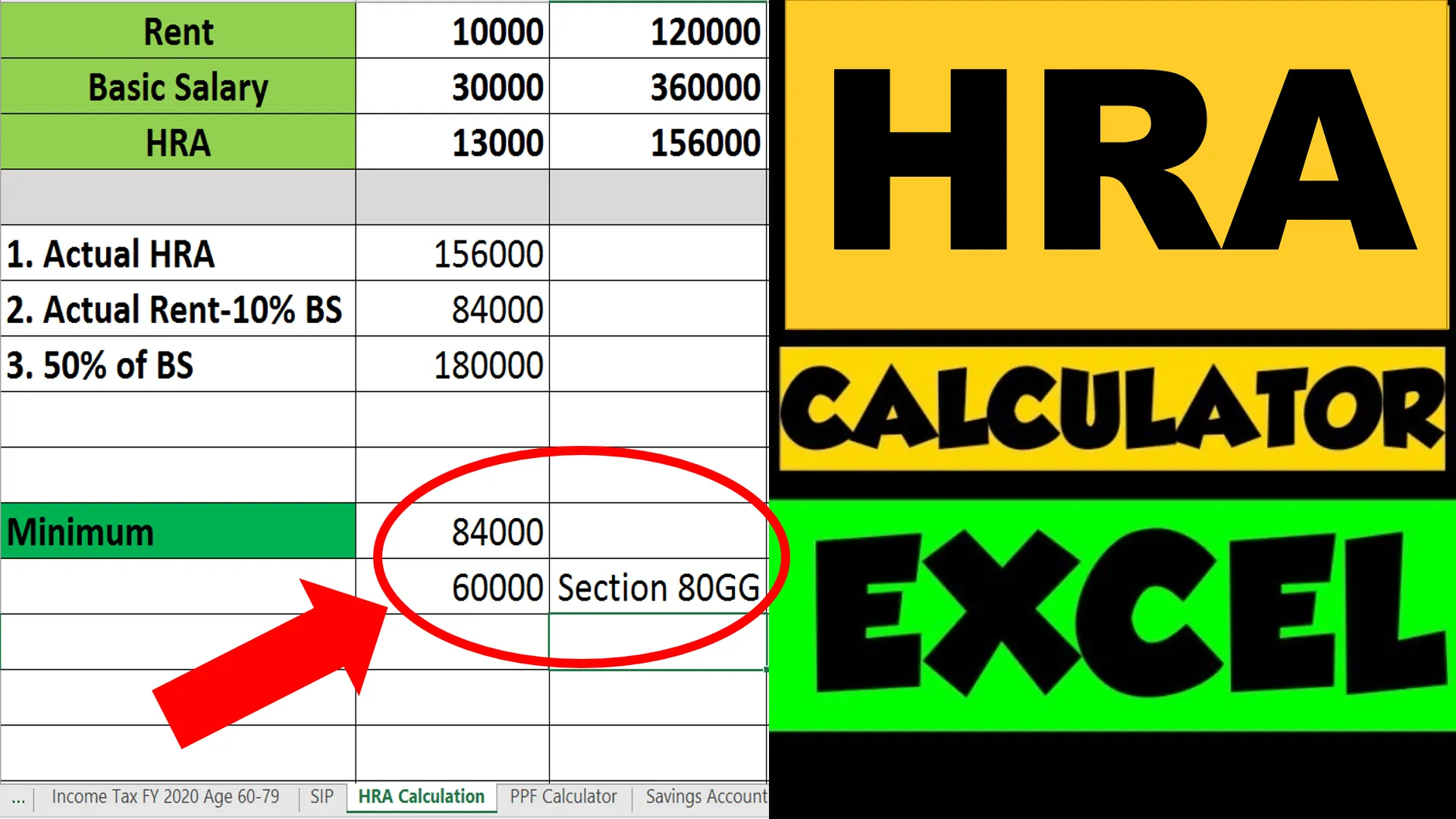

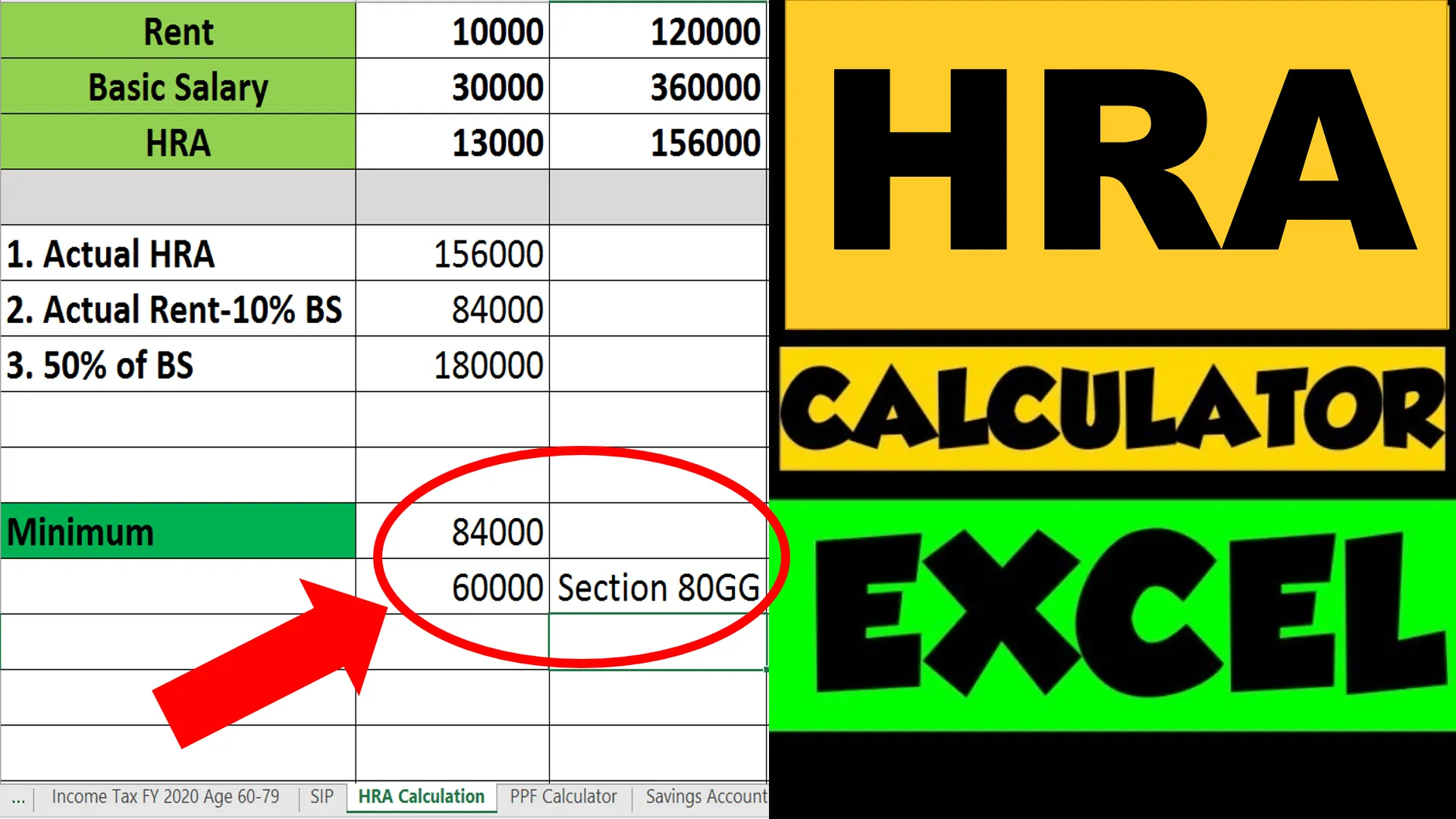

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

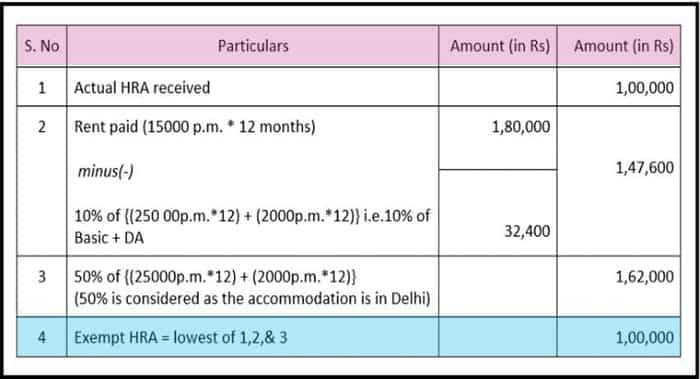

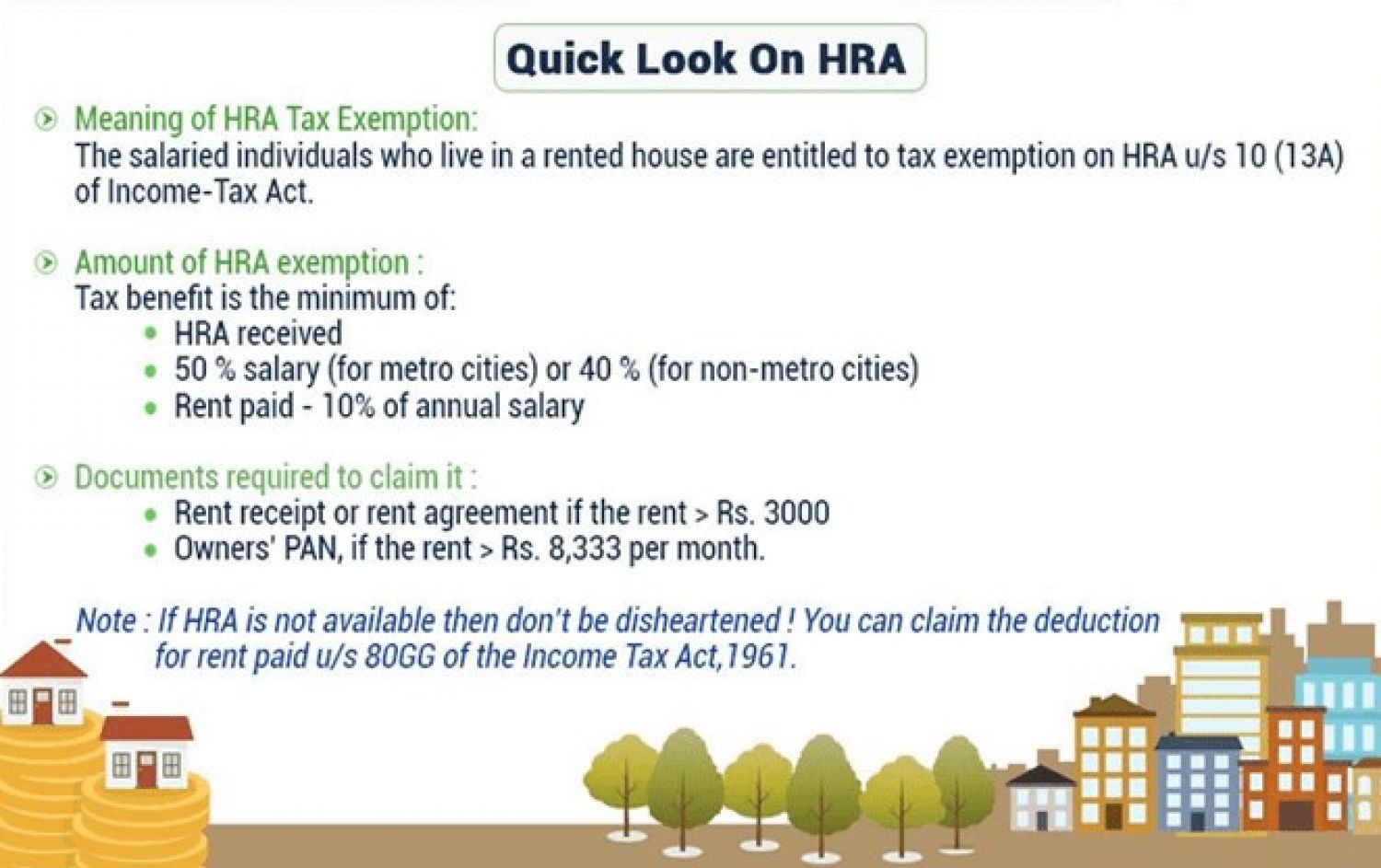

A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA

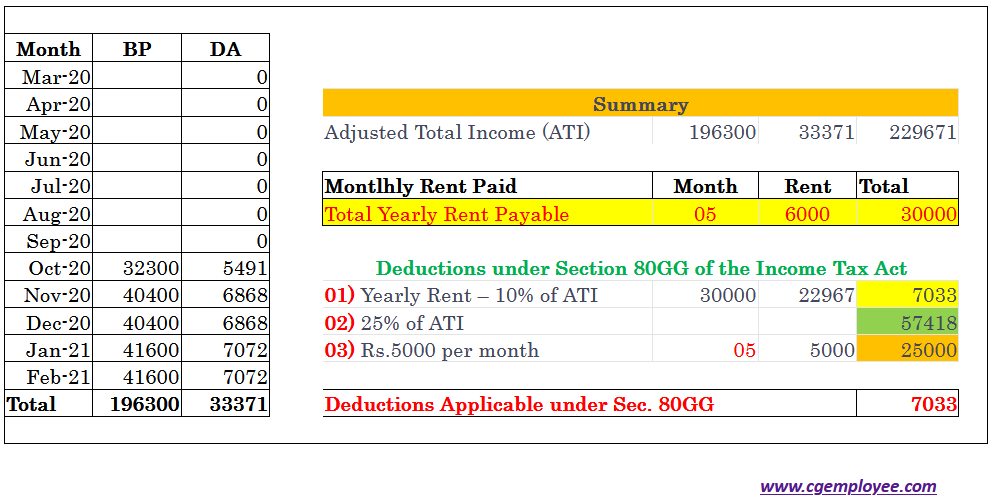

If you are paying rent for your residential accommodation but do not receive House Rent Allowance HRA from your employer you can still benefit from a deduction under Section 80GG To claim this deduction

House Rent Allowance Deduction Under Section have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: You can tailor printables to fit your particular needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: These House Rent Allowance Deduction Under Section can be used by students from all ages, making these printables a powerful tool for teachers and parents.

-

Convenience: immediate access a myriad of designs as well as templates can save you time and energy.

Where to Find more House Rent Allowance Deduction Under Section

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee The Exemption on HRA is covered

Under Section 80GG the deduction is allowed to an individual who pays rent without receiving any House Rent Allowance from an employer Hence check the Salary Slip

Now that we've ignited your interest in printables for free We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with House Rent Allowance Deduction Under Section for all needs.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to planning a party.

Maximizing House Rent Allowance Deduction Under Section

Here are some ways in order to maximize the use use of House Rent Allowance Deduction Under Section:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

House Rent Allowance Deduction Under Section are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them a valuable addition to both personal and professional life. Explore the vast world of House Rent Allowance Deduction Under Section and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are House Rent Allowance Deduction Under Section really are they free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printing templates for commercial purposes?

- It's dependent on the particular rules of usage. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations on their use. Be sure to check the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit an in-store print shop to get better quality prints.

-

What software do I need in order to open printables free of charge?

- The majority are printed in PDF format. These can be opened using free software such as Adobe Reader.

Income Tax Savings HRA

Section 80GG House Rent Allowance HRA Deduction For AY 2017 18

Check more sample of House Rent Allowance Deduction Under Section below

Calculating Exemption U s 10 13 For House Rent Allowance Income Tax

How To Calculate HRA With EXAMPLES House Rent Allowance DEDUCTION

House Rent Allowance Under Section 10 13A Detailed Guide

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

House Rent Allowance Under Section 10 13A Calculation And Exemption

https://taxadda.com/house-rent-allowance-hra-section-10-13a

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

https://www.etmoney.com/.../house-ren…

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

How To Calculate HRA With EXAMPLES House Rent Allowance DEDUCTION

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

House Rent Allowance Under Section 10 13A Calculation And Exemption

Section 80GG House Rent Allowance

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA Exemption Calculator In Excel House Rent Allowance Calculation

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19