Today, in which screens are the norm but the value of tangible printed objects hasn't waned. Whether it's for educational purposes as well as creative projects or simply to add the personal touch to your area, Housing Loan Interest Income Tax Exemption 2019 20 are now a useful source. With this guide, you'll take a dive into the world "Housing Loan Interest Income Tax Exemption 2019 20," exploring the benefits of them, where you can find them, and how they can improve various aspects of your life.

Get Latest Housing Loan Interest Income Tax Exemption 2019 20 Below

Housing Loan Interest Income Tax Exemption 2019 20

Housing Loan Interest Income Tax Exemption 2019 20 -

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Printables for free include a vast assortment of printable, downloadable resources available online for download at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and many more. One of the advantages of Housing Loan Interest Income Tax Exemption 2019 20 is in their versatility and accessibility.

More of Housing Loan Interest Income Tax Exemption 2019 20

How To Show Interest On A Home Loan In An Income Tax Return

How To Show Interest On A Home Loan In An Income Tax Return

A new Section 80EEA has been inserted by government to allow for an interest deduction from AY 2020 21 FY 2019 20 The existing provisions of Section

Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh tax deductions on home loan interest payment

Housing Loan Interest Income Tax Exemption 2019 20 have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: Printables for education that are free cater to learners of all ages. This makes the perfect source for educators and parents.

-

It's easy: Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Housing Loan Interest Income Tax Exemption 2019 20

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits

Section 24 Under this section exemption of interest payment on home loan maximum upto Rs 2 00 000 under house property income is available subject to

Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01

We hope we've stimulated your curiosity about Housing Loan Interest Income Tax Exemption 2019 20 We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Housing Loan Interest Income Tax Exemption 2019 20 to suit a variety of uses.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide range of topics, from DIY projects to party planning.

Maximizing Housing Loan Interest Income Tax Exemption 2019 20

Here are some ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Housing Loan Interest Income Tax Exemption 2019 20 are an abundance of creative and practical resources which cater to a wide range of needs and desires. Their access and versatility makes them a valuable addition to each day life. Explore the vast array of Housing Loan Interest Income Tax Exemption 2019 20 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes, they are! You can print and download the resources for free.

-

Are there any free printables in commercial projects?

- It's based on the conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on their use. Be sure to review the terms and conditions offered by the creator.

-

How do I print Housing Loan Interest Income Tax Exemption 2019 20?

- Print them at home using any printer or head to a local print shop for superior prints.

-

What program do I require to open Housing Loan Interest Income Tax Exemption 2019 20?

- The majority of PDF documents are provided in the PDF format, and can be opened using free programs like Adobe Reader.

Housing Loan Interest Income Tax Exemption 2019 20 LOAKANS

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Check more sample of Housing Loan Interest Income Tax Exemption 2019 20 below

Tax Benefits On Home Loan Know More At Taxhelpdesk

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Income Tax Exemption Limit Raised To Rs 5 Lakh Higher Standard

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

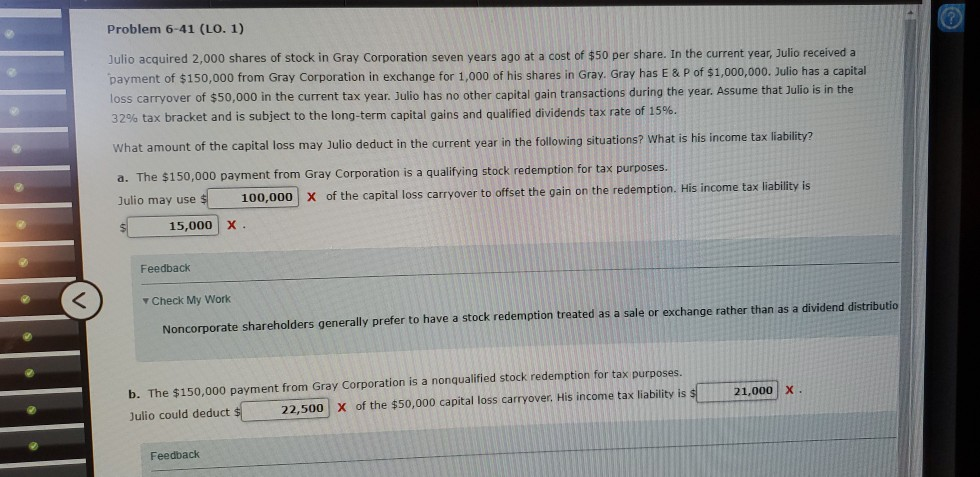

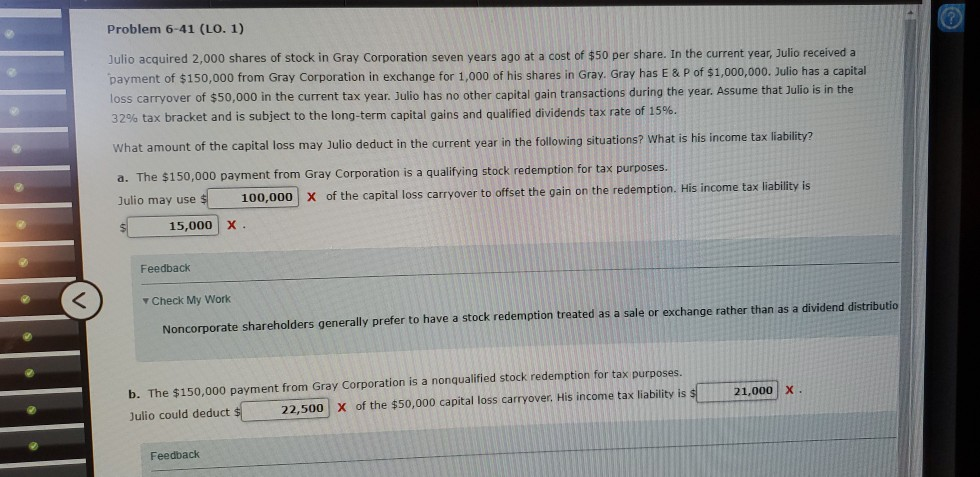

Solved Problem 6 41 LO 1 Julio Acquired 2 000 Shares Of Chegg

https://cleartax.in/s/home-loan-tax-benefits

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://taxguru.in/income-tax/faq-on-housing-loan...

In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money

Income Tax Exemption Limit Raised To Rs 5 Lakh Higher Standard

Interim Budget 2019 Income Tax Exemption Limit Hiked To Rs 5 Lakh

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Solved Problem 6 41 LO 1 Julio Acquired 2 000 Shares Of Chegg

Stamp Duty Exemption 2019 Warren Churchill

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 24 Of Income Tax Act Deduction For Home Loan Interest