In this day and age with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes for creative projects, just adding the personal touch to your space, House Tax Rules In Haryana are now an essential resource. In this article, we'll dive into the world of "House Tax Rules In Haryana," exploring the benefits of them, where they are, and how they can be used to enhance different aspects of your life.

Get Latest House Tax Rules In Haryana Below

House Tax Rules In Haryana

House Tax Rules In Haryana -

Website is designed developed and maintained by Department of Urban Local Bodies Govt of Haryana A one time waiver of hundred percent of interest on the arrears of

Search the Property see the property tax generated If satisfied click Pay Property tax and pay the tax online If Not Satisfied Click on Self Assessment Update the

The House Tax Rules In Haryana are a huge assortment of printable, downloadable items that are available online at no cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. The attraction of printables that are free is in their variety and accessibility.

More of House Tax Rules In Haryana

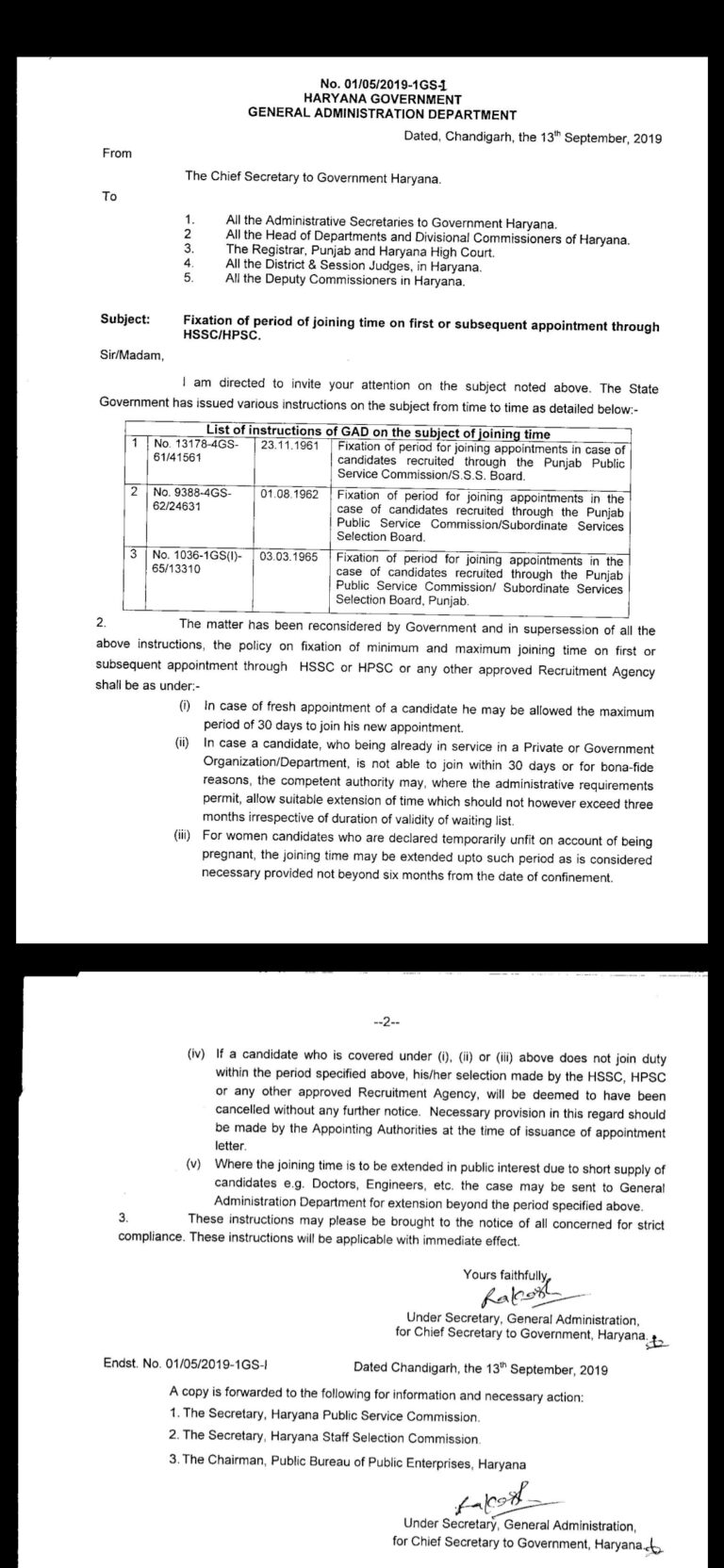

Revised TA DA Rules Haryana Govt PDF

Revised TA DA Rules Haryana Govt PDF

The Haryana Property Tax Waiver of Interest and Penalty is open to all property owners in Haryana irrespective of their income or property type However property owners

Haryana is the first state in India to implement the Property ID system comprehensively across all urban and rural areas The system integrates property details into a centralized database

House Tax Rules In Haryana have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: It is possible to tailor the templates to meet your individual needs for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Worth: Free educational printables can be used by students of all ages. This makes the perfect source for educators and parents.

-

The convenience of instant access many designs and templates, which saves time as well as effort.

Where to Find more House Tax Rules In Haryana

Service Rules Group C Roadways Transport Department Haryana

Service Rules Group C Roadways Transport Department Haryana

Tax Advantages on Stamp Duty Registration Charges in Haryana A house buyer in Haryana is eligible to deduct up to Rs 1 5 lakh in stamp duty and registration fees The Income Tax Act of

The Property Tax in Haryana is governed by Haryana Municipal Corporation Act 1994 Below is the Gist of Provisions applicable on the property taxes pursuant to which the

In the event that we've stirred your interest in House Tax Rules In Haryana and other printables, let's discover where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and House Tax Rules In Haryana for a variety needs.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing House Tax Rules In Haryana

Here are some new ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

House Tax Rules In Haryana are a treasure trove filled with creative and practical information catering to different needs and interests. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the vast array of House Tax Rules In Haryana today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can download and print the resources for free.

-

Can I use the free printables for commercial purposes?

- It's based on the terms of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to review these terms and conditions as set out by the author.

-

How do I print House Tax Rules In Haryana?

- You can print them at home with either a printer or go to the local print shop for the highest quality prints.

-

What software will I need to access printables that are free?

- The majority of printables are with PDF formats, which can be opened with free software like Adobe Reader.

Episode 25 Ll Haryana Civil Services Leave Rules 2016 Ll Chapter 3

The Haryana Motor Vehicles Rules 1993 Transport Department

Check more sample of House Tax Rules In Haryana below

How Property Investors SAVE TAX Most People STILL DON T Know

High Court Decision Regarding Earned Leave Exceed Limit Teacher

Freelancer Tax Rules In India YouTube

New Income Tax Rules 1

HARYANA LEAVE RULES HIPA

Gift Tax Rules In India Explained Tax Talks By Mansi Jain YouTube

https://ulbharyana.gov.in › WebCMS › Start

Search the Property see the property tax generated If satisfied click Pay Property tax and pay the tax online If Not Satisfied Click on Self Assessment Update the

https://www.ulbharyana.gov.in

All residential commercial industrial institutional vacant lands situated under the jurisdiction of Municipal Corporation have to pay Property Tax The Municipal Corporations are

Search the Property see the property tax generated If satisfied click Pay Property tax and pay the tax online If Not Satisfied Click on Self Assessment Update the

All residential commercial industrial institutional vacant lands situated under the jurisdiction of Municipal Corporation have to pay Property Tax The Municipal Corporations are

New Income Tax Rules 1

High Court Decision Regarding Earned Leave Exceed Limit Teacher

HARYANA LEAVE RULES HIPA

Gift Tax Rules In India Explained Tax Talks By Mansi Jain YouTube

New YouTube Tax Rules In Kannada AdSense Tax YouTube

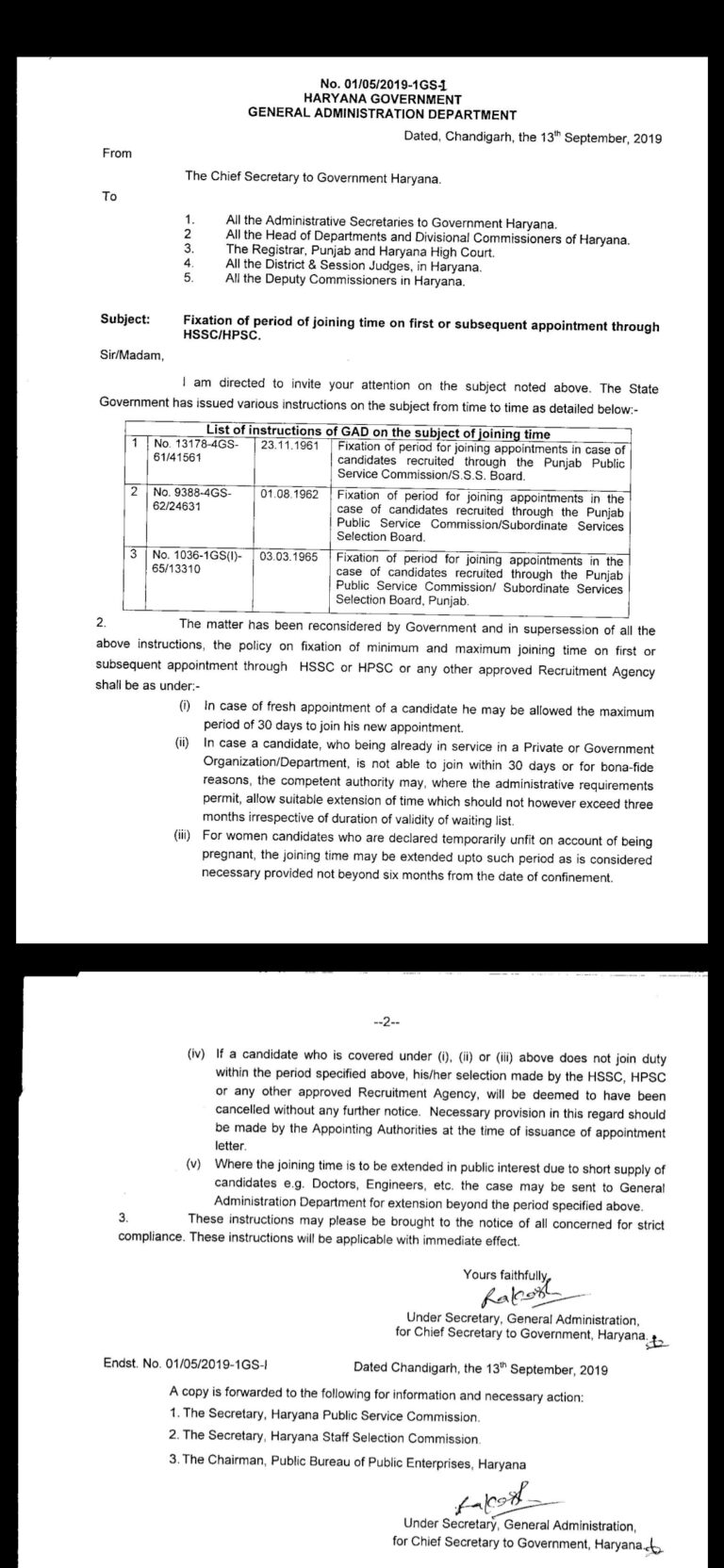

Joining Date Extension Rules Haryana 2023

Joining Date Extension Rules Haryana 2023

Housing Societies In Haryana Can t Charge More Than Rs 10 000 As