In a world where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. Whether it's for educational purposes project ideas, artistic or simply to add some personal flair to your home, printables for free can be an excellent resource. This article will dive into the world "House Tax Rebate Under Section," exploring their purpose, where they are available, and what they can do to improve different aspects of your life.

Get Latest House Tax Rebate Under Section Below

House Tax Rebate Under Section

House Tax Rebate Under Section - Home Loan Tax Benefit Under Section, House Loan Rebate Under Section, How To Get House Rent Rebate In Income Tax, Income Tax Rebate On House Rent, How To Calculate House Rent Rebate In Income Tax

Web 31 mai 2022 nbsp 0183 32 First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there are a few conditions to be aware of To

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Printables for free include a vast collection of printable materials available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and many more. The great thing about House Tax Rebate Under Section lies in their versatility as well as accessibility.

More of House Tax Rebate Under Section

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Web 9 f 233 vr 2018 nbsp 0183 32 You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000 The total amount eligible for a tax

Web If a house owner fails to meet any of the below mentioned conditions for the Rs 2 Lakhs tax rebate then their income tax rebate on the home loan interest cannot be more than

House Tax Rebate Under Section have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Personalization They can make designs to suit your personal needs whether it's making invitations planning your schedule or decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages. This makes them a vital tool for parents and educators.

-

Easy to use: Fast access a variety of designs and templates is time-saving and saves effort.

Where to Find more House Tax Rebate Under Section

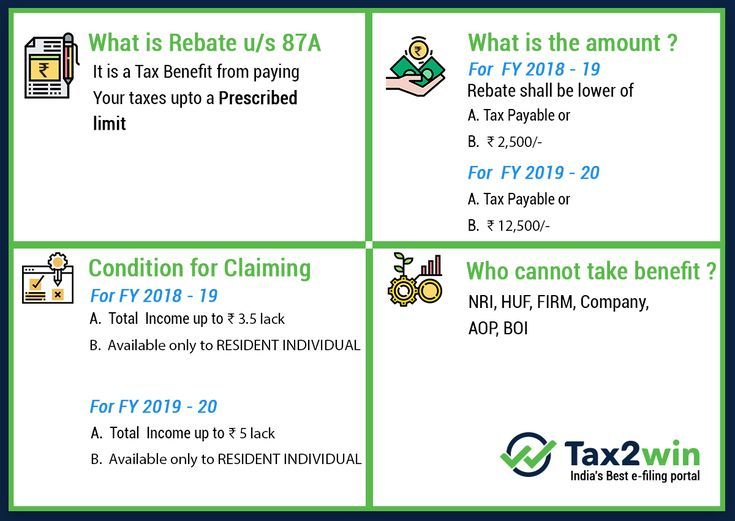

Section 87A Tax Rebate Under Section 87A Rebates Financial

Section 87A Tax Rebate Under Section 87A Rebates Financial

Web 10 mars 2021 nbsp 0183 32 How can I claim tax benefits under section 80EEA Individual must satisfy certain conditions to be eligible to claim benefit under section 80EEA These include a The home loan must be taken

Web 7 mars 2023 nbsp 0183 32 Deductions Under Section 24 There are two types of deductions for the property owners who are liable to pay income tax under Section 24 as explained below Standard Deduction The house

We hope we've stimulated your interest in House Tax Rebate Under Section Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of goals.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing House Tax Rebate Under Section

Here are some new ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

House Tax Rebate Under Section are a treasure trove of creative and practical resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast array of House Tax Rebate Under Section to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can download and print these files for free.

-

Are there any free printables for commercial uses?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with House Tax Rebate Under Section?

- Certain printables may be subject to restrictions on their use. Always read the terms and regulations provided by the creator.

-

How can I print House Tax Rebate Under Section?

- You can print them at home using an printer, or go to the local print shop for premium prints.

-

What program do I require to open printables for free?

- The majority of PDF documents are provided in the format PDF. This can be opened with free software such as Adobe Reader.

Rebate Of Income Tax Under Section 87A YouTube

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Check more sample of House Tax Rebate Under Section below

Tax Rebate Under Section 87A All You Need To Know YouTube

Budget 2023 Summary Of Direct Tax Proposals

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Tax Rebate Under Section 87A Investor Guruji Tax Planning

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

https://cleartax.in/s/80c-80-deductions

Web 24 mars 2017 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web 24 mars 2017 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Budget 2023 Summary Of Direct Tax Proposals

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Income Tax Rebate Under Section 87A