Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding an individual touch to your home, printables for free have proven to be a valuable source. This article will dive into the sphere of "Housing Loan Relief For Income Tax," exploring what they are, where to find them and how they can improve various aspects of your lives.

Get Latest Housing Loan Relief For Income Tax Below

Housing Loan Relief For Income Tax

Housing Loan Relief For Income Tax -

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments

Printables for free include a vast variety of printable, downloadable items that are available online at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and many more. One of the advantages of Housing Loan Relief For Income Tax is in their versatility and accessibility.

More of Housing Loan Relief For Income Tax

Student Loan Relief Biden Approves 16 Million Applicants Fate Lies On

Student Loan Relief Biden Approves 16 Million Applicants Fate Lies On

1 Qualifying loans and alternative finance arrangements Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for affordable housing during the period 1 April 2019 to 31 March 2022

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization This allows you to modify printables to your specific needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: Free educational printables are designed to appeal to students of all ages, making these printables a powerful tool for teachers and parents.

-

Easy to use: instant access various designs and templates can save you time and energy.

Where to Find more Housing Loan Relief For Income Tax

Property Tax Relief For Income qualified Homeowners Local Housing

Property Tax Relief For Income qualified Homeowners Local Housing

Yes you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question If you are only person repaying the loan you can claim the entire tax benefit for yourself provided you are an owner or co owner

If you have let out house property you can claim a deduction for interest paid on the housing loan Note that the new tax regime restricts the deduction to the taxable rent received from the property against the old regime

Now that we've piqued your interest in printables for free Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Housing Loan Relief For Income Tax for a variety uses.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Housing Loan Relief For Income Tax

Here are some ideas that you can make use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Housing Loan Relief For Income Tax are an abundance of useful and creative resources for a variety of needs and interest. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the vast array of Housing Loan Relief For Income Tax now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can download and print these tools for free.

-

Can I make use of free printables for commercial use?

- It's based on the terms of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright violations with Housing Loan Relief For Income Tax?

- Certain printables might have limitations in their usage. Make sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in a print shop in your area for superior prints.

-

What program must I use to open printables for free?

- The majority of printables are in the format of PDF, which can be opened with free software such as Adobe Reader.

Malaysia Personal Income Tax Relief 2022

IRS Will Allow Taxpayers To File Amended Returns Electronically

Check more sample of Housing Loan Relief For Income Tax below

Joint Home Loan Declaration Form For Income Tax Savings And Non

Mortgages Loan Relief For Homeowners During COVID 19 In Dallas Fort Worth

Joint Home Loan Declaration Form For Income Tax Savings And Non

Union Budget 2023 Major Relief For Income Tax Payers

Student Loan Relief For 308 000 Washingtonians On Hold Flipboard

PHEAA Launches Student Loan Relief For Nurses

https://economictimes.indiatimes.com/wealth/tax/...

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Union Budget 2023 Major Relief For Income Tax Payers

Mortgages Loan Relief For Homeowners During COVID 19 In Dallas Fort Worth

Student Loan Relief For 308 000 Washingtonians On Hold Flipboard

PHEAA Launches Student Loan Relief For Nurses

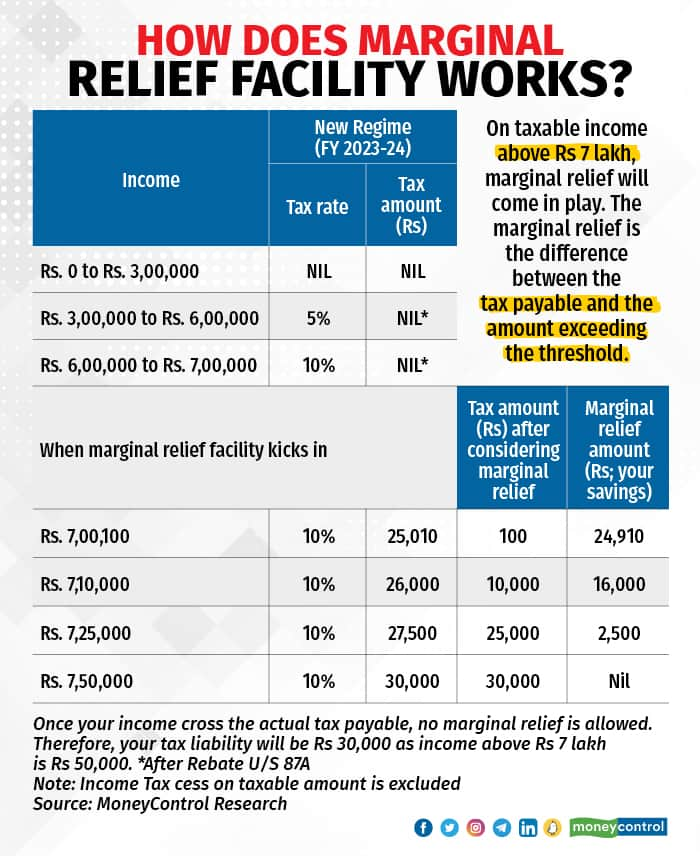

How Finance Act 23 Offers Marginal Relief For Income Of Slightly Over

PM s 5 Big Promises Ahead Of Election Year Includes A Housing Loan

PM s 5 Big Promises Ahead Of Election Year Includes A Housing Loan

Relief For Foreign Currency Loan Defaulters Financial Tribune