Today, where screens have become the dominant feature of our lives, the charm of tangible printed products hasn't decreased. Whether it's for educational purposes as well as creative projects or simply adding the personal touch to your home, printables for free are now a useful resource. Through this post, we'll take a dive into the world "House Rent Received Deduction In Income Tax," exploring what they are, where they are, and how they can add value to various aspects of your lives.

Get Latest House Rent Received Deduction In Income Tax Below

House Rent Received Deduction In Income Tax

House Rent Received Deduction In Income Tax -

If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80

If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards

Printables for free cover a broad collection of printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages, and many more. The attraction of printables that are free is in their versatility and accessibility.

More of House Rent Received Deduction In Income Tax

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for these

What is HRA House Rent Allowance Full Form Meaning HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost

House Rent Received Deduction In Income Tax have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: You can tailor printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages, which makes them a valuable tool for teachers and parents.

-

Convenience: Fast access the vast array of design and templates is time-saving and saves effort.

Where to Find more House Rent Received Deduction In Income Tax

How To Calculate Standard Deduction In Income Tax Act Scripbox

How To Calculate Standard Deduction In Income Tax Act Scripbox

Generally the amount received from renting out residential properties is classified under income from house property The tax on rental income is determined after deducting

An individual paying rent for a furnished unfurnished accommodation can claim the deduction for the rent paid under Section 80 GG of the Income tax Act provided he is not paid HRA as a part of his salary by

Since we've got your interest in House Rent Received Deduction In Income Tax Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with House Rent Received Deduction In Income Tax for all applications.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast variety of topics, everything from DIY projects to party planning.

Maximizing House Rent Received Deduction In Income Tax

Here are some ideas create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

House Rent Received Deduction In Income Tax are an abundance of practical and innovative resources for a variety of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast array of House Rent Received Deduction In Income Tax today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can print and download these documents for free.

-

Can I make use of free printables to make commercial products?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using House Rent Received Deduction In Income Tax?

- Certain printables might have limitations on their use. Always read the conditions and terms of use provided by the creator.

-

How do I print House Rent Received Deduction In Income Tax?

- You can print them at home using an printer, or go to a local print shop to purchase superior prints.

-

What program do I need to open printables free of charge?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

Know Income Tax Deduction For HRA House Rent Allowance

Does My Corporation Qualify For The Dividends Received Deduction

Check more sample of House Rent Received Deduction In Income Tax below

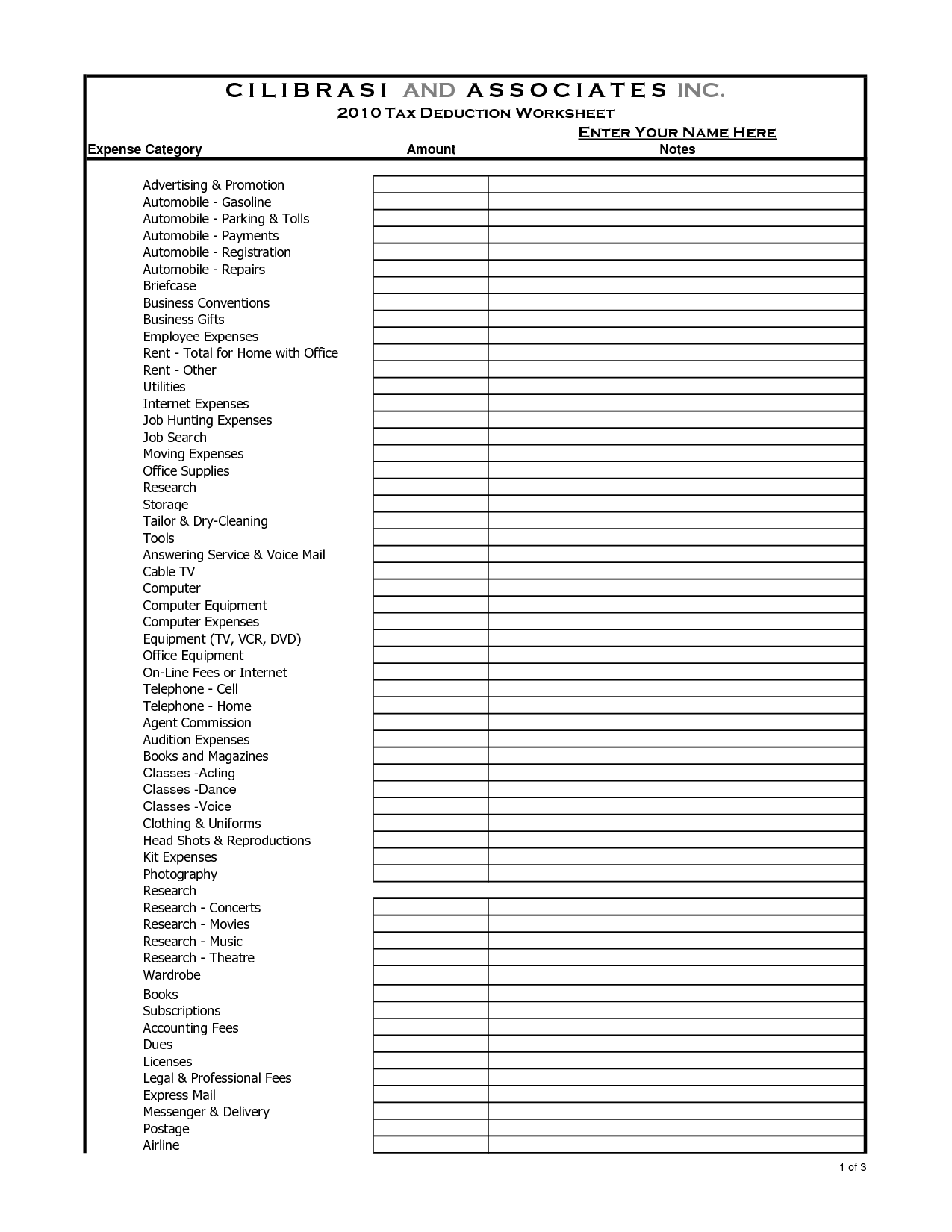

16 Tax Organizer Worksheet Worksheeto

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Is Your Corporation Eligible For The Dividends received Deduction

Is Your Corporation Eligible For The Dividends received Deduction

Make Optimum Use Of The Dividend Received Deduction DRD KBC Banking

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

https://cleartax.in/s/claim-deduction-un…

If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards

https://www.vero.fi/en/individuals/property/rental_income/deductions

Regarding rental of an apartment or house you can claim deductions for the direct expenses of renting The tax rules require that you claim the expenses the year when

If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards

Regarding rental of an apartment or house you can claim deductions for the direct expenses of renting The tax rules require that you claim the expenses the year when

Is Your Corporation Eligible For The Dividends received Deduction

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Make Optimum Use Of The Dividend Received Deduction DRD KBC Banking

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

Does Your Business Qualify For The Dividends Received Deduction

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Section 80GG Deduction On Rent Paid Yadnya Investment Academy