Today, where screens rule our lives The appeal of tangible printed material hasn't diminished. For educational purposes, creative projects, or simply adding an individual touch to your area, Housing Loan Income Tax Exemption 2021 22 are now an essential resource. We'll take a dive into the world of "Housing Loan Income Tax Exemption 2021 22," exploring what they are, where to find them, and how they can improve various aspects of your daily life.

Get Latest Housing Loan Income Tax Exemption 2021 22 Below

Housing Loan Income Tax Exemption 2021 22

Housing Loan Income Tax Exemption 2021 22 -

Tax benefits on a home loan in 2021 With additional income tax benefits on home loans announced by the union minister of finance in the previous budgets which are applicable for the financial year 2020 21 you can enjoy tax benefits under the old tax regime through exemptions and deductions

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

Housing Loan Income Tax Exemption 2021 22 encompass a wide range of printable, free resources available online for download at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and more. The value of Housing Loan Income Tax Exemption 2021 22 lies in their versatility as well as accessibility.

More of Housing Loan Income Tax Exemption 2021 22

Lawmakers Consider Student Loan Income Tax Exemption YouTube

Lawmakers Consider Student Loan Income Tax Exemption YouTube

These instructions are guidelines for filling the particulars in Income tax Return Form 2 for the Assessment Year 2021 22 relating to the Financial Year 2020 21 In case of any doubt please refer to relevant provisions of the Income tax Act

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax benefit

The Housing Loan Income Tax Exemption 2021 22 have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor printables to your specific needs for invitations, whether that's creating them to organize your schedule or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages, making them a valuable tool for parents and teachers.

-

Simple: Quick access to numerous designs and templates reduces time and effort.

Where to Find more Housing Loan Income Tax Exemption 2021 22

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

The home loan provides tax benefits under section 24 b 80C 80EE and 80EEA Therefore a home loan is providing additional tax saving options to the purchaser of a house However the borrower needs to be very mindful of conditions prescribed under each section and documents required to substantiate the tax benefit availed under each

Where an individual has taken home loan for purchase or construction of residential house property then the principal portion of the emi Easy Monthly Installment made for repayment of such loan paid for the year would be eligible for deduction under section 80C subject to certain conditions

Now that we've ignited your curiosity about Housing Loan Income Tax Exemption 2021 22, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Housing Loan Income Tax Exemption 2021 22 for a variety objectives.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide variety of topics, everything from DIY projects to planning a party.

Maximizing Housing Loan Income Tax Exemption 2021 22

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Housing Loan Income Tax Exemption 2021 22 are an abundance of practical and innovative resources that cater to various needs and preferences. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use the free printables for commercial uses?

- It's determined by the specific conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Housing Loan Income Tax Exemption 2021 22?

- Some printables may contain restrictions regarding usage. Make sure you read the terms of service and conditions provided by the creator.

-

How can I print Housing Loan Income Tax Exemption 2021 22?

- Print them at home using any printer or head to an in-store print shop to get superior prints.

-

What program do I need to open printables for free?

- The majority of printables are in the format PDF. This can be opened with free programs like Adobe Reader.

Education Loan Income Tax Exemption How To Save Tax On Education

CA EXEMPTION 2021 Icap Exemption 2021 YouTube

Check more sample of Housing Loan Income Tax Exemption 2021 22 below

File Your Homestead Exemption 2021 YouTube

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

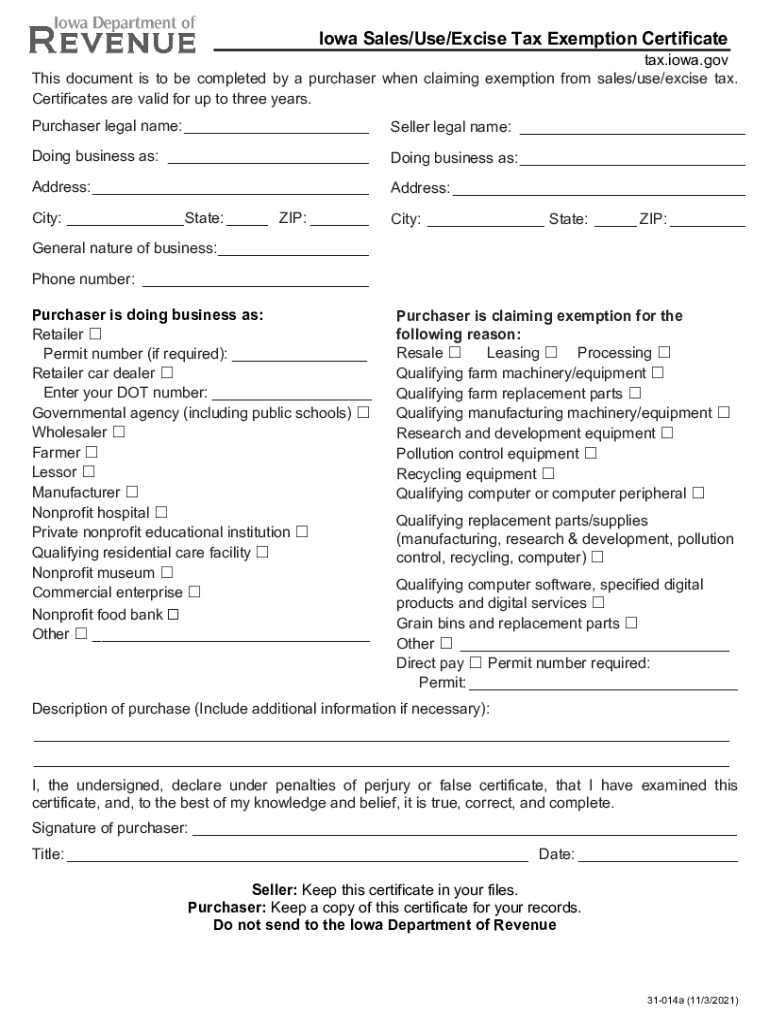

2021 2023 Form IA DoR 31 014 Fill Online Printable Fillable Blank

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Stamp Duty Exemption 2021 Nov 30 2021 Johor Bahru JB Malaysia

Benefits Of Housing Loan Income Tax CA Inter CA Umesh Bhat YouTube

https://www.livemint.com/money/personal-finance/...

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Under this provision first time homebuyers can claim tax deduction of up to Rs 1 5 lakh on the interest paid on affordable housing loans However tax deduction under Section 80EEA is no longer available to home loans sanctioned on and after 1 April 2022 as the benefits offered under this section were for housing loans sanctioned till 31

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

Under this provision first time homebuyers can claim tax deduction of up to Rs 1 5 lakh on the interest paid on affordable housing loans However tax deduction under Section 80EEA is no longer available to home loans sanctioned on and after 1 April 2022 as the benefits offered under this section were for housing loans sanctioned till 31

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Stamp Duty Exemption 2021 Nov 30 2021 Johor Bahru JB Malaysia

Benefits Of Housing Loan Income Tax CA Inter CA Umesh Bhat YouTube

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Abroad Education Loan Income Tax Exemption Section 80 E Hindi How