In this age of electronic devices, in which screens are the norm yet the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses for creative projects, simply to add an element of personalization to your area, How Are Property Taxes Calculated In Montana can be an excellent resource. Here, we'll take a dive deeper into "How Are Property Taxes Calculated In Montana," exploring the benefits of them, where they can be found, and how they can add value to various aspects of your life.

Get Latest How Are Property Taxes Calculated In Montana Below

How Are Property Taxes Calculated In Montana

How Are Property Taxes Calculated In Montana -

Property taxes are the primary way Montanans pay for local government services including schools law enforcement and fire departments Here s how property taxes are calculated

By Eric Dietrich 06 22 2023 Property owners across Montana are receiving their 2023 reappraisal letters from the state Department of Revenue this month notices that are in many cases indicating the valuations used to calculate their property tax bills have risen dramatically since the last reappraisal cycle in 2021

How Are Property Taxes Calculated In Montana encompass a wide range of printable, free items that are available online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and much more. One of the advantages of How Are Property Taxes Calculated In Montana lies in their versatility and accessibility.

More of How Are Property Taxes Calculated In Montana

How To Calculate Property Taxes In Cherokee County Ga About Indian

How To Calculate Property Taxes In Cherokee County Ga About Indian

Montana statute MCA 15 10 420 limits a county s ability to levy additional mills and as taxable values rise absent voted mills the number of mills a county may levy most likely will have to decrease That was not taken into account in the mailed estimates and that specifically is what we are calling out as inaccurate information

Our Montana Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Montana and across the entire United States

How Are Property Taxes Calculated In Montana have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages, making them a valuable tool for teachers and parents.

-

Easy to use: instant access various designs and templates is time-saving and saves effort.

Where to Find more How Are Property Taxes Calculated In Montana

How Are Property Taxes Calculated In Texas Learn How Property Taxes

How Are Property Taxes Calculated In Texas Learn How Property Taxes

HOW ARE PROPERTY TAXES CALCULATED The property tax is an ad valorem tax meaning it is based on the value of the property The property value is multiplied by the tax rate and the mill rate to determine taxes due Market Value Department of Revenue Tax Rate Legislature Taxable Value Department of Revenue certifies Mill Levies 1 000

The first part of the property tax section explains these underlying concepts of Montana s property tax in more detail The second part focuses on the distribution of the tax burden and total revenue collected It is calculated by applying the tax rate and any relevant exemptions to the market value Therefore taxable value is typically

Now that we've piqued your curiosity about How Are Property Taxes Calculated In Montana Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of How Are Property Taxes Calculated In Montana designed for a variety goals.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing How Are Property Taxes Calculated In Montana

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to reinforce learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

How Are Property Taxes Calculated In Montana are an abundance of useful and creative resources catering to different needs and needs and. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the world of How Are Property Taxes Calculated In Montana today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes, they are! You can download and print these tools for free.

-

Can I use free printables for commercial purposes?

- It's contingent upon the specific rules of usage. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may have restrictions regarding usage. Make sure to read the conditions and terms of use provided by the designer.

-

How do I print How Are Property Taxes Calculated In Montana?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What software do I need to open printables that are free?

- The majority of PDF documents are provided as PDF files, which can be opened using free software like Adobe Reader.

How Are Property Taxes Calculated In Broward County Florida Genteel

How Are Property Taxes Calculated In Nevada

Check more sample of How Are Property Taxes Calculated In Montana below

How Are Property Taxes Calculated Getloans

Property Tax Reduction Consultants How Are Property Taxes Calculated

How Are Property Taxes Calculated In Illinois Diamond Real Estate Law

How Are Property Taxes Calculated In Texas TaxesTalk

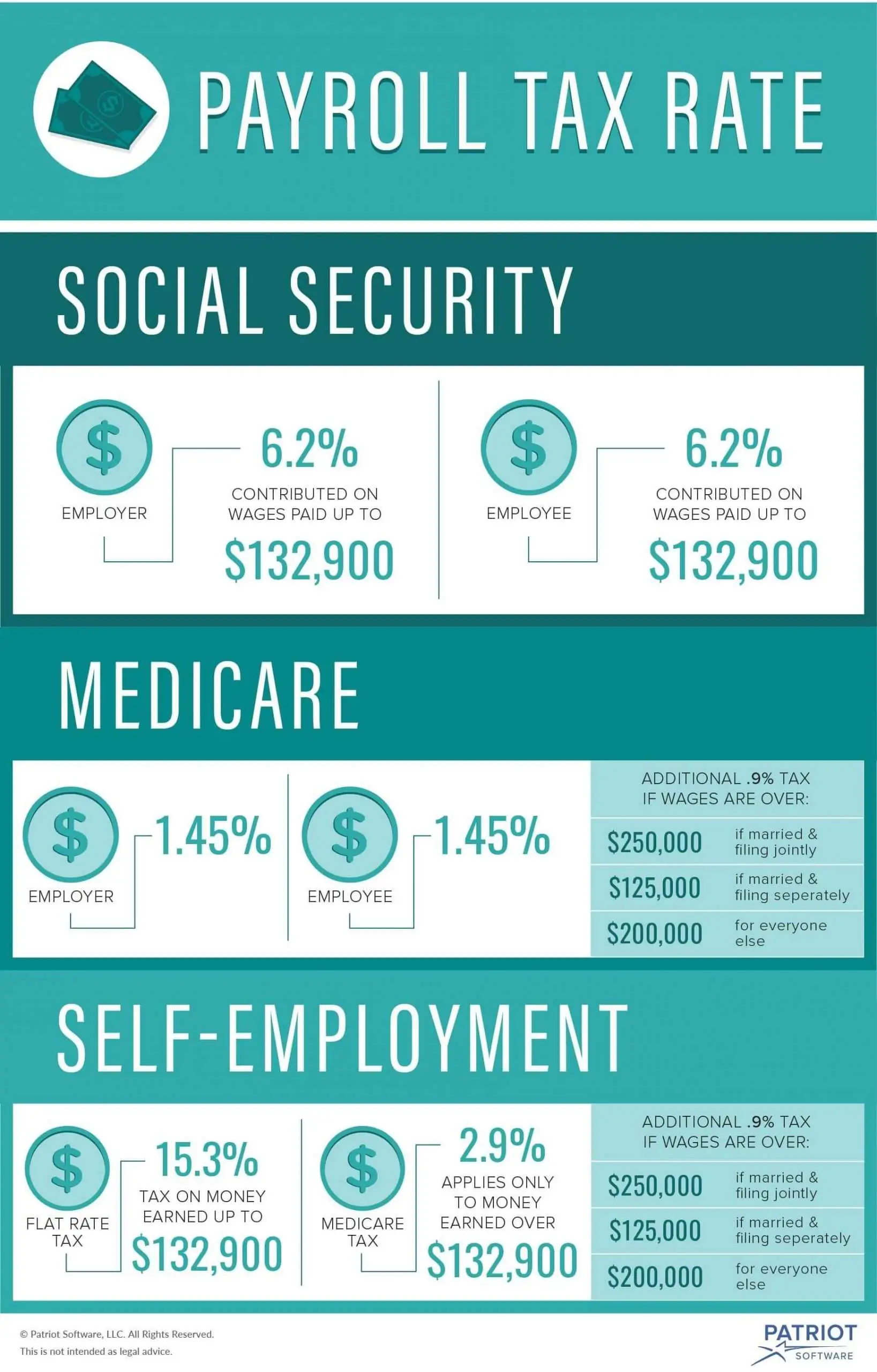

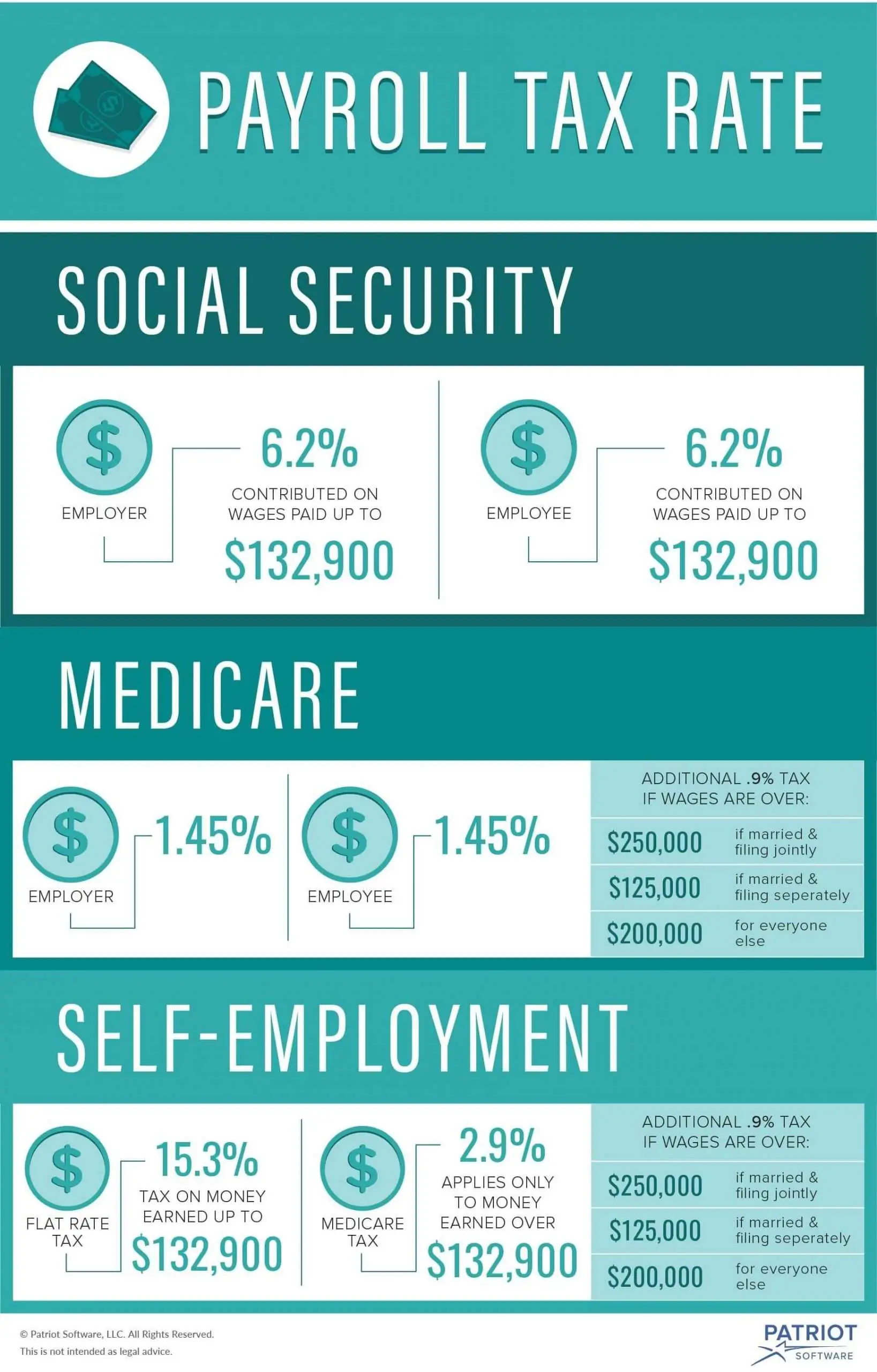

How To Calculate Payroll Tax Expense TaxesTalk

When Are Property Taxes Due In California And How Are They Calculated

https://montanafreepress.org/2023/06/22/property...

By Eric Dietrich 06 22 2023 Property owners across Montana are receiving their 2023 reappraisal letters from the state Department of Revenue this month notices that are in many cases indicating the valuations used to calculate their property tax bills have risen dramatically since the last reappraisal cycle in 2021

https://mtrevenue.gov/property

Property taxable values determined by the department are used by the county governments to calculate property taxes 2023 Supplemental Tax Bills On November 22 2023 the Montana Supreme Court ruled that all county governments must collect the 95 mill state school equalization levy for Tax Year 2023 property tax collections rather than the

By Eric Dietrich 06 22 2023 Property owners across Montana are receiving their 2023 reappraisal letters from the state Department of Revenue this month notices that are in many cases indicating the valuations used to calculate their property tax bills have risen dramatically since the last reappraisal cycle in 2021

Property taxable values determined by the department are used by the county governments to calculate property taxes 2023 Supplemental Tax Bills On November 22 2023 the Montana Supreme Court ruled that all county governments must collect the 95 mill state school equalization levy for Tax Year 2023 property tax collections rather than the

How Are Property Taxes Calculated In Texas TaxesTalk

Property Tax Reduction Consultants How Are Property Taxes Calculated

How To Calculate Payroll Tax Expense TaxesTalk

When Are Property Taxes Due In California And How Are They Calculated

Property Taxes Harris County How Are Property Taxes Calculated In

How Are Property Taxes Calculated In Broward County Florida Mission

How Are Property Taxes Calculated In Broward County Florida Mission

Hecht Group How Is Commercial Property Taxes Calculated In Denver