In this age of electronic devices, with screens dominating our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education as well as creative projects or simply adding the personal touch to your area, Housing Loan Interest Rebate In Income Tax New Regime are a great resource. Through this post, we'll take a dive into the world of "Housing Loan Interest Rebate In Income Tax New Regime," exploring what they are, how they are available, and how they can add value to various aspects of your daily life.

Get Latest Housing Loan Interest Rebate In Income Tax New Regime Below

Housing Loan Interest Rebate In Income Tax New Regime

Housing Loan Interest Rebate In Income Tax New Regime -

Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24 b even in the new proposed tax regime Budget 2020 has proposed a new tax regime with lower tax slab rates along with removal of almost all deductions exemptions

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

Housing Loan Interest Rebate In Income Tax New Regime include a broad collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and many more. The attraction of printables that are free is their versatility and accessibility.

More of Housing Loan Interest Rebate In Income Tax New Regime

Union Budget 2023 Tax Rebate On Housing Loan Interest Expected To Hike

Union Budget 2023 Tax Rebate On Housing Loan Interest Expected To Hike

While it offers lower tax rates it also affects the way you can claim deductions for your home loan Here s how the new regime impacts home loan tax benefits Reduced Benefits Section 24 b Deduction Interest on Self Occupied Property This common deduction for interest paid on self occupied properties is not available under

Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction of 50 000

Housing Loan Interest Rebate In Income Tax New Regime have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printing templates to your own specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them a vital device for teachers and parents.

-

The convenience of Access to many designs and templates will save you time and effort.

Where to Find more Housing Loan Interest Rebate In Income Tax New Regime

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

1 min read 26 Oct 2021 05 40 PM IST Shipra Singh The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The new tax structure

However for homebuyers income tax deduction of up to 1 50 lakhs on the repayment of housing loans principal interest under Sec 80C is available under the old tax regime and switching

If we've already piqued your curiosity about Housing Loan Interest Rebate In Income Tax New Regime We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of uses.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing Housing Loan Interest Rebate In Income Tax New Regime

Here are some ideas create the maximum value use of Housing Loan Interest Rebate In Income Tax New Regime:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Housing Loan Interest Rebate In Income Tax New Regime are an abundance of useful and creative resources that cater to various needs and passions. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the vast world of Housing Loan Interest Rebate In Income Tax New Regime and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can download and print the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It's all dependent on the rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions in use. Check the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit the local print shop for superior prints.

-

What software do I need to open Housing Loan Interest Rebate In Income Tax New Regime?

- The majority of printed documents are in the format of PDF, which can be opened using free software, such as Adobe Reader.

Income Tax New Regime Rebate Slabs 2023 Explained Should You Choose

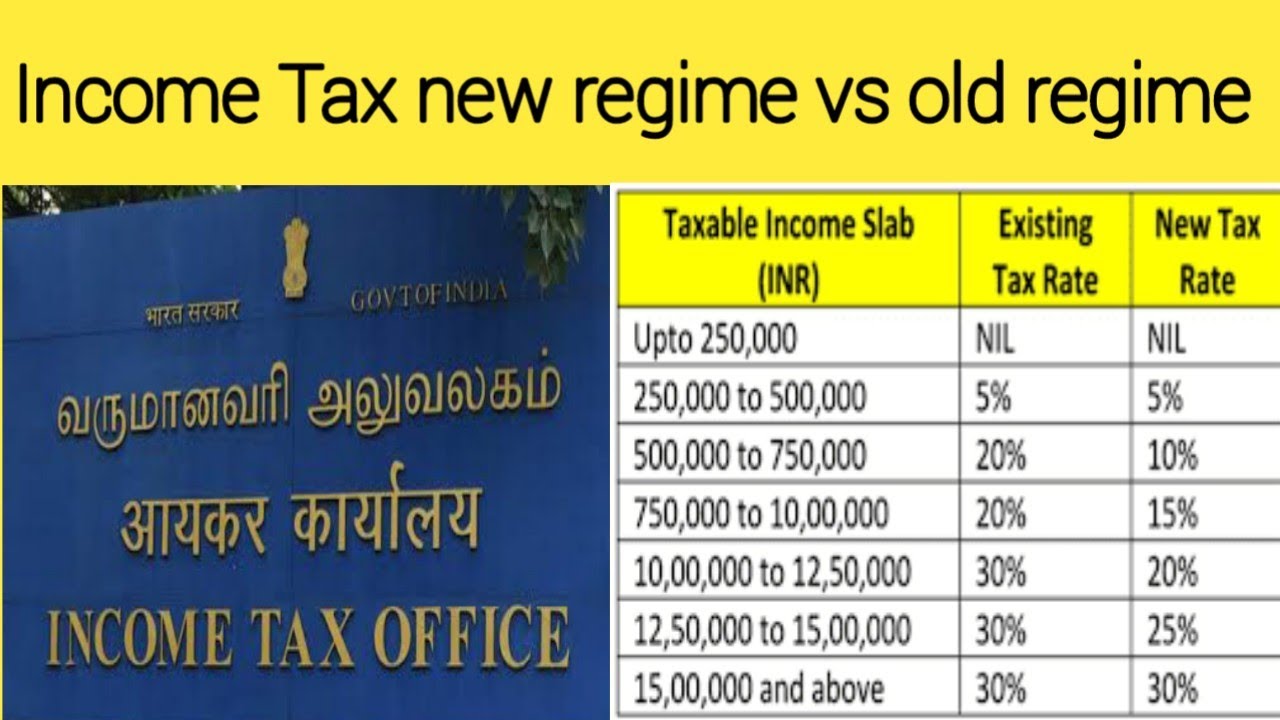

Income Tax New Regime Vs Old Regime YouTube

Check more sample of Housing Loan Interest Rebate In Income Tax New Regime below

Income Tax New Regime Vs Old Regime shorts budget2023 income

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Income Tax New Regime New Tax Regime Vs Old Tax Regime 2023 24 YouTube

How To Save Income Tax Tax Saving Income Tax New Regime Old Regime

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://cleartax.in/s/home-loan-tax-benefits

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

https://www.godrejcapital.com/media-blog/knowledge...

Income Tax Benefits on Home Loans in the New Income Tax Regime In the updated income tax return policy exemptions on the interest paid for a self occupied property are no longer available under section 24 Furthermore since deductions under section 80C are not allowed in the new tax regime you cannot claim an exemption on the principal

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home loan holders claim deductions What are the impacts of

Income Tax Benefits on Home Loans in the New Income Tax Regime In the updated income tax return policy exemptions on the interest paid for a self occupied property are no longer available under section 24 Furthermore since deductions under section 80C are not allowed in the new tax regime you cannot claim an exemption on the principal

How To Save Income Tax Tax Saving Income Tax New Regime Old Regime

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

How To Write A Letter For Repayment Of Loan Alice Writing

INCOME TAX NEW RULE W e f 0104 2023 INCOME TAX SLAB 2023 24 INCOME

INCOME TAX NEW RULE W e f 0104 2023 INCOME TAX SLAB 2023 24 INCOME

Income Tax New Regime And Old Regime viral shortvideo incometax