Today, where screens rule our lives however, the attraction of tangible printed items hasn't gone away. If it's to aid in education and creative work, or simply to add personal touches to your space, Housing Loan Interest Income Tax Exemption Section are now an essential resource. Here, we'll take a dive deep into the realm of "Housing Loan Interest Income Tax Exemption Section," exploring what they are, how you can find them, and how they can add value to various aspects of your lives.

Get Latest Housing Loan Interest Income Tax Exemption Section Below

Housing Loan Interest Income Tax Exemption Section

Housing Loan Interest Income Tax Exemption Section -

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan

Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh

Housing Loan Interest Income Tax Exemption Section encompass a wide assortment of printable material that is available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and more. One of the advantages of Housing Loan Interest Income Tax Exemption Section is their versatility and accessibility.

More of Housing Loan Interest Income Tax Exemption Section

How To Show Interest On A Home Loan In An Income Tax Return

How To Show Interest On A Home Loan In An Income Tax Return

Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans

Individuals are eligible for income tax benefits under Section 80EE of Income Tax Act on the interest component of residential property loans obtained from any

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor designs to suit your personal needs be it designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets are designed to appeal to students of all ages, making them an essential aid for parents as well as educators.

-

An easy way to access HTML0: immediate access an array of designs and templates reduces time and effort.

Where to Find more Housing Loan Interest Income Tax Exemption Section

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

As per section 2 28A interest means interest paid towards borrowed money Further it would also include any service fee or other charge incurred due to borrowing or

An Individual who has taken loan for acquisition of residential house property interest payable on such loan would qualify for deductions under this section

If we've already piqued your interest in Housing Loan Interest Income Tax Exemption Section Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Housing Loan Interest Income Tax Exemption Section suitable for many reasons.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Housing Loan Interest Income Tax Exemption Section

Here are some ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Housing Loan Interest Income Tax Exemption Section are an abundance with useful and creative ideas that satisfy a wide range of requirements and desires. Their availability and versatility make them an invaluable addition to both professional and personal life. Explore the world that is Housing Loan Interest Income Tax Exemption Section today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can print and download the resources for free.

-

Can I make use of free printables in commercial projects?

- It's all dependent on the conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Housing Loan Interest Income Tax Exemption Section?

- Some printables may contain restrictions on their use. Make sure you read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using your printer or visit a local print shop for high-quality prints.

-

What software do I need to open printables that are free?

- The majority of printables are in PDF format, which is open with no cost software, such as Adobe Reader.

Tax Benefits On Home Loan Know More At Taxhelpdesk

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits

Check more sample of Housing Loan Interest Income Tax Exemption Section below

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 24 Of Income Tax Act Deduction For Home Loan Interest

HRA Exemption Calculator In Excel House Rent Allowance Calculation

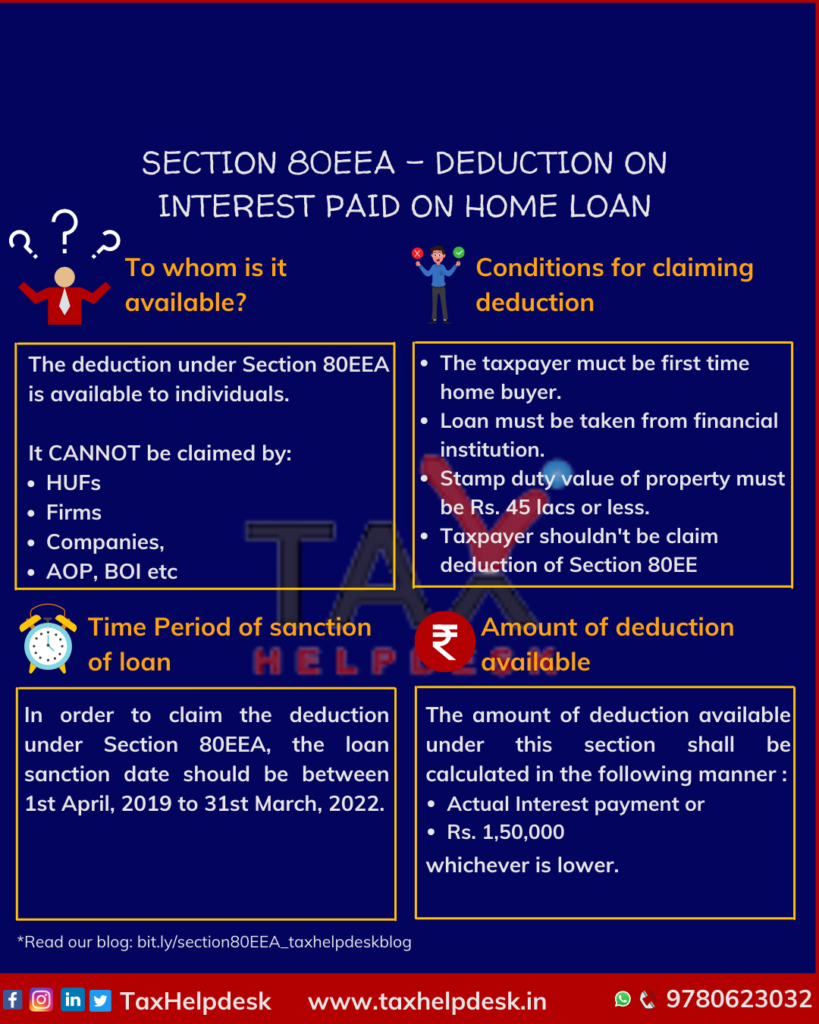

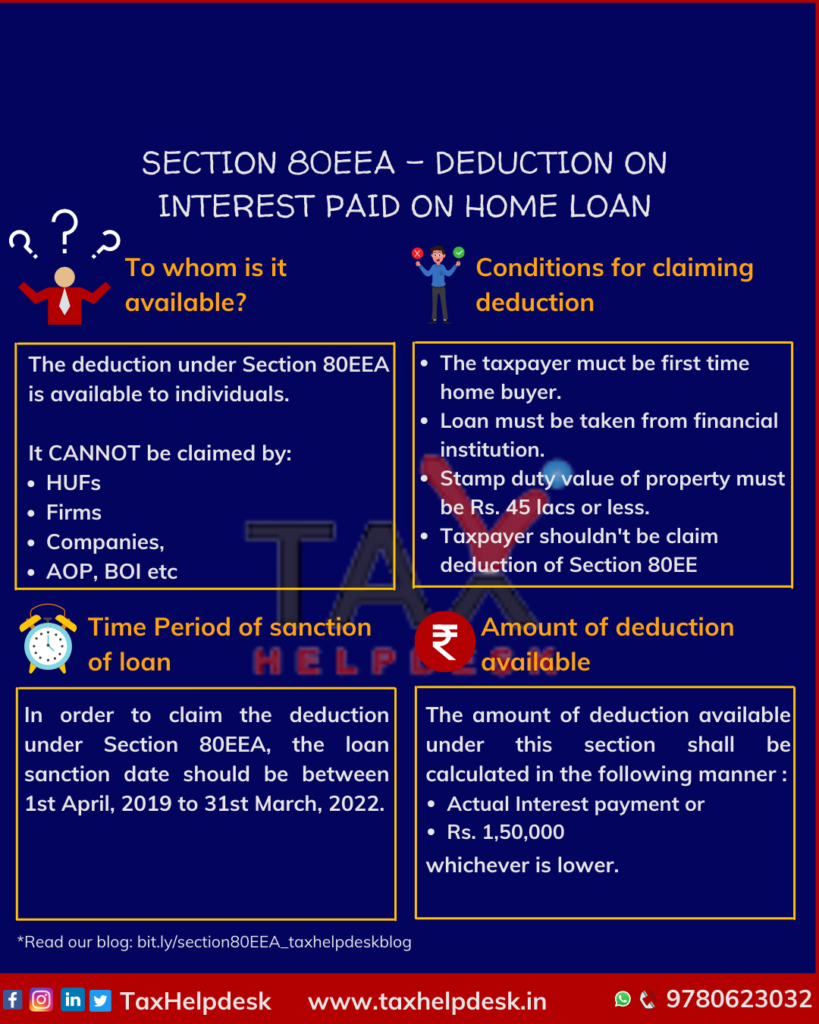

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://tax2win.in/guide/income-tax-benefit-on-housing-loan-interest

Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh

https://tax2win.in/guide/section-80ee

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any

Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Income Tax Exemption On Interest Of Education Loan YouTube

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Revised Income Tax Exemption Calculator For Interest Paid On Housing